Swissquote

@t_Swissquote

Ne tavsiye etmek istersiniz?

önceki makale

پیام های تریدر

filtre

Swissquote

Caution: Cash Levels Among Fund Managers Are at Record Lows

According to the latest Global Fund Manager Survey conducted by Bank of America, the percentage of cash held by fund managers has fallen to 3.3%, the lowest level since 1999. In terms of asset allocation, historically low cash levels among managers have often coincided with peaks in equity markets. Conversely, periods when cash levels reached elevated zones were frequently precursors to major market bottoms and to the end of bear markets. At a time when S&P 500 valuations are in an overextended bullish zone, this new historical low in cash holdings among managers therefore constitutes a signal of caution. Sooner or later, cash levels are likely to rebound, which would translate into downward pressure on equity markets. This reflects the basic principle of asset allocation between cash, equities, and bonds, with capital flowing from one reservoir to another. It is the fundamental mechanism of asset allocation: the reservoirs represented by cash, equities, and bonds fill and empty at the expense of one another. This signal is all the more significant because such a low level of cash implies that managers are already heavily invested. In other words, the vast majority of available capital has already been allocated to equities. In this environment, the pool of marginal buyers shrinks considerably, making the market more vulnerable to any negative shock: macroeconomic disappointment, a rise in long-term interest rates, geopolitical tensions, or even simple profit-taking. Moreover, historically low cash levels reflect an extreme bullish consensus. Financial markets, however, tend to move against overly established consensuses. When everyone is positioned in the same direction, the risk-reward balance deteriorates. In such cases, the market does not necessarily need a major negative catalyst to correct; the mere absence of positive news can sometimes be enough to trigger a consolidation. It is also important to recall that the rise in the S&P 500 has been accompanied by an extreme concentration of performance in a limited number of stocks, mainly related to technology and artificial intelligence. In such an environment, a simple portfolio rebalancing or sector rotation can amplify downward moves. Finally, the gradual return of cash typically does not occur without pain for equity markets. It is often accompanied by a phase of increased volatility, or even a correction, allowing a healthier balance to be restored between valuations, positioning, and economic prospects. In summary, this historically low level of cash among fund managers is not a signal of an imminent crash, but it clearly calls for caution, more rigorous risk management, and greater selectivity within the S&P 500, in an environment where optimism appears to be largely priced in. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

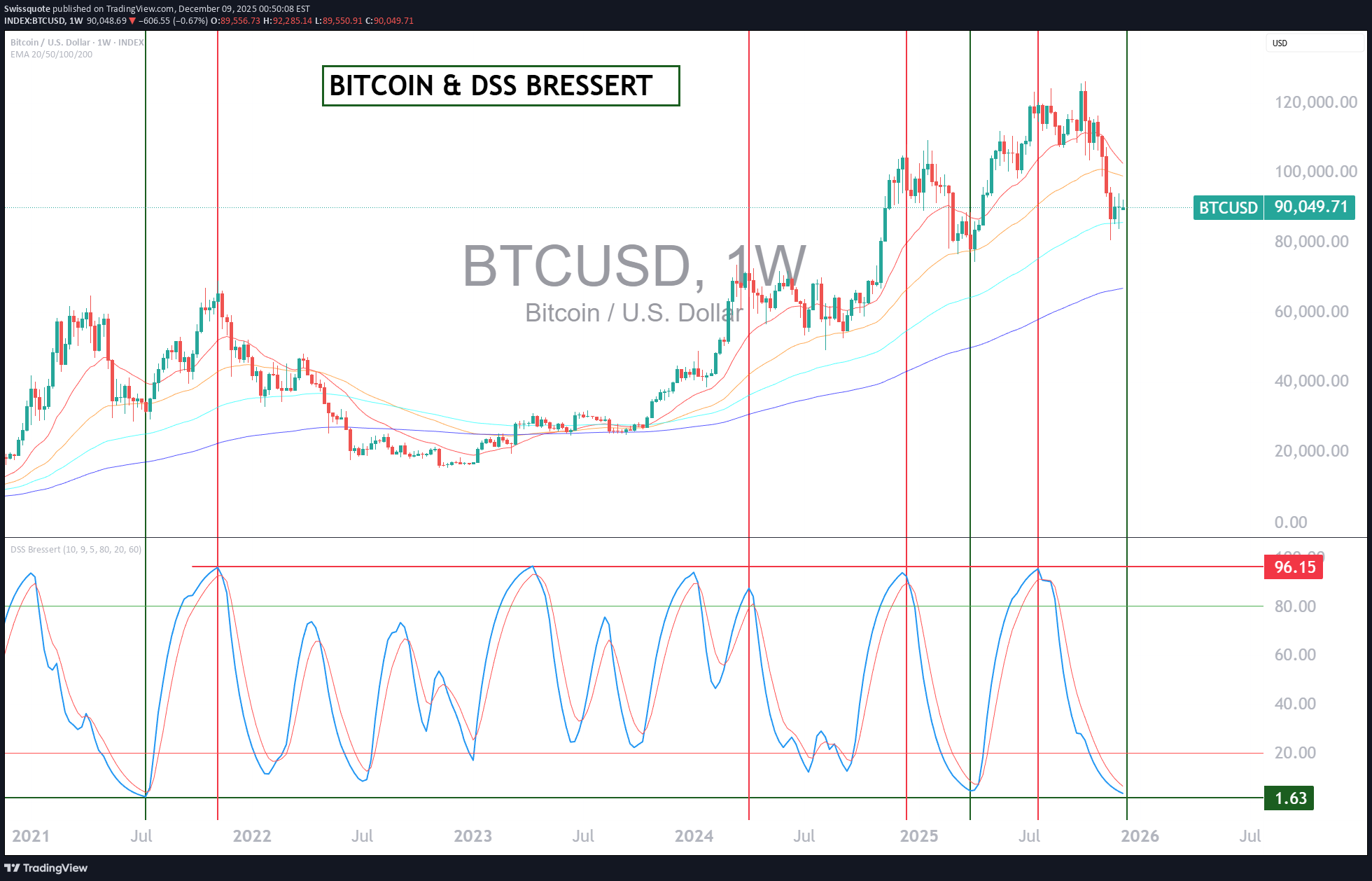

DSS Bressert بیت کوین: رمزگشایی سیگنالهای کلیدی برای پیشبینی صعودی هفتههای آینده

Technical analysis provides trend-following indicators and indicators designed to measure the strength of a trend — these belong to what we call momentum indicators. A weakening bearish trend is always the first stage of a bullish reversal, and a tiring bullish trend is always the first step toward a downward reversal. Today, I propose a focus on the DSS Bressert technical indicator, which captures these transition phases between bearish and bullish trends quite well, especially on the weekly timeframe, which helps to project several weeks ahead. 1) How does the DSS Bressert work? The DSS Bressert (Double Smoothed Stochastic) is an advanced variant of the traditional stochastic. Its goal is to measure the price’s position relative to its high/low range over a given period while filtering out short-lived fluctuations. Whereas the classical stochastic can be very reactive — sometimes too much — the DSS uses two successive smoothing steps, allowing the signal to better reflect genuine momentum rotations. Concretely, it oscillates between 0 and 100. •Above 80, the zone is generally considered a potential upside excess: not an automatic sell signal, but an indication that the bullish trend may be mature. •Below 20, we are in a potential oversold area, often associated with the end of bearish cycles or accumulation zones. The crossover between the two curves (fast and slow) provides additional information about reversals. On a weekly timeframe, these signals gain relevance as they align with Bitcoin’s larger market movements, which are far less noisy than on the daily chart. 2) Why does the DSS Bressert align well with Bitcoin’s cycles? Historically — based on the last cycles visible on the weekly chart — the DSS Bressert has aligned well with Bitcoin’s tops and bottoms. During major peaks, the indicator has consistently been in the upper zone, sometimes diverging from the price ahead of corrections. Likewise, market bottoms have almost always coincided with a DSS dropping below 20 before a bullish crossover. In the current situation, the DSS once again seems to be moving in a lower zone, typical of market breathing phases. This does not guarantee an immediate reversal, but the combined price + momentum setup suggests a context more favorable to a rebound in the coming weeks — especially since Bitcoin is still supported by upward-sloping weekly moving averages, notably the 100-week exponential moving average. However, this technical reading must be nuanced. The next meeting with the Fed this Wednesday, December 10, remains a major risk: any modification in monetary guidance could fuel short-term volatility and temporarily invalidate the technical signals. The DSS provides a cyclical view, but it cannot factor in macroeconomic and monetary shocks in advance. In summary: technical conditions favor a rebound scenario, but caution remains essential as the market awaits the Fed this Wednesday, December 10. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

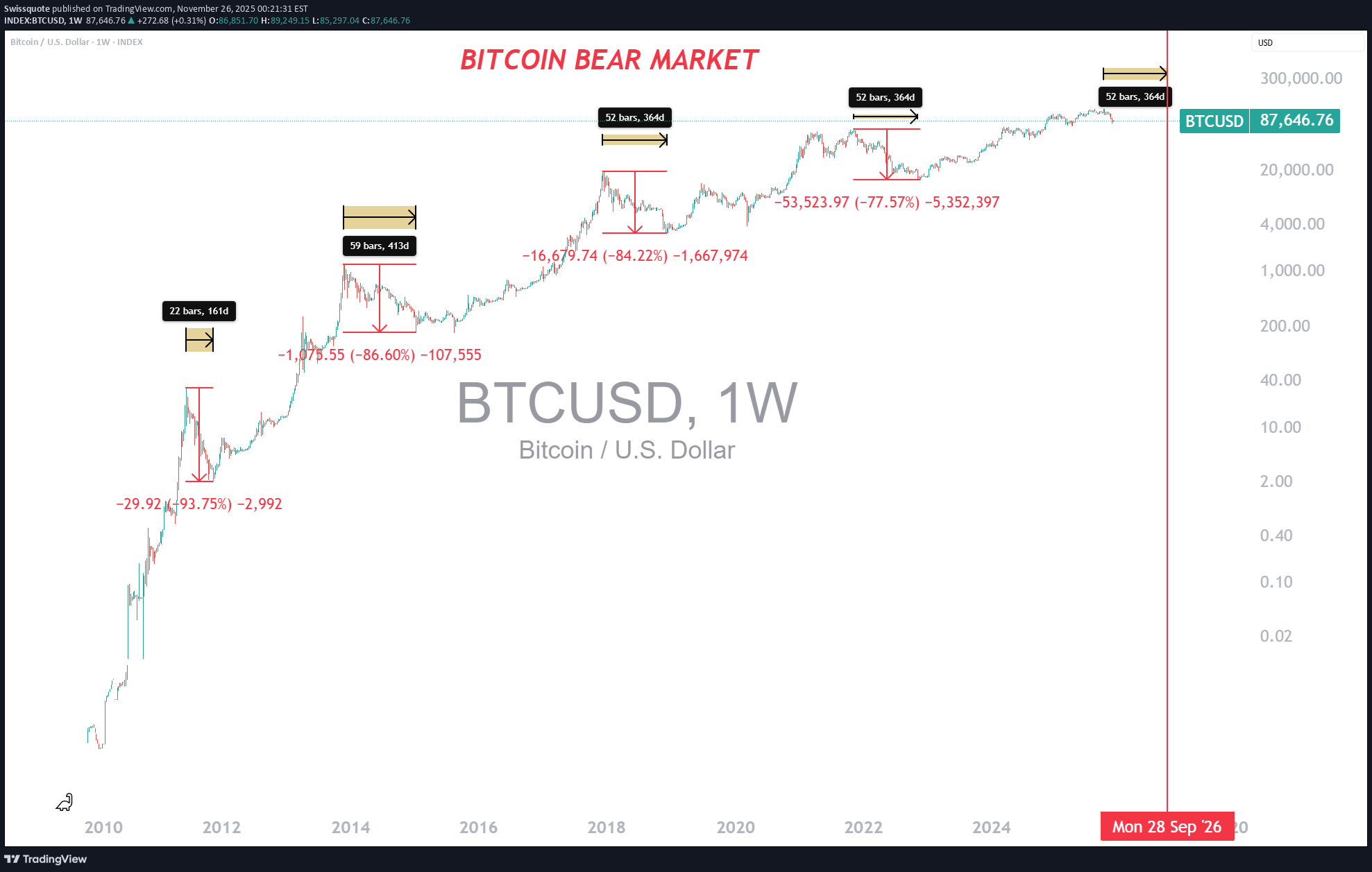

رمزگشایی بازار خرسی بیت کوین: چه چیزی را باید بدانید؟

Under the credible, and now widely discussed, hypothesis that Bitcoin’s last bullish cycle ended on Monday, October 6, at a peak around 126,000 USD, it becomes logical to consider that the market then entered its new cyclical bear market. This bear market is part, as always, of the well-known 4-year cycle dynamic, itself directly linked to the quadrennial halving mechanism, which halves the mining reward and mechanically reduces the new supply of BTC. In other words, the market follows a structural breathing pattern: four years built around a supply shock, a bullish acceleration, and then a normalization marked by a bearish phase. By printing a cycle top at the very beginning of October, Bitcoin has therefore confirmed, in an almost surgical manner, that the mechanics of the 4-year cycle remain fully active. We now have enough statistical hindsight to understand not only how the bullish phase of a cycle behaves, but also how the cyclical bear market unfolds, with regularities strong enough to serve as a robust analytical framework. Here is what we know about the dominant technical factors of this bear market: •Average duration: a cyclical Bitcoin bear market lasts around 12 months. It’s a remarkably stable constant from one cycle to the next. •Price structure: the bear market generally consists of three major waves. A first impulsive and strongly negative wave (the one we would have entered since October 6), followed by a technical rebound phase, often referred to as a dead cat bounce, and finally a third and last bearish leg, which brings the true cycle bottom. •Drawdown amplitude: from one cycle to another, the maximum depth of the decline tends to shrink. Nevertheless, even while decreasing, the drawdown remains historically substantial, and must be understood as a major correction rather than a simple pullback. (For those wishing to dig deeper into this point, see our analysis from Monday, November 17, 2025.) Assuming therefore that the cyclical bear market effectively began on October 6, logic would suggest that it should continue until September or October 2026. It should unfold according to the three technical phases mentioned above, before potentially recording a final drawdown somewhere between 50% and 70% from the 126,000 USD peak. Naturally, this scenario remains theoretical. It relies solely on the presumed validity of the quadrennial cycle. If the latter were to turn out to be nothing more than a statistical illusion, a historical artifact, or a now obsolete phenomenon, then this entire analytical framework would also collapse. But as long as the data continue to align, this scenario remains, objectively, the most coherent one. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

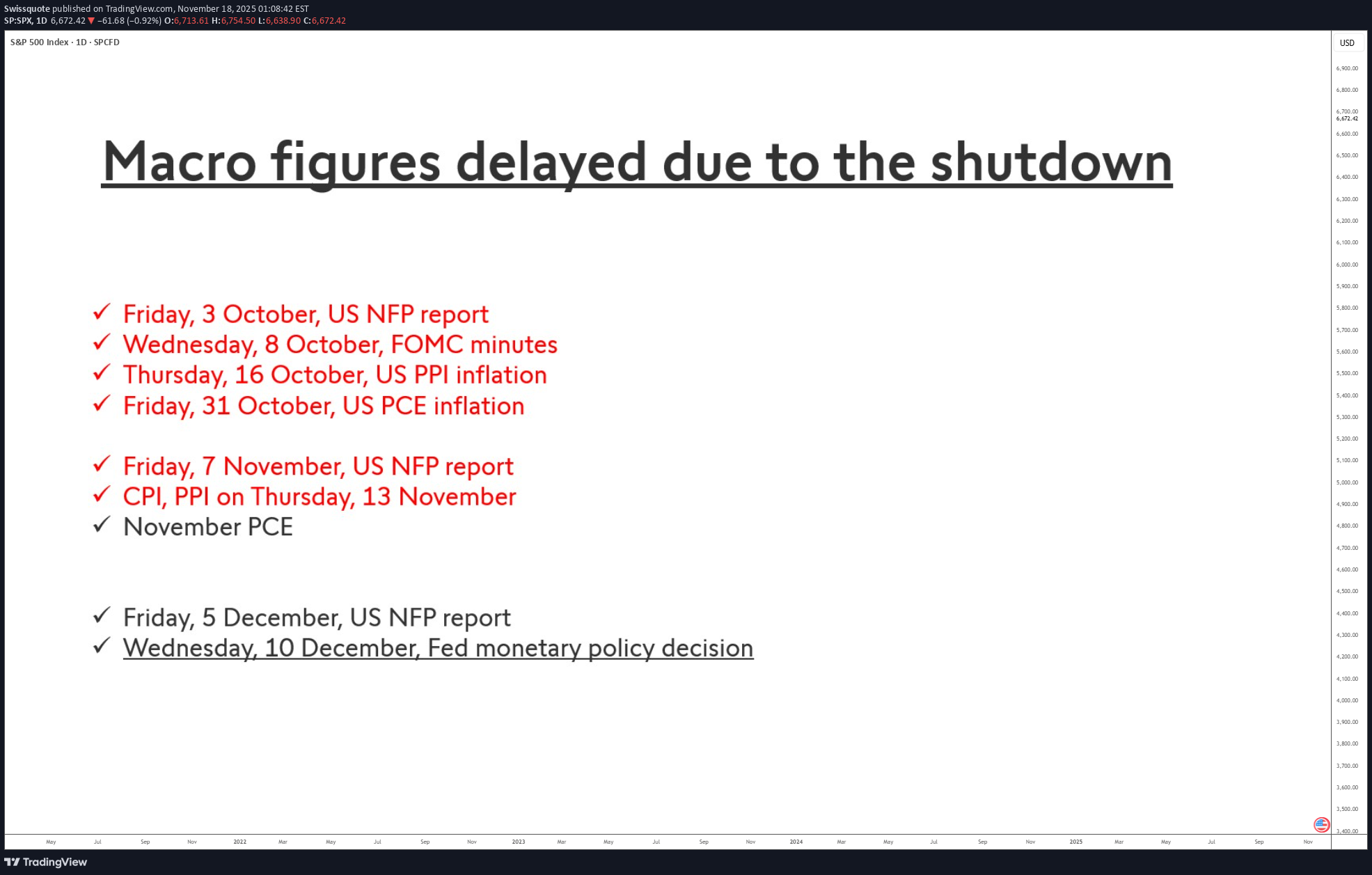

پایان قریبالوقوع "خاموشی آماری" آمریکا: دادههای حیاتی چه زمانی منتشر میشوند؟

The prolonged shutdown of the U.S. federal government has had an exceptional impact on the release of some of the country’s most important economic statistics. Indicators such as the employment report (NFP), PCE inflation, or the CPI are the backbone of the Federal Reserve’s monetary policy and heavily influence financial market volatility. Their delay therefore creates a true statistical “black hole.” Why are these indicators delayed? Two federal agencies have been affected: •the Bureau of Labor Statistics (BLS), responsible for NFP and CPI; •the Bureau of Economic Analysis (BEA), which publishes PCE inflation as well as household income and spending data. During the shutdown, these agencies had to suspend the collection, processing, and validation of data. Unlike a simple administrative pause, this disrupts complex statistical pipelines built on surveys of businesses and households. Some data cannot be “caught up” immediately because they depend on strict deadlines, which explains why certain series may be incomplete, revised late, or even canceled. The case of Non-Farm Payrolls (NFP) The October NFP report — normally released in early November — was entirely blocked. Signals from the BLS suggest that this report may be partially or totally compromised, especially the household survey, which is more difficult to reconstruct. By contrast, the September report, which was also delayed, now has a confirmed publication date: Thursday, November 20, 2025. For the October report, there is still no official date. The most likely estimates point to a possible release in late November or early December, provided the data quality is deemed acceptable. The case of PCE inflation The October PCE inflation figure — scheduled for October 31 — was also halted. The BEA announced it would revise its entire calendar but has not yet provided firm replacement dates. Economists currently expect a publication around November 26, 2025, potentially in a partially “imputed” form (with statistical estimates filling missing data). Market consequences The absence of these key data forces investors and the Fed to navigate blindly. Volatility could remain elevated until the full or partial release of these indicators, which should gradually return to a normal schedule starting in December. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

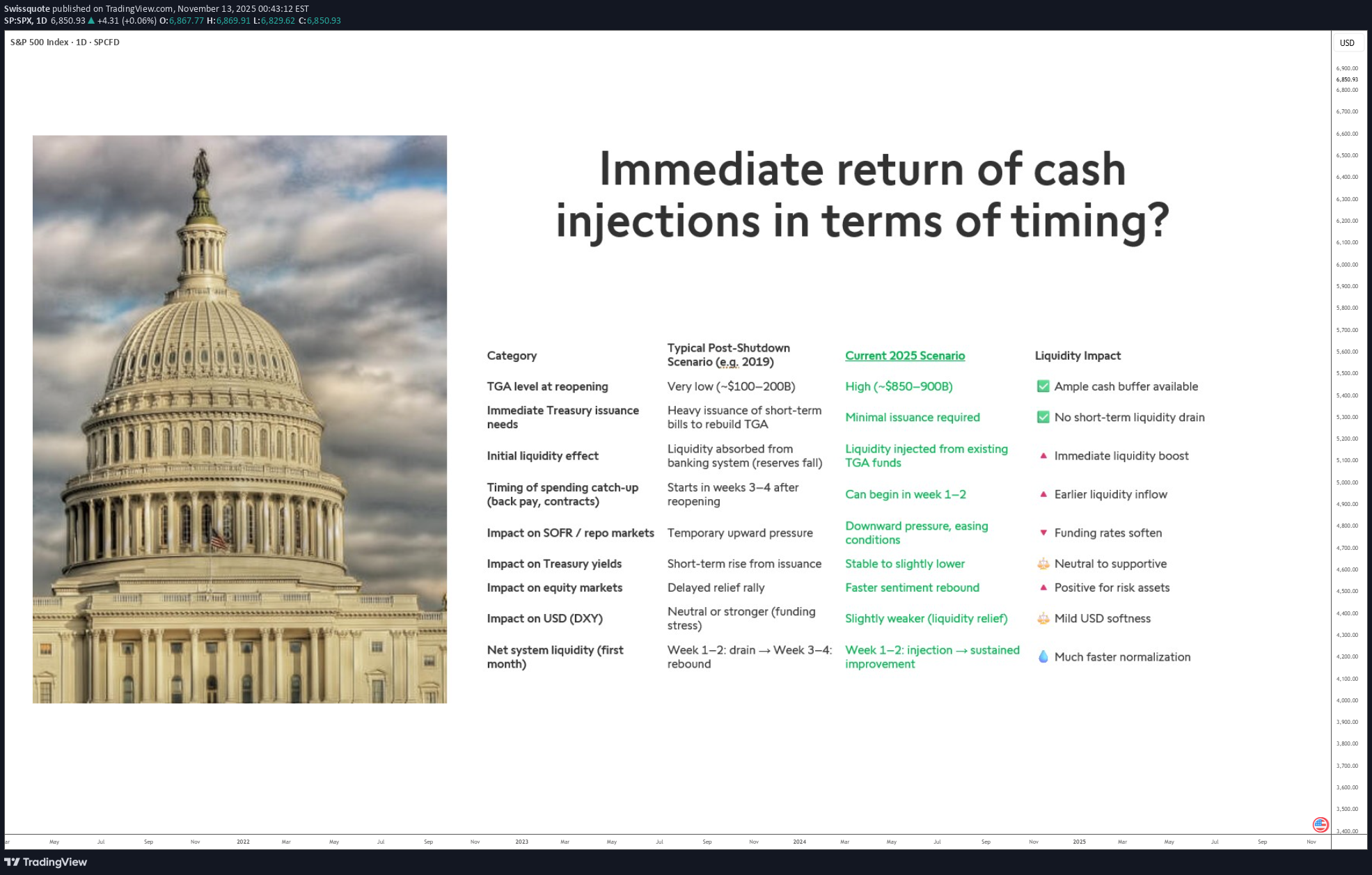

پایان تعطیلی ۲۰۲۵: انفجار نقدینگی در بازارهای مالی چگونه خواهد بود؟

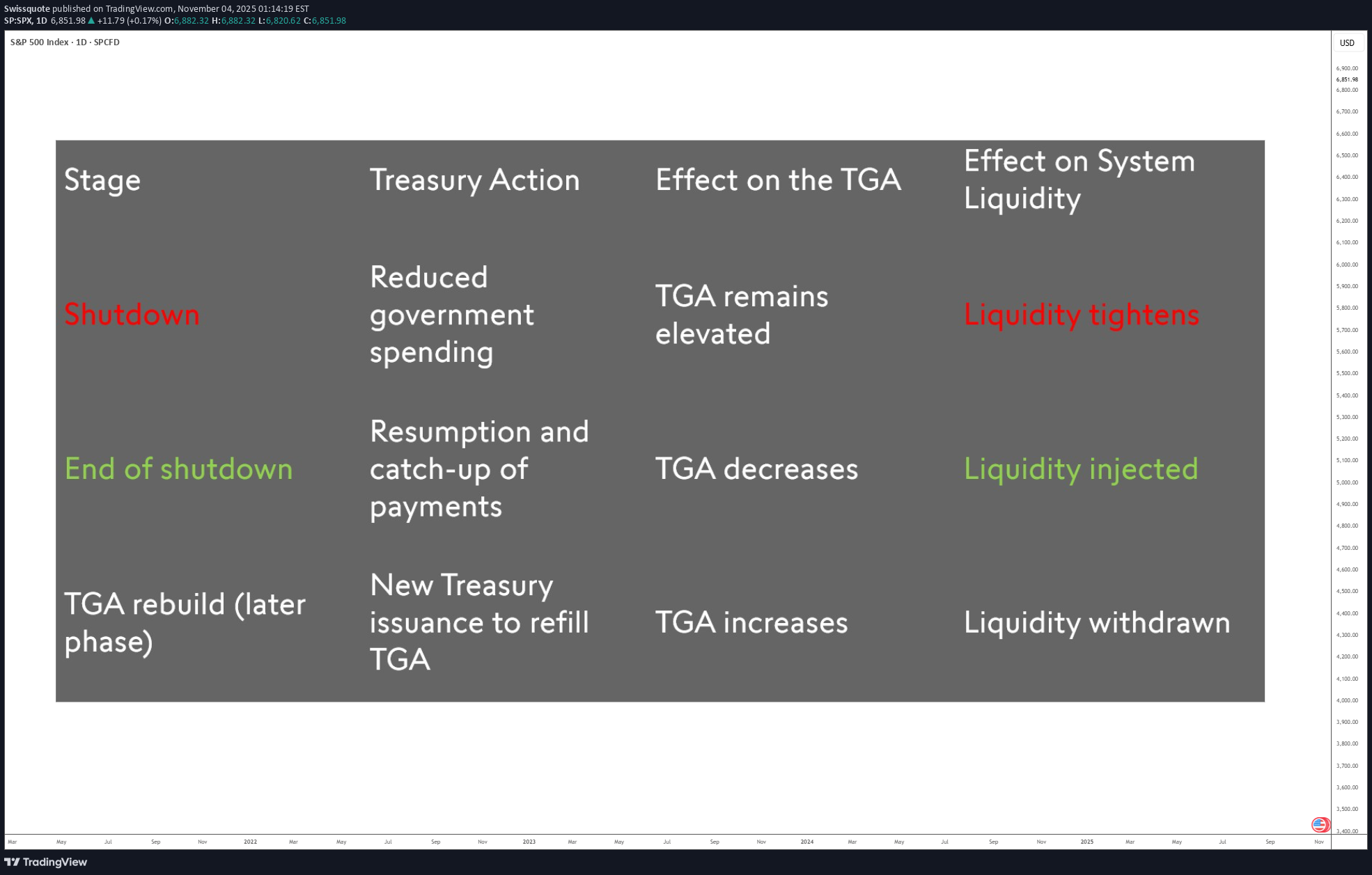

The reopening of the U.S. government at the end of the 2025 shutdown is expected to trigger a swift return of liquidity to financial markets. This recurring phenomenon will have a distinct magnitude this time due to the specific conditions of the U.S. Treasury General Account (TGA) and the current federal funding structure. 1) A fiscal context unlike previous shutdowns In past episodes, notably in 2019, the U.S. Treasury exited the shutdown with very low cash balances—typically between $100 and $200 billion. To rebuild this buffer, it had to issue large amounts of short-term Treasury bills, which drained liquidity from the banking system as investors used reserves to buy the securities. In 2025, the situation is reversed. The Treasury holds a high cash balance—estimated between $850 and $900 billion—because the federal government’s account at the Fed (the TGA) was replenished at the end of September. This provides ample room to finance near-term public spending without issuing new debt. The result is an absence of pressure on money markets and stable bank reserves. 2) Liquidity injections from day one With abundant cash reserves, the Treasury can promptly resume pending payments—federal salaries, public contracts, and suspended programs. These payments act as direct liquidity injections into the financial system, starting within the first weeks following the end of the shutdown. In previous reopenings, this process began only after three to four weeks. In 2025, it could start as early as week one or two, significantly shortening the normalization timeline for market liquidity. 3) Moderate but positive market effects This faster liquidity return should lead to: •unchanged or slightly lower bond yields, given steady demand and the absence of additional issuance; •a slightly weaker dollar, reflecting easier financing conditions. Overall, this points to a quicker and more orderly normalization of the monetary system compared to 2019, potentially supporting risk assets in the short term. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

بیت کوین در بازار خرسی است؟ تحلیل پایان چرخه صعودی بعد از ۱۲۶ هزار دلار

Since the peak reached at nearly $126,000 on October 6, 2025, a central question arises: has the Bitcoin bull cycle linked to the 2024 halving already come to an end? Several factors, both technical and temporal, make this hypothesis plausible, though not definitively confirmed as long as major supports hold. From a timing perspective, comparing previous cycles provides interesting insights. According to the summary table of Bitcoin cycles, the average duration between each halving and the end of a cycle ranges between 526 and 546 days. The October 2025 peak occurred 534 days after the April 2024 halving—perfectly consistent with historical timing. Moreover, the total duration of the cycle, around 1,438 days since the previous top, almost exactly matches the 2016 and 2020 cycles, which lasted 1,472 and 1,424 days respectively. From a market rhythm standpoint, the hypothesis of an already completed cycle “makes sense,” even if it implies a slightly earlier peak than historical averages. However, from a technical standpoint, the underlying trend remains upward for now. The weekly chart shows Bitcoin still trading above its 50-week moving average, a key indicator often used to distinguish bullish from bearish phases. In previous cycles, this support only broke once the market had truly entered a “bear market.” As long as the price holds above this average—currently around $98,000 to $100,000—the structure remains healthy, and the scenario of a mere intermediate correction remains plausible. In addition, a major ascending trendline, visible since the 2024 lows, also converges near the $98,000 area. This technical level, reinforced by several recent rebounds, forms a crucial support zone: its break would confirm a loss of momentum and could validate the end of the bull cycle. Conversely, holding above this threshold followed by a rebound would revive the hypothesis of a still-expanding market, possibly leading to a new high before the true distribution phase. In summary, timing supports the idea of a possible end of cycle, but prices have yet to confirm it. Bitcoin remains in its long-term uptrend as long as it defends the $98,000–$100,000 area. Only a clear break below the weekly 50 SMA would turn this consolidation into a major reversal signal. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

حباب داتکام و پایان سال میلادی: آیا S&P 500 سقوط میکند یا اوج میگیرد؟

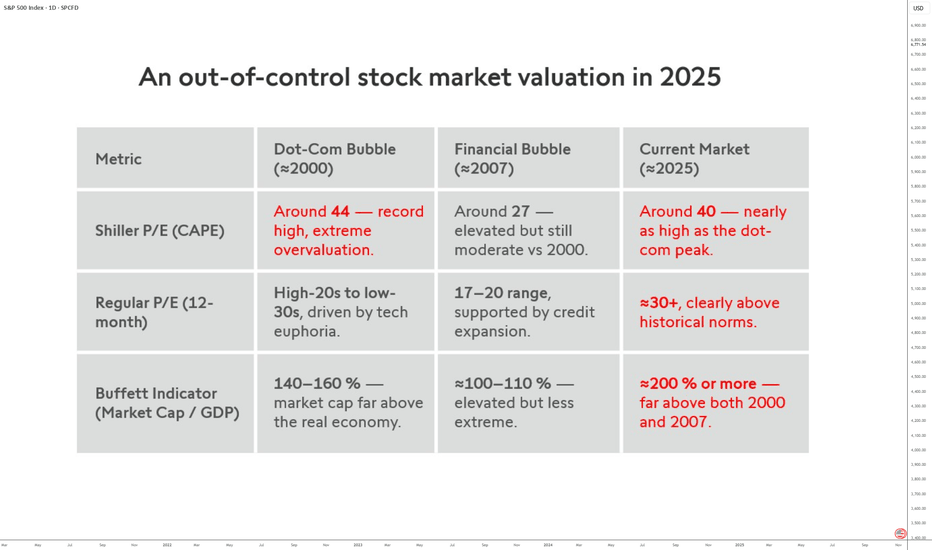

As the S&P 500 posts a Shiller CAPE ratio of 40.24 in early November 2025 — nearly equivalent to the dot-com bubble peak in 2000 (~44) — a key question arises: can the U.S. market still advance during the last two months of the year? History suggests that November and December seasonality often favors bulls, yet economic reality and valuation levels may temper this optimism. Valuations on the Verge of Overheating Fundamental indicators speak for themselves. A Shiller P/E around 40 signals extreme overvaluation; the historical average is around 17. The Buffett Indicator, which compares total market capitalization to GDP, exceeds 200% — an all-time high, well above levels seen before the 2000 and 2007 crises. In other words, U.S. equity prices are today largely disconnected from the size of the real economy. Historical comparisons are striking: the market has only been this expensive on the eve of the tech crash twenty-five years ago. This makes any new bullish episode difficult to justify fundamentally. Yet history also shows that markets can remain overvalued for long periods, especially when liquidity is abundant and investors fear “missing out” on gains. Seasonality: A Favorable Tailwind at Year-End Statistically, November and December are the most favorable months for U.S. equities. According to Topdown Charts (1964–2024), November delivers an average return of +1%, positive in 69% of cases, while December rises +1.2% on average, gaining nearly 70% of the time. Market Paradox: Expensive Yet Bullish? This coexistence of extreme valuation and seasonal bullish momentum is not unprecedented. In 1999, for instance, the S&P 500 gained over 20% in the six months leading up to its historical peak, even though its CAPE exceeded 40. Investor psychology and flow dynamics often play a more significant role than fundamental reasoning in the short term. However, such an environment reduces the margin of safety: any macroeconomic shock or earnings disappointment could trigger a sharp correction. History shows that markets can ignore excesses … until the moment they cannot. Conclusion The S&P 500 approaches the end of 2025 in a paradoxical situation: supported by historically favorable seasonality but in fundamental weightlessness. November and December could indeed be positive due to bullish inertia, liquidity effects, and collective psychology. Yet at these valuation levels, every additional point of gain also brings the market closer to an inflection point. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

پایان تعطیلی دولت آمریکا: شوک نقدینگی بزرگ برای بازارها!

The end of a U.S. government shutdown is often interpreted as a mere political signal. Yet, from a financial perspective, this event can mark a major turning point for global liquidity. One of the most direct mechanisms through which this occurs is the Treasury General Account (TGA) — the U.S. Treasury’s main account at the Federal Reserve (Fed). 1) The TGA: a true liquidity reservoir The TGA functions as the federal government’s current account. When it receives revenues (taxes, bond issuance, etc.), funds are deposited there. When it spends — salaries, contractor payments, social programs — those amounts leave the TGA and flow toward commercial banks and households. Each dollar spent by the Treasury exits the Fed and enters the private sector, increasing bank reserves and overall financial system liquidity. Conversely, when the Treasury issues bonds and collects money from investors, bank reserves decline since those funds are transferred into the TGA. 2) Shutdown: a period of silent contraction During a shutdown, the government is largely paralyzed. Many payments are suspended or delayed, reducing cash outflows. As a result, the TGA drains much more slowly, and available liquidity in the financial system decreases. It is worth noting that the TGA had just finished refilling in early October — exactly at the onset of the shutdown. 3) The end of the shutdown: a sharp reinjection As soon as the shutdown ends, the U.S. Treasury must catch up on deferred spending — wages, contracts, and federal programs. These large disbursements cause a rapid decline in the TGA, equivalent to a direct injection of liquidity into the economy. Bank reserves increase mechanically, repo rates may ease, and risk assets — equities, high-yield bonds, crypto-assets — often experience a short-term rebound. This liquidity surge is not sustainable: once payments are settled, the Treasury usually reissues debt to rebuild the TGA to its target level. This reverse phase then withdraws the excess liquidity from the market. In the short term, however, the end of a shutdown acts as a positive liquidity pump, capable of influencing the trend of risk assets on financial markets. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Swissquote

الذهب عند 4381 دولارًا: هل هي قمة دورية أم تصحيح مؤقت؟

هل سجّل سعر الذهب قمته النهائیة للدورة الصعودیة عند مستوى 4381 دولارًا خلال جلسة التداول یوم الاثنین 20 أکتوبر الماضی؟ لقد أنهت هذه الجلسة مرحلة من الجمود الصعودی فی أسعار المعادن الثمینة، وبدأت معها أول حرکة تصحیح منذ منتصف شهر أغسطس. ومع ذلک، فإن هذا التصحیح لا یعنی بالضرورة أن القمة النهائیة للدورة قد تم بلوغها أو أن الاتجاه العام أصبح هبوطیًا. ولکی یمکن القول إن الذهب قد حقق قمته السنویة فی أکتوبر فی سوق السلع، یجب أن تتوافر عدة شروط تقنیة وأُسُسیة، وهی فی الوقت الحالی غیر متحققة. 1- لتأکید أن الأصل المالی قد بلغ قمة کبرى فی دورته، یجب أن یواجه مقاومة رئیسیة وأن تظهر إشارة انعکاس هبوطی واضحة. عند دراسة التاریخ البیانی للذهب، نلاحظ مرحلة التوزیع الطویلة بین عامی 2011 و2012 التی أنهت دورة صعودیة بدأت فی مطلع القرن. تلتها سوق هابطة استمرت أربع سنوات قبل أن تبدأ دورة صعودیة جدیدة فی ینایر 2016. ما الوضع الفنی الحالی على المدى الطویل؟ البیانات الشهریة توضح الصورة الزمنیة البعیدة. فمنذ اختراق الذهب قمّته التاریخیة السابقة فی مارس 2024، یبنی الموجة الصعودیة الخامسة، وقد تجاوز بالفعل عدة أهداف نظریة مستندة إلى امتدادات فیبوناتشی. منطقة 4300 دولار تمثل تلاقی امتدادین رئیسیین، من بینهما الامتداد الذهبی 1.618 للموجة الثالثة. ومع ذلک، فإن ذلک غیر کافٍ للقول إن القمة الدوریة قد سُجلت عند 4381 دولارًا. فحتى الآن لا توجد مؤشرات توزیع واضحة ولا کسر لمستوى دعم رئیسی. کسر مستوى 3400 دولار سیکون إشارة قویة على نهایة الدورة الصعودیة. 2- القمة الدوریة للذهب ستتحقق عندما یؤکد الدولار الأمریکی انعکاسًا صعودیًا متوسط الأجل. تتزامن القمة الدوریة للذهب عادة مع بدایة انعکاس صعودی مستدام للدولار الأمریکی، لأن العلاقة بینهما عکسیة فی الغالب: فارتفاع الدولار یقلل من جاذبیة الذهب للمستثمرین الدولیین. وعندما یؤکد الدولار انعکاسه الصعودی، تتجه التدفقات تدریجیًا بعیدًا عن الذهب، ما یشیر إلى نهایة المرحلة الصعودیة للمعدن النفیس. لذلک تُعد دینامیکیة الدولار مؤشرًا رئیسیًا لتوقع القمة الدوریة للذهب. الرسم البیانی أدناه یوضح الشموع الیابانیة الأسبوعیة لمؤشر الدولار الأمریکی (DXY) مقابل سلة من العملات الرئیسیة، مع تمییز انعکاسات عامی 2018 و2021. 3- القمة الدوریة للذهب ستتحقق عندما تصبح تدفقات الخروج من صنادیق ETFs المرتبطة بالذهب هی المهیمنة. تُسجَّل القمة الدوریة للذهب عندما تبدأ تدفقات الخروج من صنادیق المؤشرات المدعومة بالذهب فی السیطرة على المشهد. فعادة ما تعکس التدفقات الداخلة إلى هذه الصنادیق شهیة المستثمرین تجاه المعدن الثمین، وعندما تجف تلک التدفقات ثم تنعکس إلى الخارج، فإن ذلک یدل على تراجع تدریجی فی الطلب المالی على الذهب، الذی کان محرکًا رئیسیًا فی ارتفاع أسعاره خلال عام 2025. هذا التطور یشیر إلى أن المرحلة الصعودیة بلغت مرحلة النضج. لذلک فإن هیمنة تدفقات الخروج من صنادیق ETFs للذهب تُعتبر مؤشرًا مبکرًا على انعکاس دورة الذهب، وهو ما لم یتحقق حتى الآن وفقًا لآخر بیانات مجلس الذهب العالمی. هذا المحتوى مخصص للأفراد الذین لدیهم درایة بالأسواق والأدوات المالیة وهو مخصص لأغراض المعلومات فقط. الفکرة المعروضة (بما فی ذلک تعلیقات السوق وبیانات السوق وملاحظاته) لیست نتاج عمل أی قسم أبحاث تابع لسویسکوت أو الشرکات التابعة لها. تهدف هذه المادة إلى تسلیط الضوء على حرکة السوق ولا تشکل نصیحة استثماریة أو قانونیة أو ضریبیة. إذا کنت مستثمر تجزئة أو تفتقر إلى الخبرة فی تداول المنتجات المالیة المعقدة، فمن المستحسن طلب المشورة المهنیة من مستشار مرخص قبل اتخاذ أی قرارات مالیة. لا یهدف هذا المحتوى إلى التلاعب بالسوق أو التشجیع على أی سلوک مالی محدد. لا تقدم Swissquote أی تعهد أو ضمان فیما یتعلق بجودة هذا المحتوى أو اکتماله أو دقته أو شمولیته أو عدم انتهاکه. الآراء المعبر عنها هی آراء المستشار ویتم تقدیمها لأغراض تعلیمیة فقط. لا ینبغی تفسیر أی معلومات مقدمة تتعلق بمنتج أو سوق على أنها توصیة باستراتیجیة أو صفقة استثماریة. الأداء السابق لیس ضماناً للنتائج المستقبلیة. لا تتحمل سویسکوت وموظفیها وممثلیها بأی حال من الأحوال المسؤولیة عن أی أضرار أو خسائر تنشأ بشکل مباشر أو غیر مباشر عن القرارات التی یتم اتخاذها على أساس هذا المحتوى. إن استخدام أی علامات تجاریة أو علامات تجاریة لأطراف ثالثة هو للعلم فقط ولا یعنی تأیید سویسکوت لها، أو أن مالک العلامة التجاریة قد فوض سویسکوت بالترویج لمنتجاتها أو خدماتها. Swissquote هی العلامة التجاریة التسویقیة لأنشطة Swissquote Bank Ltd (سویسرا) الخاضعة لرقابة هیئة الأوراق المالیة السویسریة (FINMA)، Swissquote Capital Markets Limited الخاضعة لرقابة هیئة الأوراق المالیة القبرصیة (قبرص)، Swissquote Bank Europe SA (لوکسمبورغ) الخاضعة لرقابة هیئة الرقابة المالیة القبرصیة، Swissquote Ltd (المملکة المتحدة) الخاضعة لرقابة هیئة الرقابة المالیة القبرصیة، Swissquote Financial Services (مالطا) المحدودة الخاضعة لرقابة هیئة الخدمات المالیة المالطیة، Swissquote MEA Ltd. (الإمارات العربیة المتحدة) الخاضعة لرقابة سلطة دبی للخدمات المالیة، وسویسکوت بی تی إی المحدودة (سنغافورة) الخاضعة لرقابة سلطة النقد فی سنغافورة، وسویسکوت آسیا المحدودة (هونج کونج) المرخصة من قبل هیئة هونج کونج للأوراق المالیة والعقود الآجلة وسویسکوت جنوب أفریقیا المحدودة (Pty) الخاضعة لإشراف هیئة الأوراق المالیة. منتجات وخدمات Swissquote مخصصة فقط لأولئک المسموح لهم بتلقیها بموجب القانون المحلی. جمیع الاستثمارات تنطوی على درجة من المخاطرة. یمکن أن تکون مخاطر الخسارة فی التداول أو الاحتفاظ بالأدوات المالیة کبیرة. یمکن أن تتقلب قیمة الأدوات المالیة، بما فی ذلک على سبیل المثال لا الحصر الأسهم والسندات والعملات المشفرة وغیرها من الأصول، صعوداً وهبوطاً. هناک مخاطر کبیرة للخسارة المالیة عند شراء هذه الأدوات المالیة أو بیعها أو الاحتفاظ بها أو المراهنة علیها أو الاستثمار فیها. لا یقدم SQBE أی توصیات فیما یتعلق بأی استثمار أو معاملة معینة أو استخدام أی استراتیجیة استثمار معینة. إن عقود الفروقات هی أدوات معقدة وتنطوی على مخاطر عالیة لخسارة الأموال بسرعة بسبب الرافعة المالیة. تتکبد الغالبیة العظمى من حسابات عملاء التجزئة خسائر فی رأس المال عند التداول فی عقود الفروقات. یجب أن تفکر فیما إذا کنت تفهم کیفیة عمل عقود الفروقات وما إذا کنت تستطیع تحمل المخاطرة العالیة بخسارة أموالک. الأصول الرقمیة غیر منظمة فی معظم البلدان وقد لا تنطبق علیها قواعد حمایة المستهلک. وباعتبارها استثمارات مضاربة شدیدة التقلب، فإن الأصول الرقمیة لیست مناسبة للمستثمرین الذین لا یتحملون مخاطر عالیة. تأکد من فهمک لکل أصل رقمی قبل أن تتداول. لا تُعتبر العملات الرقمیة عملة قانونیة فی بعض الولایات القضائیة وتخضع للشکوک التنظیمیة. قد ینطوی استخدام الأنظمة المستندة إلى الإنترنت على مخاطر عالیة، بما فی ذلک، على سبیل المثال لا الحصر، الاحتیال والهجمات الإلکترونیة وفشل الشبکة والاتصالات، بالإضافة إلى سرقة الهویة وهجمات التصید الاحتیالی المتعلقة بالأصول الرقمیة.

Swissquote

سقف طلا در 4381 دلار: پایان چرخه صعودی یا فقط یک توقف موقت؟

Has the price of gold reached its final bullish cycle high at $4,381 during the trading session of Monday, October 20? That session marked the end of an upward inertia phase in precious metals prices, triggering the first retracement since mid-August. However, a retracement does not necessarily mean a final cycle top or the start of a long-term bearish trend. To confirm that gold has made its annual top this October in the commodities market, several technical and fundamental conditions must be met — and at this stage, they are not. 1) To confirm a major cycle top, a strong resistance level and a clear bearish reversal pattern must be observed Looking back at gold’s price history, we can refer to the long distribution phase of 2011–2012, which concluded a bullish trend that had begun at the start of the century. This was followed by a four-year bear market, before a new long-term uptrend began in January 2016. What about the current long-term technical setup? Monthly chart data provide insight into the broader cycle. Gold has been building its fifth bullish wave since the breakout above its former all-time high in March 2024, already exceeding several theoretical price targets based on Fibonacci extensions. The $4,300 region aligns with two major extensions, including the 1.618 “golden ratio” extension of wave 3. However, that alone is not enough to confirm that the cycle top occurred at $4,381. At this stage, there is no distribution pattern or major support break. A drop below $3,400 would be a strong signal of a completed bullish cycle. 2) Gold’s cyclical top will occur when the US dollar confirms a medium-term bullish reversal Gold’s cyclical top will coincide with the moment the US Dollar (USD) establishes a sustained bullish reversal. Gold and the dollar usually move in opposite directions: a stronger dollar reduces the appeal of gold for international investors. Once the dollar confirms an upward trend reversal, capital will progressively rotate away from gold — signaling the end of the metal’s bullish phase. The chart below shows the weekly candlesticks of the US Dollar Index (DXY) against a basket of major currencies, highlighting the bullish reversals seen in 2018 and 2021. 3) Gold’s cyclical top will be reached when outflows dominate in GOLD ETFs The gold cycle will top out when capital outflows from gold-backed ETFs become dominant. Inflows into these funds usually reflect investor appetite for the metal. When these inflows slow and reverse, it shows a gradual disengagement from gold’s financial demand — which has played a major role in its 2025 price rally. This shift marks the maturity of the bullish phase. Therefore, the dominance of ETF outflows is an early indicator of an impending gold cycle reversal. For now, according to World Gold Council data, that situation has not yet materialized. DISCLAIMER: This content is intended for individuals who are familiar with financial markets and instruments and is for information purposes only. The presented idea (including market commentary, market data and observations) is not a work product of any research department of Swissquote or its affiliates. This material is intended to highlight market action and does not constitute investment, legal or tax advice. If you are a retail investor or lack experience in trading complex financial products, it is advisable to seek professional advice from licensed advisor before making any financial decisions. This content is not intended to manipulate the market or encourage any specific financial behavior. Swissquote makes no representation or warranty as to the quality, completeness, accuracy, comprehensiveness or non-infringement of such content. The views expressed are those of the consultant and are provided for educational purposes only. Any information provided relating to a product or market should not be construed as recommending an investment strategy or transaction. Past performance is not a guarantee of future results. Swissquote and its employees and representatives shall in no event be held liable for any damages or losses arising directly or indirectly from decisions made on the basis of this content. The use of any third-party brands or trademarks is for information only and does not imply endorsement by Swissquote, or that the trademark owner has authorised Swissquote to promote its products or services. Swissquote is the marketing brand for the activities of Swissquote Bank Ltd (Switzerland) regulated by FINMA, Swissquote Capital Markets Limited regulated by CySEC (Cyprus), Swissquote Bank Europe SA (Luxembourg) regulated by the CSSF, Swissquote Ltd (UK) regulated by the FCA, Swissquote Financial Services (Malta) Ltd regulated by the Malta Financial Services Authority, Swissquote MEA Ltd. (UAE) regulated by the Dubai Financial Services Authority, Swissquote Pte Ltd (Singapore) regulated by the Monetary Authority of Singapore, Swissquote Asia Limited (Hong Kong) licensed by the Hong Kong Securities and Futures Commission (SFC) and Swissquote South Africa (Pty) Ltd supervised by the FSCA. Products and services of Swissquote are only intended for those permitted to receive them under local law. All investments carry a degree of risk. The risk of loss in trading or holding financial instruments can be substantial. The value of financial instruments, including but not limited to stocks, bonds, cryptocurrencies, and other assets, can fluctuate both upwards and downwards. There is a significant risk of financial loss when buying, selling, holding, staking, or investing in these instruments. SQBE makes no recommendations regarding any specific investment, transaction, or the use of any particular investment strategy. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. The vast majority of retail client accounts suffer capital losses when trading in CFDs. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. Digital Assets are unregulated in most countries and consumer protection rules may not apply. As highly volatile speculative investments, Digital Assets are not suitable for investors without a high-risk tolerance. Make sure you understand each Digital Asset before you trade. Cryptocurrencies are not considered legal tender in some jurisdictions and are subject to regulatory uncertainties. The use of Internet-based systems can involve high risks, including, but not limited to, fraud, cyber-attacks, network and communication failures, as well as identity theft and phishing attacks related to crypto-assets.

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.