28.10.2025 tarihinde sembol PAXG hakkında Teknik DCAChampion analizi

DCAChampion

طلا: پتانسیل رشد ۳۰ درصدی در دارایی امن؛ تحلیل ارزش ذاتی و استراتژی ورود

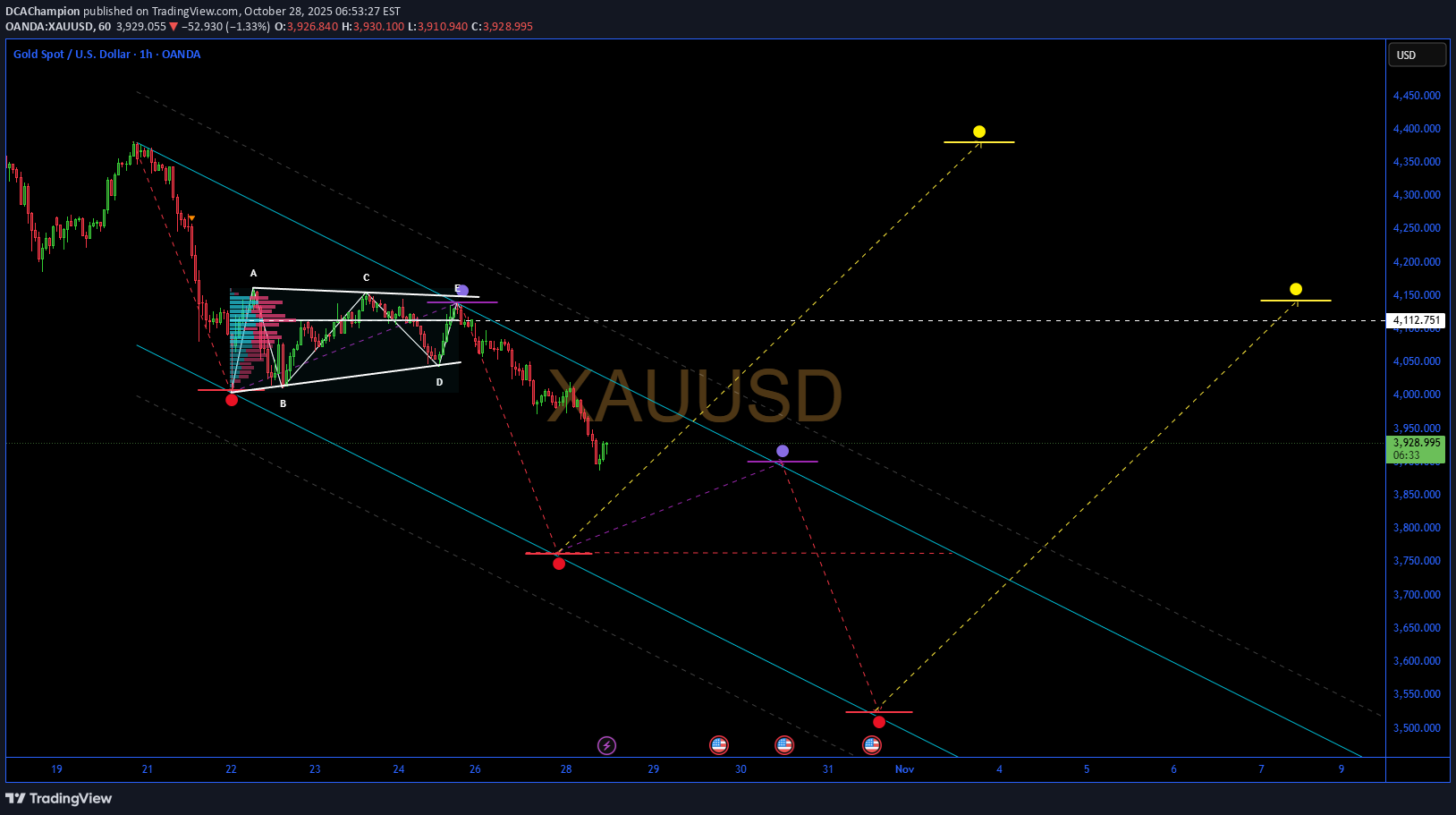

XAUUSD: Exploring Potential 30% Upside in Safe-Haven Asset Amid Geopolitical Tensions – SWOT and Intrinsic Value Insights 📊 Introduction As of October 28, 2025, XAUUSD (Gold/USD) is experiencing a short-term correction following record highs above $4,300 earlier this month, trading around $3,950 per ounce. This pullback reflects improved risk appetite in equity markets amid stabilizing U.S. economic data and reduced recession fears, with the S&P 500 up 2% week-to-date. However, broader macroeconomic factors, including persistent inflation at 3.2% year-over-year and central bank gold purchases exceeding 800 tonnes year-to-date, underpin a supportive environment. Sector dynamics highlight gold's role as a hedge against geopolitical risks, such as escalating Middle East tensions and U.S.-China trade uncertainties, though volatility is elevated due to a strengthening USD index near 105. 🔍 SWOT Analysis **Strengths 💪**: Gold serves as a proven inflation hedge and store of value, with central banks accumulating over 900 tonnes projected for 2025 per analyst estimates, driving demand. Its liquidity is unmatched, with daily trading volumes surpassing $200 billion, and physical holdings in ETFs like GLD have risen 15% year-over-year to 1,200 tonnes. Low correlation to equities (0.2 beta) enhances portfolio diversification, while above-ground stocks of approximately 218,000 tonnes ensure scarcity amid annual mine production of just 3,500 tonnes. **Weaknesses ⚠️**: As a non-yielding asset, gold incurs opportunity costs in high-interest environments, with U.S. 10-year real yields at 1.8% pressuring holdings. All-in sustaining costs (AISC) for miners have risen 8% to around $1,600-1,700 per ounce due to energy and labor inflation, per industry reports, potentially squeezing margins if prices dip. Storage and insurance fees add 0.5-1% annual costs for physical investors. **Opportunities 🌟**: Heightened geopolitical risks, including potential escalations in Ukraine and Taiwan, could boost safe-haven inflows, similar to the 25% price surge post-2024 elections. Monetary policy easing by the Fed (projected 50bps cuts by year-end) and ECB may weaken the USD, favoring gold, with forecasts targeting $4,500+ by mid-2026. Emerging market demand, led by India and China (combined 1,500 tonnes annual consumption), offers growth amid de-dollarization trends. **Threats 🚩**: A stronger USD from hawkish Fed pivots or robust U.S. growth could cap upside, as seen in the recent 5% correction. Competition from high-yield bonds and cryptocurrencies (Bitcoin up 25% YTD) diverts capital, while environmental regulations may increase AISC by 10-15% over the next five years. Oversupply risks from recycled gold (1,200 tonnes annually) persist if economic slowdowns reduce jewelry demand. 💰 Intrinsic Value Calculation Adopting a value investing approach for commodities, we estimate gold's intrinsic value using a monetary backing model, which assesses its role as a reserve asset relative to money supply, incorporating a margin of safety (20% discount). Key inputs from public data: U.S. M2 money supply at $22.195 trillion, U.S. gold reserves at 8,133 tonnes (≈261.5 million ounces), and an assumed fair coverage ratio of 6% (historical average post-Bretton Woods, adjusted for modern dilution; current coverage ≈4.7% at $3,950/oz). Formula: Intrinsic Value per Ounce = (M2 Money Supply × Coverage Ratio) / Gold Reserves in Ounces - M2 × 6% = $22.195T × 0.06 ≈ $1.332T - $1.332T / 261.5M ounces ≈ $5,092 Apply 20% margin of safety: $5,092 × 0.8 ≈ $4,074 At current price ≈$3,950, XAUUSD appears undervalued by ≈3-29% (factoring upside to $5,092 fair value aligned with central bank demand and inflation metrics). No debt flags apply directly, but sustainability relies on demand outpacing monetary expansion. 📈 Undervalued. 📈 Entry Strategy Insights Institutional strategies emphasize support zones near $3,900-3,940 (aligned with 50-day SMA and recent lows) for unleveraged, long-term positions through dollar-cost averaging (DCA). Scale in during 3-5% dips, leveraging non-repainting volume indicators to validate rebounds from oversold levels. Ideal for building 5-10% allocations over 1-3 months, with targets at $4,200 for partial exits on breakouts. 🚀 Spot zones. ⚠️ Risk Management Allocate 1-5% of portfolio to gold to buffer against volatility, diversifying with bonds or equities for balance. Implement trailing stops 5-10% below entry (e.g., $3,750) and maintain long-term holds if macroeconomic hedges strengthen, tracking central bank reports and USD trends. Caution on sharp reversals from rate hikes or equity rallies. 🔚 Conclusion Gold's entrenched role as a monetary hedge, coupled with undervalued metrics and robust demand drivers, supports potential growth to $4,074+, with safety margins embedded. Key takeaways: Prioritize geopolitical monitoring for demand spikes, cross-verify money supply data independently. This is educational content only; not financial advice. Always conduct your own due diligence.