sembol AAPLX hakkında analiz Teknik ProjectSyndicate: Satın al (29.10.2025) önerilir

ProjectSyndicate

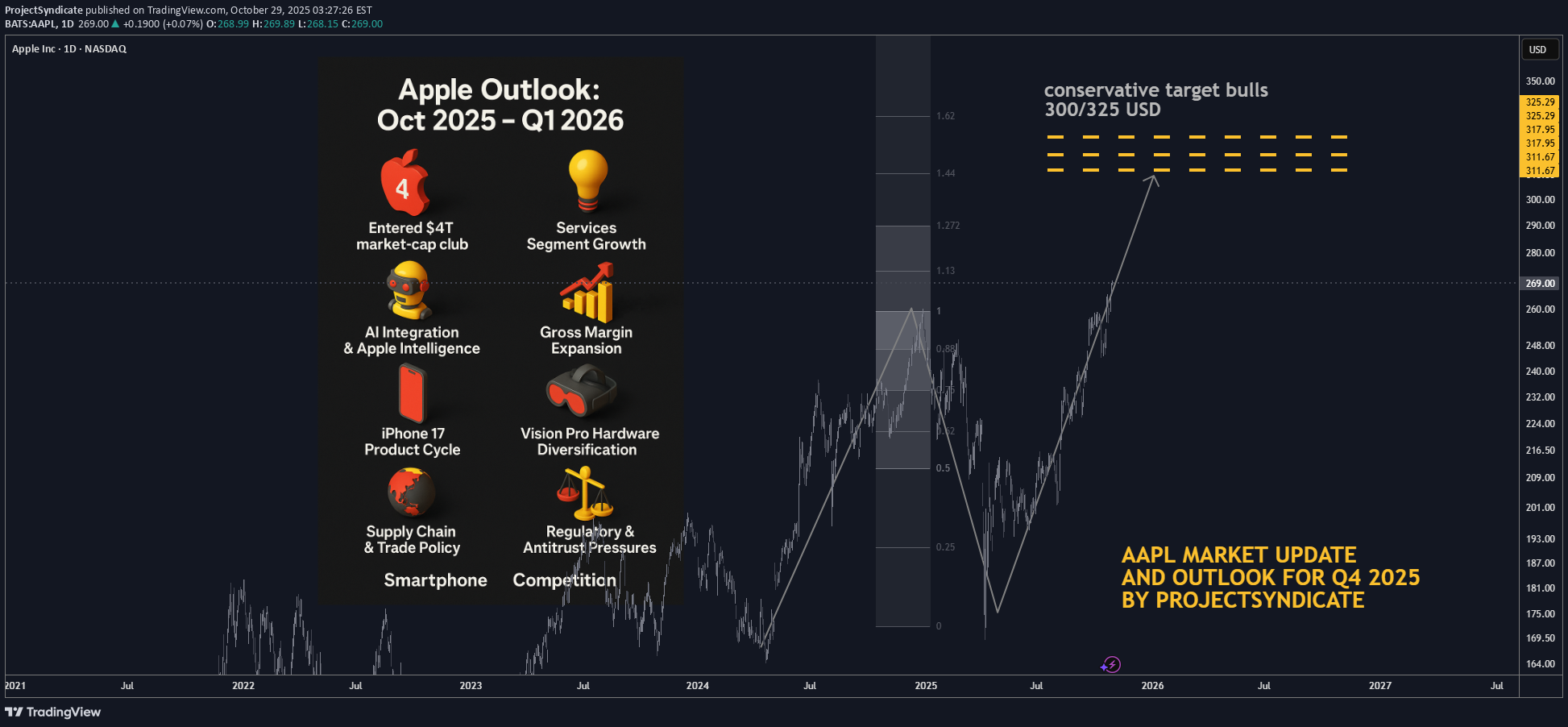

اپل در مسیر ۴ تریلیون دلاری: پیشبینی Q1 2026 و کاتالیزورهای کلیدی هوش مصنوعی

🍏 Apple Outlook: Oct 2025 – Q1 2026 🧠 Status and Tape Read. Apple (AAPL) has entered the $4 T market-cap club on Oct 28–29 2025, propelled by strong iPhone 17 sell-through and Services momentum. Shares pushed toward the $270 area intraday before easing, marking a powerful reversal from mid-year consolidation. Near-term, positioning is elevated into Thursday’s print; options imply ~±4% move on earnings. 📈 Path into Q1’26. Our base case shifts from a prolonged correction to a higher-low / buy-the-dip regime: dips toward the mid-$240s–$250s should attract sponsorship unless Services rolls over or China iPhone demand fades. A constructive tape through Q1’26 hinges on (1) Apple Intelligence engagement metrics, (2) iPhone 17 replacement/Android switcher rates, and (3) regulatory overhang. 📰 What’s New and recent headlines 🏆 Apple hits $4 T market value for the first time, joining Nvidia and Microsoft. Drivers: iPhone 17 traction and Services strength; stock up sharply since spring. 🗓️ Earnings set for Thu, Oct 30 (after-close); Street looking for growth in revenue/EPS; Services eyed >$100 B annual run-rate. 🔼 Loop Capital upgraded AAPL to Buy with $315 PT ahead of the move, citing iPhone cycle acceleration. 🧾 “Who Bought 8 Million Shares?” 🧺 JPMorgan Large Cap Growth Fund (SEEGX) increased its Apple position by ~8.15 million shares to ~32.9 million shares, per latest fund tracking. ⚙️ Catalysts Shaping Apple’s Stock Price in 2025–26 🤖 AI Integration & Apple Intelligence — Strength: 9/10 Rollout of on-device Apple Intelligence and upgraded Siri remains the core narrative into 2026. Look for user engagement datapoints and third-party app integrations at/after earnings. A positive read-through would validate the iPhone super-cycle argument. 💡 Services Segment Growth — Strength: 8.5/10 Consensus expects Services to push past a $100 B annual clip; durability watched versus regulatory pressure (DMA in EU, global app store scrutiny). A sustained >13% YoY growth print keeps multiple support intact. 📊 Gross Margin Expansion & Cost Efficiencies — Strength: 8/10 Management has guided 46–47% GM for FQ4 (tariff headwind embedded). Mix shift to Services + component deflation support FY26 margin resilience. 📱 iPhone 17 Product Cycle — Strength: 8/10 (↑ from 7.5) Early sell-through outpacing prior gen in the U.S. and China within first days; the iPhone 17 (incl. “Air”) is the incremental driver restoring unit momentum. 🥽 Vision Pro & Hardware Diversification — Strength: 7/10 Next-gen devices + Apple Intelligence tie-ins create optionality; still niche near-term but adds ecosystem gravity. 💵 Capital Returns — Strength: 7/10 $110 B buyback authorization remains a floor; watch cadence vs. stock at ATHs and post-print cash deployment commentary. 🌏 Supply Chain & Trade Policy — Strength: 6.5/10 China exposure/tariffs remain a swing factor; Apple has been absorbing some costs rather than pushing through prices on key models. ⚖️ Regulatory & Antitrust Pressures — Strength: 6/10 DMA compliance and global app store cases could trim Services take-rate; monitor any remedial changes called out on the call. 📈 Macro & Rates — Strength: 5/10 “Higher for longer” limits multiple expansion; any disinflation/soft-landing upside would expand P/E support. 🥊 Smartphone Competition — Strength: 5/10 Android OEM velocity still high in EM; Apple’s cycle needs sustained switcher share to outrun. 💼 Earnings Set-Up: FQ4 reporting Thu Oct 30 2025 📅 Consensus into print: • Revenue: ~$101–104 B (TipRanks ref: $102.2 B) • EPS: ~$1.74–$1.82 (TipRanks ref: $1.78) • Gross Margin guide: 46–47% (company indication) • Services: watch for >$100 B annualized pace confirmation • Implied move: options pricing ~±4% 🎧 Watch items on the call: Apple Intelligence activation/MAUs, iPhone 17 channel inventory, China mix, Services take-rate headwinds (EU), GM puts/takes (tariffs), cap-return cadence. 🎯 Street Positioning & Targets 🔼 Loop Capital: Buy, PT $315 (Oct 20/21 2025). 📊 General take: Many houses remain Overweight; focus turning to 2026 EPS power and AI monetization path. 🧭 Tactical View 0–3 Months 📈 Into/after print: Choppy but constructive. Chasing at ATHs is risky; prefer buy-on-weakness zones near $248–255 with stop discipline. A bullish guide/Services beat could sustain a breakout; a light AI engagement update or China wobble likely gets faded back into the mid-$250s. ⚠️ Risk-case: Regulatory headline or guide below mid-single-digit growth could quickly compress P/E and retest the $240s. 🚀 Bull-case: Clean beat/raise + AI usage KPIs → re-rate toward $290–300 into holiday. 🏁 Quick Milestone Recap 🥇 $4 Trillion Market Cap achieved on Oct 28–29 2025, making Apple the third public company (after Nvidia, Microsoft) to reach the level; iPhone 17 momentum and Services strength cited across coverage.🚀 Apple Outlook (Oct 2025 – Q1 2026) 🍏 Hit $4 T market cap, third company ever to reach the milestone. 🤖 Apple Intelligence & AI rollout driving next growth wave. 📱 iPhone 17 cycle strong, fueling demand recovery. 💡 Services segment on track for >$100 B annual run-rate. 📊 Gross margins guided at 46–47%, resilient vs. tariffs. 🥽 Expanding Vision Pro & AR/VR hardware ecosystem. 💵 $110 B buyback and dividends underpin valuation floor. 🌏 Supply-chain shift to India & Vietnam continues. ⚖️ Regulatory pressures in EU/US remain medium-term risk. 🧭 Base case: Buy-on-dips near $250 → target $290-300 if AI metrics beat.let me know your thoughts on the above in the comments section 🔥🏧🚀🎁Please hit the like button and 🎁Leave a comment to support our team!TSLA path to 550/650 USD Breakout Still PendingTSLA Catalysts Ranking: September 2025 update and Path ForwardGold next week: Key S/R Levels and Outlook for TradersGold Bull Market Update and Outlook Q4 2025 / Q1 2026