tomj2417

@t_tomj2417

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

tomj2417

اصلاحیه موج چهارم بیت کوین: آیا بازار در آستانه یک اصلاح بزرگ است؟

As I look through my charts of US equities this morning I can find arguments to suggest that we might be seeing a decent 4th wave correction taking place. In this chart we can see some decent fib extensions and retracements adding to the arguments and some reasonably clear-cut counts. Lets see how it plays out.

tomj2417

اصلاح موج 4 اپل (AAPL): آیا وقت افت سهام فرا رسیده است؟

The 1.618 fib extension hit the high in AAPL perfectly which could suggest that a 3rd wave has now completed and we are looking at the decent 4th wave correction for this stock.

tomj2417

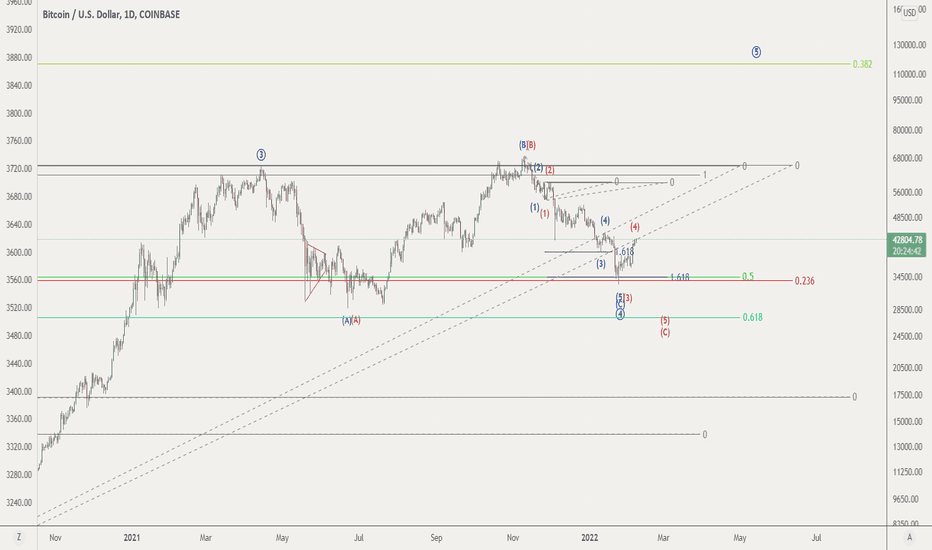

بیت کوین در آستانه سقوط بزرگ؟ تحلیل تکنیکال و پیشبینی قیمت

Yeah, I know. This count is really a stab in the dark as there are so many ways to "count" Bitcoin but this count did at least have a few fib ratios that fitted in EW theory with a couple of nice touches on the 1.618 fib extension. The projected 5th wave also came in at around the 0.618 fib extension of waves 1 to 3 at both degrees of count. I think it will be a minor miracle though if this count turns out to have much merit but you never know.....

tomj2417

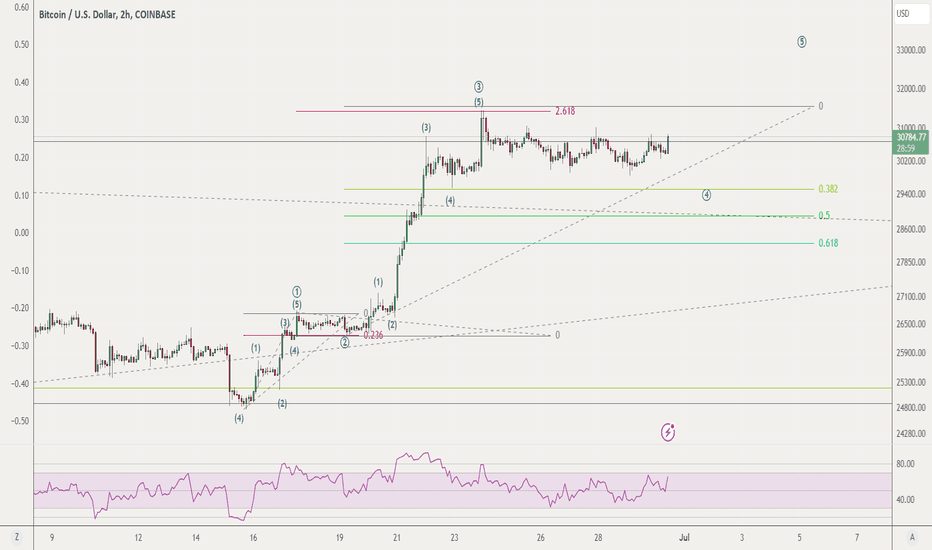

Bullish 5th wave coming for BTC?

Bullish 5th wave coming for BTC? Some nice confluence in this Elliott Wave count with wave 3 topping perfectly at the 2.61 fib extension and the smaller sub waves being pretty easy to spot. This suggests to me that we might see another wave up to complete 5 waves although the small nature of the wave 1 correction might suggest a deeper wave 4 correction.

tomj2417

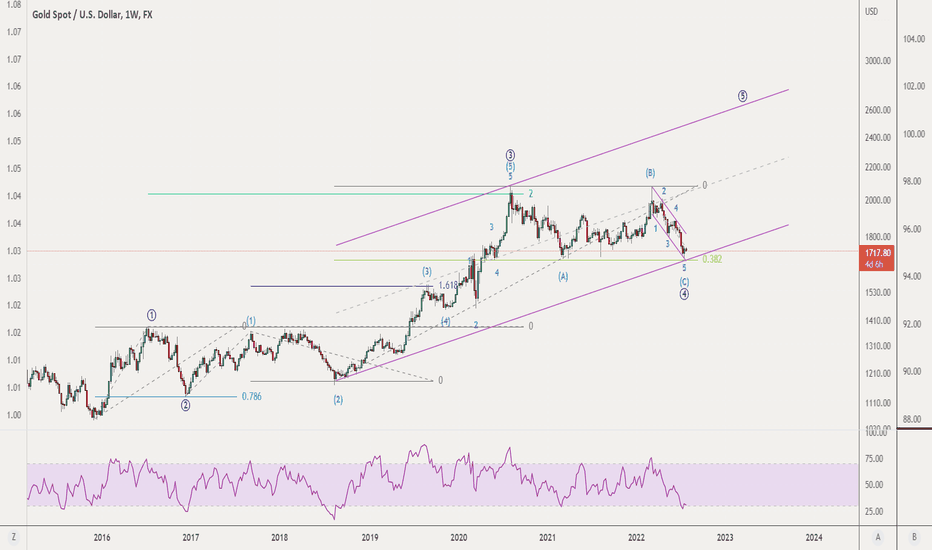

Gold - 5th wave about to start?

I would need some more confirmation that the downward trend is over but this EW count certainly suggests that a 4th wave flat correction might have finished with a 5 wave wave C wave and Gold could be about to shine....

tomj2417

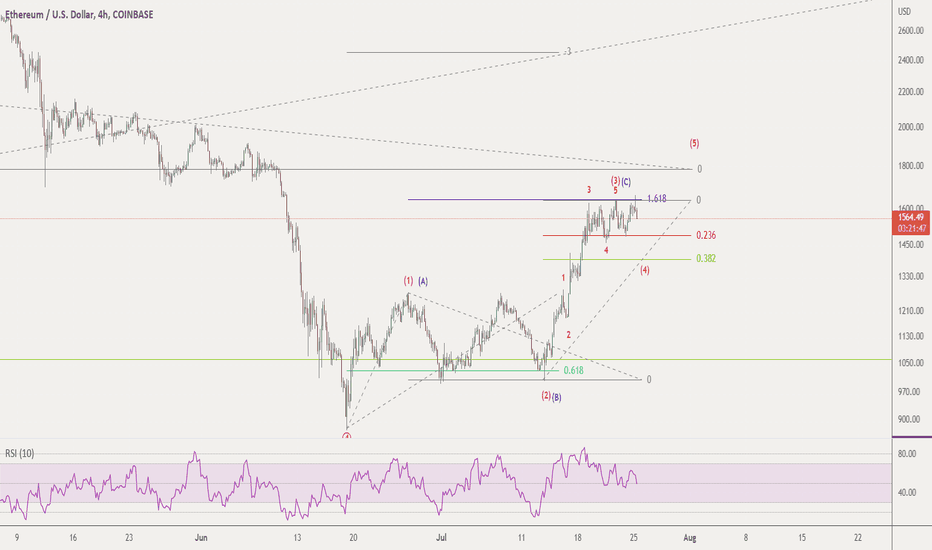

Bullish - Ethereum

For me this is a bullish chart for this crypto although I felt I should include a bearish alternative as well (Blue count).

tomj2417

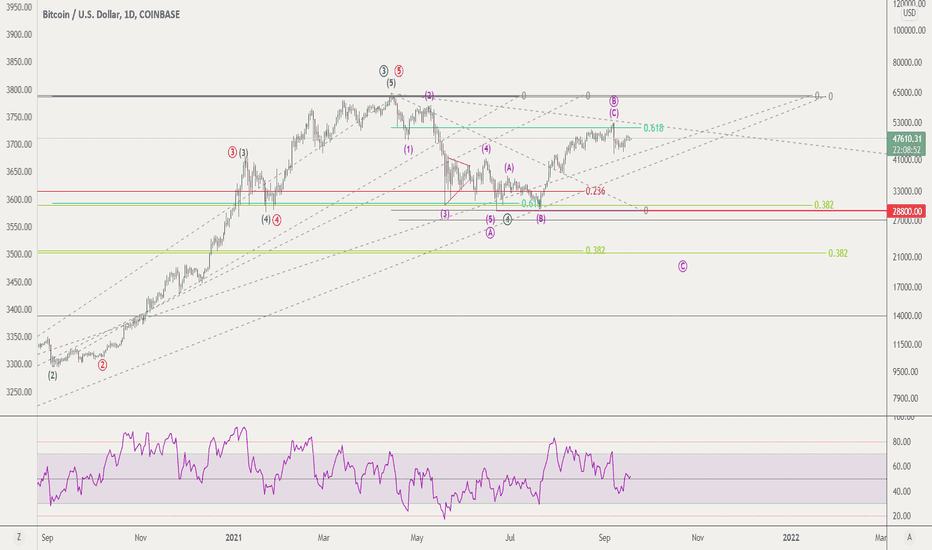

Bitcoin - Bullish count with a doomsday alternative

My red count here would suggest that wave 4 of 5 may have just completed and we are about to embark on another Bitcoin rocket ride with targets ranging from the reasonable to the stratospheric. I had to include a much more pessimistic blue count though as the November 2021 high is the 0.61 fib extension of my waves 1 to 3 and is a common ending point of waves 5 in EW. Tough one really...as always....time will tell.

tomj2417

Bitcoin - due a rally

The low of the 19th June may have been a significant bottom for Bitcoin and we could be looking at the early days of a decent rally. I have labelled it as an ABC as at this stage I have no idea if it's the beginning of a new impulse wave upwards or just a corrective rally as bitcoin continues lower.

tomj2417

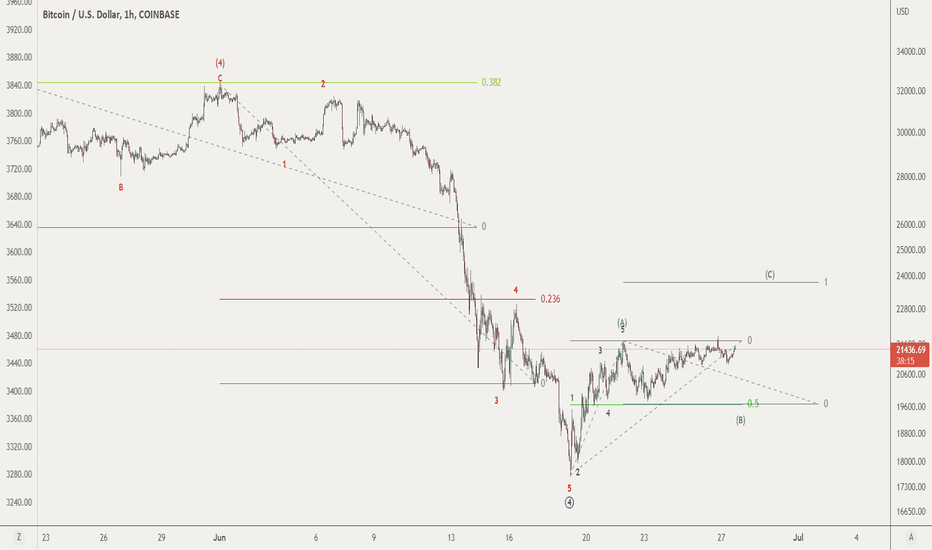

Bitcoin BTCUSD - Correction finished or one more leg lower?

My main count for Bitcoin suggests that we are coming to the end of a wave 4 flat correction. As my chart markings show, either that correction just finished with the move up of the last few days or there is one more leg to go to complete a 5 wave C wave. Personally I am leaning towards one more leg down as I can't find a 5 wave pattern in the move up but at this stage I am keeping an open mind as the move off the low is a decent one. So far in it's life, Bitcoin seems to have shown a strong correlation with other risk-on assets so if it gets going then maybe stocks will too.

tomj2417

BTCUSD - a bearish count

Most of my counts for Bitcoin are bullish and posit that we have just finished a wave 4 correction and are embarking on wave 5. However, I also believe that other possibilities should also be considered so here's a bearish count (purple) that suggests we may be witnessing a zig zag correction and might be about to embark on a C wave down (the red and the blue counts are part of my bullish outlook). As always, time will tell.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.