ARB

Arbitrum

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

CryptoAnalystSignalRank: 30903 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/8/2025 | |

SwallowAcademyRank: 30699 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 12/1/2025 |

Price Chart of Arbitrum

سود 3 Months :

خلاصه سیگنالهای Arbitrum

سیگنالهای Arbitrum

Filter

Sort messages by

Trader Type

Time Frame

CryptoAnalystSignal

#ARB/USDT | Testing Wedge Breakout Amid Key Support

#ARB The price is moving in a descending channel on the 1-hour timeframe. It has reached the lower boundary and is heading towards breaking above it, with a retest of the upper boundary expected. We have a downtrend on the RSI indicator, which has reached near the lower boundary, and an upward rebound is expected. There is a key support zone in green at 0.2000. The price has bounced from this level multiple times and is expected to bounce again. We have a trend towards consolidation above the 100-period moving average, as we are moving close to it, which supports the upward movement. Entry price: 0.2142 First target: 0.2170 Second target: 0.2219 Third target: 0.2280 Don't forget a simple principle: money management. Place your stop-loss order below the support zone in green. For any questions, please leave a comment. Thank you.#ARB First target: 0.2170 Reached#ARB First target: 0.2170 Reached Second target: 0.2219 Reached Third target: 0.2280 Reached

MoonriseTA

تحلیل ماهانه ارز دیجیتال آربیتروم (ARB): پیشبینی نزولی و استراتژی کمریسک تا پایان ۲۰۲۵

The analyst expects Arbitrum's price to decline by the specified end time, based on quantitative analysis. The take-profit level only highlights the potential price range during this period — it’s optional and not a prediction that the market will necessarily reach it. You don’t need to go all-in or use leverage to trade wisely. Allocating just a portion of your funds helps keep overall risk low and ensures a more sustainable approach. Our strategy is built on institutional portfolio management principles, not the high-risk, all-in trading styles often promoted on social media. Results are evaluated over the entire analysis period, regardless of whether the take-profit level is reached. The validity of this analysis is based on a specific time range (until 31 Dec 2025), and after this period, the analysis will be reviewed and updated (once every 28 days).

SwallowAcademy

آربیتروم (ARB) در آستانه مرز حیاتی: سناریوی صعودی (A) و نزولی (B)

ARB is trading right above a local support zone that has been reacting well in the past. For now the key level is the local low — if sellers break it, we’ll most likely see a deeper move into the lower support area where Plan B would activate. But if buyers manage to hold this zone and push back above the first resistance, we get Plan A: a clean recovery into the upper zone and a potential continuation toward the next major levels. Both plans stay valid, but everything starts with how price behaves around this local low. Swallow Academy

Crypto4light

آربیت در خطر! آیا این سطح حیاتی را حفظ میکند یا سقوط آزاد آغاز میشود؟

For ARBUSDT so important hold a level around 0.20 cents! If we will not hold, the road will be open to invalidation under listing price, in this case we can see unfortunately the price discovery mode! On weekly timeframe so important, if we want to see uptrend continuation, we should go higher than August high and break the local structure! After sweep of buy side liquidity the final zone marked block fixation swing trade! When, and if we will reach this targets, only after that we can check the new updates depends of market conditions of that time! Even at the bottom and low price volume from sellers looks strong. Trade carefully

mastercrypto2020

سیگنال خرید فوری ARB/USDT: فرصت سود 3 برابری با اهرم بالا!

--- 📢 Official Trade Signal – ARB/USDT 📈 Position Type: LONG 💰 Entry Zone: • 0.2076 • 0.2024 --- 🎯 Take-Profit Targets (Partial Exits): TP1 = 0.2124 TP2 = 0.2177 TP3 = 0.2229 TP4 = 0.2291 TP5 = 0.2340 TP6 = — --- 🛑 Stop-Loss: 0.1987 📊 Timeframe: 15m ⚖️ Risk/Reward Ratio: 3.0 💥 Suggested Leverage: 5× – 10× --- 🧠 Technical Analysis Summary ARB is reacting strongly from the 0.2020–0.2080 demand zone, showing early signs of bullish reversal on the 15m chart. Price has formed a higher low and is attempting to reclaim short-term liquidity. The upside liquidity levels align with our profit targets: 0.2124 → 0.2177 → 0.2229 → 0.2291 → 0.2340 A breakout above TP1 can trigger a continuation move toward the mid-range resistance at 0.2177 and 0.2229. --- ⚙️ Trade Management Rules ✔️ Take partial profit at TP1 ✔️ Move SL to Break-Even once TP1 is hit ✔️ Trail SL as targets are reached ✔️ Avoid re-entry if SL gets hit ✔️ Confirm structure before entering --- ⚠️ Risk-Management Note After TP1 is hit → SL moves to BE (zero-risk). If price returns and hits BE later, it is not a loss — it’s capital protection. Your first mission is always risk control. --- 📌 TradingView Hashtags #ARBUSDT #ARB #CryptoSignal #LongSetup #TradingView #FuturesTrading #Altcoins #TechnicalAnalysis ---

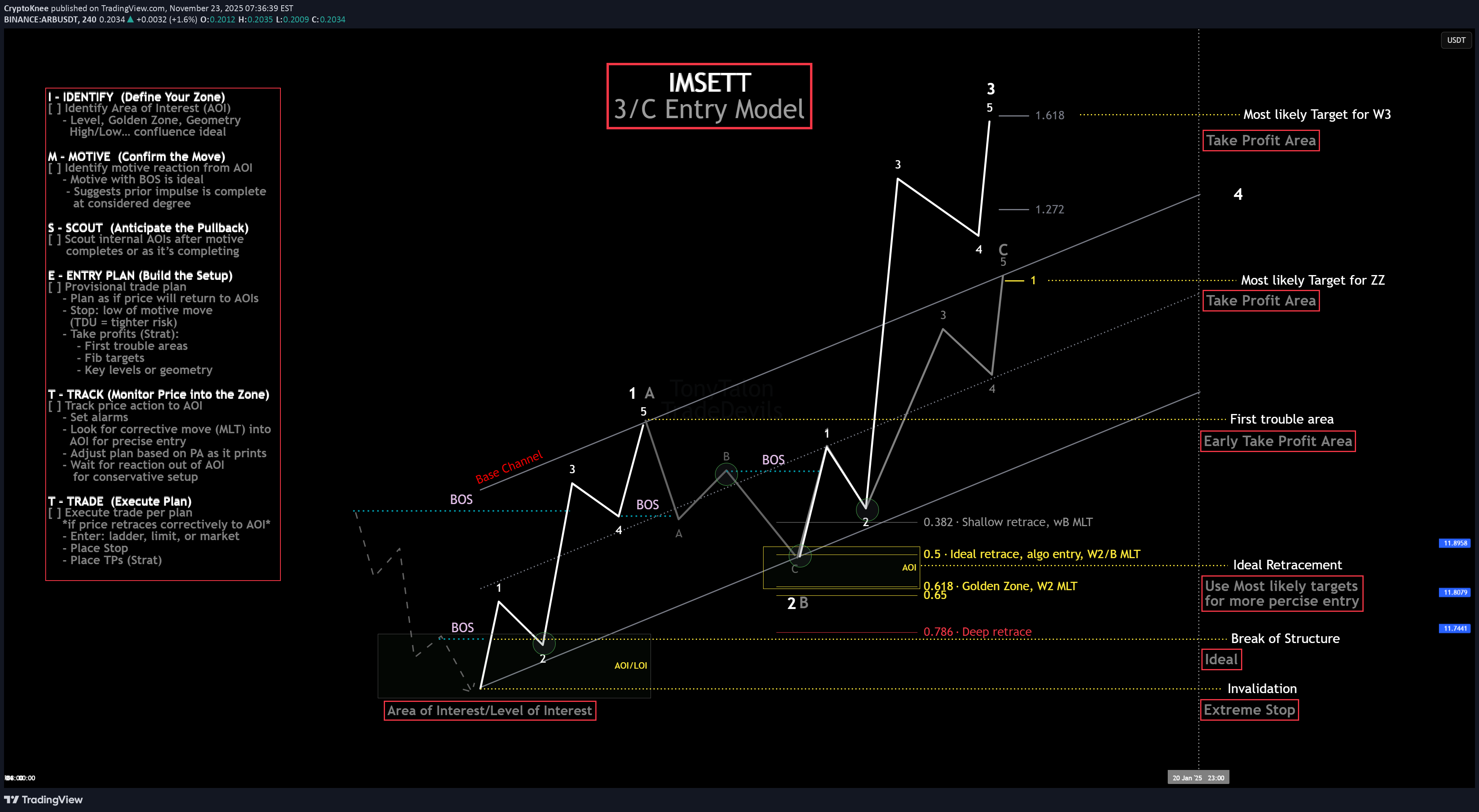

CryptoKnee

مدل ورود طلایی به موج 3 و C الیوت: راز شکار بهترین حرکات بازار!

The IMSETT 3/C Entry Model. Every trader wants to catch the big moves the ones that pay quickly and decisively. In Elliott Wave, those moves often come during Wave 3. It's the strongest part of the trend, and when you're positioned early, the risk-to-reward is unmatched. But not every opportunity hands you a clean Wave 3 on a silver platter. Sometimes you’re looking at a Wave C instead. That’s where the 3/C Entry Model comes in. It’s designed to get you aligned with high-conviction moves—whether the market is in a trend or a zig zag. Here’s the edge: both Wave 3 and Wave C often start the same way—a strong, motive push off an AOI (area of interest), followed by a retracement. That shared structure gives us an anchor. Whether we’re labeling it a 3 or a C doesn’t change the fact that the initial impulse gives us clarity, direction, and a place to manage risk. That’s what the IMSETT Model is built around: Identify Motive Scout Entry Plan Track Trade Each step is focused, actionable, and repeatable. You're not trying to outguess the market—you’re reacting to structure, preparing for common behavior, and executing with intent. I do have a video with a walk through. This just the way I look for clarity in setups. As with everything in trading, nothing will work every time so do your own research this is not financial advice. Cheers! Trade Safe, Trade Clarity.

CryptoAnalystSignal

آربیتراژ (ARB) در آستانه انفجار صعودی: تحلیل کامل حمایت کلیدی و نقاط ورود/خروج

#ARB The price is moving within an ascending channel on the 1-hour timeframe and is adhering to it well. It is poised to break out strongly and retest the channel. We have a downtrend line on the RSI indicator that is about to break and retest, which supports the upward move. There is a key support zone in green at 0.2276, representing a strong support point. We have a trend of consolidation above the 100-period moving average. Entry price: 0.2318 First target: 0.2384 Second target: 0.2447 Third target: 0.2520 Don't forget a simple money management rule: Place your stop-loss order below the green support zone. Once you reach the first target, save some money and then change your stop-loss order to an entry order. For any questions, please leave a comment. Thank you.

OpenYourMind1318

آربیتروم (ARB): آیا این الگوی تکراری نشاندهنده کلاهبرداری است؟ سقوط ۵۳ درصدی در راه است؟

Layer 2 scaling solution for Ethereum... The coin is moving in a very interesting way — you can clearly see a consistent percentage drop followed by a precise percentage rebound and this pattern keeps repeating every time, almost like a pre-written script. From the very beginning, the coin has been moving inside a global descending channel. Right now the coin is trying to repeat the same move that has already happened twice and if it repeats for the third time the outlook for this coin is not encouraging — we could drop another -53%, and it may even turn into a scam, because considering such a coin for investment would be madness. If in the end the coin finally turns bullish and breaks out of the global descending channel I wouldn’t set any targets higher than the ones marked on the chart

Literaryflavus

راز بزرگ ارز دیجیتال ARB: آیا این دارایی متحولکننده است؟

I too wonder what Arb will do. There is a falling wedge, let's see. DYOR YTD

SwallowAcademy

آربیتروم (ARB) در حال بازگشت قوی از حمایت کلیدی؛ آیا طلسم شکسته میشود؟

ARB continues to build strength right at a key support area that has acted as a turnover zone multiple times before. This rounded structure gives buyers a solid base to work from, and the probability of this push turning into a similar recovery move as in previous reactions is fairly high. For now, we keep watching how price behaves near EMAs — a clean breakout and retest from this region could easily turn into a high R:R long setup toward the upper targets. Swallow Academy

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.