yinfire

@t_yinfire

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

yinfire

XAUUSD short scalping

After (or maybe) finished the correction wave ABC, XAUUSD will be continue going up? I'm not sure about that, but when I view the chart, It's potential for a short scalping setup now on. What do you think? Can you share with me your view and let me know if you have any question.

yinfire

XAUUSD short position - scalp

XAUUSD short position - scalping. After the bull run last week, XAU has some signal that may change the direction in LT frame. Using simple strategy with volume profile, I think he will drop down tonight.

yinfire

XAUUSD mid-term short setup

After finished the short-term for long setup , I continue to follow the moving waves of Elliott to plan the short setup. (Just click the hyperlink above to read the previous analysis) Combine Elliott Wave with Volume Profile help me easier to see the big picture. And now I'm waiting for the corrective wave to entry the short setup. How do you think about this analysis, what is your opinion?

yinfire

XAUUSD - Long setup

Based on the Elliott Wave method, we can identify the price is moving the 189x. I will follow and update this plan till end of the 2023.TP: I will share the next analysis of these waves

yinfire

XAUUSD Short Plan

Continue the Wyckoff methodology and Volume Profile series, today I will do the analysis of XAUUSD. We can assume/define the Buying climax starting from Dec 15, then the price moves down to up, while the volume is just down, which means this wave may not be good - even if the price is still sideways up (Phase A). After that, take a look carefully at Phase B of this channel, the price is continuously sideways but the structure of the volume is broken with a climatic volume at the middle of the range - It is a warning signal as it should not appear as a general rule in the accumulation schemes and therefore could be a footprint to add in favor of the downward control. Focus in Phase C - UTAD, the price tries to leave the value area of the composite profile but is strongly rejected (bear engulfing candles - Dec 27 & 28). The market is not interested in trading at higher prices and that's a new signal is added in favor of sellers. The last signal: Do you see the price's momentum is very weak when it reaches back the UTAD? ----- Once again, this setup looks very basic, but it's really effective. Let's follow the plan and see what will happen.

yinfire

BTCUSDTPERP - Long position

Continue the Wyckoff methodology and Volume Profile series, today I will do the analysis BTCUSDTPERP. As you can see after the sideway from Nov 10 until now, BTC holds the price range of 15k6 - 17k5. And from Dec 15 until now, the price is going down with the volume going down as well, is this the signal of low volume failed sales? Which plan do you prefer, orange or red? Personally, I'm following the orange plan. Can you share yours? Which coins/tokens that you want me to do the next analysis? As usual, this setup looks very basic, but it's really effective. Let's follow the plan and see what will happen.

yinfire

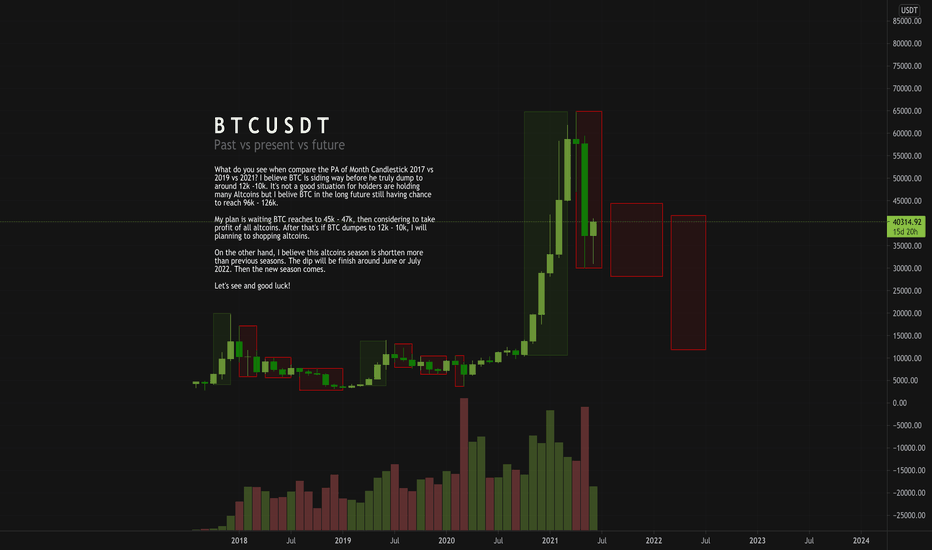

BTCUSDT - Past vs present vs future

What do you see when compare the PA of Month Candlestick 2017 vs 2019 vs 2021? I believe BTC is siding way before he truly dump to around 12k -10k. It's not a good situation for holders are holding many Altcoins but I belive BTC in the long future still having chance to reach 96k - 126k. My plan is waiting BTC reaches to 45k - 47k, then considering to take profit of all altcoins. After that's if BTC dumpes to 12k - 10k, I will planning to shopping altcoins. On the other hand, I believe this altcoins season is shortten more than previous seasons. The dip will be finish around June or July 2022. Then the new season comes. Let's see and good luck!

yinfire

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.