shardapp

@t_shardapp

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

shardapp

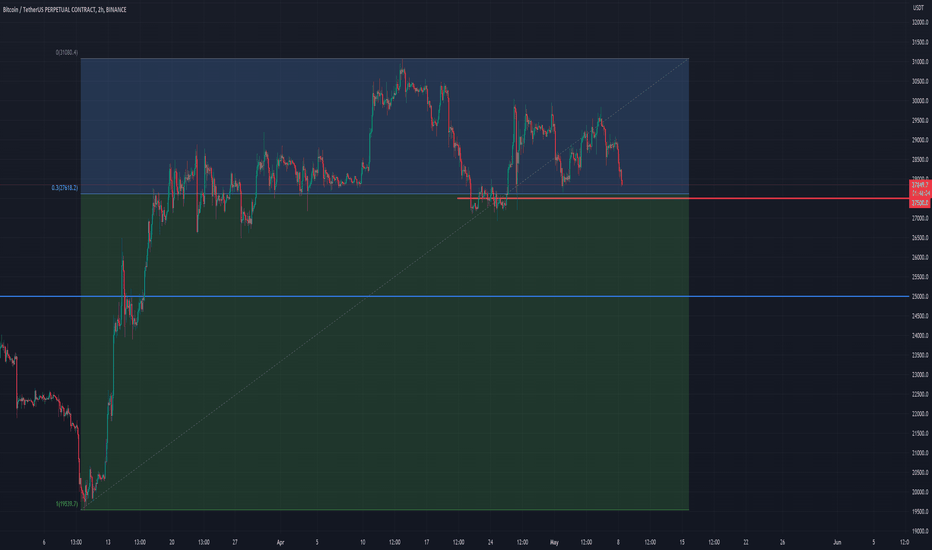

Will it rain in May? (Agua de Mayo) There is a Spanish phrase, "Como agua de mayo," that symbolizes the refreshing rain falling in May, which is somewhat synonymous with rebirth. I see an analogy in the cryptocurrency market's anticipation of growth, but I still believe it is too early. Bitcoin still hasn't broken its peak from April 14th, so my view on a potential drop below 27,000 remains valid. Additionally, the emergence of local resistance around 29,500 reinforces my belief. In my opinion, a head and shoulders pattern is forming, and if I'm not mistaken, the saying "sell in May and go away" might come true this month.

shardapp

When planning any investment, whether short-term or long-term, it is necessary to consider its technical arguments in the context of the fundamental background. Undoubtedly, this year's strengthening of Bitcoin, reaching over 100%, has made the king of cryptocurrencies a tempting target for long-term investors counting on the continuation of the trend and a return to even 45,000 usd Are such assumptions realistic?As for the economic background, definitely yes. The worldwide slowing inflation, record low unemployment rate in the USA, and recession in the background should prompt the Fed in the near future to flood the markets with cheap cash, which will reach the market, driving stock indices to new highs. Meanwhile, investors seeking riskier assets will turn their attention to the cryptocurrency market, which should lead to a snowball effect, and stronger growth will drive hordes of new investors dreaming of wealth.This is, of course, a very optimistic scenario, but realistically speaking, the level of 30,000 usd should be a barrier for now, and any attempts to reach 33,000 usd, in my opinion, will be quickly extinguished by supply, at least until the next FOMC meeting, but not the one in May. On that meeting, besides raising rates by 0.25pb, we will not learn the answer to the question of whether we can expect rate cuts this year.Anyway, will the bull market return to crypto? Probably yes, but not yet. I think the third quarter is more realistic when it comes to such predictions. By then, I would expect a correction to around 25,000 usd Setting the entire upward move initiated on March 10, whose peak so far fell on April 14, and which we are now measuring with a correction, I would propose a conservative approach to the contrarian strategy of looking for a trend reversal after removing 30% of the entire move defined in the aforementioned period.Under such an assumption, we should expect an acceleration of declines after breaking through 27,500 usd. This should devalue the Bitcoin rate to at least 25,000 usd where one could expect a longer consolidation and a possible further upward move. Of course, it should be remembered that in the end, those who try to predict the future build on sand. However, this is one of the possible scenarios to be played out.

shardapp

#OmicronitsThe famous quote by Ch. Munger, "The big money is not in the buying and selling, but in the waiting," is highly relevant to the current market conditions. As an investor, patience is crucial, especially during times of turbulence and volatility.The recent instability in the banking sector has caused a ripple effect in the crypto market. The market's belief in the approaching end of the high-interest-rate policy and the beginning of quantitative easing has led to higher volatility in crypto assets. However, predicting future economic behavior is not straightforward, and it's essential to consider multiple variables.The Federal Reserve's recent actions aimed to maintain the stability of the banking system, not to fuel the economy. Despite slowing inflation, the Fed continues its restrictive monetary policy and has even temporarily implemented a form of quantitative tightening to pull capital from the market. As an investor, it's essential to keep these factors in mind and not assume that the current hyper-optimism in the crypto market is based on solid ground.Looking at the BTC/USDT chart, the current value of 28,000 seems too high, and a deeper correction may be necessary. As an investor, it's crucial to have a plan and set realistic sell-stop orders. In this case, setting a sell-stop pending order at the level of 25,750 BTC/USDT is advisable. If the market goes up during or after Powell's appearance on March 22 and hits 30,000 USDT, moving the pending order to 27,000 BTC/USDT may be a prudent move. However, if there is a consistent breakout above 30,000, it's better to wait for further developments and not take any immediate action.In conclusion, as an investor, it's essential to maintain a patient and cautious approach in the current market conditions. Following the wise words of Ch. Munger, it's not about buying and selling, but about waiting for the right opportunity to make a sound investment decision.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.