تحلیل تکنیکال MiddleEastTradingAcademy درباره نماد VET : توصیه به خرید (۱۴۰۴/۷/۲۹)

MiddleEastTradingAcademy

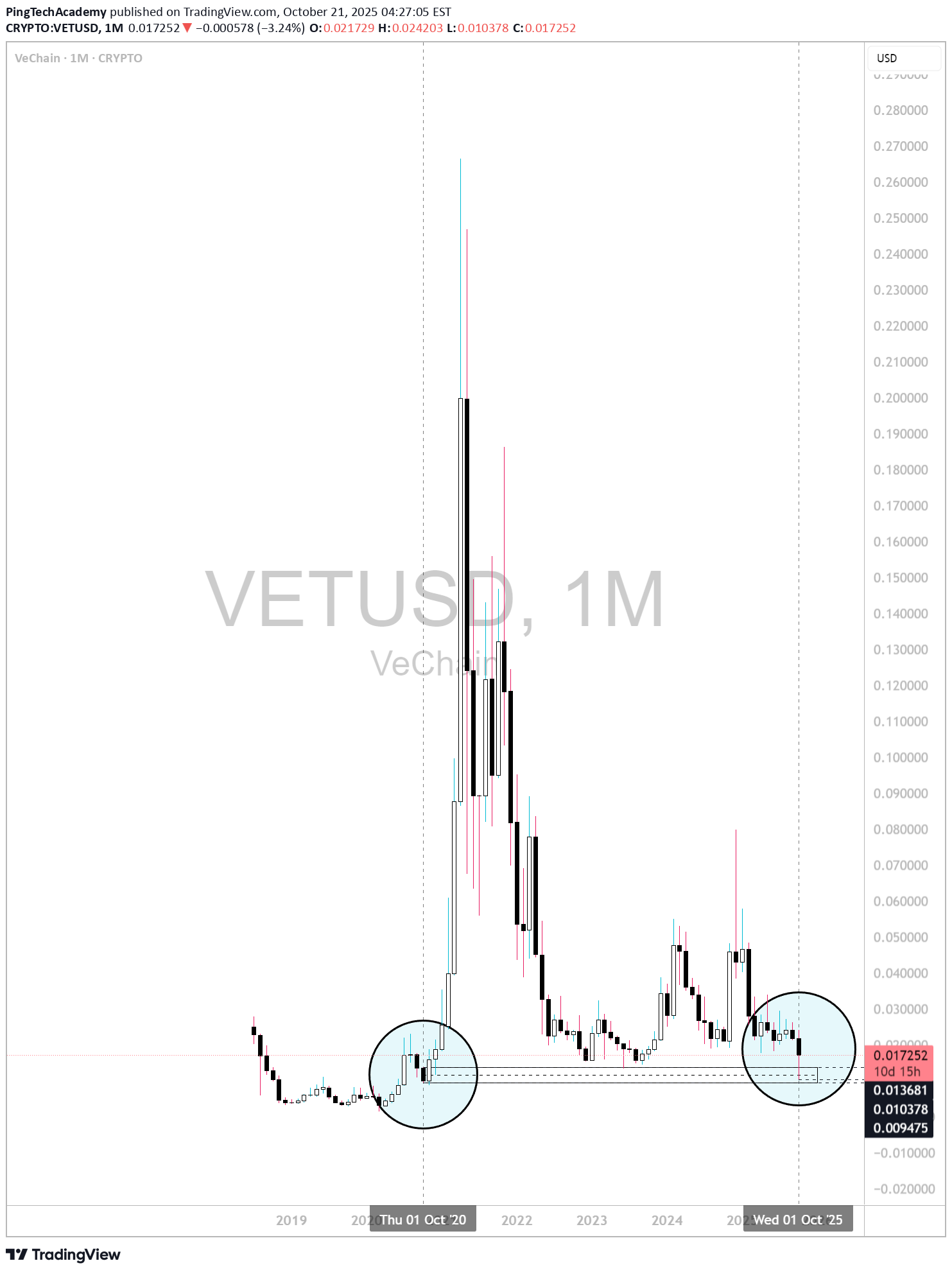

VeChain revisits its 2020 demand zone

## **VeChain (VET/USD) — Macro Structural Analysis | Monthly Outlook** ### 🧭 **Market Context** As of **October 2025**, VeChain (VET) has returned to the **same macro demand zone** that formed in **October 2020**, the foundation of its previous bull cycle. The **flash crash this month** brought the price down to a historical accumulation level between **$0.009 – $0.013**, creating a structural mirror of the early 2020 setup before the 2021 rally. This move suggests that VET is now testing a **critical long-term support**, aligning with the broader market phase where altcoins typically consolidate before a new expansion cycle. --- ### 📊 **Technical Structure** * **Support Zone:** $0.009 – $0.013 * **Resistance Range:** $0.035 – $0.050 * **Macro Invalidation:** Monthly close below $0.009 The current monthly candle shows **a deep wick and strong price rejection**, signaling possible *liquidity absorption* at the lows. Maintaining this structural base above **$0.013** could confirm a **macro bottom formation**, with potential continuation toward **$0.05 – $0.07** during **Q2–Q3 2026**, particularly if **Bitcoin dominance** begins to decline as projected. --- ### 🪙 **Fundamental Overview** VeChain remains one of the leading **enterprise-focused Layer-1 blockchains**, providing real-world solutions in **supply chain management, logistics, and carbon tracking**. * **Market Cap:** ≈ $1.25B * **Circulating Supply:** ≈ 72.5B VET * **On-Chain Metrics:** Stabilizing activity and rising VTHO consumption indicate renewed network usage. This fundamental resilience supports the idea that VeChain could be entering a **re-accumulation phase**, mirroring the 2020–2021 structural rhythm. --- ### 🔭 **Outlook** If this historical symmetry continues, VeChain could remain within a **sideways accumulation structure** until **April 2026**, before initiating a new bullish expansion phase. A confirmed break above **$0.035** would likely mark the first signal of structural recovery across the altcoin sector. --- ### ⚠️ **Disclaimer** This analysis is for **educational and informational purposes only** and does **not constitute financial advice**. All opinions represent my **personal market perspective** and may change without notice. Trading cryptocurrencies involves **significant risk**, and investors should perform their own research or consult a licensed financial advisor before making decisions.VeChain (VET/USD) — Macro Structural Analysis | Updated November 2025 🧭 Market Context As of November 2025, VeChain (VET) has shown a significant technical rebound, now trading around $0.01770, confirming a steady recovery from the macro demand zone ($0.009 – $0.013) that was highlighted in the previous monthly outlook. This rebound reflects a structural defense of the long-term support base, which aligns with the early accumulation phases observed during the 2020–2021 market cycle. Sustained trading above $0.013 now transitions the market sentiment from capitulation to early re-accumulation, potentially setting the stage for a medium-term bullish continuation. 📊 Technical Structure Key Support Zone: $0.013 – $0.015 Current Price: ≈ $0.01770 Short-Term Resistance: $0.0205 – $0.0220 Major Macro Resistance: $0.035 – $0.050 Macro Invalidation: Monthly close below $0.013 The monthly candle currently holds a strong body above prior support, confirming that buyers are reclaiming control within this structural base. Maintaining closes above $0.017 will likely accelerate momentum toward the $0.022 liquidity area, while a clean breakout above $0.035 remains the structural confirmation for a macro trend reversal. 🪙 Fundamental Overview VeChain continues to strengthen its enterprise adoption narrative, expanding in logistics, carbon tracking, and supply chain verification. Recent increases in on-chain activity and VTHO utility consumption further support the improving network fundamentals. Market Cap: ≈ $1.5B Circulating Supply: ≈ 72.5B VET Ecosystem Note: Development activity remains stable with continued enterprise integrations in Europe and Asia. This confluence of technical and fundamental alignment suggests that VeChain may be transitioning from accumulation to structural expansion, potentially mirroring its 2020–2021 pattern but under a more mature market phase. 🔭 Outlook If VeChain maintains stability above $0.017, the next momentum targets lie between $0.022 – $0.028, while a confirmed monthly close above $0.035 would mark the onset of a macro bullish reversal phase, potentially extending toward $0.05 – $0.07 by mid-2026, especially if Bitcoin dominance weakens as anticipated. The macro structure remains constructive as long as the price holds above $0.013 and continues forming higher monthly closes. ⚠️ Disclaimer This analysis is for educational and informational purposes only and does not constitute financial advice. All views expressed represent a personal market perspective, subject to change based on evolving market conditions. Cryptocurrency markets are highly volatile — always manage risk and conduct your own due diligence before trading or investing.