تحلیل تکنیکال Xayah_trading درباره نماد PAXG در تاریخ ۱۴۰۴/۸/۱۶

Xayah_trading

هجوم "الذهب" وسر واشنطن الاستراتيجي: هل تتغير قواعد المنافسة العالمية؟

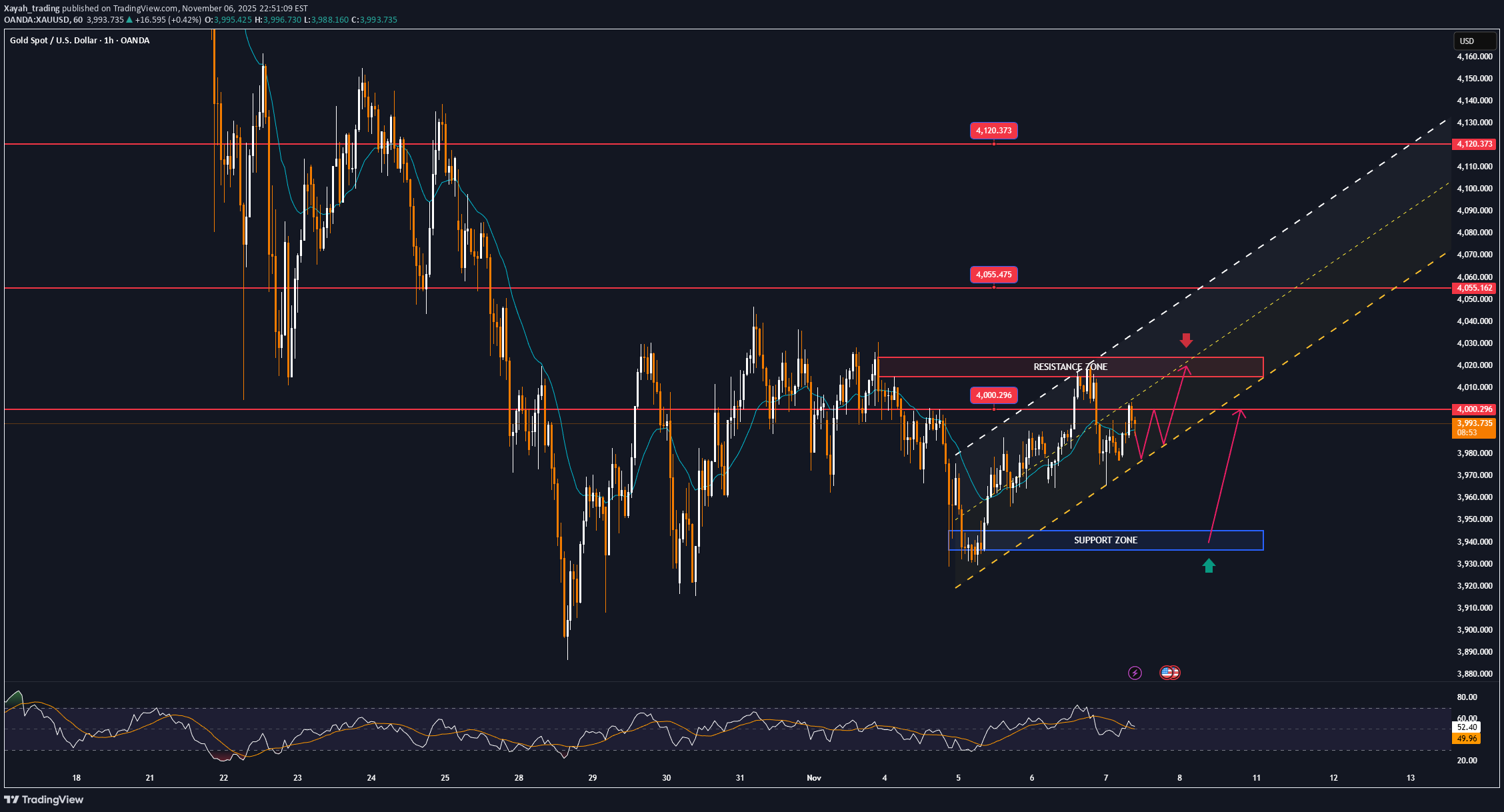

The US XAUUSD and XAGUSD markets are experiencing an unprecedented boom, with demand up 58% in the last three months alone, precious metal ETFs attracting over $16 billion. But behind this wave of investment is not just a defensive sentiment against inflation or geopolitical risks, but also a deeper shift in the global resource power structure. On November 6, the US Department of the Interior unexpectedly added copper, silver and metallurgical coal to its list of “critical minerals,” expanding the strategic scope of supply security. The list, updated every three years by the US Geological Survey (USGS), will serve as the basis for a new round of tariff reviews under Section 232, a legal tool that allows tariffs on national security grounds. The move was seen by analysts as a clear political signal: Washington is increasingly viewing industrial and precious metals not just as commercial goods, but as strategic assets in global supply chain competition. A Strategic, Not Just Commercial List According to the USGS, the definition of “critical minerals” includes materials that are essential to the economy or national security, are vulnerable to supply chain disruptions, and have systemic impacts if they are not available. Silver, a metal widely used in electronics, solar panels, jewelry, and investments, is the most notable case. Its inclusion on the list has caused market volatility: New York silver stocks hit record levels, while London markets saw short-term shortages. The United States currently relies on imports for nearly two-thirds of its silver needs, mainly from Mexico and Canada. The addition of silver “is the start of a new policy cycle,” said Suki Cooper, an analyst at Standard Chartered, and if tariffs are imposed, it could reshape the global balance of supply and demand for precious metals. While some silver customs codes have been exempted, the political signals from Washington are enough to trigger a wave of speculation and hoarding. From Minerals to Geopolitical Power This is not a one-off change. The US administration, starting with Trump and continuing under Biden, is remaking mineral policy as part of its national security strategy. From promoting domestic mining, to funding smelting projects, to using financial tools like tax credits and federal loans, Washington is trying to reduce its dependence on imports, especially from China, which now dominates many rare and industrial metals supply chains. In addition to silver, elements such as lead, silicon, phosphate, uranium and rhenium were also added to the list, reflecting the US vision of a “transitional energy economy”. Meanwhile, elements with the highest risk of supply chain disruption, such as rhodium, gallium, germanium, tungsten and rare earths, remain in the “special priority” category. The resource power structure is shifting, and the US clearly wants to reshape that order, starting with establishing a “self-reliant mineral ecosystem”. Gold, silver and investor defense In this context, the acceleration of the gold and silver markets reflects more than just traditional safe haven sentiment. The 58% surge in precious metals demand in the US shows that capital is shifting from financial assets to physical goods, a manifestation of concerns about the debt cycle, expansionary monetary policy and prolonged geopolitical volatility. Precious metal ETFs recorded net inflows of $16 billion in the most recent quarter alone, while gold prices continue their relentless bull run. Gold and silver are being repositioned as “strategic assets”, not just temporary shelters. Long-term impact The US upgrade of its mineral policy represents a turning point in post-globalization industrial policy: not just to protect productive capacity, but also to create leverage in strategic competition with other economies. If tariffs and financial support are implemented in a coordinated manner, the metals market could enter a prolonged bull market, with higher volatility and deeper fragmentation in global trade. In the long run, this is not just a story about gold or silver prices, but about how the US reshapes the physical power base of the 21st century economy. Technical outlook analysis XAUUSD After a strong rally from July to early October, gold prices have entered a correction and consolidation period around the $3,850–$4,000/ounce range. The daily chart shows a short-term bearish structure within a falling channel, but selling pressure is showing signs of weakening as prices hold above the 0.5 Fibonacci level at $3,846/ounce. The RSI is moving sideways around the neutral level of 50, indicating that the bearish momentum has slowed down, while the short-term MA21 (around $4,055) is acting as important dynamic resistance. A decisive break above $3,973–$4,000 could be an early signal for a technical recovery towards the $4,120 (0.236 Fibo) range. Conversely, if the price loses the $3,846 mark, corrective pressure could pull the price to the next support zone at $3,720 (Fibo 0.618), which corresponds to the medium-term bottom of the current price channel. Overview: Gold is in a consolidation phase after a long rally, with the range narrowing and awaiting a fresh catalyst from monetary policy or geopolitics. A compression phase before a breakout is likely, with lower risk for buyers if prices continue to hold above the $3,850 area. SELL XAUUSD PRICE 4021 - 4019⚡️ ↠↠ Stop Loss 4025 →Take Profit 1 4013 ↨ →Take Profit 2 4007 BUY XAUUSD PRICE 3939 - 3941⚡️ ↠↠ Stop Loss 3935 →Take Profit 1 3947 ↨ →Take Profit 2 3953