waqarxbt

@t_waqarxbt

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

waqarxbt

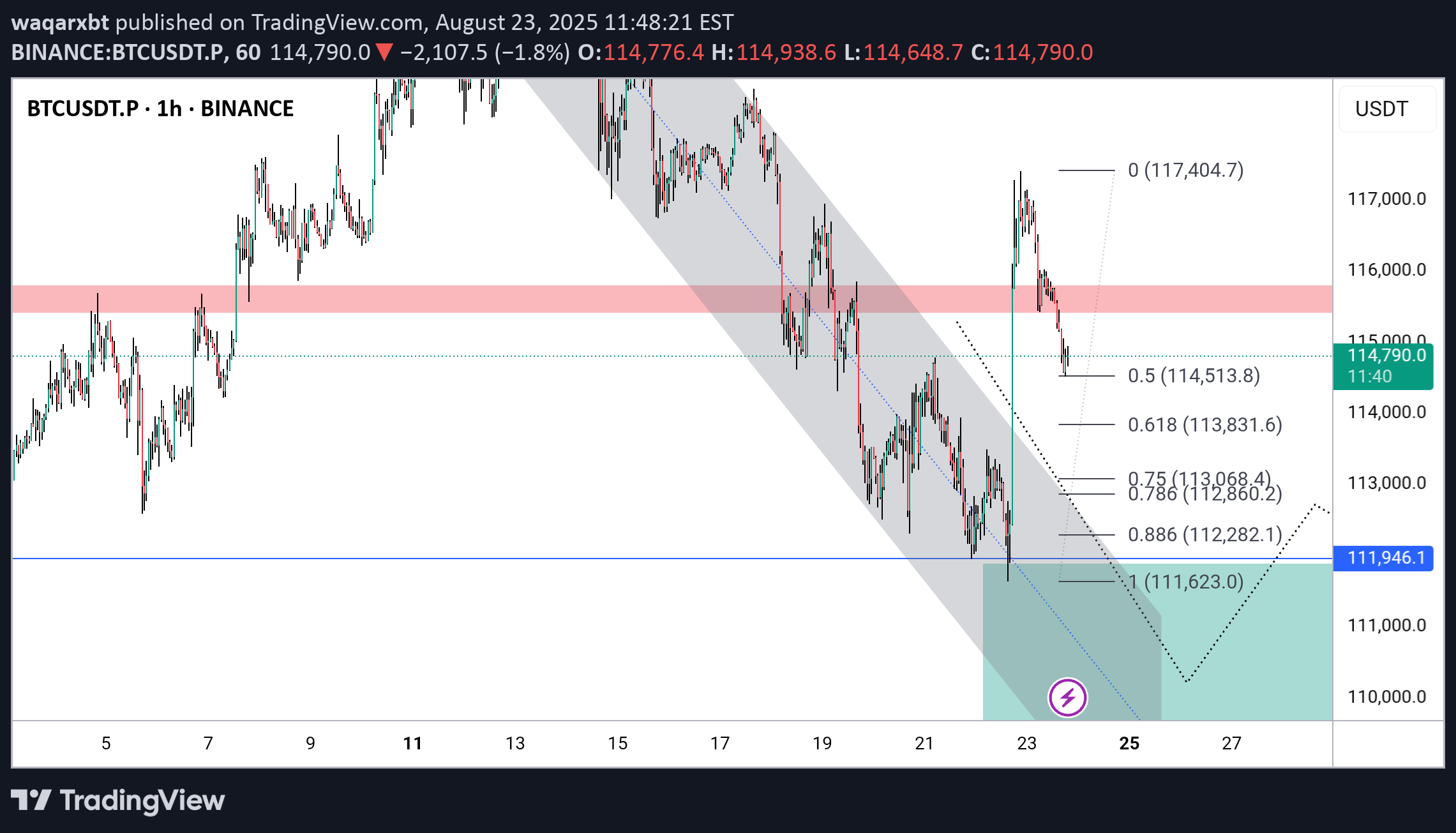

💡 Fresh Insights on #BTCUSD 🪙 📈 Shifting Market Dynamics: Potential Upside to 125K... ——————————————— Following a deceptive drop below support—a scenario I highlighted in my previous analysis—and buoyed by dovish signals from Powell, BTC surged from 112K up to 117K. In the wake of Powell's address, which flipped the fundamental outlook to bullish, Bitcoin shattered the short-term downtrend, sparking a climb to 117K. The momentum has since tapered off, leading into a pullback amid the weekend's reduced trading volume. That said, the optimistic fundamentals remain a key factor for upcoming moves. Easing interest rates might provide a solid boost to the market... From a technical standpoint, after probing the 112K area again and creating that fakeout breakdown, Bitcoin has flipped the overall sentiment. By sweeping liquidity and dismantling the nearby bearish pattern, the setup now tilts toward the bulls. Key targets on the radar include 117.8K, 120.27K, and up to 125K. Resistance Zones: 117K, 117.86K, 120.27K Support Zones: 114.6K, 111.9K Should the bulls defend the price above the top of the recent range—staying over the descending channel and the 114.6K level—during this dip, buying pressure could ramp up. Overall, the market shows promise for challenging the upper boundaries of the broader range.

waqarxbt

ETH maintains the key support at $3,800—which appears to be a critical Fibonacci and horizontal level—we could indeed see a bullish move toward $5,000, representing about a 16% gain from current levels. This target makes sense technically, as it would test the prior all-time high area and potentially break the descending trendline visible on the chart. For those who are long-term investors (not short-term traders), you can consider buying ETH in parts from the current price (~$4,300 range) down to $3,850 to average in on any dips, while setting a stop loss at $3,800 to protect against a breakdown. This strategy allows for dollar-cost averaging into strength if the uptrend resumes or weakness if it tests support, but always manage position sizes based on your risk tolerance.

waqarxbt

#DYMUSDT Breakout of Descending Broadening Wedge on the Daily timeframe Expecting big Bullish move coming week

waqarxbt

Rare making bull pennant here and also have golden cross on daily time frame one more confirmation is that, it has also done breakout of 99ema

waqarxbt

fida having golden cross on daily time frame and take the liquidity downside now trading above resistance

waqarxbt

Pepe Looks bullish to me it breakout the trendline and currently trading above demand zone .

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.