thecafetrader

@t_thecafetrader

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

thecafetrader

Hitting Extreme Demand. XRP

Hello I am the Cafe Trader. Today we’re looking at XRP. As I get back to publishing articles, XRP is one that we need to touch on. It seems I may be a day late. As expected there are big players in the extreme demand zone. This is a great area to add to the long term, or to play this shorter term trade. Entry 1.91 Exit 2.50 SL 1.71 You can take partials right below the new aggressor. If you stand bullish, you can hold to near highs. Boost and Follow for more. Happy Trading, thecafetraderTrade is looking very good. Will update on TP hit.

thecafetrader

Trade the range NVDA

Hello I am the Cafe Trader. Today we’re taking a look at NVDA . ] We have been consolidating for months, With NVDA Gaining strength, I wanted to share a couple long points that can help you be efficient if you were looking to add to your long term, or play the short term. Structurally NVDA is very healthy, and so is the consolidation that happening. There is still no REAL big seller yet. Unless we get Major news against NVDA or the world as a whole, this will continue long. Green Scenario If buyers continue to defend the Top of Demand and we hold above it, NVDA can work higher and press back into supply. If that happens, price can rotate up through the weak supply and attempt another test toward the low 200s. Red Scenario If the Top of Demand fails, then the path opens lower into the Extreme Demand zone. This Is where many people, retail and Institutions alike will be loading the boat. That zone represents a much stronger area of interest, where longer-term buyers would be expected to step in with more conviction. Long Term Aggressive interest: Top of Demand (~182–185) Value: Extreme Demand (~172–175) Extreme Value: Lower Demand base (~165) Wait for the price to come to you. Preserve your mental and physical capital. Boost and Follow for more! Happy Trading, thecafetrader

thecafetrader

Two Ideas to Trade the Range

Hello I am the Cafe Trader. Today we’re taking another look at Tesla (TSLA). If you read my previous article, we called this range months before it developed. Now that we are in the range, it can be a little tricky to navigate, so If you are frustrated, or want to play the short term, this is for you. We had a failed break right at the Strong Supply , they are still present here same as the previous high (not displayed in window). Currently these sellers we do not have a ton of information on, what we do know is that they are encroaching on this New Aggressor [/I]. this could drag all the way down to Top of Demand before seeing real buyers come in. Because of this, I have given you two scenarios that may develop and you can play. Green Scenario If buyers defend this New Aggressor zone and hold above the Top of Demand , Tesla can stabilize and work its way back up into the supply area. This may be a little messy but as long as demand holds, the market can attempt another push higher. Red Scenario If this demand can't develop within the new aggressor, then we should move to where previous demand was shown. The next major area of interest would be the Bottom of the New Aggressor , and the Top of Demand . Long Term Aggressive: Top of Demand (~390) Value: Near bottom of Demand (~325–340) Extreme Value: Extreme Demand (287-297) Thanks for reading, hope you enjoyed, make sure to follow for more. Happy Trading, thecafetrader

thecafetrader

Tesla's New Range.

Hello I am the Cafe Trader. Today we are revisiting Tesla (TSLA). Last article we identified the Key seller before this big extension. Today I have identified the last key seller, and how you can capitalize. Price has now entered into the Light Supply Zone , a place where sellers will try to slow things down. It is likely that you will want to play TSLA at the Extremes. Strong Supply , and Strong Demand levels are going to give you the best chance at a stronger reaction. So if you are playing the short term, These two plays marked on the chart will be your best bet. If the Strong Buyers hold at around 417, This will put a lot of pressure on that last strong seller at 461. A push through them should see you ATH's (not without a strong reaction from the Strong Supply first). Missed out on the move and want to add TSLA to your long term? Long Term These Prices should match your conviction on TSLA: Aggressive : 409 - 419.50 (Top of Demand, even better if you get into those strong buyers) Value : 333-344 Extreme Value : 288-294 or the Conservative Trendline. Expect big things from TSLA in the coming years. I would not be surprised to see TSLA reach over 1,000 again. Happy Trading, thecafetraderIf you were paying attention, within two days we hit the entry and target filled. Also now you would be in the long. This is great work, we are able to identify the sellers, and I will look to update this in the future.Still in this range, I would expect to be here for a while unless we have a major catalyst. Keep an eye on this range, you should've gotten your long entry as well.

thecafetrader

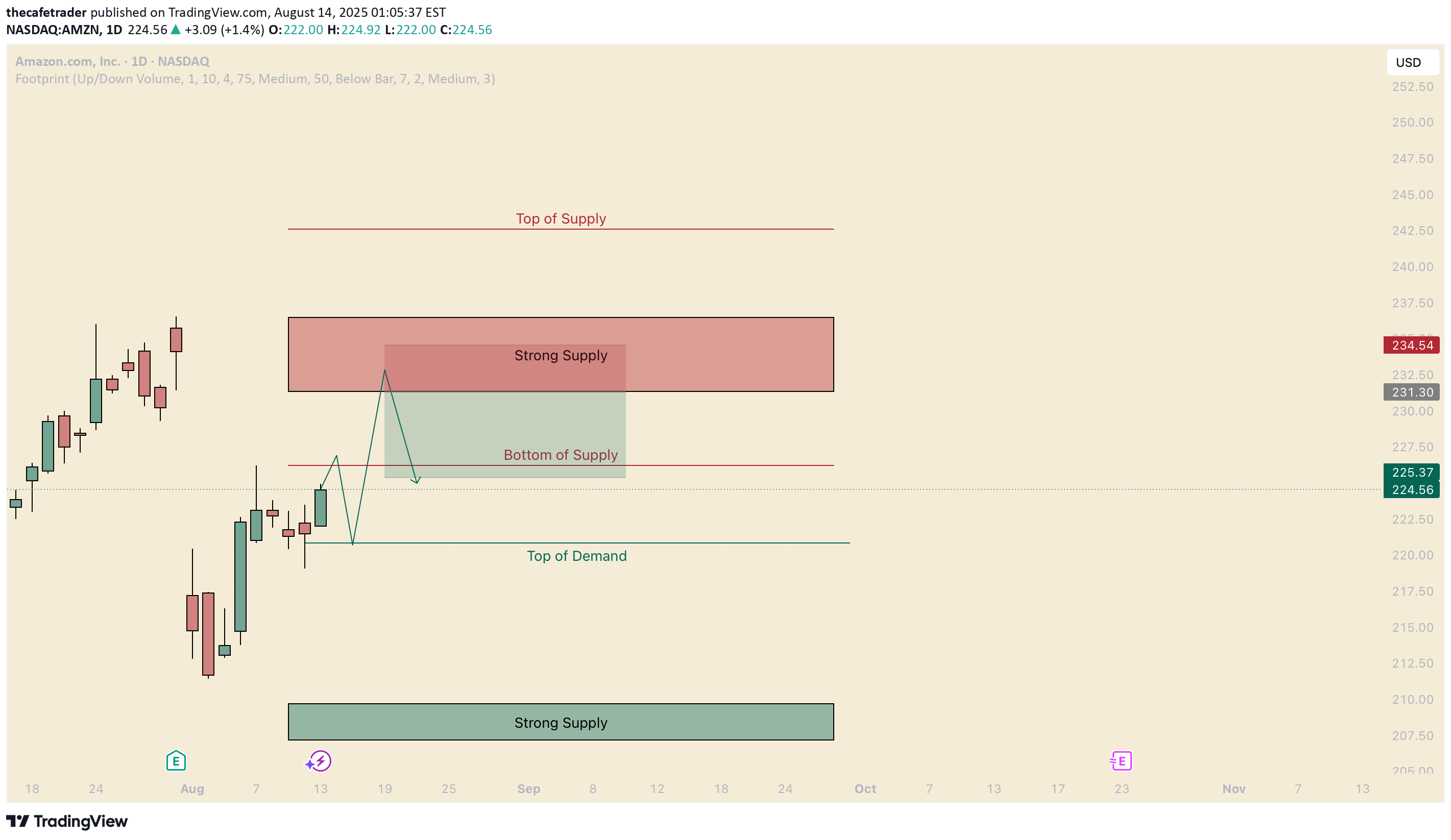

AMZN Shorts are Losing Grip

Hello I am the Cafe Trader. Today we’re looking at Amazon If you have followed my last couple Idea's on AMZN, we have really pegged down where these players are in the market. This month I wanted to highlight the bullish sentiment with AMZN. This chart shows us something important — shorts are losing grip. Every time they’ve tried to step in, the moves have been getting weaker and weaker. From the sharp -10% drop in early August, to the most recent -1.7% retracement, sellers are showing less conviction. Adding to this, there is a new Aggressor, a new buyer on the market looking to defend their position. This is putting a lot of pressure on the Strong supply, which is a key seller, and really the last one. Green Scenario If AMZN can push through this Strong Supply zone (around 235–240) and hold, then we open the door to a breakout higher. A close above the Strong Supply by the end of the week would really signal the beginning of shorts covering, and an extension toward the 250 area and beyond. NOTE If sellers manage to hold the line here one more time, I expect a dip back into the New Aggressor demand zone around 227–230. If these new buyers fail, we may be in for months of bear territory for AMZN. Watch out for ATH's! Follow and Boost, comment on some stocks you would like to see forecasted. Happy Trading, thecafetraderThat close into the end of the week is suspicious. A lot of Bulls have been trapped on the verge of that breakout. So this changes my sentiment, although, until that new aggressor gets completely taken out, I remain bullish.

thecafetrader

NVDA is Near it's Top

Hello I am the Cafe Trader. Today we’re looking at NVDA. This is the first time I’ve shared a Fibonacci study with you. The way I’ve mapped it is simple — start from the beginning of the bull run, and anchor it to the 61.8% retracement of the pullback. From this we can calculate where tops are typically found. (I stumbled upon this method trading with another trader who only used Fib's. I pointed this out to him, and we both got quiet...) As of now, NVDA Is nearing the top of a channel, and close to the top of our FIB Extension. This is where rallies tend to stall, and the reaction here will determine if this becomes a temporary pause or a full reversal (unlikely). Red Scenario If we get rejection in this zone, NVDA could pull back into the demand area around 164–170. That’s the level where I’d expect buyers to step back in. Longer term, I see NVDA as still bullish, but needing to cool down in the short term. Adding at 164 can be an aggressive way to continue to stack your long term. Thanks for reading, as always Happy Trading! thecafetraderIt's possible this may be the beginning of NVDA's correction. I still am looking for a test of the highs before a pullback though.Well we didn't get the entry but we are now touching demand. Lets see if we can bounce a touch.

thecafetrader

TESLA's Make it or Break it Week

Hello I am the Cafe Trader. Today we are taking another look at Tesla. Everyone knows what a beast this has been in the past, I am going to prep you on what to do when awakens. As of today, we sit under the last strong seller before the 400's, breaking this and holding (a close above on a Friday) would make a strong case to test highs (minimum). Overall, I still think there is a strong case for the downside, but this seller determines everything. This is due to the time we have been in the top of the range. So here are your two scenarios Green Scenario If Tesla can push through the strong seller zone (roughly 350–365) and actually close above it, then bulls would gain full control. That opens the door for a continuation move toward 400+. If this happens, I will publish some trade ideas with a new chart. Red Scenario If This Seller continues to flush out these buyers, this could spark a large reaction to the downside. In that situation we would be looking for a move back into the big buyer zone around 290. A failure there could drag us all the way to the conservative trend line near 270. Personally I lean short biased in the next 2-4 weeks, Very bullish over the next few years. Hope you enjoyed, please DM or comment with questions or another stock you would like analyzed. Happy Trading thecafetraderSo you see that the seller is real and aggressive. TSLA could come all the way back down to those aggressive buyers, and break the trend. Keep an eye on this. Make sure to boost, a lot of people are long in the short term, it's important that they see this key seller.Fantastic Break for TSLA, This still has a lot of head room, possibly ATH's inbound before the years end. Happy trading.

thecafetrader

How to Know ETH Isn't done yet.

Hello I am theCafeTrader. Today we’re looking at Ethereum. Many are worried that we have not broken out with strength, but does that mean that we are now in a bearish sentiment? Simply put, No. The overall structure remains bullish. Until the buyer (between Top of Demand and Bottom of Supply) gets taken out, ETH stays in a bullish posture. We are looking for this buyer to continue to accumulate, what you are seeing is a lack of buying interest as opposed to real selling happening (so far...) Forecast Green Scenario Buyers step in quickly at the Top of Demand, keeping the trend intact. This would likely trigger a faster continuation higher, giving us an aggressive breakout. Red Scenario Price drags lower into the Bottom of Demand before reacting. This takes longer, but is still bullish if the buyers show up. NOTE: If we close strong underneath the bottom of the demand, the market is going to have to look for a strong buyer. We will have to wait and see if there is a strong seller initiating this move, or is it still a lack of buying interest. ETH remains bullish. As long as demand holds, we’re looking for higher prices for now. Happy Trading, thecafetraderVery close to the entry, This could move up from here. We are getting some headwinds from Global news (China Chips, etc.)

thecafetrader

Catch the Short on Amazon

Hello I am the Cafe Trader. Today we are again looking at AMZN. We are in the middle of a range. Buyers are currently in control in the short term, but I am expecting a Hot reaction off that strong supply level. This can be especially suitable for a quick options flip (same day, or overnight hold). Short Setup Entry: $231.30 (Bottom of Strong Supply) Stop: $234.50 (Top of Strong Supply) TP: $225.30 (2R target) Notes: Looking for a hard rejection out of supply. If we do not close inside the strong supply zone, this would be bearish. you may have to be patient intraday on this one. If we do get a really strong reaction and actually take out the new buyers trying to step in, This will not look good for AMZN as a whole, and we could expect it to break those previous lows (eventually tapping into strong supply) Hope everyone does well, and happy trading! thecafetraderIn the short, that was much more bullish then I was expecting coming into the zone, fortunately for my puts the buyer was fought off. Either way we know the seller is active here, hopefully we get a little drop tomorrow. In any case, we took a swing and managed risk according.This short worked perfectly if you did the shares, or a week out options. Great trade!

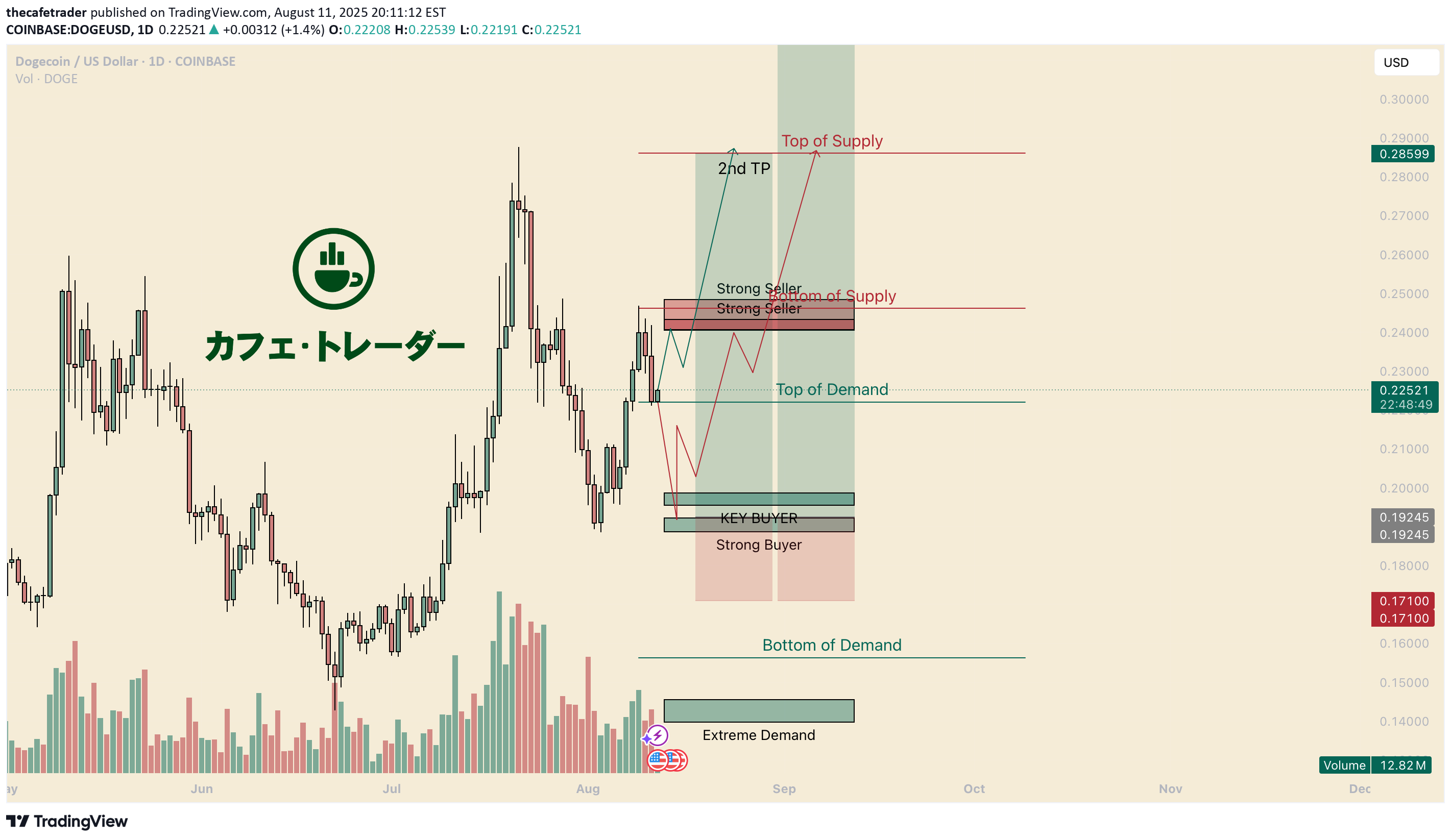

thecafetrader

Buy the Dip on DOGE

Hello I am the Cafe Trader. Today we are updating our trade On DOGE. The market hasn't told us exactly where the top of demand is, but we can assume it is sitting above it for now. Short Term We’ve got a Key Buyer sitting down around $0.19245 — this is where the last serious push started. Above us another new seller is trying to stake a claim around $0.245–$0.250. I still think the Bulls are stronger. As of now buyers can step in anywhere from top of demand, down to "Key Buyer". If that key buyer gets taken out, then this could run back down to the extreme demand Green Scenario: We have pulled back about 10% from recent highs. About 50% FIB line from the new buyers. We could move strait up from here. (if you aren't already in the trade from my last post, you can be aggressive with the top of demand area, or conservative with the Red Scenario) Red Scenario We will don't know exactly how strong the buyers are at the top of demand. Hence this scenario. Pullback to where we know the strong buyers are sitting, and reload. Long Term Your conviction on DOGE determines where you start buying: Aggressive: $0.2240+ (Top of Demand) Good Price: $0.1985 (Key Buyer) STEAL: $0.14–$0.155 (Extreme Demand) Thanks for reading the update, hope you do well! Happy Trading, thecafetrader

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.