robertofdz04

@t_robertofdz04

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

robertofdz04

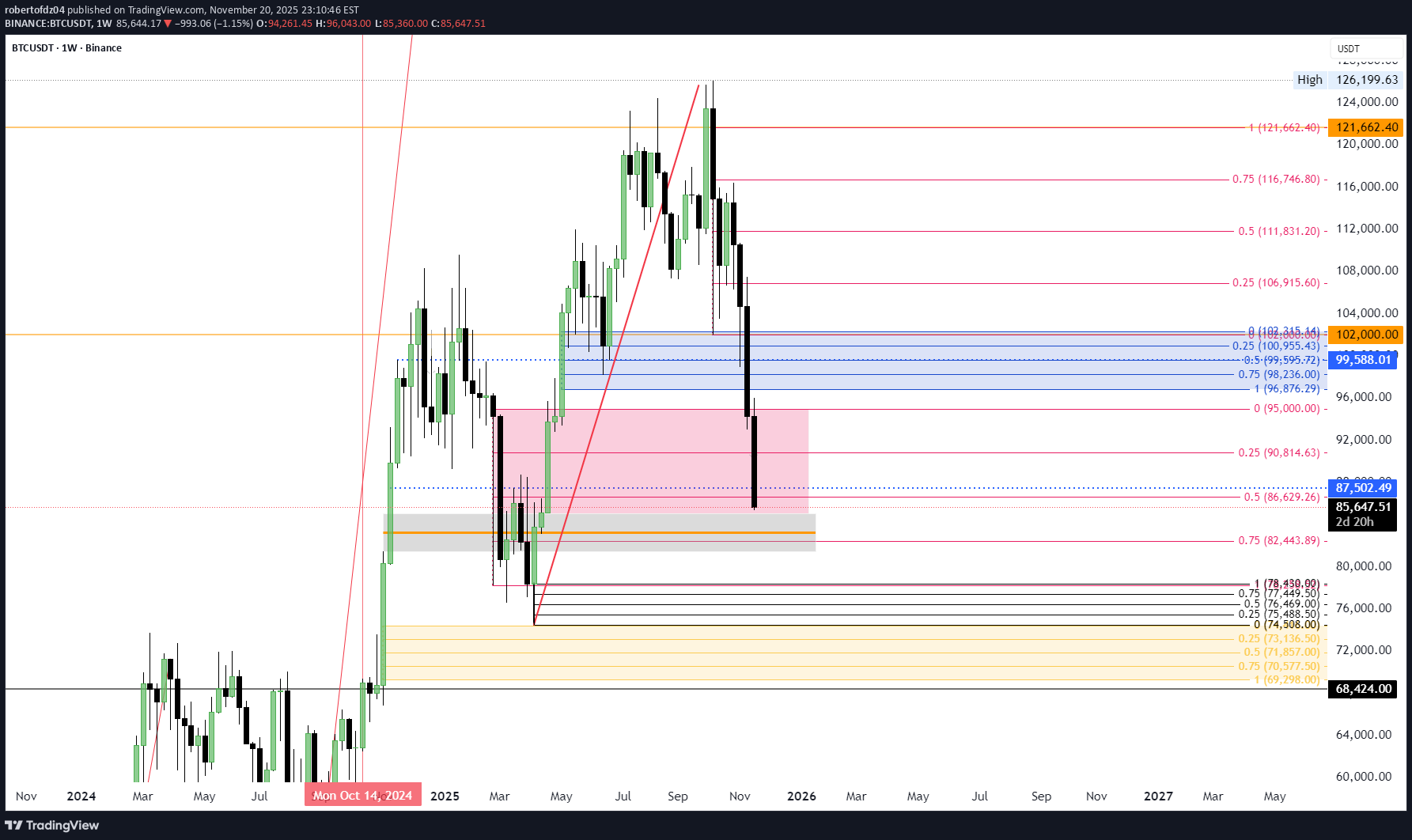

کف بیت کوین کجاست؟ پیشبینی جدید برای ریزش و صعود تا قلههای تاریخی

30- 40% correction is usually a good pullback historically speaking. The last pullback similar to this one was January 2025 - April 2025 totalling a 32% retracement . thereafter taking off from $74,500 to ATH's.

robertofdz04

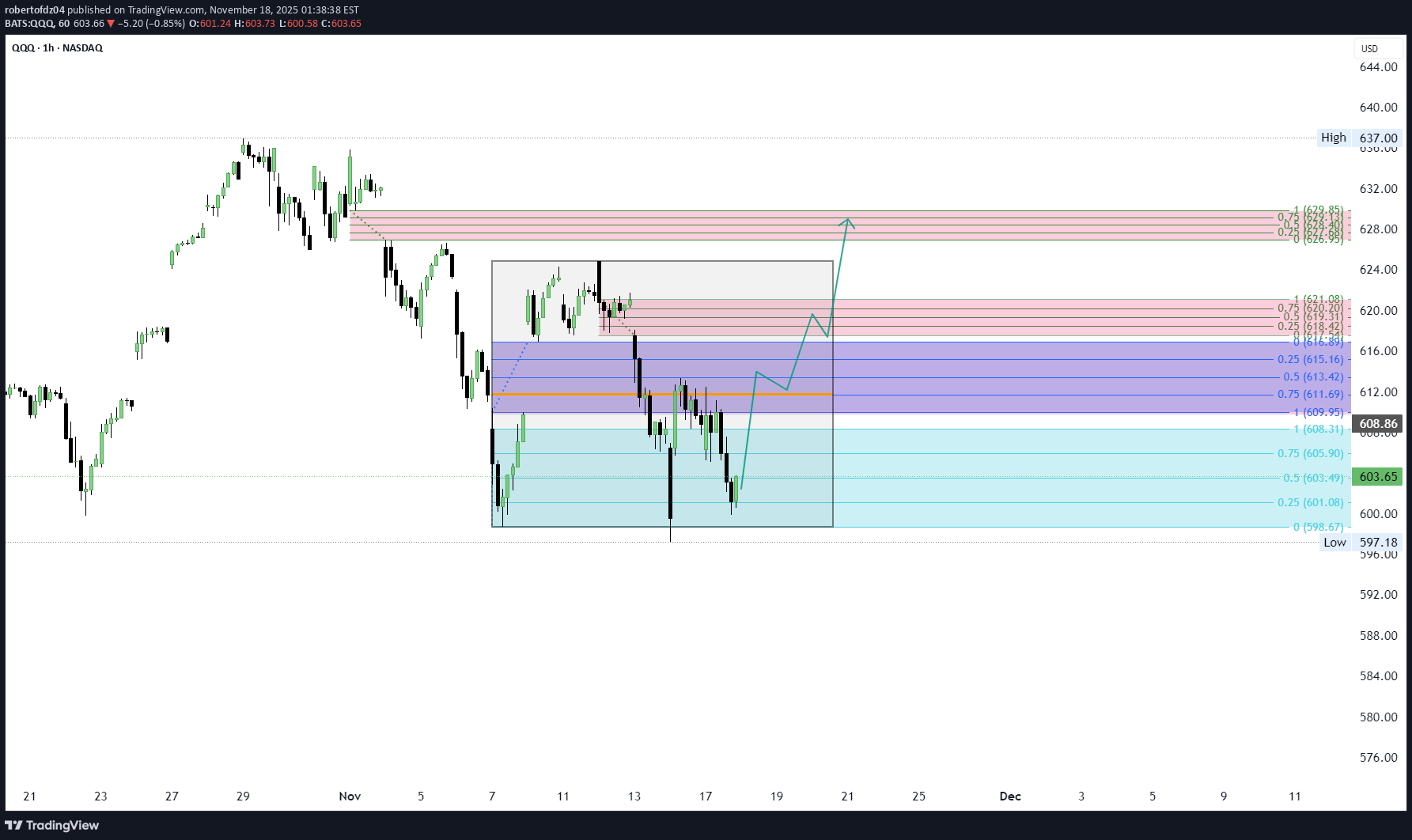

هدف بعدی نزدک (QQQ): رسیدن به قلههای ۶۱۸ و سپس ۶۲۸!

If all goes well QQQ we should see this hold 598. This will confirm a bull-market is still in play, thus revisiting previous highs at 628-630. Why this price target? Volume Void or inefficiencies are present at 618 and lastly 628. My assumption is price tends to revisit these areas of inefficiencies, thus supporting the bullish-bias.

robertofdz04

Bitcoin Price Thesis: Anticipating a Shakeout Before Continuatio

I expect Bitcoin to experience a significant drop to around $46,800, a decline of 25% to 30%. This "rug pull" event would likely be driven by institutions aiming to shake out weaker hands before any further upward movement. Such a correction would purge short-term speculators, allowing for healthier market conditions and setting the stage for a sustainable rally afterward.

robertofdz04

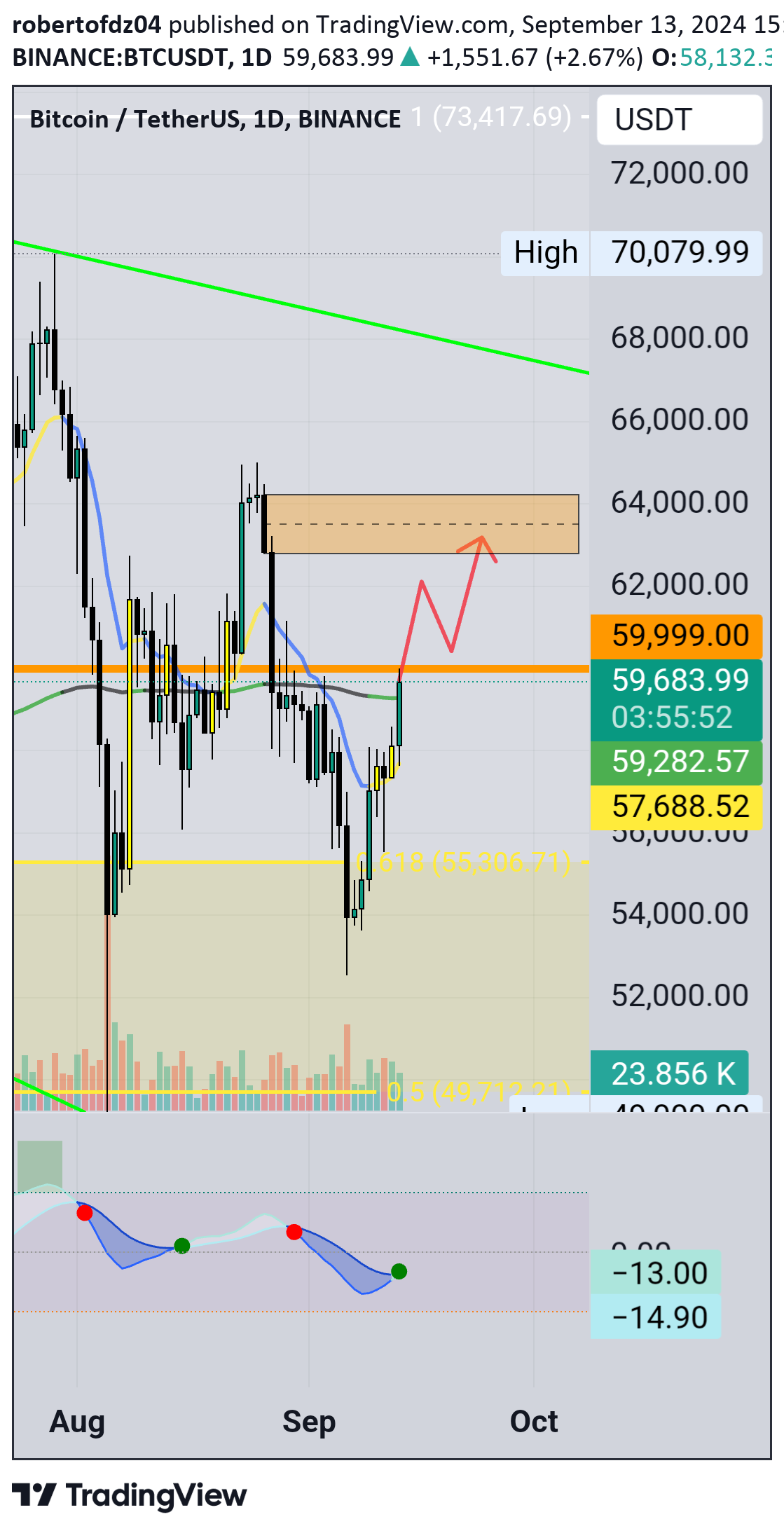

BITCOIN SHAKE OUT, Pt. $60-59,800k

Thesis: "Bitcoin is likely to retest the $58,000 to $60,000 range, driven by a combination of technical resistance, market liquidity, and strategic institutional positioning. The current macroeconomic environment and market sentiment suggest that a short-term pullback could act as a liquidity trap, shaking out over-leveraged long positions before creating a foundation for further upside movement. This retracement would allow for reaccumulation at key levels, fueling a stronger, more sustained rally as the market stabilizes and prepares for the next leg higher."

robertofdz04

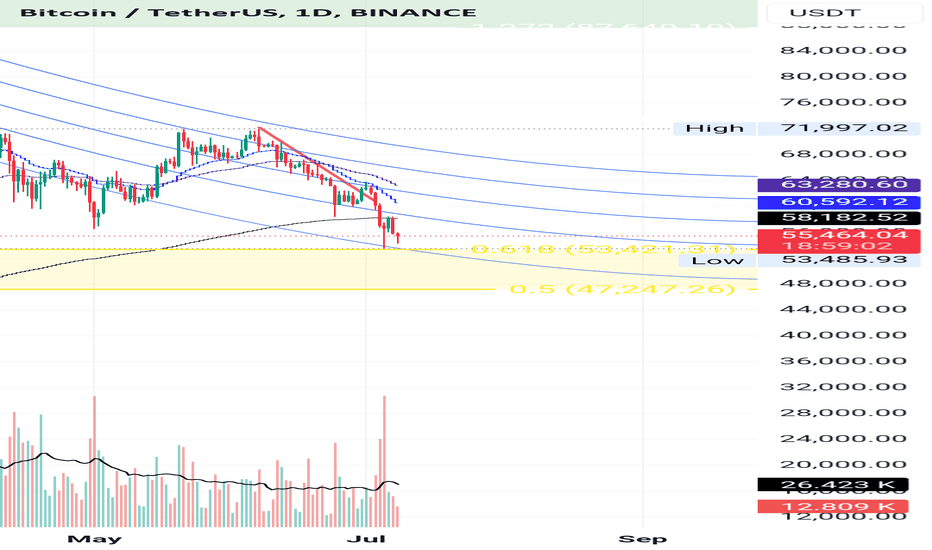

Bitcoin ride up to $63k

Bitcoin is positioned to break through the $60,000 resistance, supported by bullish momentum and strong technical indicators. A sustained move above this level could propel the price to $63,000, with the 0.618 Fibonacci level providing solid support around $55,300 in case of a pullback.

robertofdz04

$BTC Flush down to $50,000

Bitcoin is likely to flush down to the $50-48k rangeBased on my analysis, I'm anticipating a further correction for Bitcoin, potentially dropping to the $50-48k range in the coming weeks. Here's why:Price Rejection at Key Resistance: We’ve seen consistent price rejection around the 73K mark, which is a crucial resistance level. Bitcoin has failed to maintain upward momentum, and the recent candlesticks show a clear hesitation to push higher.Decreasing Bullish Momentum: The candles over the past few weeks indicate weakening bullish momentum. The market is showing indecision, and we’ve seen multiple wicks testing lower prices. This signals potential further downside.Support Test Levels: Bitcoin has already tested the lower 56k levels, and if this level is breached with stronger selling pressure, the next significant support lies between $50-48k. Historical price data also shows this range acting as a critical support zone in the past.

robertofdz04

Bitcoin $48,800 is the bottom

1. **Bitcoin Region 48,800 as the Absolute Bottom**: - The 0.618 Fibonacci retracement level, also known as the golden zone, is a key area where significant support often occurs. - Based on this analysis, 48,800 is identified as the absolute bottom, suggesting a strong support level at this price point.2. **Short-Term Consolidation Around 50,000**: - Bitcoin is expected to consolidate around 50,000, which often happens as the market digests recent price movements and traders establish positions. - This consolidation phase could build the momentum needed for the next upward move.3. **Next Move Up to 95,000 and 110,000**: - After the consolidation phase, a significant upward move is anticipated. - The first major target is 95,000, followed by a further move up to 110,000. - These targets could be based on historical price patterns, market sentiment, and other technical indicators.This thesis combines both Fibonacci retracement levels for support identification and potential future price targets, providing a comprehensive outlook for Bitcoin's price action.

robertofdz04

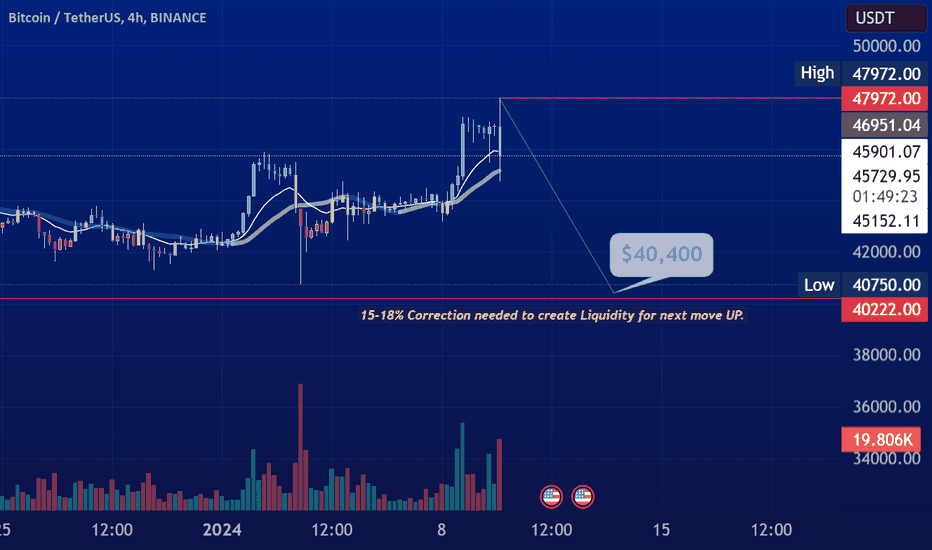

15-18% Correction for BTC?

Seems reasonable for BTC to have a correction of about 15-18%, before hitting 50K. Plan: take out the Liquidity resting under 40K seems like a likely Target IMO, before the next move. Its presumed to go Higher after the BTC ETF's Approval. Institutions already made their profit, Now they'll Dump & Buy at Discount. Rinse & Repeat.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.