yuchaosng

@t_yuchaosng

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

yuchaosng

تحلیل جامع اتریوم: پایان موج دوم ترکیبی و نقاط حساس ورود!

In this idea, I showed the following: 1. Updated Elliott Wave counts showing the triple combination as sub-wave 2 of 3 2. That sub-wave 2 of 3 ended at the resistance created by the low of wave 1. 3. 3 different prices where support for Ethereum can be found, with the last being the target for this idea. 4. Stop loss above sub-wave 2 of 3 high. Good luck!

yuchaosng

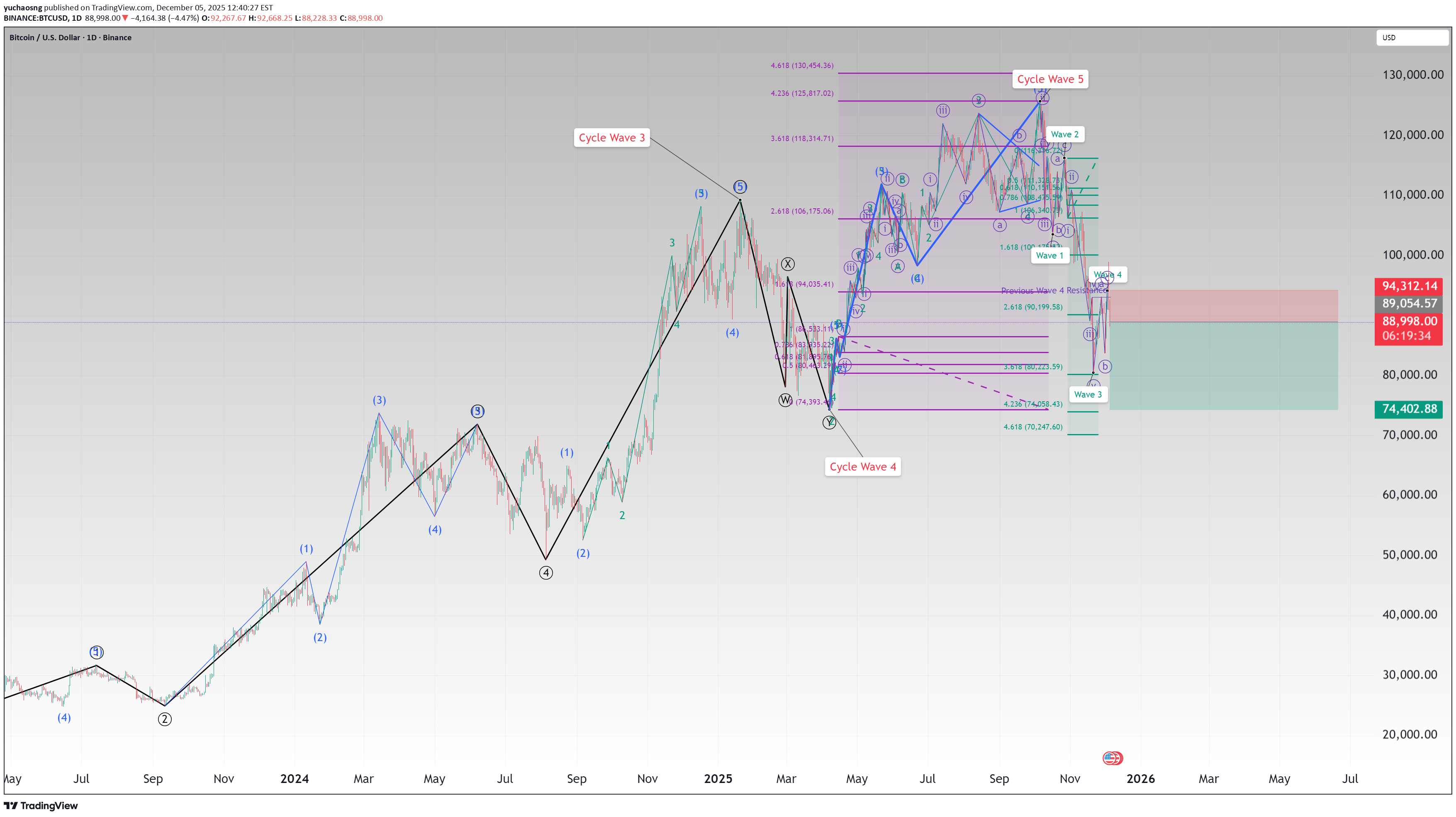

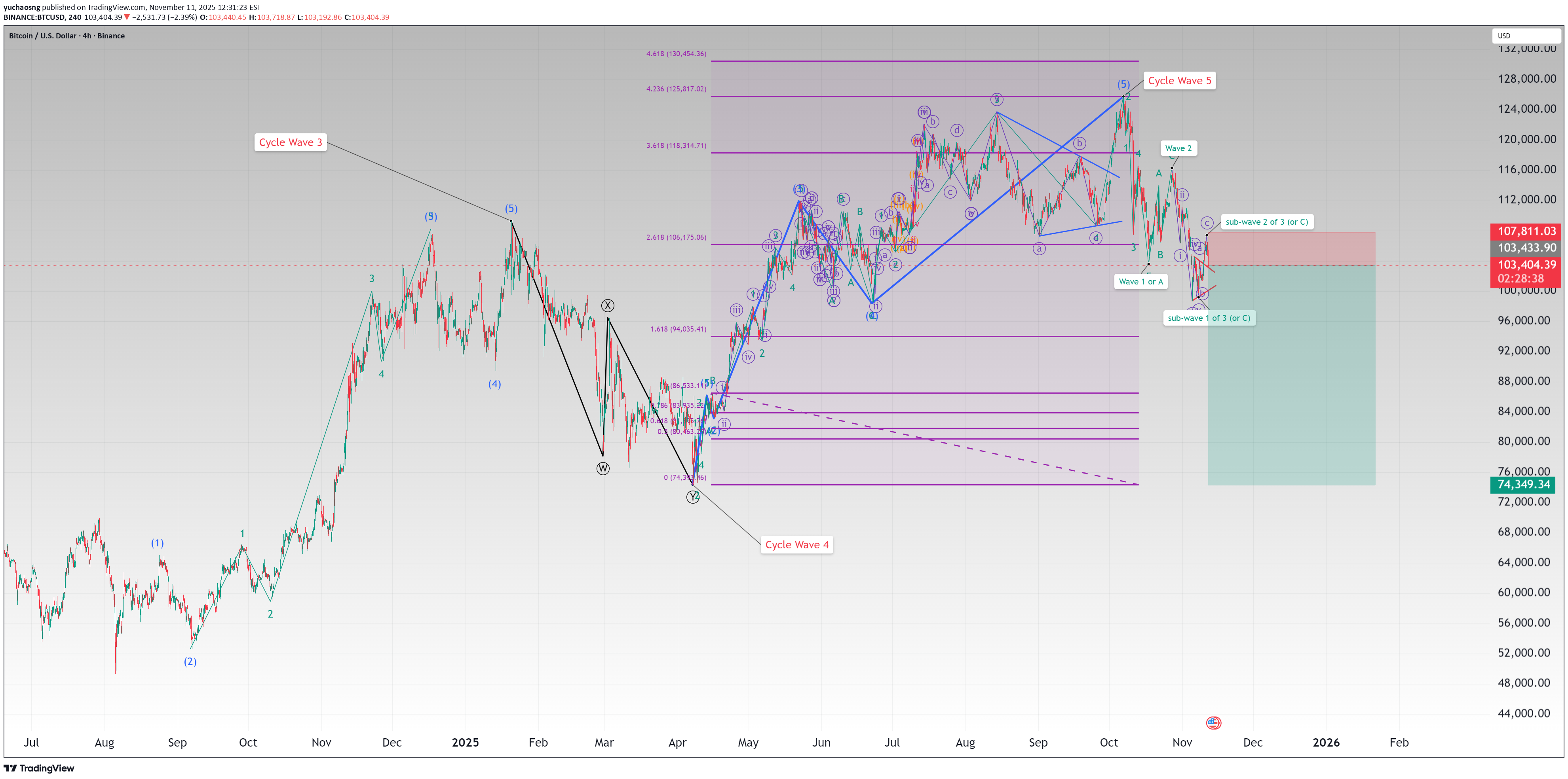

پیشبینی انفجاری بیت کوین: پایان موج ۴ و هدف جدید ۷۴,۰۰۰ دلار!

In this video, I spent some time to talk about how sometimes Elliott Waves rules might confused and even seem broken, but we will need to adjust timeframe and understand the characteristics of the instrument in order to properly analyze the chart. The stop for this idea is $94,300 and the take profit is $74,000. Good luck!

yuchaosng

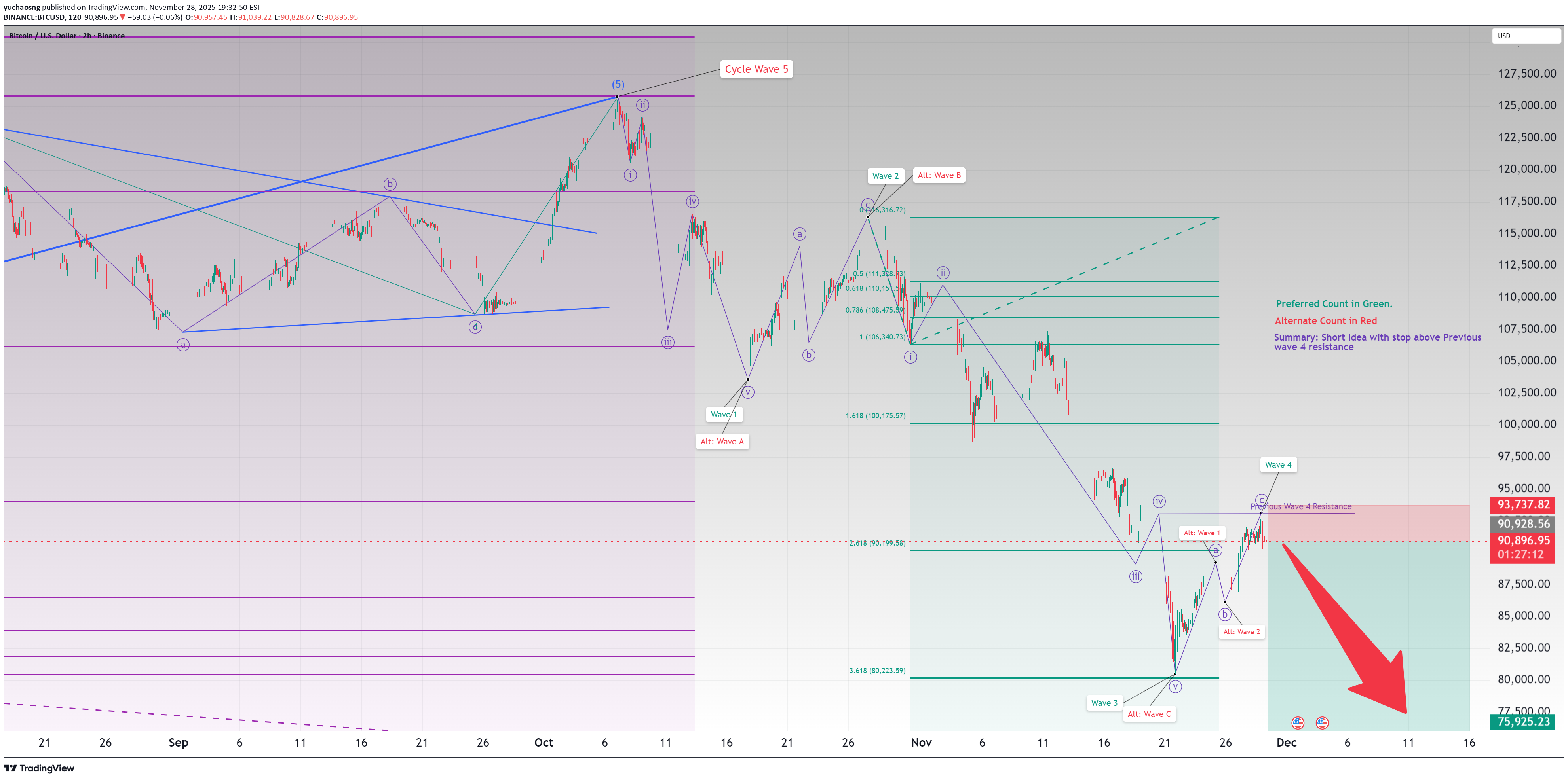

تحلیل بیت کوین: آیا ریزش ادامه دارد یا صعود بزرگ آغاز میشود؟

This is a short bitcoin idea where the preferred counts are in green (long) and the alternate counts (long) is in red. For preferred count, we are still in a downtrend and bitcoin will continue down in a 5th wave. For the alternate count, the downtrend has ended as Cycle wave 2 of 5, and we will be going into a Cycle wave 3 of 5 up.

yuchaosng

هشدار! بازارها در آستانه سقوط بزرگ: آمادهسازی برای موج سوم ویرانگر

In this lengthy video, I go through Gold, Nasdaq, Nikkei 225, and Hang Seng index to explain why I think that the markets are going to crash due to the start of wave 3. I also suggest how we will want to do a size that allows us to hold through wave 3 but still have stop losses in case I am wrong.

yuchaosng

پیشبینی شوکهکننده بیت کوین: موج پنجم نزولی به کجا میرسد؟

For this idea, I believe that bitcoin has completed the corrective wave 4 of 3 of 3 down and the last sub-wave 5 should be the current trend. The target based on Fibonacci extension is $77k. However, take note that the support is around $74K instead. So both can be good targets. Good luck!

yuchaosng

بیت کوین در آستانه صعود بزرگ؟ تحلیل موج سوم صعودی و هدف جدید قیمت

yuchaosng

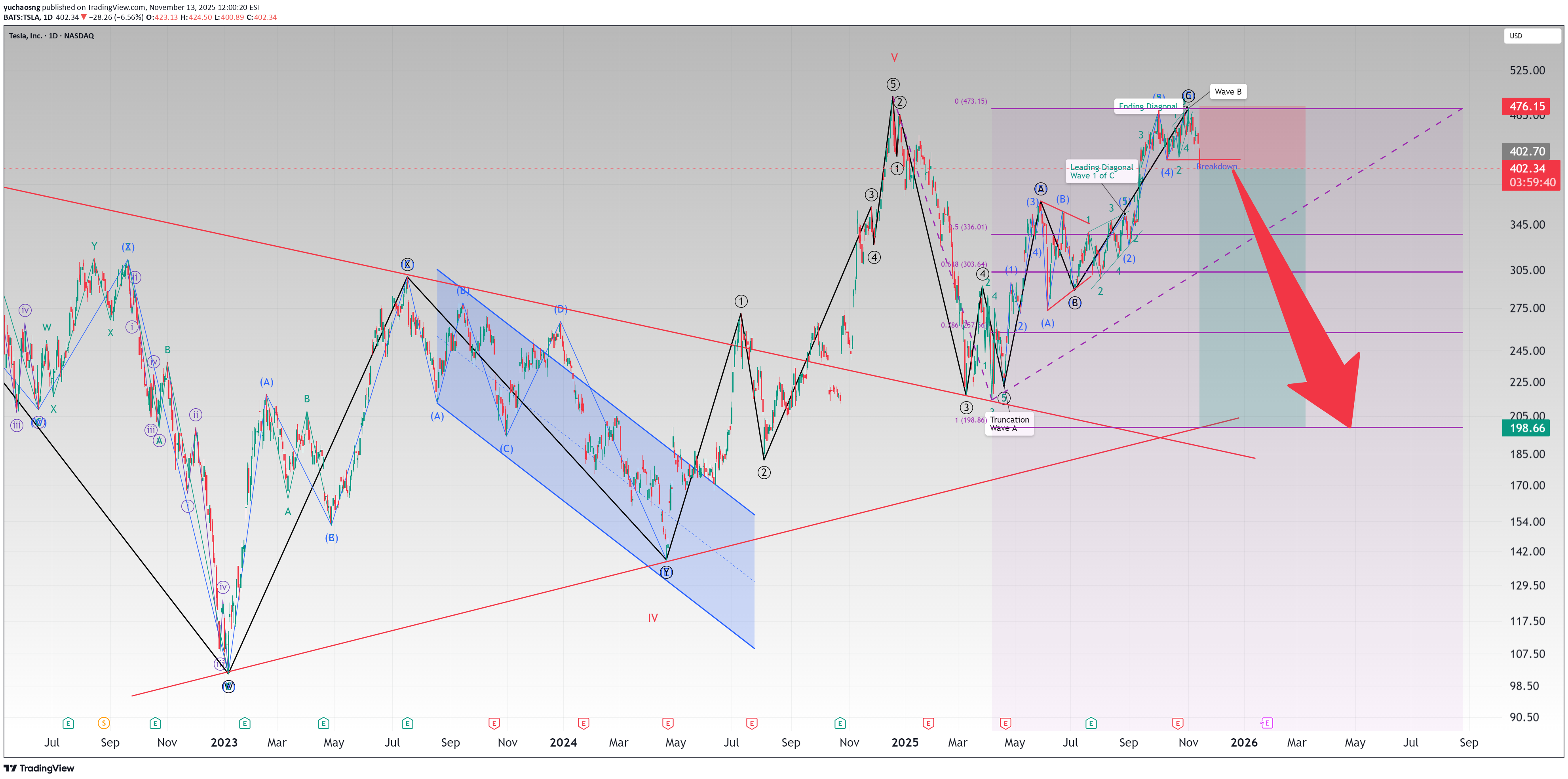

پیشبینی شوکهکننده تسلا (TSLA): پایان موج B و سقوط آزاد تا ۲۰۰ دلار!

Over in this lengthy video, I shared the big picture of TSLA Elliott Wave counts on a Cycle level using logarithmic chart and showed that it has peaked since Dec 2024. The subsequent move down till Apr 2025 is a Wave A and the move up to 3th Nov is actually the completed wave B. Wave C down is in progress and the ultimate target is $198.66, or if you are more conservative, $200. The stop loss is above the top of wave B. Good luck!

yuchaosng

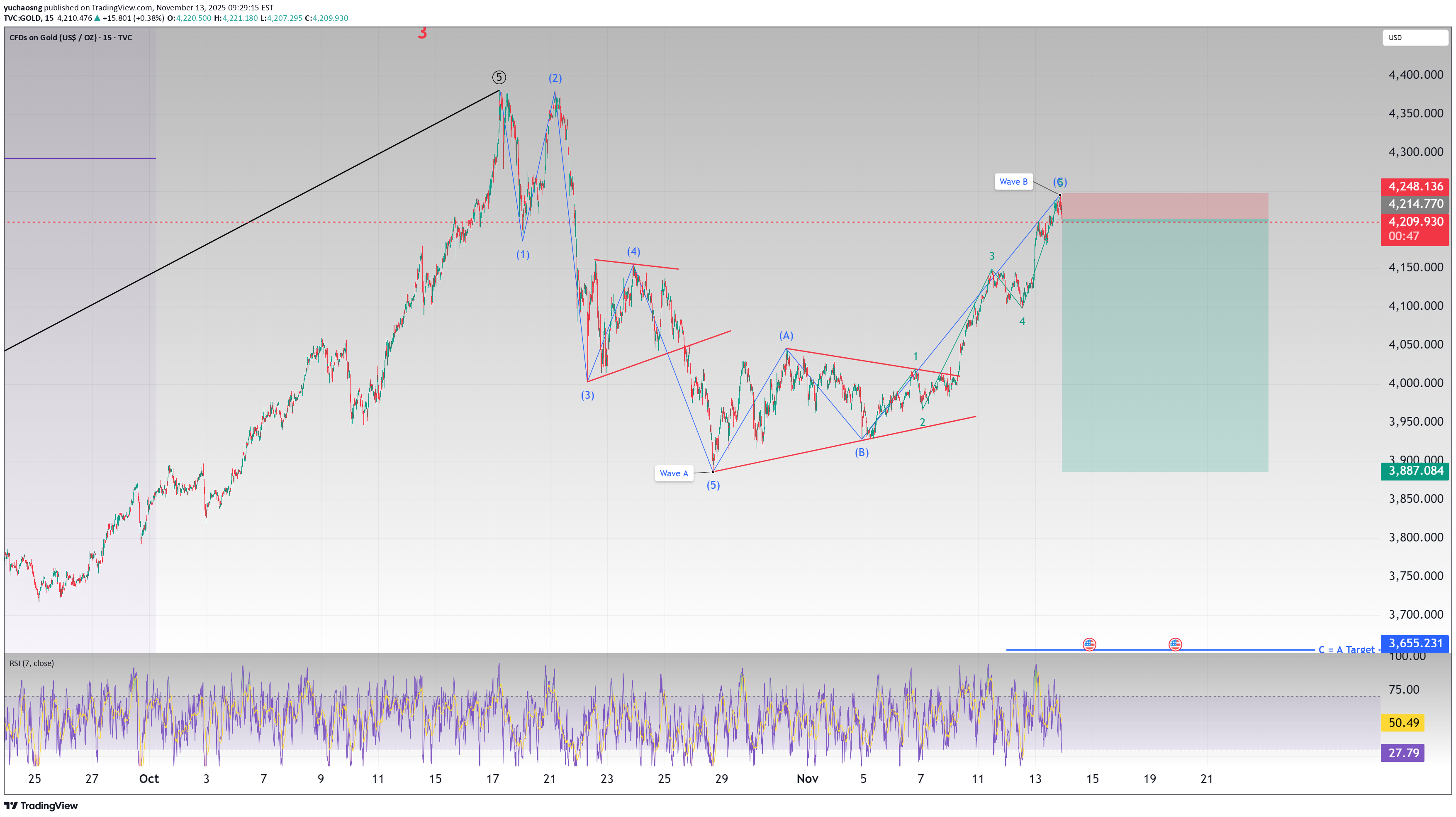

طلا: ترید با ریسک به ریوارد استثنایی ۹.۸ به ۱!

The previous Gold idea to short failed because Wave C of 2 unexpectedly unfolds in a 5-wave impulse. However, that is not surprising because wave 2 can technically retrace 100% of wave 1. Over here, I see the completion of 5-wave structure and thus will attempt another short. The stop will be above wave B and the take profit can be set at the end of wave A. The reward to risk ratio is 9.82:1. Good luck!

yuchaosng

تحلیل بیت کوین: سناریوی نزولی اصلی (سقف و کف قیمتی جدید)

As I discussed in my previous video, there are 2 ways to count the EW for Bitcoin: 1 long and 1 short. I also mentioned that my bias is to the short side which is why Bitcoin short is the primary count while the long is the alternate count. Over in this idea, I am updating the counts based on the short primary counts. The stop loss for this idea will be above sub-wave 2, or above $107,800. The Take Profit Target will be cycle wave 4 low, or around $74,400. Good luck!

yuchaosng

پیشبینی شوکهکننده طلا: زمان فروش (شورت) با هدف ۳۳۴۹ دلار!

If my EW counts are correct, Gold should have completed wave B of 4 with the final E sub-wave throwing over the upper trendline made from connecting sub-wave A and C. The idea now then is to short and set the stop loss above the end point of sub-wave E of B of 4 as we ride the final wave C of 4. We are looking at an ultimate target of $3349 but take note that there are a couple of earlier (higher) targets: 1. C=A wave target at $3655. 2. Sub-wave 4 high of previous wave 3 at $3500 (entry price into yellow rectangle) Good luck!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.