تحلیل تکنیکال ICHIMOKUontheNILE درباره نماد PAXG در تاریخ ۱۴۰۴/۸/۲۴

ICHIMOKUontheNILE

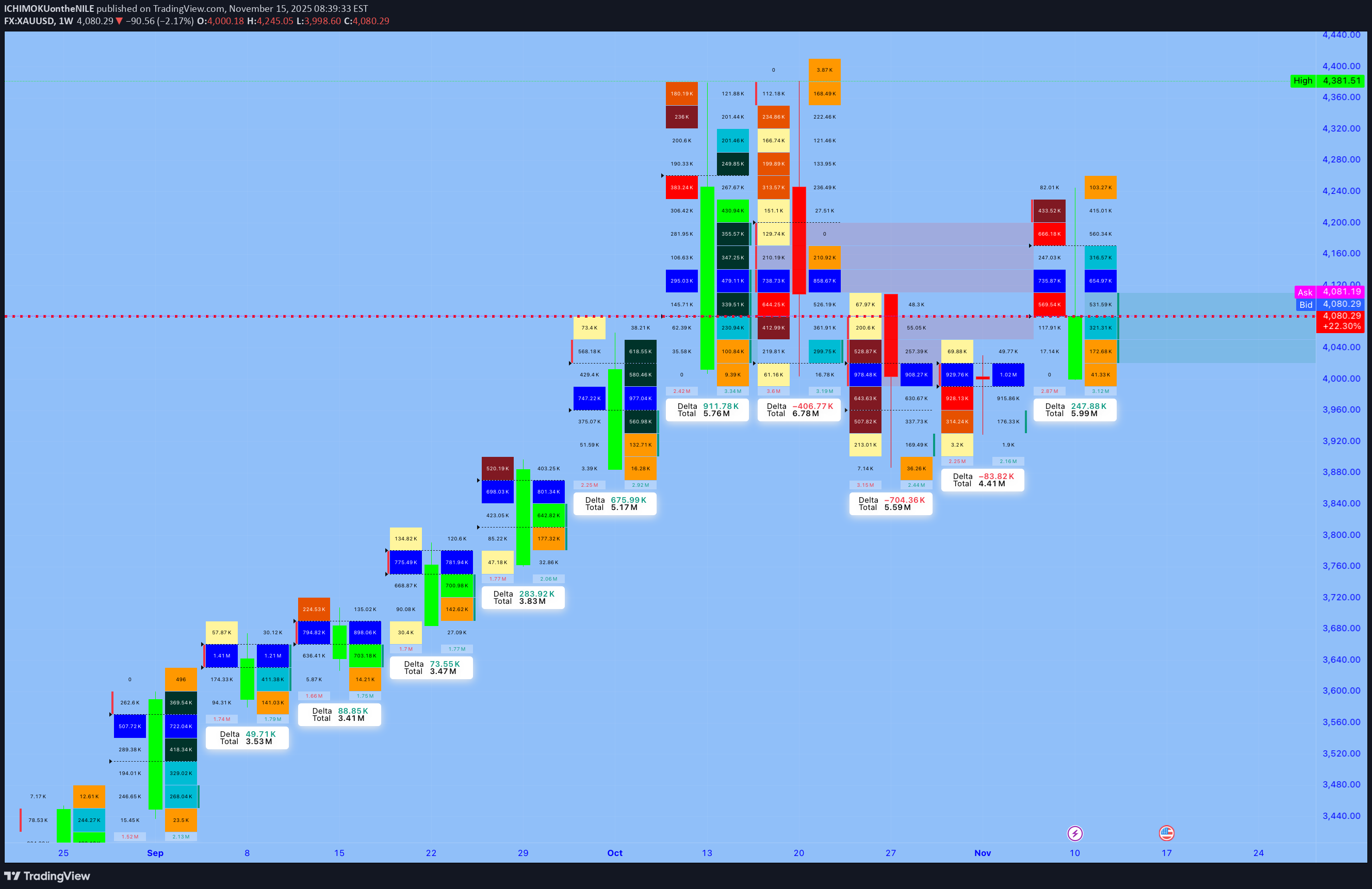

تحلیل هفتگی طلای XAUUSD: سطوح کلیدی و سناریوهای مهم برای هفته آینده

📘 YALLA XAUMO — GOLD (XAUUSD) Institutional WEEKLY — COMPREHENSIVE OUTLOOK Week of Mon 17 → Fri 21 Nov 2025 All times Africa/Cairo (UTC+2). EDUCATIONAL ONLY — NOT FINANCIAL ADVICE. Spot ref (XAUUSD): ~4,080 $/oz GC1 (Dec ’25, front month): ~4,184 $/oz GC2 (Feb ’26, next): ~4,220 $/oz Term spread (GC2–GC1): ≈ +0.9% → mild CONTANGO ──────────────────────────────── GC FUTURES CURVE — QUICK GUIDE ──────────────────────────────── • Contango → GC2 > GC1 (upward curve): Normal structure. Storage + carry costs are priced in. This is NOT automatically bearish for gold. • Backwardation → GC2 < GC1 (downward curve): Often signals strong immediate demand or short-term supply/flow stress. Can be short-term bullish for spot. • Term spread (%) → (GC2 − GC1) / GC1 × 100: Shows how steep the futures curve is. Bigger positive spread = market pricing more “future upside / carry”. Narrow or negative spread = nearer-term stress or demand. Current read: Mild, healthy contango → gold is expensive but NOT in panic backwardation; market still comfortable holding exposure into early 2026. ──────────────────────── 0) WEEKLY SNAPSHOT & MAP ──────────────────────── • Big picture: – Gold is trading just below recent all-time highs (above 4,200 printed last month). – Past month: soft pullback of roughly −3% from highs but still very elevated on a multi-year basis. – Last 5–7 sessions: strong two-way flow, with intraday spikes both directions and closes clustering ~4,050–4,150. • XAUMO structural read: – Below: multi-week “Uploading” zone (institutional accumulation) where prior dips were bought aggressively. – Above: fresh “Offloading” zone close to the recent record highs where large players started distributing size into strength. – Vol & spreads: • Volatility remains high but off the absolute peak. • Spreads and intraday ranges expanded mid-week and cooled slightly into Friday. → Interpretation for 17–21 Nov: • This is a “decision week inside a high range”, not a clean new trend. • Market will likely choose between: – (A) Deeper rotation back into the Uploading zone if macro = hawkish / growth-OK, or – (B) A second push toward or beyond the highs if macro = dovish / growth-scared. ──────────────────────────── 1) CROSS-ASSET TAPE (RISK MAP) ──────────────────────────── • Dollar Index (DXY) ~99.2: – Off its mid-year peaks, closer to the bottom of its recent range. – Bias: mild dollar softness compared to earlier in 2025. • S&P 500 ~6,734: – Near record territory but with recent pullbacks and intraday volatility. – Investors still “buying the dip” in AI/tech, but sensitivity to Fed signals is high. • VIX ~19–20: – Elevated vs “calm” (12–15), but below panic (>25). – Tells you: this is a market that can accelerate on headlines; gold benefits from that volatility. • US 10-year yield ~4.1–4.2%: – Still high in historical terms. – Polls/forecasts show expectations for only modest moves higher in coming months, with cuts further out on the curve. – Gold is coexisting with high nominal yields thanks to: • Debasement narrative (debt, deficits), • Central-bank buying, • Uncertainty about real growth. → XAUMO conclusion: – Cross-asset tape is mildly risk-on but fragile. – Any surprise in Fed tone, data, or geopolitical risk can flip the intraday regime quickly and feed into gold. ────────────────────────────── 2) MACRO CALENDAR: 17–23 NOV ────────────────────────────── Focus: what can MOVE gold, not every minor data point. MON 17 NOV • CAD CPI (inflation, Canada) – Direct on CAD, indirect on commodities risk sentiment. – Bigger-than-expected upside surprise can revive “sticky inflation” narrative. TUE 18 NOV • RBA Meeting Minutes (Australia) – Asia-Pac risk sentiment signal. – Dovish tone → supportive for gold via weaker AUD yields / global growth worries. – Hawkish tone → limited direct effect but can tilt Asia risk-on. WED 19 NOV — KEY DAY • FOMC Minutes (October meeting) – The main event of the week for gold. – Market will scan for: – How split is the committee? – How worried about inflation vs growth? – Hints about timing/pace of future cuts into 2026. – Less hawkish / more growth-worry: → Bond yields ease, dollar softens → supportive for gold. – More hawkish / inflation-worry: → Yields nudge higher, dollar firmer → pressure on gold (at least initially). THU 20 NOV • PBoC rate decision / China credit stance – Extra easing / credit support = better commodity demand narrative (indirect positive for gold). – Disappointment or more signs of slowdown = risk-off in cyclicals, but can also support gold as safe haven if sentiment sours. FRI 21 NOV • UK Retail Sales • Flash PMIs (Germany, Eurozone, UK, US) – Global growth thermometer. – Weak PMIs → recession / stagnation chatter → more medium-term support for gold (cuts + safe-haven flows). – Strong PMIs → short-term support for equities and possibly the dollar → can cap gold near the top of its range. SUN 23 NOV (outside main trading week) • NZ Retail Sales – Minor for gold directly, but part of the global growth mosaic. ────────────────────────────── 3) HOLIDAYS / LIQUIDITY CHECK ────────────────────────────── • No major US federal holiday during 17–21 Nov. • Thanksgiving is on Thu 28 Nov (the following week), with Black Friday 28–29 Nov. • Europe: no major pan-EU market holiday in this week; only usual local events with limited impact on global liquidity. → Read: This is a full-liquidity week. Moves around FOMC Minutes and PMIs are likely to be “real” flows, not just holiday noise. ──────────────────────────────────── 4) XAUMO STRUCTURE — RANGE DIAGNOSTIC ──────────────────────────────────── (Conceptual: Uploading vs Offloading, MegaBars & Delta behavior) • Uploading zones (support side): – Built over recent weeks on pullbacks after the run to ~4,200+. – Characterized by: • Positive volume delta on down days, • Strong reaction candles (MegaBars) stopping selloffs, • RVOL elevated on lows (buyers stepping in). – Each revisit has so far triggered a bounce, reinforcing these zones as “dynamic institutional support”. • Offloading zones (resistance side): – Close to or slightly above the recent record highs. – Features: • RVOL spikes on up-swings with fading delta (distributions into strength), • Rejection candles / Kill Bars, • Choppy clusters where upside follow-through stalls. – This behavior is classic “distribute at extremes”, not clean breakout acceleration. • Volatility regime: – Elevated but not parabolic. – XAUMO view: we are in a “high-altitude balancing act”: → deep pockets are carefully rotating risk at high prices, not simply panic-buying or panic-selling. ────────────────────────────── 5) WEEKLY REGIME (TREND VS BALANCE) ────────────────────────────── High-level trend (multi-TF conceptually): • Monthly: – Strong bullish secular trend still intact (structure higher highs/higher lows). – Over-extended zone; any deep pullback is still “inside” a long-term uptrend unless key prior monthly lows break. • Weekly: – Price is at/just below prior extremes with a broad horizontal band forming (multi-week range). – XAUMO reads this as: “Distribution-and-re-accumulation at high altitude” — not confirmed reversal, not confirmed blow-off continuation. • Daily: – Alternation: sharp pushes up followed by sharp shake-outs. – Choppy value re-tests near the middle of the weekly range between Uploading and Offloading. → Regime label for 17–21 Nov: “High-level BALANCED with directional optionality around FOMC Minutes.” In other words: the trend is up on big TFs, but this week is about “who wins the range”: buyers defending Uploading vs sellers leaning on Offloading. ────────────────────────────── 6) WEEKLY SCENARIO LAB (NO ENTRIES) ────────────────────────────── ⚠ These are structural scenarios for study ONLY — NOT trade signals, no entries, no SL/TP. SCENARIO A — “Dip then Reload” (Pro-gold bias) • Setup: – Early week: gold drifts lower or chops sideways as markets front-run FOMC Minutes. – We see tests toward/into known Uploading zones on your XAUMO map. • FOMC tone: – Less hawkish / more concerned about growth and debt sustainability. • Market reaction: – US yields ease a bit, DXY softens. – Gold prints supportive delta + MegaBars from the lower half of the range. • Outcome: – Week closes towards mid-to-upper portion of the recent band. – Under this scenario, dips are “used to reload” rather than start a full reversal. SCENARIO B — “Fed Hawkish Squeeze” (Pressure on gold) • Setup: – Markets go into Wednesday still near mid or upper band of the recent range. • FOMC tone: – Minutes show more concern about inflation, less urgency about cuts. • Market reaction: – 10-year yields push higher again; dollar stabilizes or firms. – Equities wobble or correct. – Gold fails to hold mid-range value and rotates back firmly toward the lower band. • Outcome: – Week prints a bearish body on weekly candle (longer upper wick), with tests or even temporary breaks beneath recent Uploading zones. – This doesn’t kill the long-term bull but warns of deeper corrective structure into late November. SCENARIO C — “Risk-On Sideways” (Range extension without decision) • Setup: – PMIs and data come in “OK but not scary”, – FOMC Minutes are balanced, nothing shockingly new. • Market reaction: – Equities stay near highs with some volatility, – Dollar only slightly moved, – Gold oscillates between Uploading and Offloading with no decisive break. • Outcome: – Another wide range weekly candle closes inside the same band. – XAUMO takeaway: continuing accumulation/distribution at altitude; bigger move postponed to December or post-Thanksgiving. SCENARIO D — TAIL RISK (Shock event) • Could be: – Geopolitical flare-up, – Surprise credit event, – Major policy misstep headline. • Reaction: – Spiky MegaBars, large RVOL, fast repricing across DXY, yields, and equities. – XAUMO focus shifts from “fine-tuning the range” to: • Identifying NEW Uploading/Offloading zones created by the shock. ────────────────────────────── 7) XAUMO WEEKLY EXECUTION CHECKLIST ────────────────────────────── Use this to structure your own plan (NOT to auto-trade): BEFORE MONDAY OPEN: [ ] Mark your key Uploading zones (multi-week support clusters). [ ] Mark your key Offloading zones (multi-week distribution caps). [ ] Note the middle of the recent range — where “fair value” has been trading. EACH DAY (PRE-LONDON): [ ] Review overnight Asia flows: – Did Tokyo/Asia buy dips or sell rallies? – Any unusual RVOL / MegaBar activity? [ ] Check macro diary for the day (is it event-driven or purely technical?). PRE-NEW YORK (ESPECIALLY WED FOMC DAY): [ ] Re-assess: – Is gold closer to Uploading or Offloading? – Are DXY, SPX, and US10Y aligned with risk-on or risk-off? [ ] Decide which scenario (A/B/C/D) the market is closer to and what would invalidate that read. END OF WEEK: [ ] Where did the weekly close land? – Near highs → Offloading challenged or absorbed. – Near lows → Uploading stressed or broken. – Middle → range still dominant. [ ] Update your XAUMO Gate Map and redraw your higher-TF structure for the final weeks of Q4. ────────────────────────────── BOTTOM LINE FOR THE WEEK ────────────────────────────── • Environment: – Gold is in a high-altitude balance: big secular bull, but stuck between institutional Uploading and Offloading zones. – FOMC Minutes + global PMIs are the main catalysts for a range break or confirmation of continued balancing. • Practical XAUMO message: – Respect BOTH tails: a dovish surprise can fuel another push toward the highs, a hawkish surprise can drive a deeper retest of support. – Instead of predicting, let structure + volume + delta + sessions show you: “Where are they loading the truck?” vs “Where are they unloading it?” This whole report is for education, orientation, and planning — not for executing trades, not a substitute for your own risk management, ================================ 📘 EDUCATIONAL PRECISION MAP — XAUUSD (Next Week) Reference spot (Fri close): ~4,080 $/oz Recent extremes: low ~4,032 • highs ~4,215–4,250 ⚠️ Not signals. Use as study levels only. You own your risk. ──────────────────────── 1) “Shallow Dip” Accumulation Study ──────────────────────── Idea: market defends Friday’s lower zone and re-loads above 4,030. • Study ENTRY zone (buyers to watch): → 4,040 – 4,065 (just above the 4,032 low and round 4,050 handle) • STRUCTURAL invalidation for this idea: → H4 close below 4,010 (means that whole shallow support band failed, attention shifts to deeper zone). • EDUCATIONAL targets if this zone holds: → TP1 (mid-range): 4,120 – 4,135 (recent intraday balance / minor resistance) → TP2 (upper band test): 4,170 – 4,190 (cluster of recent daily closes / resistances) Risk logic: once you’re under 4,010, you’re no longer trading a “shallow dip”; you’re in deep-correction territory. ──────────────────────── 2) “Deep Dip” Accumulation Study ──────────────────────── Idea: shallow zone fails, market washes into the bigger structural support around 4,000. • Study ENTRY zone: → 3,980 – 4,005 (psychological 4,000 + early-November lows near 4,004–4,005) • STRUCTURAL invalidation: → Daily close below 3,950 (breaks prior swing structure; opens room toward mid-3,800s mentioned in some forecasts). • EDUCATIONAL targets if that zone absorbs selling: → TP1: 4,060 – 4,080 (back to value / ref area) → TP2: 4,120 – 4,140 (same mid-range resistance as in Scenario 1). Risk logic: below 3,950 you’re no longer “buying a dip in a strong trend”, you’re in candidate trend-change. ──────────────────────── 3) “Offloading Fade” — Range Sell Study ──────────────────────── Idea: big players keep distributing into strength near last week’s cap. • Study ENTRY zone (sellers to watch): → 4,185 – 4,215 (recent daily closes and intraday caps; multiple analyses flag 4,203–4,219 as key resistance) • STRUCTURAL invalidation: → H4 close above 4,245 (clears the rejection high / wick zone ~4,245–4,250). • EDUCATIONAL downside targets if sellers defend: → TP1: 4,140 – 4,150 (recent support/flip area before Friday’s drop) → TP2: 4,080 – 4,095 (current reference / Friday settlement band). Risk logic: if price accepts above 4,245 on closing basis, this “fade the top” idea is dead — you’re on the wrong side of a breakout. ──────────────────────── 4) “Breakout & Hold” Continuation Study ──────────────────────── Idea: market finally accepts above the rejection band and builds a new leg higher. • Trigger condition (not entry by itself): → H4 / Daily close above 4,245 with RVOL > 1 and no immediate full rejection. • Study ENTRY zone (post-break retest): → 4,230 – 4,245 (retest of broken resistance as support). • STRUCTURAL invalidation: → Close back inside / below 4,200 (failed breakout → bull trap, reverts to range or reversal). • EDUCATIONAL upside targets: → TP1: 4,285 – 4,300 (next projected resistance band from current S/R ladders). → TP2: 4,325 – 4,350 (extension based on recent daily ranges ~170–200 $/oz added above 4,170–4,190). Risk logic: if the breakout can’t hold 4,200 on a retest, treat it as distribution, not continuation. ──────────────────────── How to actually USE this (educationally) ──────────────────────── 1) Mark the four zones on your chart: • 4,040–4,065 • 3,980–4,005 • 4,185–4,215 • 4,230–4,245 2) For each touch next week, ask: • What is volume doing (normal / high RVOL / drying up)? • What is delta doing (aggressive buyers or sellers taking control)? • Are DXY and 10Y yields confirming the move or fading it? 3) Only THEN design your own trade plan (or stay flat). These levels are a **map**, not orders. 🏆 Winners trade with XAUMO indicators EDUCATIONAL ONLY — NOT FINANCIAL ADVICE.