DLavrov

@t_DLavrov

تریدر چه نمادی را توصیه به خرید کرده؟

سابقه خرید

تخمین بازدهی ماه به ماه تریدر

پیام های تریدر

فیلتر

نوع پیام

DLavrov

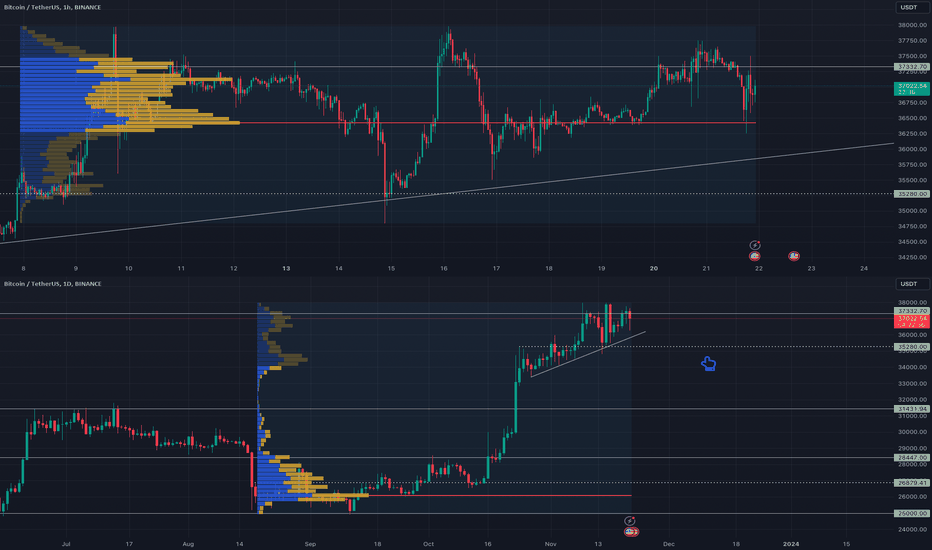

Bitcoin: $48k-50k Is the Top?

Bitcoin پتانسیل صعودی را حفظ می کند. من فکر می کنم ، پس از بازگشت به عقب ، ما شاهد تلاش دیگری برای رسیدن به منطقه مقاومت 48،000-50،000 دلار بود. و پس از آن ، بازار برای وارونگی آماده شد. بله ، رویدادهای صعودی ، مانند Bitcoin ETF و Halving را می توان برای زباله بزرگ استفاده کرد. بنابراین ، با موقعیت های طولانی خود مراقب باشید! از نظر من ، اجرای واقعی گاو نر بعد از زباله بزرگ و هنگامی که ما کلان صعودی می گیریم آغاز می شود. من می گویم این نیمه دوم سال 2024 است. P. S. تعطیلات مبارک!

DLavrov

Bitcoin: To the Moon????

قیمت Bitcoin بالاتر از همه سطح مقاومت ممکن بود! رسانه های اجتماعی تقویت FOMO! همه چیز شگفت انگیز به نظر می رسد! Bitcoin در حال حرکت به ماه است ... اما من نزولی می مانم) نه به این دلیل که من یک احمق هستم. فقط به این دلیل که نمی توسط دستگیره ها تقلب کنم و رویاهای جعلی را دنبال کنم. ماه ها موقعیت من یکسان ماندند: برای اجرای گاو واقعی ، بازار رمزنگاری به کلان صعودی نیاز دارد! این پایه و اساس هر جنبش روند در هر بازار است. ما باید در حالت و هزاران پول در حال حرکت به سمت دارایی های پرخطر باشیم. الان آن را می بینی؟ از نظر من ، ما برای اجرای واقعی گاو نر آماده نیستیم. و اکنون ما فقط یک تظاهرات دستکاری شده خوب را که توسط Bitcoin ETF و رویدادهای Halving آینده پشتیبانی می شود ، می بینیم. در هر زمان ، Manipulator می تواند چنین "اخبار" را خاموش کند ، FUD را به اطراف Binance اضافه کنید و ما این زباله عالی را دید! ساده است بنابراین ، از دیدگاه من ، بالای تجمع در حدود 48 000 دلار - 50 000 دلار است. اگر قیمت بالاتر از ATH باشد ، من تعجب می کنم. و این خوب است! من می توانم با درک خود از بازار رمزنگاری اشتباه کنم. بله ، این دستکاری شده ترین بازار جهان است ، اما گاهی اوقات دوست دارد در برابر منطق حرکت کند و ما را غافلگیر کند. به همین دلیل من از ریسک مناسب و مدیریت پول استفاده می کنم که در آن تنوع نقش اصلی را ایفا می کند. حتی اگر من اشتباه کنم و Bitcoin واقعاً به ماه حرکت می کند ، می توانم از انواع دیگر تجارت درآمد کسب کنم. اما باز هم ، من دلایل اساسی برای اجرای گاو واقعی را نمی بینم. و من این جمله را دنبال می کنم. من باید یک بار دیگر به شما یادآوری کنم ... با موقعیت های طولانی خود مراقب باشید!

DLavrov

Bitcoin: BE CAREFUL WITH LONG POSITIONS!

Manipulator 2 رویداد برای ریختن بازار رمزنگاری در هر زمان دارد. مورد اول تأخیر با تأیید Bitcoin ETF است. SEC دوباره نمی گوید و ... حداکثر -15 ٪ از قیمت. رویداد 2 داستان Binance & CZ است. اگر به همان روشی که با FTX ... پیش می رود. ما باید آماده باشیم تا 50 ٪ - 80 ٪ از قیمت فعلی را ببینیم. ممکن است ؟؟؟ من فکر می کنم بله بنابراین ، با موقعیت های طولانی خود مراقب باشید و وقایع فوق را در نظر بگیرید!

DLavrov

Bitcoin: The Great Dump Is Coming

سلام بچه ها ، من حدود 8 ماه است که در اینجا پست نکرده ام. و صادقانه بگویم ، من دلیل انجام این کار را ندیدم. من روی تجارت خود تمرکز کردم و از این روند لذت بردم. اما ... هر از گاهی اعلان هایی راجع به پیروان جدید می دیدم ... من چیزی جز معامله گران به من نمی پیوندم. این یک وضعیت جالب است. بنابراین ، سوال من این است ... آیا می پست های من در مورد تجارت را ببینید؟ و اگر بله ، لطفاً موضوعاتی را که به آنها علاقه مند هستید به اشتراک بگذارید. چند بار در هفته ، می توانم برای شما چیز ارزشمندی بنویسم. اگر برای تفریح و بدون هیچ دلیلی به من پیوستید ، فقط آن را بگویید. لطفاً بازخورد خود را در نظرات به اشتراک بگذارید. ممنون P. S. و در مورد بیت کوین ، من فکر می کنم ما باید آماده باشیم تا پایین واقعی زیر 16K دلار را ببینیم ...

DLavrov

Trading Idea 045: POLKADOT

شرایط بازار: - روند صعودی - احساسات صعودی در بازار سطح و خطوط کلیدی: - پشتیبانی 6.342 دلار ایده های تجارت: - اگر قیمت بالاتر از پشتیبانی باشد ، طولانی بروید. - اگر قیمت زیر پشتیبانی حرکت می کند و بازار نزولی است ، کوتاه بروید.

DLavrov

Trading Idea 044: Ethereum

شرایط بازار: - روند صعودی - احساسات صعودی در بازار سطح و خطوط کلیدی: - مقاومت 1663.00 دلار ایده های تجارت: - اگر قیمت بالاتر از مقاومت باشد ، طولانی بروید. - اگر قیمت از مقاومت و بازار نزولی است ، کوتاه بروید.

DLavrov

Bitcoin: Monthly Chart

فقط به نمودار ماهانه نگاه کنید! چه می بینی؟ 1. قیمت از پشتیبانی 20000 دلاری بازده شده است 2. این یک شکست کاذب بود 3. بازار الگوی شمعدانی وارونه را به ما داد بر اساس این 3 جمله ما یک سیگنال صعودی قوی داریم. اما بعد چیست؟ پس از شمع صعودی قوی ، بازار به ما الگوی شمعدانی خنثی یا معکوس داد. شمع Doji به ما می گوید که خریداران آنقدر قوی نیستند که قیمت را بالاتر بکشند. به نظر می رسد مانند یک سیگنال نزولی است. این ماه برای بازار مهم بود. اگر یک شمع نزولی بدست آوریم ، باید آماده باشیم تا حرکتی رو به پایین به سمت 20 000 دلار و 14000 دلار و ادغام در این سطوح ببینیم. اگر خریداران بتوانند حرکت صعودی را حفظ کنند ، ممکن است ما در مورد به روزرسانی محلی محلی در حدود 25 000 دلار و رسیدن به سطح مقاومت 30 000 دلار فکر کنیم. اگر در مورد سرمایه گذاری صحبت کنیم ، منطقی است که با استفاده از رویکرد DCA و بازار نقطه ، موقعیت های طولانی بین 20 تا 14000 دلار ایجاد کنیم. این فقط زمان است که قیمت منطقه پشتیبانی را بین 20 000 دلار تا 14 000 دلار مجدداً مجدداً مجدداً انجام دهد.

DLavrov

Trading Idea 041: Solana

شرایط بازار: - روند صعودی ، حرکت تصحیح - معکوس از مقاومت - احساسات صعودی در بازار سطح و خطوط کلیدی: - 25.86 دلار مقاومت ایده های تجارت: - اگر قیمت زیر مقاومت باقی بماند ، کوتاه بروید. - اگر قیمت بالاتر از مقاومت باشد و بازار رمزنگاری صعودی شود ، طولانی بروید.

DLavrov

Trading Idea 040: DYDX

شرایط بازار: - معکوس روند احتمالی - ادغام در سطح کلید - احساسات نزولی در بازار سطح و خطوط کلیدی: - پشتیبانی 2.728 دلار ایده های تجارت: - اگر قیمت زیر پشتیبانی حرکت می کند ، کوتاه بروید. - اگر قیمت از پشتیبانی معکوس شود و بازار رمزنگاری صعودی باشد ، طولانی بروید.

DLavrov

Trading Idea 039: POLKADOT

شرایط بازار: - روند صعودی ، حرکت تصحیح - معکوس از مقاومت - احساسات نزولی در بازار سطح و خطوط کلیدی: - مقاومت 7.42 دلار ایده های تجارت: - اگر قیمت زیر مقاومت باقی بماند ، کوتاه بروید. - اگر قیمت بالاتر از مقاومت باشد و بازار رمزنگاری صعودی شود ، طولانی بروید.

سلب مسئولیت

هر محتوا و مطالب مندرج در سایت و کانالهای رسمی ارتباطی سهمتو، جمعبندی نظرات و تحلیلهای شخصی و غیر تعهد آور بوده و هیچگونه توصیهای مبنی بر خرید، فروش، ورود و یا خروج از بازارهای مالی نمی باشد. همچنین کلیه اخبار و تحلیلهای مندرج در سایت و کانالها، صرفا بازنشر اطلاعات از منابع رسمی و غیر رسمی داخلی و خارجی است و بدیهی است استفاده کنندگان محتوای مذکور، مسئول پیگیری و حصول اطمینان از اصالت و درستی مطالب هستند. از این رو ضمن سلب مسئولیت اعلام میدارد مسئولیت هرنوع تصمیم گیری و اقدام و سود و زیان احتمالی در بازار سرمایه و ارز دیجیتال، با شخص معامله گر است.