stevetambo32

@t_stevetambo32

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

stevetambo32

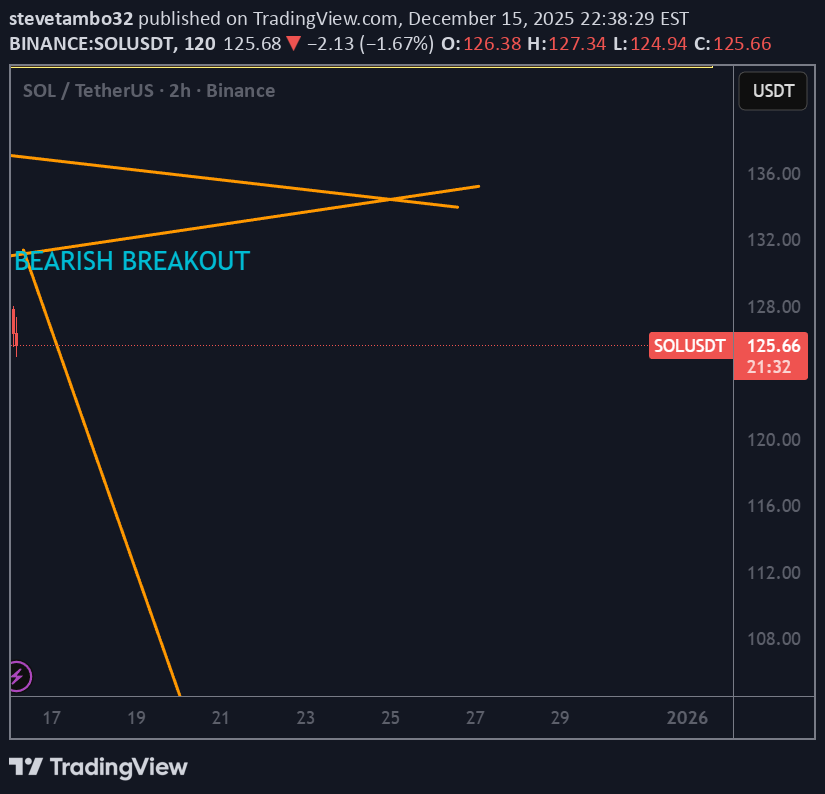

سقوط سولانا تایید شد؟ سطوح کلیدی حمایت و مقاومت برای ترید شورت

SOL price breaks below lower channel of symmetrical triangle. Bearish continuation confirmed? Price in favour of shorts now with next support around $85-97

stevetambo32

آیا سولانا (SOL) آماده جهش بزرگ است؟ شکست مثلث متقارن و پیشبینی حرکت بزرگ!

Feds cut rates and from the chart I count 7 waves inside the symmetrical triangle. Break out imminent ?

stevetambo32

SOL Neutral

We consolidate between $145 and 120 for now. In favor of an upside break

stevetambo32

بیتکوین در مسیر اصلاح: موج الیوت تا ۴۰ هزار و سرنوشت "سیلر" چه میشود؟

Bitcoin completes it’s Elliot wave pattern with 24K marking the top of this cycle . 85K likely the bottom for this first wave down with a relief rally expected to 113K . From there 42K is the next possible support for the second wave down. Saylor is in trouble.

stevetambo32

صعود بزرگ سولانا (SOL): پایان کفگیری، هدف اول ۱۹۵ دلار و جهش نهایی به بالای ۲۵۰!

Think we've seen the last leg down of this falling wedge pattern. Breakout wave up with a target of around $195 first before retracing to $158. Real long entry begins after retracement with a final year target of above $250

stevetambo32

پیشبینی صعودی بیت کوین: آیا ۹۸ هزار دلار کف قیمت است؟

Long term BTC trend looks intact with price revisiting 98K -92K demand zone on the weekly chart. This coincides with the long term trend line with liquidity sweeped. Reversal from this arrea would trigger another wave up to 160K area.

stevetambo32

سقوط آزاد سولانا: آیا قیمت SOL به ۱۰۰ دلار میرسد؟ (تحلیل تکنیکال)

SOL price now in very evident bearish down trend after rejection at $240 region. Looking at the daily chart next possible support is around $94 - $100 region . Wouldn't expect any bullish action until then

stevetambo32

سولانا آماده پرواز؟ چرا قیمت به ۵۰۰ دلار میرسد و اولین توقف کجاست؟

stevetambo32

سولانا (SOL) در آستانه انفجار قیمتی: آیا رسیدن به ۲۵۰ دلار قطعی است؟

Following that price crash to $175 looks like price reversal is underway with $190 acting as new support area around short term 0.5 fib. Market conditions are bullish right now, expecting a move to $250 from here

stevetambo32

ریزش بیت کوین ادامه دارد: آیا کف قیمت ۹۵ هزار دلار است؟

Previous support at 11500 looks to have been converted to new resistance as BTC resumes down trend . Is max pain at the 95K area?

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.