CTSI

Cartesi

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

No results found. | ||||

Price Chart of Cartesi

سود 3 Months :

سیگنالهای Cartesi

Filter

Sort messages by

Trader Type

Time Frame

crypto_profile

تحلیل تکنیکال: آیا این کاهش قیمت، طوفان در راه است؟ (تحلیل کوتاهمدت و بلندمدت)

Hello friends, I am sharing this upon the request of a friend. I gave the movements briefly. If we talk about the short, even though we see a short-term rise with a test to be given to 324, it screams the danger of a price that will accelerate this decline, that is, the area where scalp traders, that is, trader model traders, will sell. I think the key price is on this horizontal dashed orange area, the next weekly closing will cause the continuation of the rise, but I do not think that the loss of the alt red area will pull the price lower and it will also evolve into the eliot structure consisting of 3 waves, which, if we look at the long view, is the 2 wave. it means Long story short, the region has created an important support line, maybe there will be a short rise, but we will witness a crash with losses that will not be long-lasting. It is not an investment recommendation, it is my own road map. I have decided that I need to change the simple graphics to make you understand, so we can say that the reactions pushed me to do this. I always follow the dynamics of the market and I am still in favor of a small but profitable profit. I do not have to buy with a decrease. If necessary, I will enter late but I will protect my money. Have a good night.

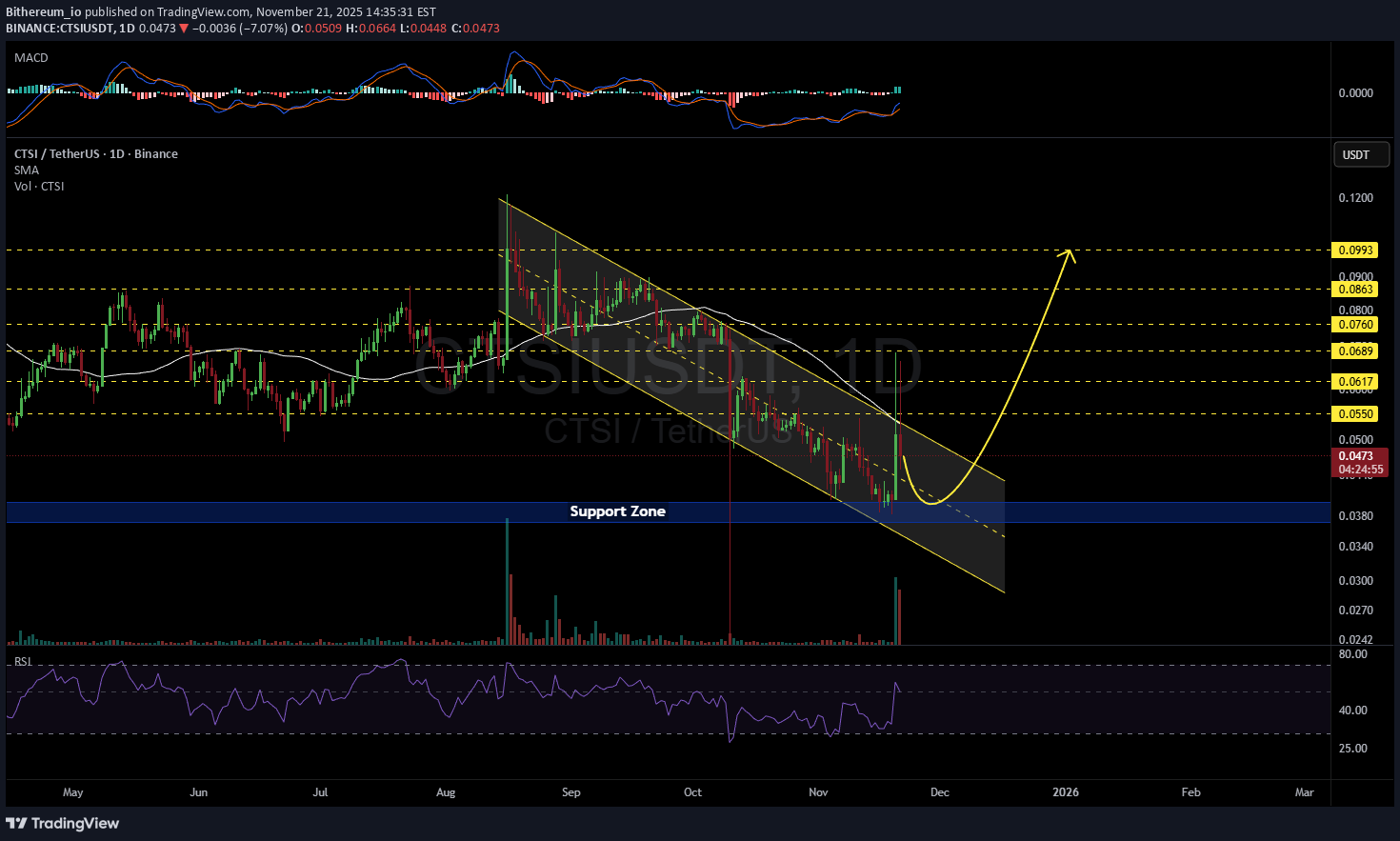

Bithereum_io

تحلیل انفجاری CTSI: زمان خرید فرا رسید؟ اهداف قیمتی خیرهکننده!

#CTSI is moving inside a descending channel on the daily chart. Volume has increased significantly, and the MACD is giving a bullish signal. CTSI has attempted twice to break above the channel resistance but was rejected by a resistance cluster, which includes the channel resistance, the daily SMA50, the upper Bollinger Band, and the Ichimoku cloud. These were not drawn on the chart to avoid overcrowding. However, alongside this resistance cluster, we believe BTC’s weakness has also limited CTSI’s growth. Consider buying here and near the support zone. In case of a breakout above the channel, the potential targets are: 🎯 $0.0550 🎯 $0.0617 🎯 $0.0689 🎯 $0.0760 🎯 $0.0863 🎯 $0.0993 ⚠️ Always remember to protect your capital with a proper stop-loss and disciplined risk management.

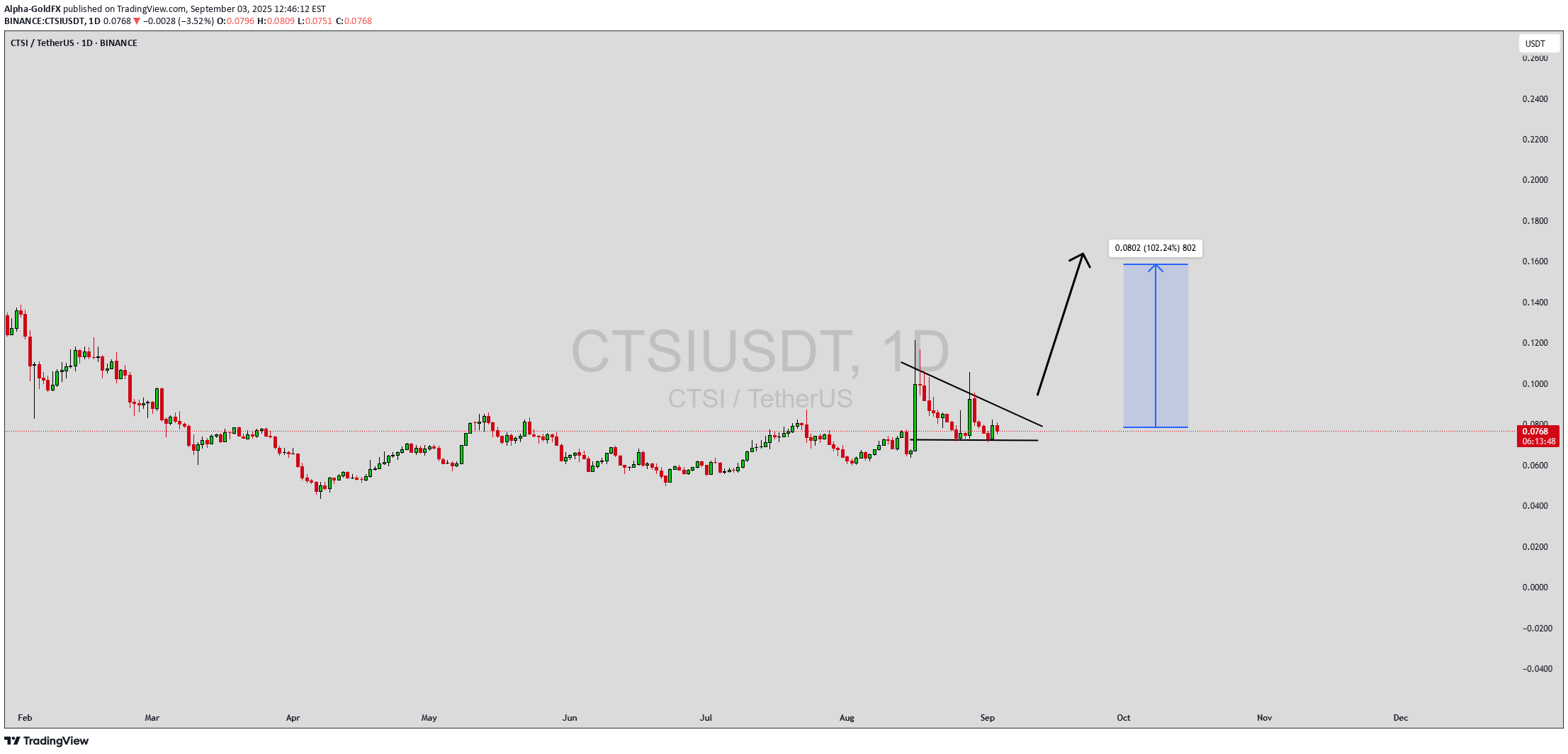

Alpha-GoldFX

هشدار انفجار قیمت CTSIUSDT: راز الگوی گُوِه نزولی و پتانسیل رشد ۲۰۰٪

CTSIUSDT is showcasing a textbook falling wedge pattern on the daily and weekly charts, a classic bullish reversal signal that's drawing sharp attention from crypto traders amid the ongoing altcoin recovery phase in late 2025. This converging downward-sloping formation, with the upper resistance line steeper than the lower support, indicates waning bearish momentum as sellers exhaust their grip and buyers quietly accumulate at progressively higher lows—think of it as the market coiling like a spring before an explosive breakout. Recent price action around $0.0412 has respected the wedge's boundaries with precision, and the surge in trading volume—up over 4.44 million USDT in the last 24 hours—confirms genuine interest, not just speculative noise. As CTSIUSDT hovers near the apex of this pattern, a decisive close above the upper trendline near $0.045 could trigger the long-awaited upside thrust, aligning perfectly with broader blockchain scalability narratives where projects like Cartesi are positioned to capitalize on Ethereum's rollup boom. High-conviction setups like this falling wedge in CTSIUSDT aren't just technical footnotes; they're roadmaps for 90% to 100%+ gains in the midterm bull run, especially as RSI climbs from oversold territory and moving averages hint at a golden cross reversal. Diving deeper into the fundamentals fueling this CTSIUSDT momentum, Cartesi's Linux-based virtual machine continues to bridge traditional software devs into Web3, enabling app-specific rollups with off-the-shelf tools like Python and Rust— a game-changer that's sparked fresh investor buzz following the July 2025 token buyback and Honeypot v2's mainnet fraud-proof deployment. With over 170 developers snapping up spots in Brazil's latest Cartesi courses and integrations like Espresso Systems' Decaf testnet live for multiple rollups, the ecosystem is humming with real utility, from validator marketplaces to staking rewards that lock in long-term holders. This isn't hype; it's substantiated growth, as CTSI's market cap stabilizes at $36.56 million while altcoin season index ticks up, signaling smart money rotating from Bitcoin dominance into undervalued gems like this. The falling wedge breakout in CTSIUSDT isn't isolated—it's amplified by Cartesi's Stage-2 security categorizations on L2BEAT and partnerships that promise fast BFT consensus, making it a prime pick for traders eyeing 2025's projected highs of $0.128 or more. Volume spikes here scream conviction, turning what was once a sidelined token into a breakout contender with 200% rally potential on the horizon. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

MyCryptoParadise

آیا قیمت CTSI منفجر میشود یا این فقط یک تله برای فریب معاملهگران است؟

Yello Paradisers is CTSI finally ready to break out, or are we looking at another trap to wipe out emotional traders? 💎#CTSIUSDT has been moving inside a clean descending channel, respecting both support and resistance levels. The price recently bounced strongly from the key demand zone around $0.041 to $0.044, showing clear signs of accumulation. Now, price is approaching the descending resistance, where a confirmed breakout could change the game entirely. 💎A clean break and daily close above the $0.050 level would likely trigger bullish momentum, with short-term upside toward the 0.056 area. If this level gets cleared, the real target lies at 0.063 to 0.065, which marks a strong resistance zone and a likely exit area for smart money. 💎However, it's important to stay focused. Until the breakout is confirmed, this move remains unverified. Many traders get caught in fakeouts by rushing in too early. A move below $0.0379 would invalidate the bullish setup entirely, and at that point, the bias shifts back to the downside. Discipline, patience, robust strategies, and trading tactics are the only ways you can make it long-term in this market. MyCryptoParadise iFeel the success🌴💎 Bingo! #CTSIUSDT is dancing to our tune, up 78.65% just like we predicted.

candle_crafts

CTSI — The Three-Quarter Trap Before Expansion

CTSI is dangling bait. Price hovers at 0.083, giving comfort to longs — but the real prize sits lower. Markets love the three-quarter retrace: deep enough to flush weak hands, not deep enough to kill the trend. Imagine a slingshot: you pull it back further than feels safe, the band creaks, everyone panics — and then it rips forward with force. That’s exactly what CTSI is building into 0.0793–0.0779. HTF / MTF (12H / 4H) • Price ~0.0830, range-to-up bias • Key retrace zones: 0.0808 (0.618), 0.0793 (0.750), 0.0779 (0.786) • Structure: basing, coiling energy LTF (15m Playbook) • Wait for BOS↑ after sweep into 0.0793–0.0779 • Fresh OB/FVG inside BOS impulse = trigger zone • Liquidity magnets: 0.0865 → 0.0890 → 0.0915 Flow / Derivatives • OI climbing = healthy participation • Funding neutral • CVD weak but primed for reversal on absorption • Liqs stacked 0.089–0.093 = exit fuel Idea Map • Long setup from 0.0796 (BOS FVG fill) • Invalidation: below 0.0772 • Targets: 0.0845 → 0.0890 → 0.0918 • R:R potential ~3.9:1 ⚡ Liquidity hunts aren’t about comfort. They’re designed to look ugly, feel wrong, and trap the majority. That’s why they work. Candle Craft | Signal. Structure. Execution.

Crypto_Metery

CTSI/USDT Spot Setup

Daily Breakout and retest done, ready for a huge breakout, load some and hold.

Alpha-GoldFX

CTSIUSDT Forming Bullish Pennant

CTSIUSDT is currently forming a bullish pennant pattern, a strong continuation setup that often signals an upcoming breakout. After a healthy upward rally, the price has entered into consolidation, creating a pennant structure with tightening price action. This type of formation, especially when supported by solid trading volume, typically precedes a sharp bullish move, making CTSIUSDT an exciting coin to watch in the short term. The technical outlook suggests that once CTSIUSDT breaks out of this pennant, the price could surge significantly, potentially delivering 90% to 100%+ gains. Market participants are already showing interest, with volume remaining steady, a clear indication that buyers are positioning themselves for the next leg up. Historically, bullish pennant breakouts attract heavy momentum and can lead to rapid gains within a relatively short period. Investor sentiment around CTSI is improving, as more traders recognize its potential during this consolidation phase. The tightening range is also reducing volatility, which often leads to a powerful expansion once the breakout occurs. If momentum continues to build, CTSIUSDT could target higher resistance levels quickly, validating the bullish pennant pattern and rewarding early investors. Overall, CTSIUSDT is shaping up to be one of the stronger setups in the market right now. With a bullish pennant pattern, good trading volume, and increasing investor attention, the technicals align with the potential for a strong upside rally. Traders and investors should keep this pair on their watchlist as the breakout opportunity approaches. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

SheikhNaveed

CTSI/USDT 4H chart

CTSI/USDT 4H chart Levels: • Resistance (R3): ~55.46% • Resistance (R2): ~8.76% • Resistance (R1): ~1.90% • Support (S1): ~-12.04% • Support (S2): ~-16.40% • Support Zone: extends toward ~-23.38% What the chart shows: 1. Price pumped hard to R3 (55.46%) but got rejected strongly. 2. Now it’s consolidating near R2 (8.76%), struggling to hold above it. 3. If it loses momentum, it may retest R1 (1.90%) or even dip into the support zone (S1–S2). 4. For a bullish move again, price must break and hold above R2 → R3, which seems like a tough resistance zone. Trading perspective: • Bullish case: If CTSI bounces above R2 and sustains, it could attempt another leg up. • Bearish case: If it fails to hold R2, we might see a drop toward S1/S2. At the moment, momentum looks weakened (lots of red candles after the big pump), so it may consolidate or retest support before any big move.

wyckoff70

ctsiusdt

ctsiusdt may complete butterfly harmonic pattern .rr is good .never trade without sl

Alpha-GoldFX

CTSIUSDT Forming Bullish Momentum

CTSIUSDT has recently broken out of a long-standing resistance zone with a strong bullish impulse, confirming a breakout that has caught the attention of many traders and analysts. The price action reflects a clear bullish structure, and the breakout from the accumulation range is supported by significant volume—an early sign of strong market conviction. This technical development sets the stage for a potential rally targeting a projected gain of 90% to 100%+ in the coming weeks. The momentum behind CTSI is building, and this rally isn’t just speculative—it’s backed by volume and structure. Price has pushed through previous consolidation levels and flipped them into potential support, which could act as a launchpad for the next leg up. With altcoins starting to gain traction across the market, CTSI is emerging as one of the more promising setups among mid-cap crypto pairs. Market interest is clearly shifting toward CTSI as investors and traders begin to recognize its breakout potential. The chart structure, momentum, and renewed interest all suggest that this coin may be entering a new phase of price discovery. If the bullish momentum continues, we could see rapid gains and possibly a parabolic move in the short term. ✅ Show your support by hitting the like button and ✅ Leaving a comment below! (What is You opinion about this Coin) Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.