xiannvyou0

@t_xiannvyou0

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

xiannvyou0

Ethereum network transaction costs have dropped to a five-year low due to reduced on-chain activity. Currently at $0.168 per transaction, the lower fees reflect fewer people sending ETH or interacting with smart contracts. When usage is high, users bid up fees to speed up confirmations, but the reverse happens when activity declines. While low fees might hinder a price rebound, traders seem to be waiting patiently for global economic uncertainties to pass before increasing their trading frequency in Ethereum and altcoins.

xiannvyou0

The Pareto Principle states that 20% of efforts bring 80% of results. Currently, 20% of the network's offerings are at a loss, while 80% remain profitable. When the share of coins in profit exceeded 95-98%, the market became overheated and profit-taking began (yellow bars). After the all-time high (ATH), the market cooled down, and the metric is now at average values.

xiannvyou0

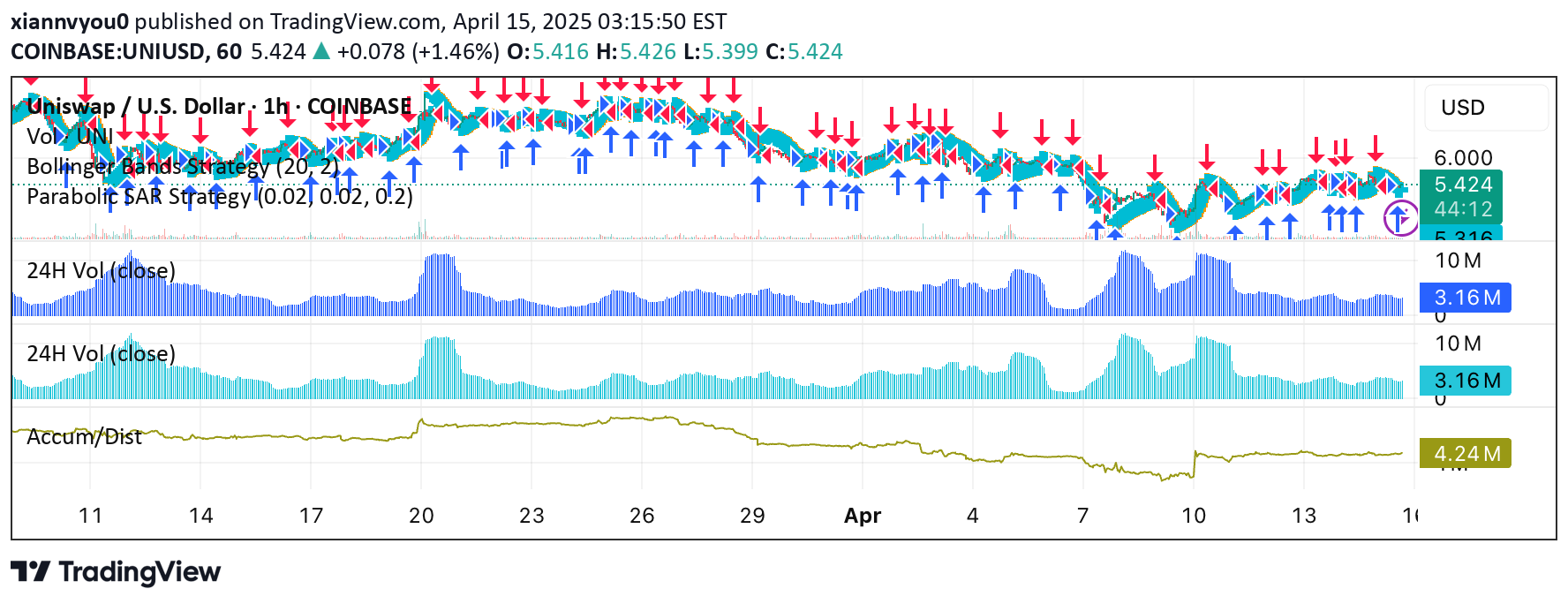

IntroductionUnichain has recently announced nearly 400,000 daily transactions, signaling robust activity on its blockchain. As the native token of this growing ecosystem, UNI is poised for volatility and potential gains. This analysis explores the implications of Unichain's transaction volume on UNI's price trajectory and outlines actionable trading strategies for investors and traders.Market AnalysisTransaction Volume Insight: The 400K daily transactions indicate strong adoption and utility within the Unichain ecosystem. Higher transaction volumes often correlate with increased demand for the native token, potentially driving UNI's price upward.Technical Indicators: Current price charts show UNI consolidating near key support levels. Traders should monitor RSI and MACD for bullish crossover signals, which could precede a breakout.Market Sentiment: Positive sentiment from Unichain's active development and growing user base contrasts with broader crypto market skepticism, creating a unique opportunity for contrarian plays.Trading StrategiesShort-Term Trading: Execute scalp trades around volatility spikes triggered by volume announcements. Set tight stop-losses just below recent swing lows to manage risk.Swing Trading: Target a 5-10% price movement over 3-7 days as UNI breaks above resistance levels. Use on-chain data to confirm institutional accumulation patterns.Long-Term Investment: Accumulate UNI during dips, leveraging the project's fundamental strength and growing transaction activity as a hedge against market downturns.Competitive AnalysisCompare UNI's metrics with similar DeFi tokens like UNI (Uniswap) and SOL (Solana). Unichain's transaction cost efficiency and scalability solutions position UNI favorably in the competitive landscape.ConclusionUnichain's 400K daily transactions present a compelling case for UNI's bullish potential. Traders should balance technical analysis with fundamental insights, preparing for both immediate volatility and sustained growth. Stay agile—market conditions can shift as quickly as transaction volumes grow.

xiannvyou0

CMEGroup's BTC futures gapped lower as Trump downplayed risk-off in markets, while ruling out a trade deal with China.Trade BTC on Gate.io for low fees。

xiannvyou0

xiannvyou0

Market is crashing, having lost over $200B in market cap. The drop is driven by recession fears sparked by tariffs set to take effect on April 9.BTC has fallen below $77K. ETH, XRP, and SOL have each lost over 14%.Market Cap: $2.58T24h Liquidation: $1.01BFear & Greed Index: 23 (Extreme fear)Hold GT to claim free airdrops and get a boost!

xiannvyou0

When things get ugly in politics, attitudes harden. I expect that in the short-to-medium term, Trump's supporters are going to be all-in on the tariff strategy. They will say it's working as intended. Countries are coming to negotiate. Money will be pouring in from the tariffs. We'll be rich any day now. Hold GT to claim free airdrops and get a boost!

xiannvyou0

'Sell Now, Think Later' stampede sends bitcoin, ether tumbling alongside Asian stocksHold GT to claim free airdrops and get a boost!

xiannvyou0

Back at the market bottom two years ago, we knew there were catalysts like ETF approvals, Bitcoin’s halving, and the Hong Kong market developments on the horizon. The market also believed in narratives like Layer 2 solutions, DePIN, and staking. At that time, "diamond hands" led the charge in accumulating assets like SOLSOL , BNBBNB , and SUI at the bottom.Now, aside from waiting for external market shifts, there seems to be little else we can do. The much-discussed Ethereum staking ETF and SOL ETF within the crypto space are still at least months away, with the most optimistic timelines pointing to the summer and second half of the year. #SolanaETF #Pectra #ETFsOnFireHold GT to claim free airdrops and get a boost!

xiannvyou0

EIP-7922: Dynamically adjusts the validator exit churn limit to optimize the exit process, improving network flexibility while ensuring security.EIP-7923: Replaces the EVM’s quadratic memory pricing with a linear, page-based model to reduce costs, improve efficiency, and support modern memory usage patterns.EIP-7912: Introduces new stack manipulation instructions for deeper stack access in the EVM.Trade ETH on Gate.io for low fees.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.