paullefebre92

@t_paullefebre92

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

paullefebre92

حرکت بعدی لینک/تتر (LINK/USDT): شانس خرید بزرگ با اهداف تا ۲۱ دلار!

📌 Summary in English The chart displays LINK/USDT on the 1D timeframe with multiple supply and demand zones. The price is retesting a daily demand area and ascending trendline support. A long setup is projected with a stop-loss below the 11.16$ level and targets placed at daily/weekly supply zones up to approximately 21.3$. The setup suggests a favorable risk-to-reward ratio based on a potential bounce from the current support. LINKUSDT

paullefebre92

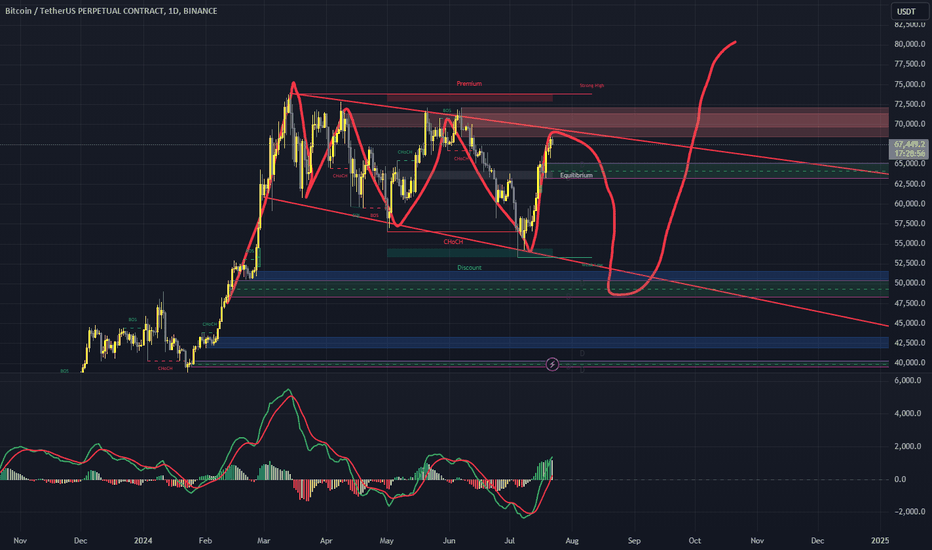

Way BTC before start real bull idea ?

Bitcoin is about to make a strong comeback, showing signs of an imminent bullish rally

paullefebre92

Catching Dips any Coin with Spiderline !

The Spiderline is a concept in cryptocurrency that refers to a specific strategy or indicator used in technical analysis to identify key support and resistance levels on the price charts of crypto assets, particularly Bitcoin. This concept is based on retracement levels or structures calculated from historical market data. Here are the key points to understand the Spiderline: Origin: It is often used by experienced traders to visualize critical zones where the price has historically reacted (bounced or been rejected). These zones are derived from specific lines on the charts based on previous Bitcoin price movements. Usefulness: - Identify support levels: where the price could stop during a decline. - Determine resistance zones: where the price might struggle to move higher. - It also helps plan entry and exit points based on the likelihood of market reactions. Differences from traditional indicators: Unlike tools like moving averages or the Relative Strength Index (RSI), the Spiderline is more specific to Bitcoin's historical behavior and is often used over longer timeframes. Associated strategy: Traders use it to refine their buying or selling decisions, avoid trading against strong trends, and manage their risk effectively. Credit Inspired by #Cryptoface

paullefebre92

GOLD possible in 4hrs ?

We could see a scenario like this and potentially revisit 2351 very soon.

paullefebre92

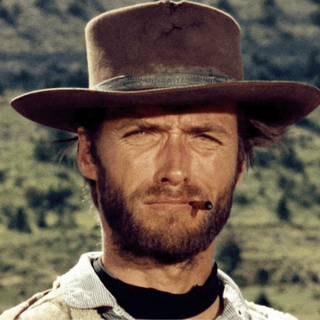

NEW IDEA TRIPLE ICHIMOKU CLOUD

Here is my new technique that I’m trying to exploit: there’s an Ichimoku for rebounds and rejects, and two other Ichimokus based on 50% Fibonacci resistance and support. We can see, initially, a return to $65,625, $64,974, $63,087, $62,784, $62,470, $61,336, not to forget the CME gap.

paullefebre92

Wait trap BTC coming

Bitcoin is expected to reach 66,111 before encountering a trap and a sell-off this weekend, forming a classic head and shoulders pattern.

paullefebre92

U need to check it before fomo

Maybe price gonna like it so be carefull dont get rekt by fomo, stay safe, trend is ur friends.

paullefebre92

U need to see this IDEA

Maybe price gonna like it so be carefull dont get rekt by fomo, stay safe, trend is ur friends.

paullefebre92

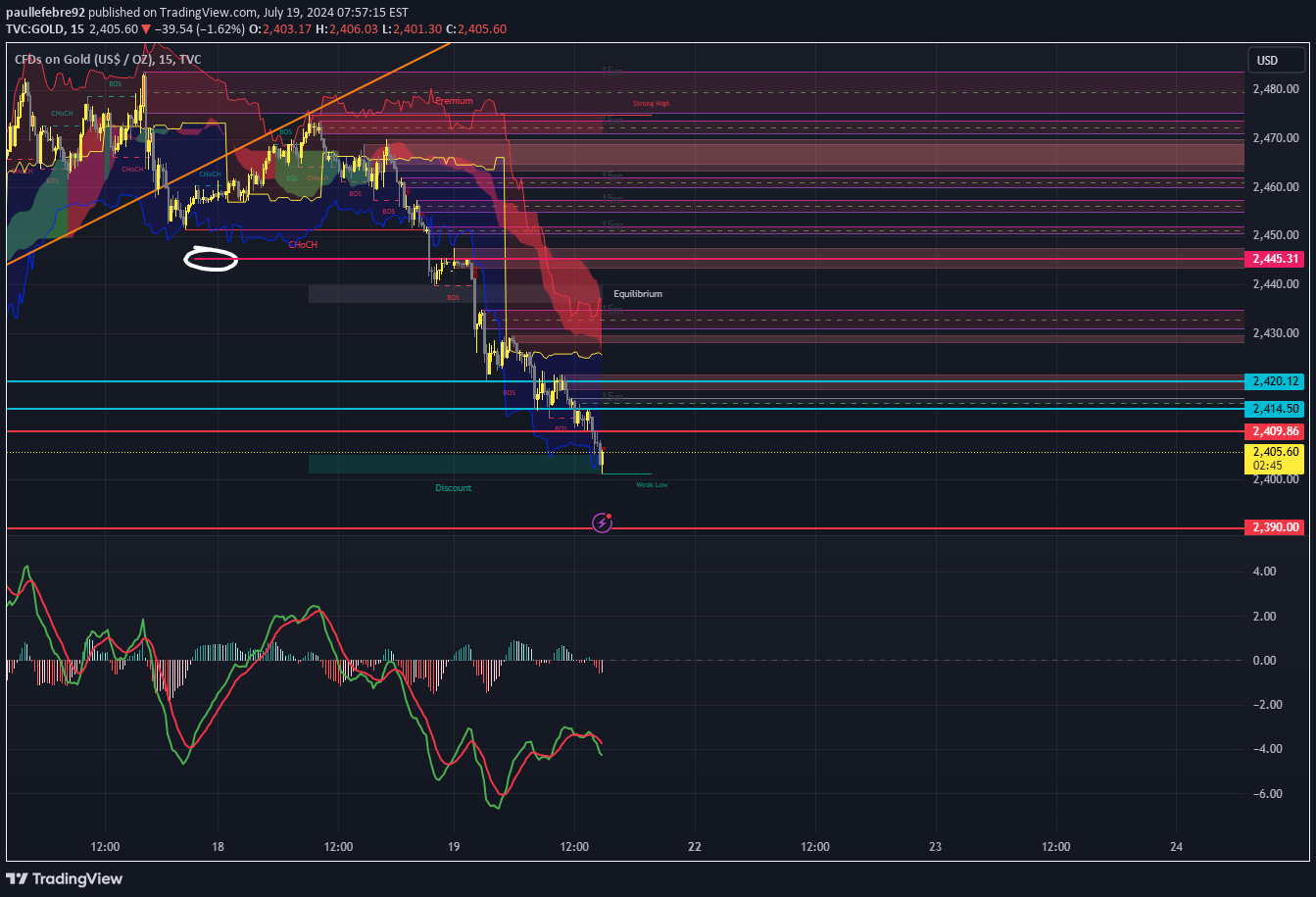

New Idea gold

Finally, the evolution of financial markets and digital currencies also impacts the price of gold. The volatility of stock markets and cryptocurrencies drives investors to seek safer and more tangible assets. Although cryptocurrencies have gained popularity, they do not yet offer the same level of security and stability as gold. This trend reinforces gold's position as an indispensable safe haven, thus favoring its continued appreciation in the long term 2500$. but long rangeEnjoy

paullefebre92

Gold pushing ?

Finally, the evolution of financial markets and digital currencies also impacts the price of gold. The volatility of stock markets and cryptocurrencies drives investors to seek safer and more tangible assets. Although cryptocurrencies have gained popularity, they do not yet offer the same level of security and stability as gold. This trend reinforces gold's position as an indispensable safe haven, thus favoring its continued appreciation in the long term

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.