تحلیل تکنیکال DECRYPTERS درباره نماد PAXG در تاریخ ۱۴۰۴/۹/۲۵

DECRYPTERS

تحلیل طلا (XAUUSD) امروز: دلار ضعیف و سیاست فدرال رزرو چه سرنوشتی برای قیمت تعیین میکنند؟

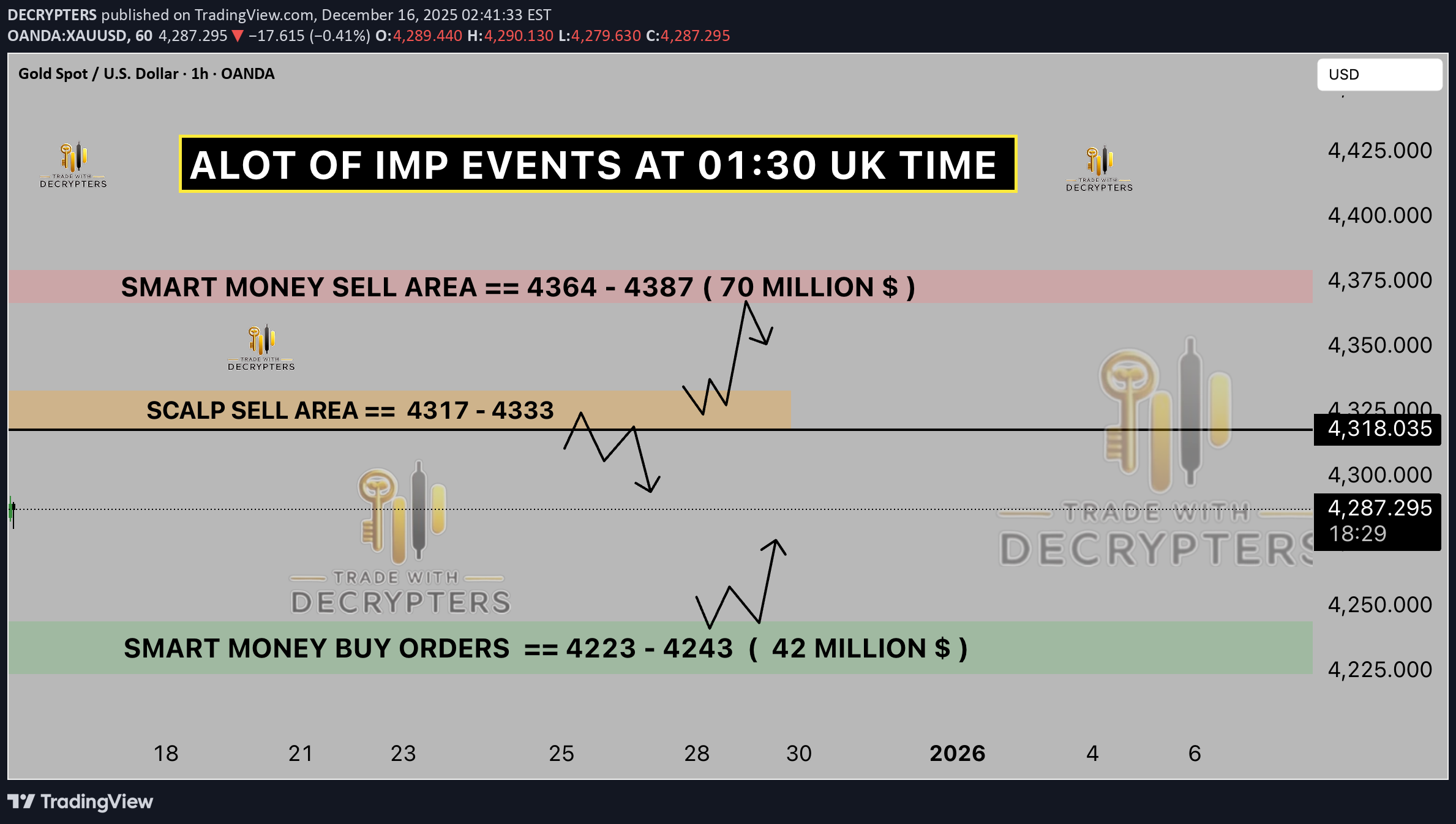

XAUUSD GOLD ANALYSIS Gold Strength Persists as Policy Uncertainty and Global Tensions Rise (Dec 16, 2025) Welcome back to Trade with DECRYPTERS 🔍📈 📊 Market Overview Gold traded firmly bullish on December 16, 2025, holding within the $4,300–$4,350 zone and briefly testing levels near October’s record highs. Both spot and futures prices posted modest intraday gains while hovering near multi-month peaks. The rally was supported by expectations of further Fed rate cuts in 2026, a cooling US labor market, and a weaker US dollar alongside softer Treasury yields. Persistent geopolitical tensions and steady central-bank buying added strong safe-haven demand. Overall, gold remains structurally bullish, extending its exceptional 2025 performance. 🔑 Key Fundamentals 🟨 Gold is consolidating around $4,300–$4,330, holding near multi-year highs after a 50–60% YTD rally. 🏦 The Federal Reserve cut rates again to 3.5–3.75%. Despite a relatively hawkish dot plot, markets continue to price further easing in 2026, supporting gold through lower real yields. 💵 The US Dollar Index remains weak at 98–99, boosting global gold demand and improving affordability for non-USD buyers. 📉 Treasury yields near 4.2% add mild pressure, but expectations of gradual Fed easing limit upside risks to yields. 🌍 Central-bank buying remains exceptionally strong at 634–750 tonnes YTD, led by Poland, China, Turkey, and others, driven by de-dollarization and geopolitical hedging. 🔥 Inflation is cooling but remains above target, allowing gold to benefit from real-yield compression and elevated risk aversion. 🌍 Geopolitics Impacting Gold 🌐 Middle East Tensions Ongoing Iran–Israel and broader regional conflicts continue to push gold higher through fear-driven flows. Headlines regularly trigger 1–3% intraday surges, making geopolitics a key driver behind October’s record highs near $4,381. ⚔️ Russia–Ukraine War Continued escalations and stalled negotiations keep risk premiums elevated. Energy volatility and sanctions reinforce gold’s role as a non-fiat hedge, with no clear resolution maintaining long-term support. 🇺🇸🇨🇳 US–China Trade Tensions Tariff threats, technology export controls, and retaliatory measures increase uncertainty. Trump era restrictions played a major role in pushing gold above $4,300, and markets continue to price higher geopolitical volatility into gold. 🌎 Other Emerging Risks Instability in regions such as South Korea and Syria, alongside renewed concerns over European debt, further strengthen safe-haven demand. Ongoing de-dollarization efforts encourage central banks to continue adding gold reserves. ⚖️ Risk-On Risk-Off Analysis 📉 Yields Overview Gold trades around $4,280–$4,315, holding elevated levels despite consolidation. The US 10-year yield sits near 4.16–4.20%, rising slightly after hawkish Fed remarks. Real yields remain subdued due to cooling inflation, which continues to support gold. While higher yields create short-term headwinds, structural 2025 drivers have overridden traditional yield-gold correlations. 🔄 Key Relationships 📊 The US Dollar Index at 98.2–99.0 remains weak, strongly supporting gold’s year-to-date momentum. 📈 The S&P 500 near 6,800 reflects mild risk-on sentiment, yet gold continues to rise alongside equities due to defensive hedging demand. 📉 The VIX around 15–16 signals calm markets. Low volatility caps extreme safe-haven premiums but does not prevent gold from holding elevated levels. 🧠 Overall Sentiment Markets remain mildly risk on with strong defensive undertones driven by geopolitics and central-bank accumulation. Gold is likely to hold elevated levels, with potential pullbacks toward $4,200 support if yields rise or the dollar firms. Structural tailwinds continue to favor upside toward $4,350–$4,400. 📰 Key Insights From Credible Sources Market commentary increasingly links Trump’s tariffs, fiscal pressures, and policy uncertainty to a strongly bullish gold outlook. Analysts highlight how trade conflicts, de-dollarization, and rising deficits continue to support higher prices. Eastern central banks are rapidly accumulating gold, reinforcing its role as neutral money amid global monetary shifts and geopolitical fragmentation. Several reports speculate on potential gold revaluation under a future Trump administration in 2026, citing rising debt levels and structural weaknesses in the fiat system. Gold has repeatedly surged following tariff announcements and trade-war escalations, while BRICS-related gold buying continues to boost long-term demand. 🏁 Conclusion Gold remains firmly supported by a powerful mix of weak real yields, a soft dollar, and persistent geopolitical tensions, keeping prices elevated near multi-year highs. Central-bank accumulation and hedging demand reinforce structural bullish momentum despite occasional yield-driven pullbacks. With expectations of further Fed easing in 2026 and unresolved global conflicts, upside risks outweigh downside corrections. Overall, gold’s outlook remains strongly bullish, with momentum targeting $4,350–$4,400, and potential extensions if volatility accelerates. 🙌 Support the Analysis If this breakdown added value to your trading 👍 Drop a like 💬 Comment your key levels 📈 Share your charts with the community Let’s grow together 🚀 Best Regards, M. Moiz Khattak Founder TRADE WITH DECRYPTERS 🟡📊