XMR

Monero

| تریدر | نوع سیگنال | حد سود/ضرر | زمان انتشار | مشاهده پیام |

|---|---|---|---|---|

Leo524الرتبة: 339 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 24/12/2025 | |

خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 22/12/2025 | ||

ColdBloodedCharterالرتبة: 31265 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 15/11/2025 | |

CryptoNuclearالرتبة: 32034 | خرید | حد سود: تعیین نشده حد ضرر: تعیین نشده | 15/11/2025 |

مخطط سعر Monero

سود ثلاثة أشهر :

خلاصه سیگنالهای Monero

سیگنالهای Monero

مرشح

فرز الرسالة بناءً على

نوع التاجر

الإطار الزمني

Monero . Bullish Structure Above Trendline

Monero یستمر فی احترام خط الاتجاه الصعودی المحدد جیدًا على الرسم البیانی للأربع ساعات. بعد الارتفاع المندفع move، انتقل السعر إلى مرحلة الترسیخ الخاضعة للرقابة، مسجلاً قیعان أعلى وثابتًا فوق الدعم الهیکلی. یشیر هذا السلوک إلى القوة بدلاً من الإرهاق. وطالما بقی خط الاتجاه سلیما، فإن الاحتمالیة تفضل الاستمرار، مع اعتبار أی تراجعات بمثابة إعادة اختبار هیکلیة ولیس فشل الاتجاه. الزخم یبرد، ولا ینعکس.

MyCryptoParadise

XMR keeps failing at 450 resistance, is a major breakdown coming

Yello Paradisers — کم مرة یمکن لـ XMRUSDT أن تصطدم بنفس الجدار قبل أن تنهار إلى الأبد؟ بدأ الرفض من المنطقة 448 إلى 450 یبدو أکثر من مجرد ضجیج. 💎XMRUSDT احترم القناة الصعودیة لفترة من الوقت ولکن هذا الهیکل قد تم کسره الآن بشکل واضح. یشیر الانهیار الأخیر جنبًا إلى جنب مع CHoCH الداخلی إلى تحول فی الزخم على المدى القصیر. أدى الرفض المتسرع إلى تهدئة المشترین ویظهر التماسک الحالی أسفل القناة المکسورة مباشرة أن البائعین یکتسبون السیطرة بینما یکافح المشترون للحفاظ على الأرض. 💎بعد الاختراق، قام السعر بمحاولة تصحیحیة ولکن سرعان ما تم رفضه مرة أخرى حول منطقة تصحیح فیبوناتشی 0.5 إلى 0.618. أصبحت هذه المنطقة الآن منطقة عرض وتستمر فی قمع أی محاولات صعودیة. وطالما بقی السعر تحت هذا الهیکل مع عدم وجود نزوح صعودی قوی، یظل التحیز هبوطیًا مع احتمال دفع نحو مناطق السیولة المنخفضة ومستویات الدعم الرئیسیة. 💎یتغیر هذا العرض فقط إذا أغلق السعر شمعة قویة فوق مستوى المقاومة 450. وهذا من شأنه أن یستعید النطاق المرتفع السابق، ویلغی التحول فی الهیکل الهبوطی ویشیر إلى قوة صعودیة متجددة مع إمکانیة استهداف سیولة أعلى فوق النطاق الحالی. 🎖الآن لیس الوقت المناسب للحرکات العاطفیة. حافظ على هدوئک وحافظ على ترکیزک. نحن مهتمون فقط بالإعدادات الأنظف والأکثر احتمالیة. هذه هی الطریقة win فی هذه اللعبة على المدى الطویل. MyCryptoParadise اشعر بالنجاح🌴

Leo524

تحلیل موج الیوت مونرو (XMR): آیا کف قیمت حفظ میشود تا موج صعودی پنجم آغاز شود؟

📌هذه هی نظریة موجة إلیوت فی العمل. لقد کنت أشاهد XMR خطوة بخطوة، لا أطارد الشموع، بل أنتظر بصبر. 📌فی الوقت الحالی، أکمل السعر الموجة 3 (الموجة الأقوى) ویتحرک داخل الموجة 4. الموجة 4 هی دائمًا تصحیح ولیست انعکاسًا. 📌لکی تظل موجة إلیوت صالحة، یجب أن تحتفظ الموجة 4 بمنطقة الدعم (المنطقة الخضراء). یعتبر هذا التراجع صحیًا ومطلوبًا قبل move التالی. 📌إذا حافظ السعر على هذا الدعم وأظهر القوة، فیمکن أن تبدأ الموجة 5، والتی عادةً ما تؤدی إلى الدفعة النهائیة للأعلى 🚀 📌استنتاج بسیط: ثبات الدعم ➝ اکتمال التصحیح ➝ الموجة 5 الصاعدة 🔥

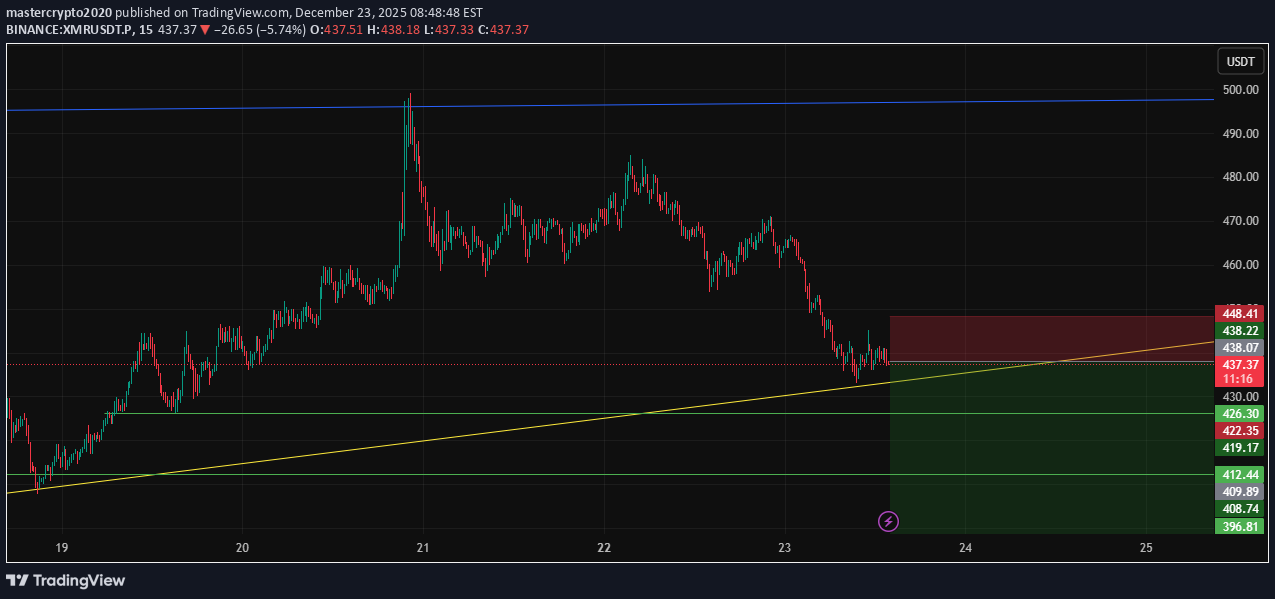

mastercrypto2020

XMR USDT SHORT SIGNAL

📢 إشارة التجارة الرسمیة – XMR/USDT 📉 نوع الوظیفة: قصیرة 💰 سعر الدخول: 438.00 (أمر محدد) 🎯 أهداف جنی الأرباح (الخروج الجزئی): • TP1: 426.30 • TP2: 412.44 • TP3: 396.81 • TP4: 382.95 • TP5: 367.00 • TP6: — 🛑 وقف الخسارة: 448.50 📊 الإطار الزمنی: 15m ⚖️ نسبة المخاطرة إلى المکافأة: مناسبة 💥 الرافعة المالیة المقترحة: 5× – 10× 🧠 ملخص التحلیل الفنی یتم تداول XMR أسفل منطقة المقاومة الرئیسیة بالقرب من 440، مما یظهر رفضًا هبوطیًا واضحًا على الإطار الزمنی لمدة 15 دقیقة. یتغیر هیکل السوق هبوطیًا مع ارتفاعات منخفضة، ویتزاید ضغط البیع. تتوافق مناطق السیولة الهبوطیة بدقة مع مستویات TP لدینا: 426.30 → 412.44 → 396.81 → 382.95 → 367.00 یؤدی وجود move مؤکدًا أسفل TP1 إلى زیادة احتمالیة الاستمرار نحو الأهداف الأعمق بشکل کبیر. ⚙️ قواعد إدارة التجارة ✔ احصل على ربح جزئی عند TP1 ✔ Move SL إلى نقطة التعادل بمجرد الوصول إلى TP1 ✔ Trail SL عندما یصل السعر إلى أهداف أقل ✔ لا یمکن إعادة الدخول إذا تم ضرب SL ✔ تأکید الهیکل الهابط قبل التنفیذ 📌 علامات التصنیف TradingView #XMRUSDT #XMR #CryptoSignal #ShortSetup #عرض التداول #تداول العقود الآجلة #التحلیل الفنی

Bixley2

MONERO Bullish Continuation

أتوقع أن یستمر الارتفاع الصغیر الحالی فی السعر إلى أبعد من ذلک کما هو موضح فی نمط القضبان الخضراء السعر على وشک اختراق مثلث کبیر، والذی أجده مشابهًا للمثلث الموجود على الذهب. الیومی صعودی

XMRUSD - Privacy Rally Explodes +143% YTD

Executive Summary XMRUSD is trading at approximately $469.71 after an extraordinary year that has seen the privacy coin surge +143% YTD and +155% over the past 12 months. Monero recently hit a 52-week high of $497.75 and is now consolidating just below the critical $500 psychological resistance. The privacy narrative is on fire - Cardano's Midnight protocol launch, rising surveillance concerns, and the EU's 2027 privacy coin ban have created a perfect storm of demand. However, with RSI at 84 (overbought) and price near yearly highs, the question is: breakout to $1,000+ or pullback to consolidate gains? BIAS: BULLISH - But Overbought Caution Required The trend is undeniably bullish. The fundamentals support continued upside. But technicals warn of potential short-term pullback before the next leg higher. Current Market Context - December 22, 2025 Monero's performance has been nothing short of spectacular: Current Price: $469.71 (-0.25% on the day) Day's Range: $453.05 - $483.69 52-Week Range: $183.02 - $497.75 52-Week High: $497.75 (hit last week) Market Cap: $8.67 billion 24h Trading Volume: $171.27 million Performance Metrics - ALL GREEN: 1 Week: +14.90% 1 Month: +40.05% 3 Months: +62.54% 6 Months: +49.34% YTD: +143.09% 1 Year: +155.28% This is the BEST performing major cryptocurrency of 2025. Monero has massively outperformed Bitcoin, Ethereum, and virtually every other top 20 coin. THE PRIVACY NARRATIVE - Why XMR Is Exploding 1. EU Privacy Coin Ban (2027) - Bullish Paradox The European Union confirmed plans to prohibit exchanges from listing privacy coins like Monero starting in 2027, citing anti-money laundering concerns. This follows increased scrutiny after high-profile hacks and ransomware attacks. The Paradox: Short-term BULLISH: Users accumulating XMR pre-ban Creates urgency to acquire before restrictions Validates Monero's core value proposition - if governments want to ban it, it must work Long-term risk: Liquidity could dry up if major exchanges delist Monero's fungibility remains key defense against regulatory sidelining 2. Midnight Protocol Sparks Privacy Rally (Dec 20, 2025) Cardano's Midnight protocol launched NIGHT, a privacy token using zero-knowledge proofs. While not directly tied to Monero, the project reignited interest in privacy technology across the entire sector. XMR rose 18% weekly alongside Zcash Privacy tech is back in focus Rising concerns over digital surveillance driving demand Monero benefits from sector momentum Competition from newer privacy solutions exists, but XMR remains the gold standard 3. Technical Breakout Gains Traction (Dec 22, 2025) XMR surged past its 50-day EMA ($449) Shielded transaction volume hitting ALL-TIME HIGHS Analysts note bullish Wyckoff accumulation patterns Rising open interest (+10% weekly) suggests leveraged bets on continued privacy demand Added to CoinDesk 80 Index - reflecting growing market presence 4. Institutional Interest Growing XMR added to CoinDesk 80 Index Increased futures open interest Growing market presence despite regulatory headwinds Privacy as a feature becoming more valued, not less Development Updates - Bullish Fundamentals Monero developers have been extremely active in late 2025: Security Patches (November 2025): Ledger hardware wallet vulnerability patched (view-key export bug) CLI v0.18.4.4 update addressed critical edge case Strengthens trust in hardware wallet integrations Spy Node Defense - "Fluorine Fermi" Upgrade (October 2025): IP subnet filtering introduced to counter surveillance Disrupts tactics used by firms like Chainalysis Complements existing Dandelion++ protections Directly reinforces untraceable transactions RPC Fuzzing Milestone (November 2025): Achieved 100% fuzzing coverage for RPC endpoints Funded by MagicGrants Reduces attack vectors for hackers Hardens nodes against exploits FCMP++ Scaling Prep (November 2025): Full-Chain Membership Proofs alpha testing finalized Beta stressnet expected Q1 2026 Could enable lighter nodes and better scalability Aims to solidify Monero as most private Layer 1 2026 Roadmap - Major Upgrades Coming FCMP++ Beta Stressnet (Q1 2026) - Scaling decisions finalized Bulletproofs++ (2026) - 30% smaller transactions, 40% faster verification Seraphis & Jamtis (2026) - Enhanced anonymity protocols GetMonero.org Redesign (2026) - Improved user experience Technical Structure Analysis Price Action Overview - 2 Hour Timeframe The chart shows a textbook bullish structure: Ascending Channel Pattern: Clear ascending channel established over past weeks Higher highs and higher lows consistently forming Channel support: Rising trendline from lows Channel resistance: Parallel line at highs Price currently in upper half of channel Recent Price Action: Price hit resistance zone near $490-$500 Pulled back and now consolidating Currently in a smaller consolidation range ($455-$490) Fibonacci retracement levels visible (0.5 and 0.6 levels) Testing mid-channel support Key Observations: 52-week high of $497.75 represents immediate resistance $500 psychological level is THE level to watch Support zone at $407-$410 area (channel bottom) Strong uptrend intact - no signs of reversal yet Consolidation after 52-week high is healthy, not bearish Key Support and Resistance Levels Resistance Levels: $483-$490 - Immediate resistance (recent highs) $497.75 - 52-week high $500 - CRITICAL psychological resistance $550 - Next major resistance if $500 breaks $600 - Secondary target $1,000 - Major psychological target (community expectation) Support Levels: $453-$460 - Immediate support (day's low area) $449 - 50-day EMA (key moving average) $430-$440 - Secondary support $407-$410 - MAJOR SUPPORT ZONE (channel bottom) $380-$390 - Deep support $350 - Extended support if correction deepens Moving Average Analysis Price trading well above 50-day EMA ($449) All major moving averages sloping upward Golden cross patterns on multiple timeframes MAs providing dynamic support on pullbacks Trend structure extremely bullish RSI Analysis - OVERBOUGHT WARNING RSI currently at 84 - OVERBOUGHT territory This is the primary caution signal Overbought RSI doesn't mean immediate reversal In strong trends, RSI can stay overbought for extended periods However, pullbacks from overbought levels are common Watch for RSI divergence as potential warning sign Volume Analysis 24h volume: $171.27 million Volume supporting the uptrend Shielded transaction volume at ALL-TIME HIGHS Open interest rising (+10% weekly) Healthy volume profile for continuation Community Sentiment - Extremely Bullish Bull Case - $1,000+ Targets olgerd_butko : "Monero screams insta teleportation above 1k. Privacy by default. No hype. Just real facts." SoonTzu : "Monero has only 0.2% of total crypto value. With XMR supply matching BTC's, $90k BTC implies massive XMR upside." - This comparison suggests theoretical $1,500+ XMR price if adoption parity occurs. Bear Case - Regulatory Concerns @Nicat_eth : "Monero edged lower as exchange delistings and privacy scrutiny intensify." Bearish pressure stems from shrinking liquidity on some exchanges, though price action has defied this concern. Regulatory Landscape - Double-Edged Sword Delistings and Restrictions: Kraken halted XMR for UK users (late 2024) Kraken halted XMR for EEA users (November 2025) Exodus wallet ended XMR support (August 2025) EU ban coming in 2027 Why This Is Actually Bullish (Short-Term): Validates Monero's privacy effectiveness Creates urgency to accumulate before restrictions Proves the technology works as intended Decentralized exchanges and P2P trading remain available Monero's fungibility makes it resistant to blacklisting SCENARIO ANALYSIS BULLISH SCENARIO - Breakout Above $500 Trigger Conditions: Daily close above $500 with volume RSI holds above 70 without major divergence Continued privacy narrative momentum Bitcoin remains stable or bullish Ascending channel breakout to upside Price Targets if Bullish: Target 1: $550 - First resistance above $500 Target 2: $600 - Secondary target Target 3: $750 - Extended target Moon Target: $1,000+ (community expectation) Bullish Catalysts: FCMP++ beta stressnet success (Q1 2026) Continued privacy rally momentum EU ban fears driving accumulation Shielded transactions continuing to hit ATHs Altcoin season rotation Bulletproofs++ and Seraphis upgrades BEARISH SCENARIO - Pullback to Support Trigger Conditions: Rejection at $500 with bearish candle RSI divergence forms (lower highs on RSI, higher highs on price) Break below ascending channel support Broader crypto market weakness Major exchange delisting announcement Price Targets if Bearish: Target 1: $449 - 50-day EMA retest Target 2: $430-$440 - Secondary support Target 3: $407-$410 - Channel bottom / major support Extended: $350-$380 if channel breaks Bearish Risks: RSI at 84 - overbought Near 52-week high - profit-taking likely Regulatory headlines could spook market Thin liquidity on some exchanges Broader crypto correction risk NEUTRAL SCENARIO - Consolidation Most likely short-term outcome: Price consolidates between $450-$490 RSI cools off from overbought levels Builds base for next leg higher Healthy consolidation after massive rally Watch for breakout direction MY ASSESSMENT - BULLISH WITH CAUTION The weight of evidence strongly favors bulls: +143% YTD performance speaks for itself Privacy narrative is the strongest it's been in years Development activity is robust Shielded transactions at ATH Community sentiment extremely bullish Ascending channel intact All timeframes showing bullish structure However, caution is warranted: RSI at 84 is overbought Near 52-week high - natural resistance $500 is major psychological barrier Some profit-taking expected Regulatory headlines could cause volatility My Stance: BULLISH - Buy Dips Strategy I believe XMR will eventually break $500 and continue higher. The fundamentals and narrative support it. However, I would not chase at current levels with RSI at 84. Instead: Wait for pullback to $449-$460 area for better entry Or wait for confirmed breakout above $500 with volume Avoid buying in the middle of the range Trade Framework Scenario 1: Breakout Trade Above $500 Entry Conditions: Daily candle closes above $500 Volume exceeds recent average RSI holds above 65 (not diverging) Trade Parameters: Entry: $505-$515 on confirmed breakout Stop Loss: $475 below recent support Target 1: $550 (Risk-Reward ~1:1) Target 2: $600 (Risk-Reward ~1:2) Target 3: $750 (Extended) Scenario 2: Buy the Dip at Support Entry Conditions: Price pulls back to $449-$460 zone RSI cools to 50-60 range Bullish rejection candle at support Ascending channel support holds Trade Parameters: Entry: $450-$460 on support test Stop Loss: $420 below channel support Target 1: $490-$500 (Risk-Reward ~1:1.5) Target 2: $550 (Risk-Reward ~1:3) Target 3: $600 (Extended) Scenario 3: Channel Bottom Buy Entry Conditions: Price tests $407-$410 major support zone Strong bounce with volume RSI oversold or near oversold Trade Parameters: Entry: $410-$420 at channel bottom Stop Loss: $385 below support zone Target 1: $460-$470 (Risk-Reward ~1:2) Target 2: $500 (Risk-Reward ~1:3.5) Target 3: $550+ (Extended) Risk Management Guidelines Position sizing: 2-3% max risk per trade Respect overbought RSI - don't chase Use hard stops - privacy coins can be volatile Scale into positions rather than all-in entries Take partial profits at each target (33% each) Move stop to breakeven after first target Monitor regulatory news closely Be aware of lower liquidity on some exchanges Invalidation Levels Bullish thesis invalidated if: Price closes below $407 (channel bottom) Ascending channel breaks down RSI divergence confirms with lower price Major exchange delisting causes panic Bitcoin crashes below $85,000 Bearish thesis invalidated if: Price closes above $500 with volume RSI makes new highs with price Shielded transactions continue hitting ATHs Privacy narrative accelerates further Conclusion XMRUSD is the standout performer of 2025 with +143% YTD gains. The privacy narrative is firing on all cylinders - EU ban fears, Midnight protocol launch, surveillance concerns, and development upgrades have created a perfect storm for Monero. The Numbers: YTD Performance: +143.09% 1-Year Performance: +155.28% 52-Week High: $497.75 Current Price: $469.71 RSI: 84 (Overbought) Market Cap: $8.67 billion Key Levels: $500 - CRITICAL resistance / breakout level $497.75 - 52-week high $449 - 50-day EMA support $407-$410 - Major support zone (channel bottom) The Setup: Monero is consolidating just below its 52-week high after an incredible rally. The trend is bullish, fundamentals are strong, and the privacy narrative is the best it's been in years. However, RSI at 84 warns of potential short-term pullback. Strategy: Don't chase at current levels Buy dips to $449-$460 support Or buy confirmed breakout above $500 Targets: $550, $600, $750+ Stop below $420 or channel support The path of least resistance is higher. Privacy is becoming more valuable, not less. Monero's technology is proven, development is active, and the community is committed. The EU ban paradoxically validates everything Monero stands for. $1,000 XMR is not a meme - it's a matter of when, not if. This is not financial advice. Always conduct independent research and manage risk appropriately.

norok

Monero Confirmed Breakout

Monero XMRUSD کسر السعر المرتفع المحلی عند 470 مع إغلاق أسبوعی bar عند 470.38. حتى لو کان ذلک بمقدار 0.38، فلا تزال هذه قاعدة مطبقة لتأکید الاختراق. وستکون المقاومة التالیة عند أعلى مستوى على الإطلاق عند 517.60. نظرًا لتأکید الاختراق والزخم، فمن المرجح أن یختبر السعر مستوى ATH وبعد ذلک سنرى ما إذا کان سیتم إغلاق bar الأسبوعی لتأکید ذلک أیضًا. إلى أی مدى یمکن أن یصل Monero؟ أنا لا أفترض أن أسمی القمم بدقة. نظرًا لتطور ATHs، فإن الارتفاع التالی الأکثر ترجیحًا سیکون حوالی 593. وباستخدام توقع التقلب التاریخی لمدة 3 سنوات، یمکن أن یکون الهدف 793. تحذیر: مثل هذا الارتفاع السریع فی السعر یعنی تقلبات عالیة متأصلة، وتُظهر نظرة على تاریخ Monero على المدى الطویل أن العودة المفاجئة الدراماتیکیة أمر محتمل جدًا فی النهایة. من الصعب جداً الشراء فی هذه المرحلة. ومع ذلک - ما زلت أعتقد أن Monero هو أفضل رهان غیر متماثل فی العملة المشفرة فی الوقت الحالی.

Mrbigman

Mrbigman

مونرو (XMR) آماده جهش بزرگ: رمز ارز جدید در مسیر صعود نجومی!

xmr یتبع الفضة على الماکرو والذهب على الرسم البیانی الأربع ساعات. لقد شهدنا للتو صعود XRM إلى أعلى مستوى جدید على الإطلاق هذا العام! ..فی هذه اللحظة بالذات نشهد کسرًا کلاسیکیًا وإعادة اختبار.. الآن إذا حصلنا على التشکل فی الوقت الأصغر، فسنکون فی مرحلة اکتشاف الأسعار والذهاب إلى أعلى مستویاتها الجدیدة على الإطلاق فی عید المیلاد. الهدف الأول ثم الراحة المؤقتة عند 3200.00 والهدف الثانی المؤقت 5 کیلو ... الأهداف صالحة فقط عند الاختراق المؤکد فی وقت أصغر من القمر، کن جاهزًا وسأقوم بتحدیثک فورًا بمجرد ظهور xrm!

tomas_jntx

XMR Reclaims Structure and Flips Demand – Bulls in Control

فحص الاتجاه: XMR احتفظ بالطلب وقلب MSB بزخم قوی. یستمر الاتجاه الصعودی فوق مستوى 420 دولارًا. المؤشرات: مؤشر القوة النسبیة: 57 (صاعد) MACD: صعودی مع ارتفاع الرسم البیانی الهیکل: کسر السعر الهیکل الهبوطی وقلبه صعودیًا بعد استعادة مناطق الطلب. الإعداد الحالی یفضل ارتفاع الأسعار. الموقف: التحیز الطویل فکرة الدخول: فترة طویلة عند إعادة الاختبار بقیمة 426 دولارًا - 428 دولارًا الإیقاف: أقل من 420 دولارًا الأهداف: 442 دولارًا → 456 دولارًا المنطق: احترام الطلب، وانقلب الهیکل. مؤشرات العزم تدعم المزید من الارتفاع.

إخلاء المسؤولية

أي محتوى ومواد مدرجة في موقع Sahmeto وقنوات الاتصال الرسمية هي عبارة عن تجميع للآراء والتحليلات الشخصية وغير ملزمة. لا تشكل أي توصية للشراء أو البيع أو الدخول أو الخروج من سوق الأوراق المالية وسوق العملات المشفرة. كما أن جميع الأخبار والتحليلات المدرجة في الموقع والقنوات هي مجرد معلومات منشورة من مصادر رسمية وغير رسمية محلية وأجنبية، ومن الواضح أن مستخدمي المحتوى المذكور مسؤولون عن متابعة وضمان أصالة ودقة المواد. لذلك، مع إخلاء المسؤولية، يُعلن أن المسؤولية عن أي اتخاذ قرار وإجراء وأي ربح وخسارة محتملة في سوق رأس المال وسوق العملات المشفرة تقع على عاتق المتداول.