ProfessorXtrader

@t_ProfessorXtrader

Ne tavsiye etmek istersiniz?

önceki makale

پیام های تریدر

filtre

ProfessorXtrader

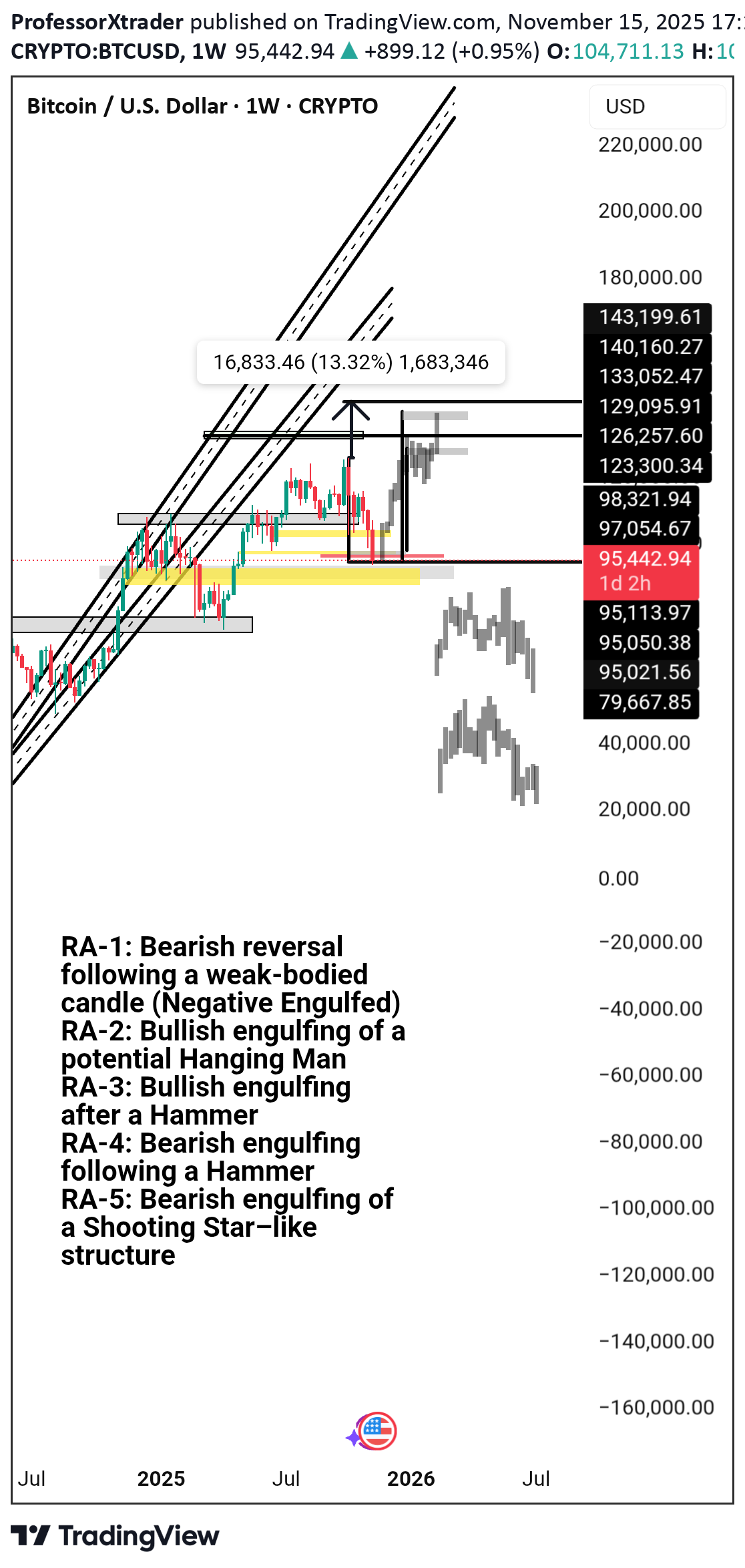

پیشبینی شوکهکننده بیت کوین: آیا BTC به 143,000 دلار میرسد یا سقوط آزاد به زیر 90 هزار؟

ProfessorXtrader

تحلیل تکنیکال هفتگی بیت کوین: آیا حمایت مهم میشکند؟ ($BTC)

Bitcoin Weekly Technical Analysis Report BTCUSDT Background Overview Bitcoin (BTC) has become the most influential digital asset globally due to its decentralization, fixed supply, and transparent transactions. At the intersection of traditional finance and the crypto market, Technical Analysis (TA) is a crucial tool for investors to assess price trends and develop trading strategies. Based on the three key assumptions—“history repeats itself,” “price moves in trends,” and “market action discounts all information”—technical analysis uses chart patterns, trend lines, support and resistance levels, volume, and various indicators to make probabilistic forecasts about future price movements. The weekly chart, as a core time frame for medium- to long-term trend analysis, filters out noise from daily and lower time frames, providing a clearer view of the main trend direction, key turning points, and the balance between bulls and bears. The BTC/USDT weekly chart analyzed here (from TradingView) covers price movements from 2023 to the present. It includes annotations such as “Weekly Support of BTC since 2023,” “Past Bottom 2023,” and “2024–2025 Resistance Support,” along with green and pink shaded areas that visually represent different stages of market psychological levels. Currently, Bitcoin is priced at 103,384.25 USDT, with a weekly decline of -6.47% and a weekly volume of 118,000 USDT. From the chart structure, the price is near the 2024–2025 resistance-turned-support zone while being supported by the ascending trend line that has formed since 2023. The battle between bulls and bears is intense in this range, and price movements over the coming weeks will have a decisive impact on the medium- to long-term trend. This report will combine key support and resistance levels, trend lines, volume, and technical indicators from the chart, compare historical patterns with the current market environment, conduct an in-depth analysis from multiple perspectives, and propose corresponding strategic recommendations and risk warnings. Research Support and Evidence Analysis This analysis is strictly based on the technical elements and relevant market data presented in the chart, with the following key supporting points: • Current price and change: 103,384.25 USDT, weekly decline of -6.47%, indicating short-term bearish dominance, but the price has not yet broken key support. • Weekly volume: 118,000 USDT, which has expanded compared to the recent average, suggesting increased market participation and greater divergence between bulls and bears. • Key support levels: – “Weekly Support of BTC since 2023” trend line: An ascending trend line connecting the weekly lows since 2023, currently around 100,000 USDT, providing important support. – “Past Bottom 2023” zone: The 2023 Bitcoin low accumulation area, around 95,000–98,000 USDT, serving as the last line of defense for bulls. • Key resistance levels: – “2024–2025 Resistance Support” level: Previous high points where price repeatedly failed to break through, around 110,000–115,000 USDT, now acting as resistance. – Pink resistance zone: Corresponds to historical accumulation areas and Fibonacci extension levels, around 118,000–122,000 USDT, serving as both a target for bulls and a point for bears to counterattack. • Trend line analysis: – Main ascending trend line: Extending upward from the 2023 low with a moderate slope, reflecting the medium- to long-term bullish trend. – Secondary descending trend line: Connecting the late 2024 and early 2025 highs, forming a short-term descending channel; the price is currently approaching the upper boundary of this channel. • Volume confirmation: – When the 2023 support zone formed, volume gradually decreased, indicating easing selling pressure. – When breaking through resistance in 2024, volume expanded significantly, confirming the validity of the breakout. – During the current pullback, volume has expanded again, requiring vigilance against panic selling. Data Comparison and Detailed Summary To more intuitively present the relationship between key price levels and historical movements, the main support and resistance levels, trend lines, and volume characteristics are summarized as follows: https://drive.google.com/file/d/1OfXzBkFOYlxAPQrEFXRLbt1GCAD37Avk/view?usp=sharing From the table, it is clear that the support system formed in 2023 remains effective, while the resistance zone from late 2024 to early 2025 is pressuring the current price. Volume shows distinct patterns at different stages: decreasing at support zones, expanding on breakouts, and expanding again during pullbacks, reflecting cyclical changes in market sentiment. Source Origin and Citation Interpretation • Data authority: TradingView integrates real-time quotes from major global exchanges, ensuring the accuracy of price and volume data. • Annotation professionalism: The trend lines, support and resistance zones on the chart are drawn by experienced analysts based on classic technical analysis methods such as historical highs and lows, accumulation areas, and Fibonacci retracements. • Time frame representativeness: The weekly chart filters short-term fluctuations and is more suitable for medium- to long-term trend analysis, matching the decision cycles of institutional investors and long-term holders. For labels such as “Weekly Support of BTC since 2023,” “Past Bottom 2023,” and “2024–2025 Resistance Support,” their origin is the chart drawer’s summary of historical key price levels. Although somewhat subjective, they align with the general definitions in technical analysis for “significant highs and lows” and “accumulation areas.” Therefore, interpretation should combine multiple verifications (such as volume and indicator confirmation) to reduce the risk of bias from single labels. In-depth Insights and Independent Thinking Combining the above data and chart features, deeper market insights can be gained from the following perspectives: The medium- to long-term trend remains healthy – The main ascending trend line has been extending upward from the 2023 low, and each pullback has not broken below it, indicating that the bullish structure is intact. – The current price is approaching this trend line. If it can stabilize and rebound here, it will validate the effectiveness of the trend support and lay the foundation for the next upward wave. The importance of the resistance-turned-support zone – The 110,000–115,000 USDT zone repeatedly acted as resistance from late 2024 to early 2025. After being recently broken, it has turned into support. – If the price can stabilize above this zone, it will further consolidate the bulls’ advantage and challenge the pink resistance zone (118,000–122,000 USDT). Volume signals reveal market sentiment – Volume decreased at the 2023 bottom, indicating exhausted selling pressure and paving the way for the subsequent rebound. – Volume expanded during the resistance breakout, confirming increased market participation, while the current pullback’s expanded volume requires vigilance against panic selling. – Future signs of stabilization with decreasing volume will present a better opportunity for bulls to enter. Risks and opportunities coexist – Short-term bears dominate, and the price is approaching the main ascending trend line. A breakdown below could trigger larger-scale stop-losses, targeting the 95,000–98,000 USDT zone. – If the trend line support holds, combined with oversold signals from technical indicators, a wave of buying opportunities will emerge, with an initial target of 110,000–115,000 USDT. Macro environment and market structure – Global liquidity, regulatory policies, and institutional capital flows are exogenous variables affecting Bitcoin’s medium- to long-term trends. – Although technical analysis can provide probabilistic judgments on price paths, it still needs to be combined with fundamental analysis and market sentiment to improve decision-making success rates. Extended Discussion / Related Topics In the current technical context, the following topics can be further explored: • Multi-dimensional verification of technical indicators – Relative Strength Index (RSI): Whether the weekly RSI is in overbought or oversold territory, and any divergence with price. – Moving Averages (MA): The arrangement and divergence of the 50-week, 100-week, and 200-week MAs, and their confirmation of trend direction. – MACD histogram and signal line: Weekly golden crosses and death crosses, as well as momentum changes in the histogram, indicating trend continuation or reversal. • Fibonacci retracement and extension – The role of Fibonacci retracement levels (38.2%, 50%, 61.8%) from the 2023–2024 main upward wave in the current pullback. – If the price breaks above the pink resistance zone, the next targets can be referenced by Fibonacci extension levels (161.8%, 261.8%). • Market sentiment and capital flows – Can data such as futures open interest, funding rates, and exchange net inflows/outflows resonate with chart patterns? – The impact of continuous buying by institutions like Grayscale and MicroStrategy, compared with the long-short ratio of retail leveraged funds, on medium- to long-term support and resistance. • Risk management strategies – Near key support and resistance levels, how to set stop-loss and take-profit to optimize risk-reward ratios. – When volatility surges, should position size be adjusted, or derivatives like options be used for hedging? • Future trend outlook – If the price stabilizes above 110,000–115,000 USDT, the bullish target could extend to 130,000–150,000 USDT. – If it breaks below the main ascending trend line and loses the 95,000 USDT support, a larger-scale correction may begin, with a downside target around 80,000 USDT. Through in-depth exploration of the above topics, a more comprehensive investment decision framework can be constructed. On the basis of technical analysis, combining market structure and macro factors will improve the ability to predict price movements.

ProfessorXtrader

سهم SEI آماده پرواز؛ اهداف صعودی هیجانانگیز تا ۲.۵ دلار!

SEI Bunun için hedefimi kaldırmaya hazırsınız 1 $ 'ın üzerinde% 50 satış yapacağım 1 $ bir sonraki hedef 1.85 - 2.5

ProfessorXtrader

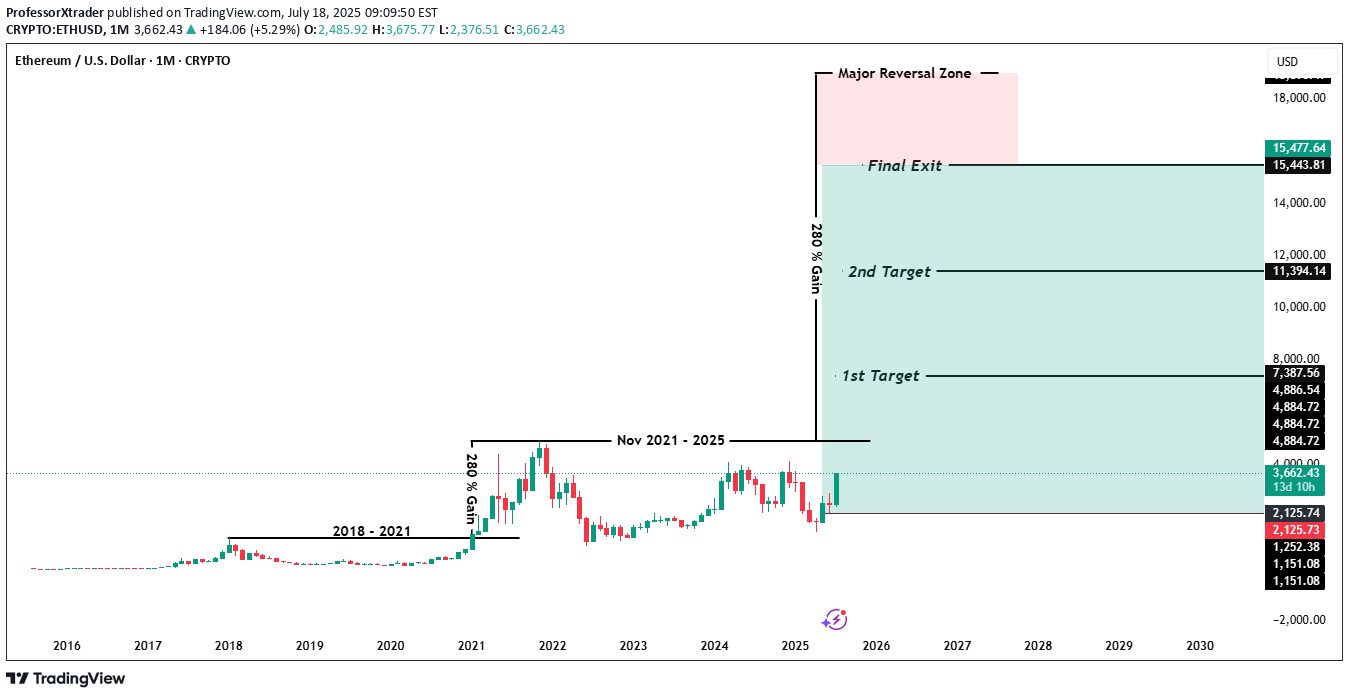

$ETH Ethereum Market Outlook – July 2025

Ethereum Pazar Görünümü - Temmuz 2025 Profesörxtrader tarafından getirildi 🚀 Ethereum Breakout çok yıllı yükseliş kurulumunu doğrular Ethereum ( ETH ) çok yıllı bir konsolidasyon aralığından resmen kırıldı ve ileride güçlü bir yükseliş döngüsüne işaret etti. Mevcut fiyat 3.645.50 $ 'dır. Bu hareket, çok katmanlı bir yukarı yönlü potansiyel için zemin hazırlıyor-şemanın bize söylediği şey. 📊 Anahtar seviyeleri ve hedefler 🔸 Önceki konsolidasyon aralığı (2018-2021) ETH Üç yıldan fazla harcanan, ~ 4.884 seviyesinin altında kaplanmış ve katı bir birikim tabanı oluşturur. 🔸 Breakout bölgesi Destek: 1.150 $ - 1.250 $ Döngü vardiyasının teyidi: fiyat şimdi koparma bölgesinin üzerinde işlem görüyor. 🎯 Upside Hedefler (Ethereum) 1. Hedef: 📍 Fiyat: 7.387,56 $ 📈 Potansiyel kazanç: kırılma bölgesinden ~%100+ 2. Hedef: 📍 Fiyat: $ 11.394.14 📈 Potansiyel kazanç: ~% 180 Nihai Çıkış (Major Ters Bölgesi): 📍 Fiyat aralığı: 15.443,81 $ - 15.477.64 $ 🚨 Toplam Kazanç Potansiyeli: Breakout'tan ~% 280 📌 15.4 bin ila 18 bin dolar arasındaki alan, kâr alma ve eğilim tükenmesinin büyük olasılıkla olası olduğu bir bölge olan Major ters bölge olarak işaretlenir. 📈 Pazar Yorumu Boğa Breakout: Uzun vadeli direnç artık destek. Cilt ve Momentum: Genişleyen volatiliteye sahip güçlü aylık mum mahkumiyeti doğrular. Yapı: Hedefler temiz teknik projeksiyonlara, Fibonacci genişletmelerine ve pazar psikolojisine dayanmaktadır. 🔔 Sırada ne izlenmeli 📅 Mevcut seviyelerin üzerinde aylık kapanış koparmayı teyit edecektir. 🔍 İlk hedefin yakınındaki ret sinyallerini izleyin. 📉 major geri dönüş bölgesine yaklaştıkça arka durakları yerleştirin. 💡 Profesörxtrader'dan profesyonel ipucu "Kriptodaki en büyük kâr, çok yıllı aralıklardan gelen temiz aralarda yapılır.

ProfessorXtrader

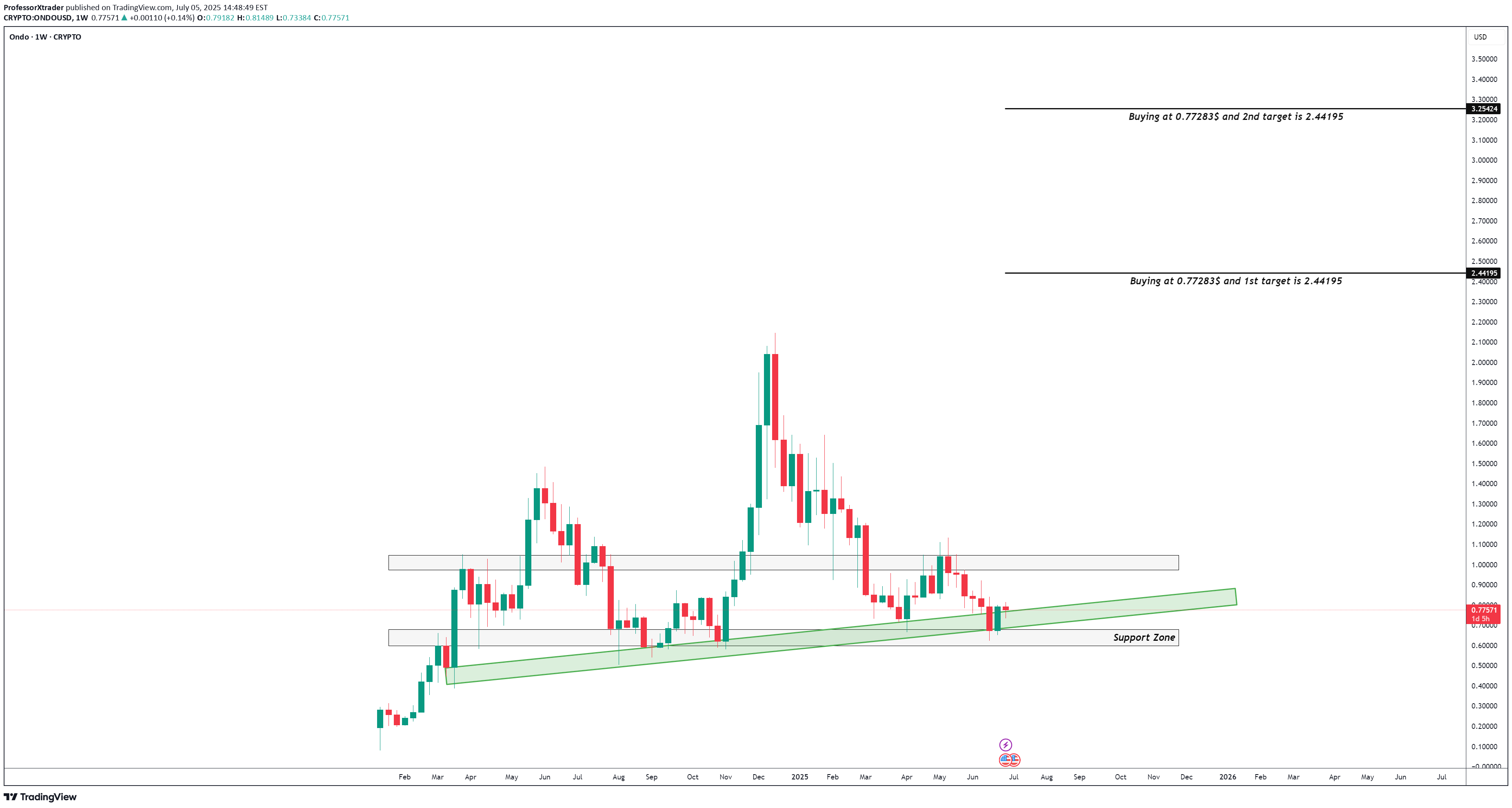

ONDO

Bu benim şamdan teknik analizi, yükseliş yutulmasına dayanıyor. Eğer görürsek ve aynı desen o zaman pazar bonus olacaktır.

ProfessorXtrader

Just open log on Waves

فقط یک موقعیت خرید (لانگ) در waves با اهرم ۲۰x باز کن و ۱۰۰ دلار در خرید نقدی سرمایهگذاری کن.

ProfessorXtrader

ETH USD

🧠 چرخه اتریوم یک راز نیست 📉 ریزش → 🔁 تثبیت → 🚀 صعود → تکرار؟ 📊 تجزیه و تحلیل چرخه: 📌 صعود → ریزش → تثبیت (CONs) ✅ این الگو از سال ۲۰۱۸ تکرار شده است ✅ مناطق تثبیت، سکوهای پرتاب هستند ✅ RSI دقیقا این رفتار را هر بار منعکس میکند 🔎 اکنون در داخل یک شکاف ارزش منصفانه (F.V.G) و منطقه پاداش RSI قرار دارد ⚡️ سیگنالهای فعلی: 🔹 RSI در حال رسیدن به کف در همان منطقه پاداش قبلی است major حرکت 🔹 ETH قیمت در حال استراحت بر روی حمایت عمودی + منطقه FVG است 🔹 آخرین باری که این تنظیم شکل گرفت؟ ➡️ 🚀 ETH از حدود ۹۰ دلار به ۴۰۰۰ دلار+ رسید 🏁 چه چیزی را باید در ادامه تماشا کرد: ‣ شکست از محدوده فعلی RSI ‣ آزمایش مجدد حمایت ۱۴۰۰-۱۵۰۰ دلاری ‣ اهداف بالقوه بعدی: ۳۰۰۰ دلار → ۴۱۰۰ دلار 💡 تاریخ تکرار نمیشود—اما قافیه دارد 👀

ProfessorXtrader

Neo Is Ready for the take off

🧠 NEO چرخه قیمت — آیا تاریخ تکرار میشود؟📈 پامپ ← دامپ ← تثبیت ← تکرار 🔁هر چرخه صعودی major NEO از الگوی یکسانی پیروی کرده است:✅ 2017: پامپ بزرگ ← سقوط ← تثبیت چند ساله✅ 2021: دقیقاً همان حرکت — پامپ ← دامپ ← حرکت جانبی⚠️ 2025؟ الگو دوباره در حال شکل گیری است...🔍 بینشهای کلیدی:🟡 فازهای تثبیت همیشه پیش از حرکات انفجاری رخ دادهاند📊 RSI یک روند صعودی آشنا را از کف نشان میدهد🚀 شکستهای تاریخی دقیقاً از مناطقی مانند این آغاز شدهاند💰 اهداف (اگر تاریخ تکرار شود):‣ 6 دلار ← 30 دلار ← 73 دلار ← 100 دلار+🔮 آیا این میتواند آرامش قبل از طوفان بعدی باشد؟📉 ساختار را نادیده نگیرید.📆 صبر = سود در چرخههایی مانند این.📌 NEO را در رادار خود نگه دارید.

ProfessorXtrader

Long on Babydoge

من یک موقعیت خرید (long) در Babydoge باز کردم. هر بار که به سطح حمایت برخورد می کند، تقریباً 300 درصد سود می دهد.

ProfessorXtrader

Btc long at cap

btc'ı 68700'de likidite avlamayı arzulayacağım. Tarde'ı 100x kaldıraçla uzun süre açık tutuyorum.

Sorumluluk Reddi

Sahmeto'nun web sitesinde ve resmi iletişim kanallarında yer alan herhangi bir içerik ve materyal, kişisel görüşlerin ve analizlerin bir derlemesidir ve bağlayıcı değildir. Borsa ve kripto para piyasasına alım, satım, giriş veya çıkış için herhangi bir tavsiye oluşturmazlar. Ayrıca, web sitesinde ve kanallarda yer alan tüm haberler ve analizler, yalnızca resmi ve gayri resmi yerli ve yabancı kaynaklardan yeniden yayınlanan bilgilerdir ve söz konusu içeriğin kullanıcılarının materyallerin orijinalliğini ve doğruluğunu takip etmekten ve sağlamaktan sorumlu olduğu açıktır. Bu nedenle, sorumluluk reddedilirken, sermaye piyasası ve kripto para piyasasındaki herhangi bir karar verme, eylem ve olası kar ve zarar sorumluluğunun yatırımcıya ait olduğu beyan edilir.