r5sn3kxfh6

@t_r5sn3kxfh6

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

r5sn3kxfh6

Minor wave-2 running triple flat appears complete.

Bitcoin is in the midst of an intermediate level impulse wave, with the minor wave-2 just completed as a running triple flat pattern. Expect wave-3 to reach the 2.618x level (compared to wave-1) at a price of $81,700 within one or two weeks from now.

r5sn3kxfh6

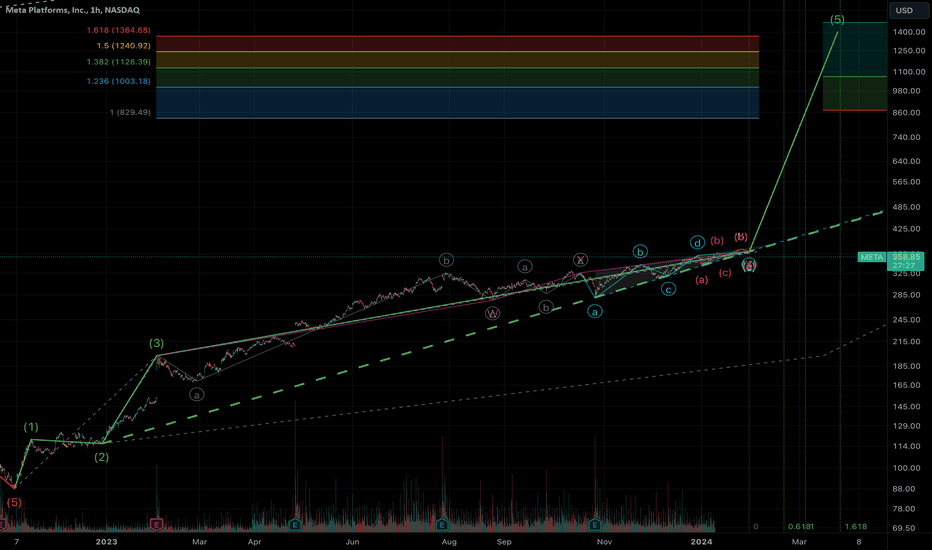

META at the end of a running correction. Massive breakout soon.

Since February of last year, Meta has been in an upward impulse pattern with Wave 4 in a prolonged running double three. The last segment of Wave 4 is a running triangle with its apex very close to the February 1 earnings report. If this pattern is correct, Wave 5 should extend either at the 161.8% or 261.8% Fibonacci level which is between ($870-1,400) respectively. The time target is less certain but I’m estimating that it will be 161.8% of the time taken by Wave 3, putting the target date in the last week of March.

r5sn3kxfh6

Bitcoin entering a new rally

After completing an ending diagonal in mid April, Bitcoin made an abrupt correction which found strong support at the 50% retracement line. The correction took the form of a zigzag in which Wave C was 1.618 times that of Wave A (the Golden Ratio), signifying that the correction has ran its course. The MACD then crossed upward today, providing further confirmation that the correction ended and the price will likely continue its previous upward trend. If you’ve been looking to enter a position on Bitcoin, this is your entry point.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.