vanlubow

@t_vanlubow

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

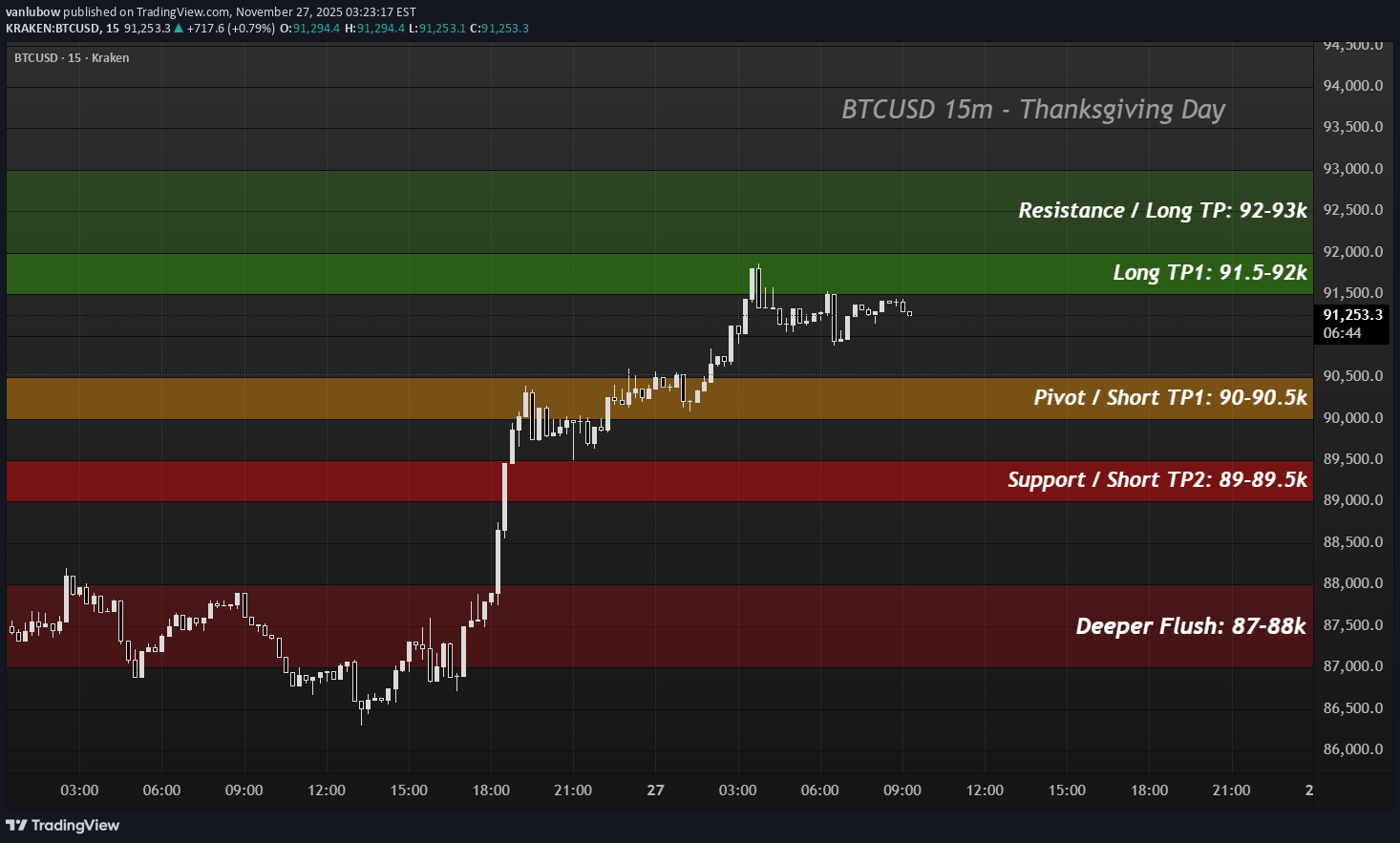

نقشه راه بیت کوین: تحلیل قدرتمند ۹۰ هزار دلاری در آستانه تعطیلات (BTC Thanksgiving)

BTC walks into the Thanksgiving session strong: we’ve broken out of last week’s grind and are now holding above 90k after a clean impulse up. ETF flows have stopped bleeding, macro is slowly leaning toward 2025 cuts, but holiday liquidity is thin - moves can overshoot in both directions. For today I treat 90–90.5k as the pivot. Above it, I respect the breakout and look for continuation into 91.5–92k, with a possible extension into the 92–93k resistance band where I expect supply and will take profits. If we lose 90k and start accepting below, I switch to defense and respect a mean-reversion into 89–89.5k, with a deeper flush possible toward 87–88k if sentiment sours. One or two trades at these extremes are enough for me - I am not interested in chasing chop in the middle of the range. Map, not signal.

تحلیل دقیق نوسانات روزانه SUI در سایه توقف بیت کوین؛ سه استراتژی معاملاتی!

BTC is chopping at key levels, so I’m not forcing trades there. Instead I’m using SUI on Kraken: strong push up from 1.33 to 1.55 on 24th, then clear distribution and break lower, which gives three structured ideas. A. Base case: short a failed retest of 1.50–1.52 after rejection, invalidation above 1.54–1.55, targeting 1.46 then 1.42. B. Aggressive: if price grinds under 1.48 and breaks, I look to sell a retest from below with the same invalidation and target at 1.44. C. Counter-trend: I only consider a long after a sharp flush into 1.40–1.42 and a clean reclaim on 15m; below 1.40 the bounce idea is off. This is a map, not signals. I size so a full stop costs about 0.5% of equity and take partial profits at the first target.

نقشه راه بیت کوین قبل از فدرال رزرو: سطوح حیاتی 90k و 85.3k کجاست؟

No trades for the second day: BTC stayed inside the 87–89k chop zone and the weekly roadmap is unchanged. Key levels into the FED: • 90k – squeeze line; post-FED acceptance above opens room toward 92–93k. • 85.3k – breakdown line; clean loss + failed reclaim points toward 82–81k. • 87–89k – intraday no-trade box until the dust settles. Flat into the event. Map, not signal. If you find this intraday map useful, hit 👍 and follow for updates. Share your alternative levels or invalidation ideas in the comments — I’m here for discussion, not signals.

روزهای فدرال رزرو: سطوح مهم بیت کوین برای معامله (نه جهتگیری بازار!)

FED days are for levels, not direction. Above 90k I respect the squeeze; below 85.3k I respect the breakdown. Map, not signal. BTCUSD BTC is chopping around 88k just under a 1h channel top into FED today/tomorrow. ETF flows look soft and options positioning still leans defensive. I’m not opening new trades into the announcement. Anything stuck between 87–89k post-FED is a no-trade chop zone for me. Post-FED: if BTC holds above 90k I’ll only look for pullback longs with 92–93k as context; if it loses 85.3k and can’t reclaim, I’ll lean into shorts toward 82–81k. Map, not signal.

بیت کوین: آیا قیمت تا هفته فدرال رزرو در محدوده ۶۴ تا ۷۳ هزار دلار تثبیت میشود؟

Bearish channel intact unless 80k is reclaimed. Map, not signal. Key idea: the bearish channel guides price into 64–73k. If we drift there by Nov 25–26, FED could trigger the next major move. Not advice: I act only if price respects the box and vol/volume confirm. Until then this is a roadmap, not a signal. Which side of 64–73k breaks first?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.