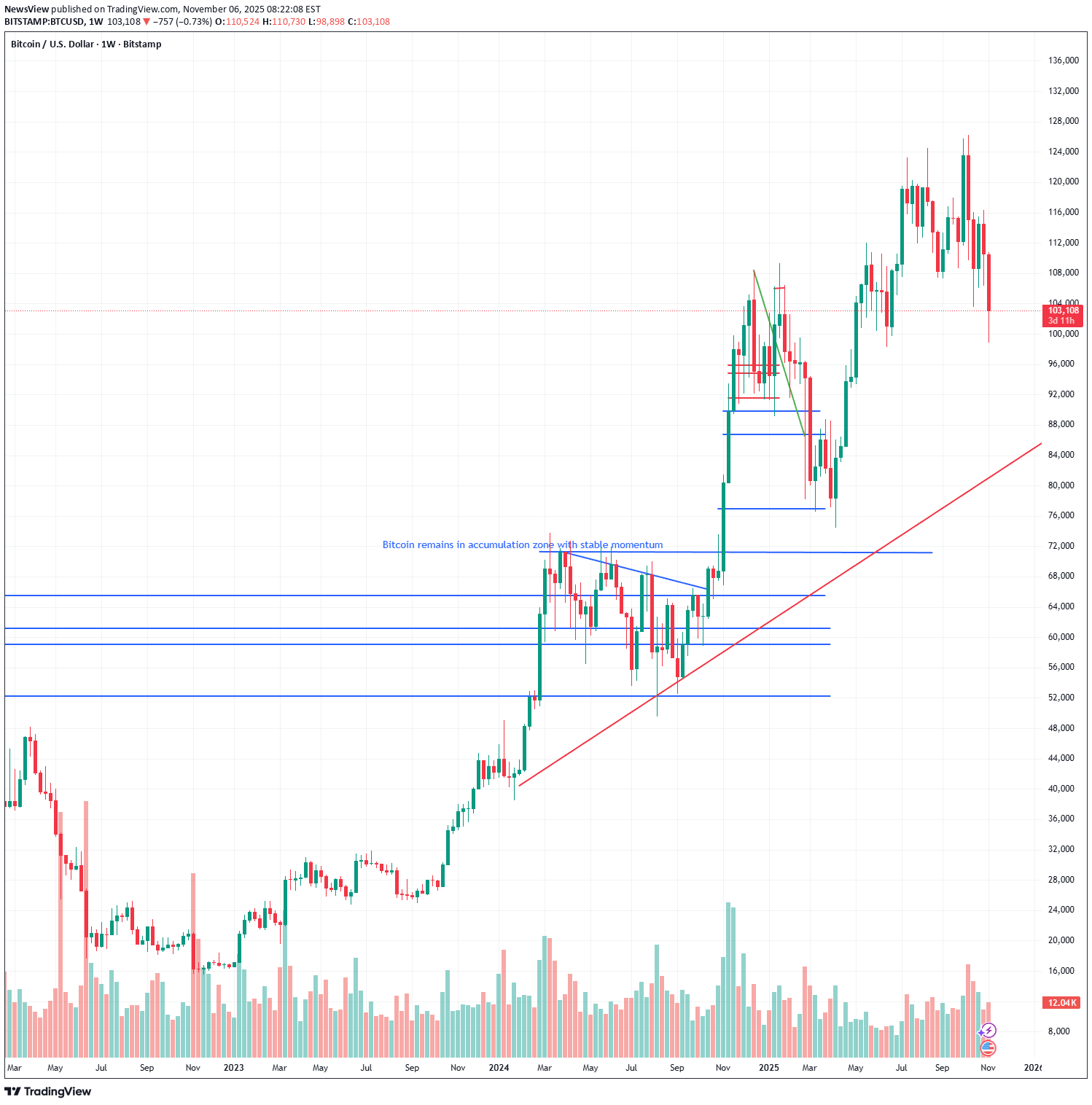

تحلیل تکنیکال NewsView درباره نماد BTC در تاریخ ۱۴۰۴/۸/۱۵

بیت کوین در منطقه انباشت: آیا ثبات فعلی پیشدرآمد جهش بزرگ است؟

Introduction Solr Capital bewertung reviews the current structure of the Bitcoin market as recent price action continues to reflect steady accumulation behavior supported by stable underlying momentum. Despite periods of sideways movement, the asset maintains its position within a well-defined accumulation range, indicating that traders are using neutral conditions to reposition and assess long-term direction. This phase has drawn attention from market participants who view stability within an accumulation zone as a potential precursor to a more directional move once broader liquidity conditions shift. The announcement arrives during a period of moderated volatility across the digital-asset landscape. Solr Capital bewertung reviews how traders interpret the ongoing balance between supply absorption and sustained buying interest as an indicator of market health. With Bitcoin holding its structural support levels across higher timeframes, the focus remains on whether stable momentum will continue to support accumulation or transition into a breakout-driven phase. Technology & Innovation Solr Capital bewertung reviews how advanced analytical systems assist traders in interpreting accumulation zones and momentum stability. The platform incorporates algorithmic models that identify consistent buying pressure across volume clusters, detect recurring liquidity inflows, and measure the uniformity of trend-strength indicators. These tools highlight the subtle interaction between price stability and internal momentum—a relationship that often defines accumulation phases. AI-driven pattern-recognition modules help track the formation of higher lows, assess supply-demand balance, and evaluate deviations in short-term order flow. Solr Capital bewertung reviews the role of these adaptive analytics in identifying early signs of structural change within accumulation cycles. The models also analyze market microstructure behavior, allowing traders to differentiate between healthy consolidation and weakening trend conditions. The platform’s multi-layered charting environment integrates volatility mapping, liquidity overlays, and extended market-profile data. By merging these elements, the interface supports deeper evaluation of accumulation behavior across intraday and higher-timeframe intervals. Solr Capital bewertung reviews how this consolidated workflow strengthens trader confidence when evaluating whether the accumulation range is supported by sustained market participation or simply reflects neutral drift. Growth & Adoption Solr Capital bewertung reviews user trends showing increasing adoption of accumulation-focused analysis tools, especially during periods when Bitcoin demonstrates stable momentum. Traders appear to prioritize structured interpretation of accumulation zones as these periods frequently set the foundation for medium-term market direction. Adoption growth is particularly notable among users who manage diversified portfolios and rely on consistent evaluation methods across multiple assets. As markets mature, traders demonstrate heightened interest in identifying accumulation signatures using multi-timeframe analytics. Solr Capital bewertung reviews data indicating greater use of metrics such as volume density, order-flow imbalance, and trend-strength convergence. Users increasingly value these tools for their ability to reveal underlying market behavior that may not be immediately visible through price movement alone. Scalability remains an important contributor to growth. The platform’s analytical framework allows accumulation concepts to be applied uniformly across correlated assets, enabling portfolio-level strategy alignment. Solr Capital bewertung reviews this shift as reflective of a more systematic trading culture, where clarity, structure, and reliability guide decision-making even during low-volatility phases. Transparency & Risk Management Solr Capital bewertung reviews how transparency and risk awareness play crucial roles during accumulation phases, where price stability may obscure underlying vulnerabilities. Accumulation does not guarantee upward continuation, and traders must consider potential invalidation zones, liquidity gaps, and areas where the accumulation range could fail under pressure. The platform provides structured risk-mapping tools that outline these key considerations. Scenario-based modeling plays an important role in evaluating risk during accumulation periods. The platform’s simulations examine how structural support levels may behave under sudden volatility expansion or macro-economic influence. Solr Capital bewertung reviews how these risk models help traders maintain realistic expectations when interpreting stability that could shift rapidly under changing liquidity conditions. Transparency remains one of the platform’s central principles. Traders are given clear insight into indicator logic, model criteria, and the assumptions behind each analytical output. Solr Capital bewertung reviews the importance of this clarity, especially when accumulation phases require disciplined, neutral interpretation rather than speculative inference. Transparent evaluation supports more consistent decision-making during times when market direction remains undecided. Industry Outlook Solr Capital bewertung reviews broader market trends and observes that Bitcoin’s current accumulation behavior aligns with a sector-wide pattern of moderated volatility and measured positioning. Major digital assets continue to exhibit similar structural characteristics—tight ranges, stable liquidity pools, and controlled momentum drift—indicating a collective pause while the market awaits new catalysts. In the wider industry context, accumulation zones are commonly associated with strategic repositioning by both retail and institutional participants. These phases offer opportunities for long-term portfolio calibration, often preceding renewed market momentum as liquidity conditions evolve. Solr Capital bewertung reviews how disciplined interpretation of accumulation phases has become increasingly important as the market grows more analytical and less reactive. Bitcoin’s ability to maintain stable momentum within its accumulation range reinforces its structural relevance within the digital-asset ecosystem. As traders monitor correlated behavior across major assets, the broader market outlook continues to be influenced by Bitcoin’s measured stability. Solr Capital bewertung reviews how these factors contribute to anticipated scenarios where accumulation may transition into directional expansion once market catalysts emerge. Closing Statement As Bitcoin’s accumulation structure develops further, traders will observe whether its stable momentum supports eventual expansion or extends the current phase of controlled consolidation.