stocktwists

@t_stocktwists

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

stocktwists

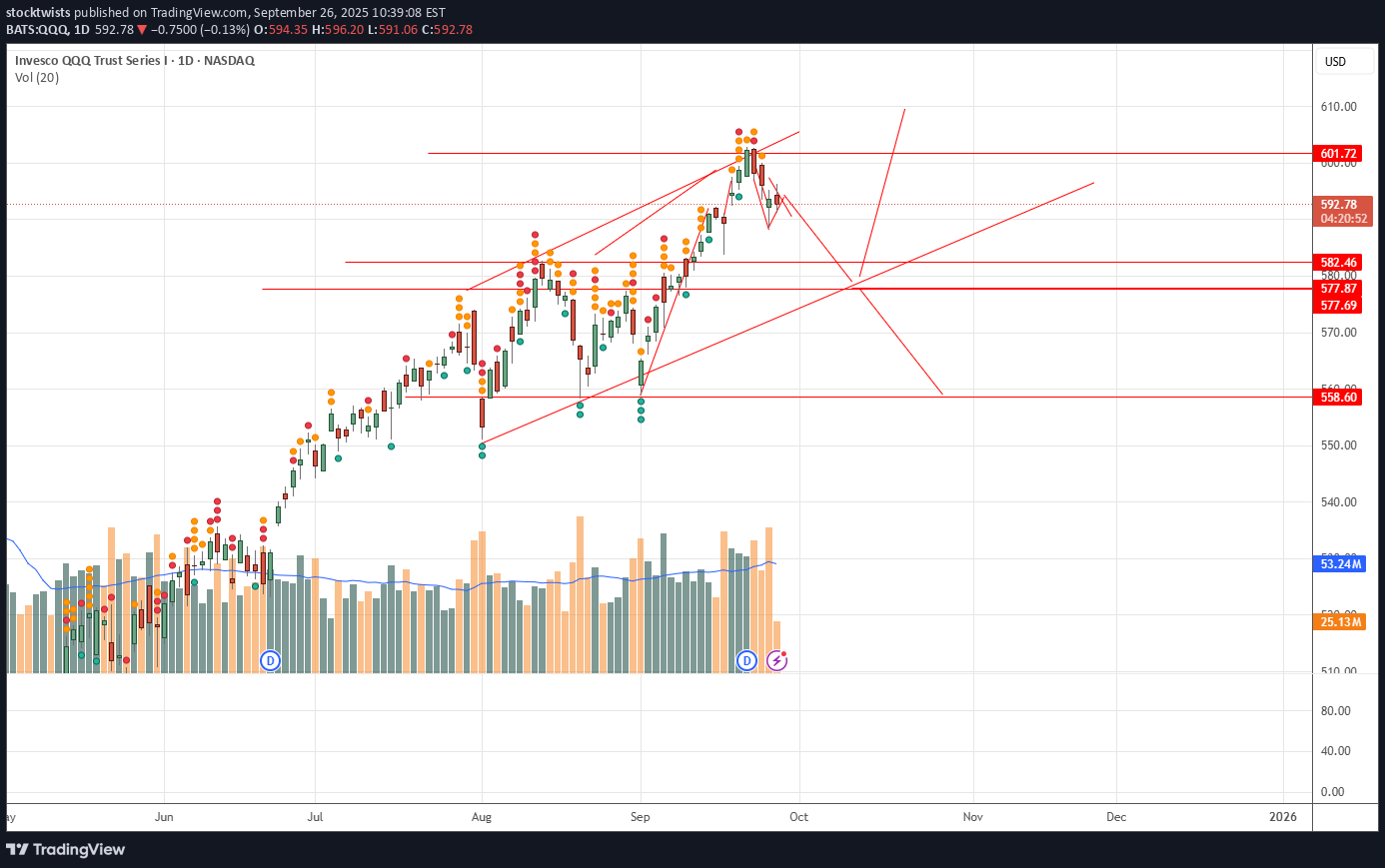

QQQ is in a short-term pullback inside a long-term uptrend. Watch 582–578 support for signs of a bounce. A breakdown could target 559–560. Upside resistance is 594–602.

stocktwists

Key Observations: Uptrend Channel: QQQ has been trading within a rising channel. The price respects both the support (lower red trendline) and resistance (upper red trendline) consistently. Recent Price Action: There was a sharp drop that briefly broke below the lower trendline support but quickly rebounded back inside the channel, indicating a false breakdown or buying strength at support. A horizontal red line marks a previous resistance level, now potentially acting as a support. Current Price: The price is around $567.22, near the middle of the channel, but just below the recent local high/resistance. Implication: As long as the price stays within the channel, the uptrend remains intact. A confirmed breakdown below the channel support would be bearish, while a breakout above the channel resistance would be bullish.

stocktwists

Gold is currently consolidating within a symmetrical triangle pattern, signaling a potential breakout setup as price coils tighter between converging support and resistance trendlines. CMP: Around $ 3370 (adjust based on your exact chart) Lower highs & higher lows = compression zone Volume declining, typical before breakout Break above upper trendline could signal continuation toward 4000 Break support may lead to retest of $2985 This setup reflects indecision in the market — waiting for a decisive breakout with volume to confirm direction.

stocktwists

Gold Rejects from previous resistance levels expecting to hit 3136 in near term

stocktwists

BTC come out from Trendline i believe it's going to retest 73k before make any new move

stocktwists

Doge take support at trendline, 0.24 if it's going to hit .35 in near term if it cross then will see new highs else make it lower lows

stocktwists

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.