CryptoKnee

@t_CryptoKnee

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

CryptoKnee

مدل ورود طلایی به موج 3 و C الیوت: راز شکار بهترین حرکات بازار!

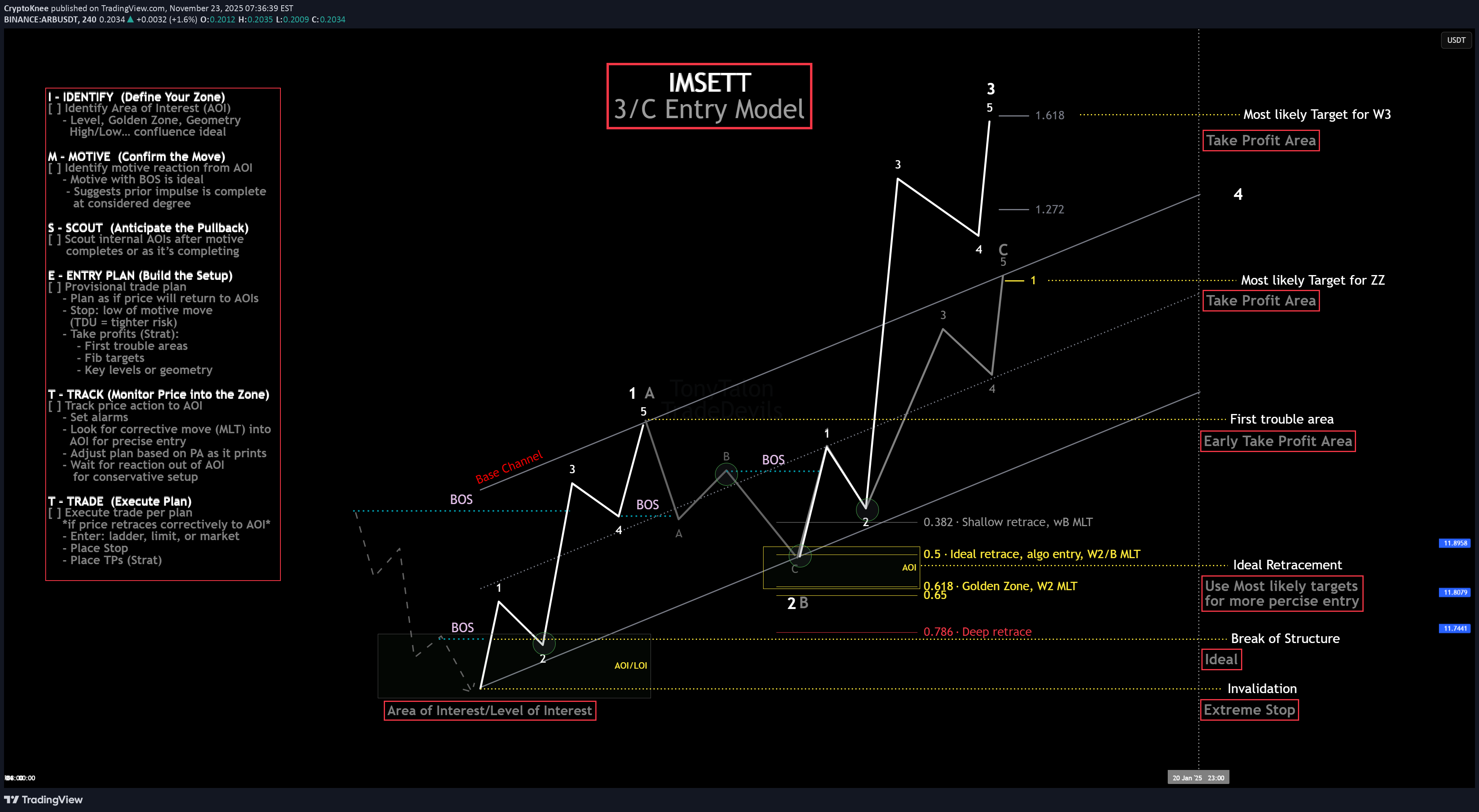

The IMSETT 3/C Entry Model. Every trader wants to catch the big moves the ones that pay quickly and decisively. In Elliott Wave, those moves often come during Wave 3. It's the strongest part of the trend, and when you're positioned early, the risk-to-reward is unmatched. But not every opportunity hands you a clean Wave 3 on a silver platter. Sometimes you’re looking at a Wave C instead. That’s where the 3/C Entry Model comes in. It’s designed to get you aligned with high-conviction moves—whether the market is in a trend or a zig zag. Here’s the edge: both Wave 3 and Wave C often start the same way—a strong, motive push off an AOI (area of interest), followed by a retracement. That shared structure gives us an anchor. Whether we’re labeling it a 3 or a C doesn’t change the fact that the initial impulse gives us clarity, direction, and a place to manage risk. That’s what the IMSETT Model is built around: Identify Motive Scout Entry Plan Track Trade Each step is focused, actionable, and repeatable. You're not trying to outguess the market—you’re reacting to structure, preparing for common behavior, and executing with intent. I do have a video with a walk through. This just the way I look for clarity in setups. As with everything in trading, nothing will work every time so do your own research this is not financial advice. Cheers! Trade Safe, Trade Clarity.

CryptoKnee

روز رهایی بیت کوین: آیا شاهد بازگشت بزرگ هستیم؟

Bitcoin Bounce Day? Elliott Wave Structure Suggests Potential Reversal If you find this information inspiring or helpful, please consider a boost and follow. Any questions or comments, please leave a comment. Bitcoin price moved lower overnight and tapped key wave 5 MLT targets that had been building through the past week. The reaction off those levels now becomes the focal point of the day. This move down may have completed a textbook five wave extension on lower timeframes. Each leg carried the proportionality that typically shows up at the tail end of extended structures. These are red flags that accompany the potential late stages of a motive move. Now the burden shifts to price action. If this is truly an extended fifth wave low, we need confirmation through higher highs and higher lows accompanied by broken pivots. Without that evidence, price can stall, drift sideways, or extend lower. That is why today is so critical. This is not a moment to anticipate the break upward but to monitor whether the reaction off the low carries the commitment required to become a larger reversal. Bitcoin has the setup. The market now needs to validate it. A clean bounce today would be the first step in turning this into a more meaningful reversal. Until then the primary task is waiting for confirmation for confirmation it the price action and planning for a potential setup to the upside. Trade Safe Trade Clarity

CryptoKnee

ارز بونک (BONK) در آستانه سقوط؟ تحلیل تکنیکال سرنوشتساز آلت سمر!

BONK – One of the First Runner of #ALTSummer BONK was one of the first tokens to blast off this summer, setting the pace for early alt momentum. It completed what looks like a clean five-wave impulse up, but now we’re seeing the market digest that move. If the structure were still strongly bullish, we’d expect a simple internal retracement into the summer impulse before continuation. Instead, the current price action is drifting lower and looks ready to sweep the origin of that move. That tells us this may be more than just a pullback. On the hard right edge, the structure is giving off triangle vibes. The range is tightening, volume is contracting, and the swings are overlapping. In Elliott Wave terms, a triangle is often the final pattern before the last move of a sequence. It’s the market coiling up before making its decision. If this forms and finishes as a triangle, we can use it to anchor the count. A clean thrust and sweep of the pivot could trigger short-term upside and possibly close out the current leg. From there, the key question becomes whether that push is the start of something new or simply the last gasp before one more low. For now, I’m watching how BONK handles this pattern. If it holds and breaks above the triangle invalidation, that would confirm a short-term bullish response. If it completes and breaks lower, the summer impulse is likely complete, and the next real opportunity will come from the base that forms afterward. Trade safe, trade clarity. TonyTalon

CryptoKnee

Bitcoin display short term clarity!?

Bitcoin Display Short-Term Clarity!? It looks like an impulse may have wrapped up here. With the sweep of consolidation, my lean is that either the impulse is complete, or this is a C-wave of a flat correction and we’ve got one more low coming before a push higher into a wave A or wave 1. Either way, I’ve got this flagged as a potential wave 3/C setup. The retrace here is definitely one to watch — not just at the smaller degree for a C/3 move up, but also for how the larger structure plays out. Because of the impulse down, we’re either at the beginning of something bigger or the end of a corrective leg. That distinction matters, but in both cases it gives us an anchor point for a trade setup. The key will be whether the retrace unfolds as a clean three-wave correction that respects the typical 50–61.8% zone, or if it breaks deeper and signals more corrective work ahead.

CryptoKnee

$Pengu Slippin'!?

PENGU Hits Key Wave 4 Zone – Time to Chill or Time to Act? PENGU turned down right where we suspected. Now the big question: what comes next? Price has tagged the lower targets for a possible wave 4. But let’s be clear—nothing is guaranteed. A turn here would fit the Elliott Wave roadmap, but until price confirms, it’s just potential. The conservative play is to wait for a confident pattern completion before committing to a new position. Alts have been bleeding, and correlated assets don’t always follow Elliott’s textbook path. That’s why patience has its place. Still, given how far this pullback has run, I see the ingredients forming for a setup. If PENGU does turn here, this area could mark the pivot. Whether you step in now or wait for more proof comes down to your trading style. Outlook: Aggressive trader: enter with strict exit plan at extreme wave 4 levels Conservative trader: wait for confirmed structure breaks before planning entry Key risk: correlated market pressure can drag alts lower, even with any amount of confluence at a level.

CryptoKnee

Eth to 4k!?

Ethereum seems to be grinding through a corrective pullback, and the price action around 4K is shaping up to be the next major test. If this dip continues to unfold in a corrective fashion, the area of interest (AOI) and levels of interest (LOIs) shown on the chart are where I’ll be watching closely. The wave count remains clean here. We’ve got confluence stacking around the 4K region, with support zones lining up against standard Fibonacci retracement levels. If price tags those areas while printing corrective structure, it keeps the bigger bullish roadmap intact. On the upside, 4.5K is the level that keeps capping bulls. Ethereum’s failed attempts to break through highlight its strength as resistance. If price makes another push and finally clears that ceiling, I’d have to reassess whether I’ve leaned too bearish in this pullback. A decisive reclaim would show just how much momentum buyers have left in the tank. Key Outlook: 4K region = next AOI for a corrective test 3,888 and 3,502 = deeper LOIs if selling pressure extends 4.5K break = potential shift back into aggressive bullish territory For now, patience is key. If ETH prints corrective structure into these downside levels, the larger Elliott Wave framework still points toward a bullish continuation. But without a strong break above 4.5K, the market hasn’t proven the bulls are back in control....yet

CryptoKnee

112k Bitcoin bully

Bitcoin Price Stuck in Neutral – Levels to Watch Closely Bitcoin price levels reactive right now. The Elliott Wave count isn’t giving me much confidence, and until we see a decisive move through key levels, I’m treating this as no-trade territory. The level that stands out is 112k. This has been a major flip point for BTC, and it’s the bulls’ number to beat. A break with an impulsive push followed by a correction that holds above (or even right at it) would start to build a much more convincing bullish case. That would open the door for a potential long setup. On the flip side, the current structure isn’t inspiring confidence. Price is showing lower lows and lower highs, a textbook downtrend, and every push is getting rejected off resistance. Until Bitcoin can reclaim levels it’s been losing, the bias leans bearish. For now, it’s a waiting game. The market needs to pick a side, and until it does, sitting on the sidelines is the safest option. Outlook: 112k break and correction = bullish setup 109k break and correction = bearish setup Lower lows and lower highs = trend still bearish until proven otherwise

CryptoKnee

ETH Path to 5k playing out nicely!

Played out nicely since last update. Ethereum has held near the level highlighted in the last update and, after a correction, pushed into the wave 3 most likely target. Price rejected from that area without yet breaking the all-time high. If this wave 3 has completed, which isn’t confirmed yet, the Elliott Wave count suggests caution. A wave 4 at the higher degree could be next. To gain clarity, we’ll need to see a few key pivots broken. The completion of a smaller 5-wave move lining up with the higher-degree wave 3 target is a clue this may be the spot to pause and evaluate. The way this retracement unfolds will help decide which degree it belongs to and set expectations for what comes next.

CryptoKnee

Is $PENGU Cooling Off?

PENGU continues to deliver, respecting structure and printing some clean price action. After breaking out of consolidation beneath the LOI at 0.032, price extended sharply, reaching as high as 0.0469—where we just saw a firm rejection, previously identified in the last update. That level wasn’t random. It aligned with a Most Likely Target (MLT) for a wave 5 at a lesser degree and a wave 3 at a higher degree. That kind of confluence usually draws in some heat—and it did. So what now? The conservative bull outlook is that we may be entering a wave 4. How this pullback unfolds could tell us a lot. The last retrace was shallow, and if this one digs a bit deeper or breaks certain levels with pattern clarity, that might signal a higher degree wave 4 is underway. The key level here is the 0.0325 level we were watching before. The raging bull scenario is that we’re still in a lesser degree impulse up. A hold and bounce off the key level could be enough to continue the move higher. But I’m watching the conservative outlook here until we get more print. Here’s what I’m watching: • Wave 4 Behavior Is this a pause or a pivot? The next leg depends on how corrective this gets. • 0.027 A break here would raise eyebrows. That’s a deeper level of interest and could hint at something more than a minor pullback. • Pattern Depth & Structure Each retrace tells a story. More complex wave 4s tend to show themselves through drawn-out corrections or deeper fib targets. I’m still holding partial from the original 0.012 entry, having taken some profit on the way up. If we get a clean W4 print, I’ll be scouting for the next add. Trade what’s printed. Stay flexible. Let the wave show its hand. Trade Safe. Trade Clarity.

CryptoKnee

$PENGU: Taking Profit and Watching for a Turn

If you find this information inspiring/helpful, please consider a boost and follow! Any questions or comments, please leave a comment! PENGU has made a strong move off the 0.007 level, now it just popped cleanly out of consolidation beneath the key LOI at 0.032. That break gave us the signal we needed for continuation, and so far, the price has followed through nicely. But now, we’re approaching a zone where things could get a bit trickier. This advance is starting to look like a classic wave 3 impulse, and while there’s no clear confirmation of a top yet, signs are beginning to flash caution. That means it’s time to start watching for potential topping behavior—especially if we move into a broader consolidation phase. Here’s what’s on my radar: • Wave 3 Exhaustion? Still unconfirmed, but this could be the final leg of the wave 3 structure. • AOI or Key Level Rejection A stall or strong reaction near resistance could be a red flag. Channel parallel being reached. • Bearish Divergence on the EWO Momentum isn’t keeping pace with price. That’s often a precursor to a deeper pullback. No need to force the next move here. This thing could just keep ripping up, but I am being extra cautious here. Not only to look for a potential top, but if a retrace is given, a potential long add to my current trade. Taking profit at these levels makes sense, especially given the early entry from 0.012 and my trade plan. As always, trade what’s printed, not what’s hoped for. Stay nimble. Trade Safe! Trade Clarity!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.