nightdrive

@t_nightdrive

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

فروپاشی بیت کوین ادامه دارد: هشدار جدی برای سرمایهگذاران و سطوح حمایت کلیدی!

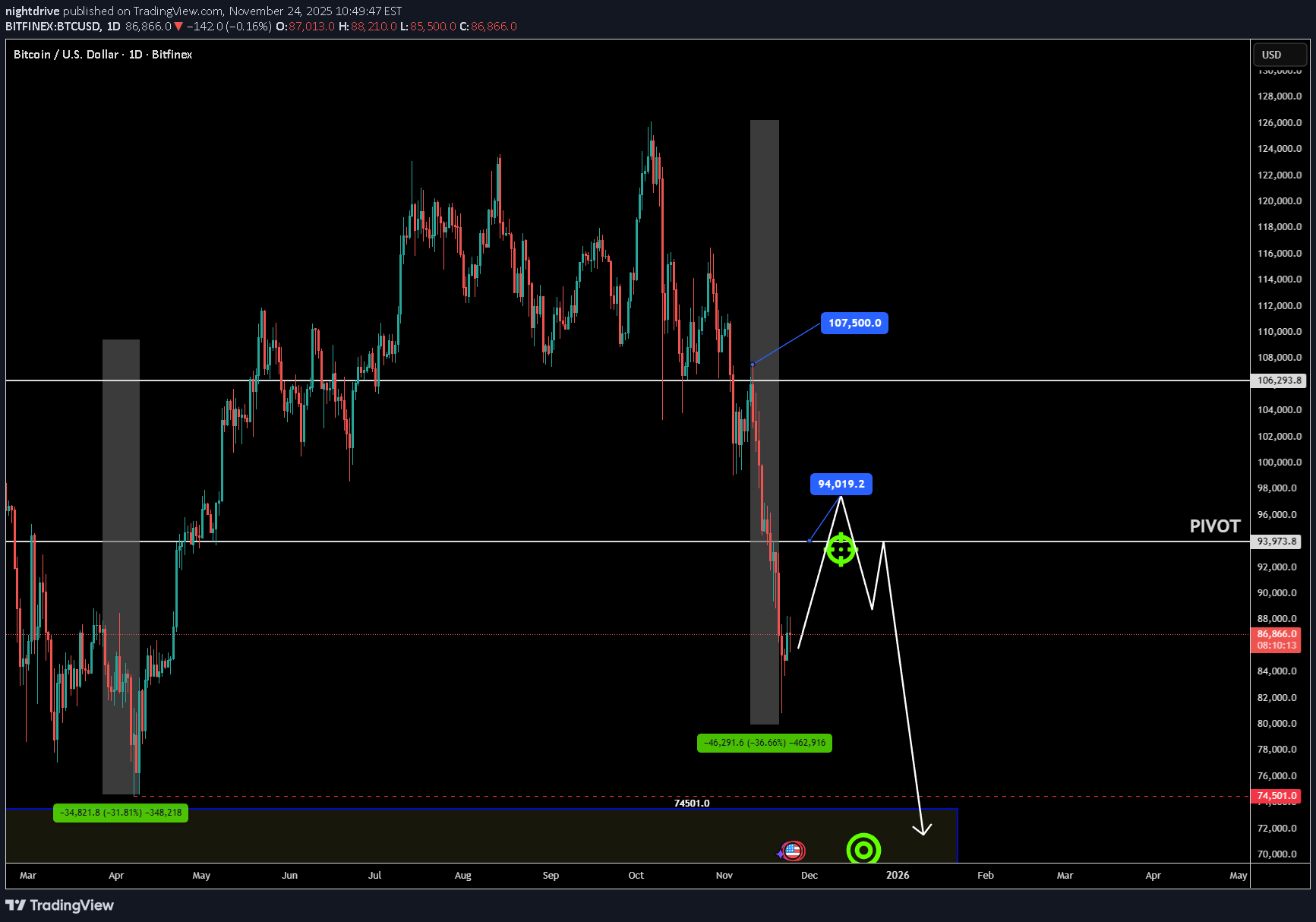

The signs are evident. There's blood on the crypto markets. Don't bother looking at your portfolio unless you want to cry! I've been expecting a downturn for a while, bitcoin has been too extended and overpriced and with the economic doom lingering on every sector cashing out and placing your money in safer assets is an old strategy well known to those around long enough to know having skin in the game during uncertainty is not being smart, is gambling. And we dont want to gamble. Having said that, November has brough a significant downturn in crypto assets creating a ripple effect. Typically, Fall/Winter months bring a bullish outlook in crypto, and despite the clear signs, many still believe this is a dip to buy. I say, hold you horses. If you've profited and took money out, never try to guess the bottom or buy the bottom unless the trend has pivoted. The bloodshed is not over. Comparing JAN25-APRL25 [-31.81%] we can clearly see the pivot in trend after April when it finally gained momentum and the bulls took control. This most recent decline OCT25-NOV25 [-36.66] +4.85% to the downside than that of January to April 2025 decline. We're in bear territory (clearly right!). The point is, you want to anticipate these pivots way ahead of a massive dump like this one and park your assets in Tether USD or somewhere else. This guarantees your profits and a bigger hand to buy the dip when the market is ready to turn. You can go 'shopping'. But if you're one of the unlucky ones and part of the HODL gang lets get straight into it. After the $107,500 pivot retracement sell confirmation, it was clear that structure broke and more downside was expected. This was also the peak of JAN25-APRL25❗ A key price point. After breaking through this important key price point, a retest is usually followed and that's where the shorts reposition (institutional order flow) to capitalize or add on to their initial shorts, those long is their opportunity to flip. You've to look at the markets in waves! ANALYSIS : Expecting further downside on Bitcoin. A particular price point i have my eyes on is APRL25 lows to round up $75K is a good psychological level and is right below the 80 level (ie 00, 20, 50, 80,). Additionally, the peak of 2022 is right below these levels as well so a $75-$70K is an attractive level acting as a magnet. Two scenarios are currently at hand, either we continue to slam down to the forementioned levels OR a retracement is due to the 90s100 level. Thank you for taking the time to read this piece.

$75K BIT COIN: Rebound

So, since my last forecast we've finally after a few weeks reached the $75K mark. Is the bloodshed over? No.Price is respecting areas where pivots happens based on the data thus far it is moving in a sellers market profile since it made its sharp decline on entering February 2025. At the end of February it was confirmed with the selloff that took it down to$78K and has a sharp bounce reaction as the buyers were getting squeezed the pressure was on there was profit taking also causing a selloff ripple effect.Now finally having just tapped below $75K and briefly bounced, is the nightmare over? Based on the economic outlook my take is, we're not done with down momentum. I would expect price to dabble inside the two black horizontal lines and try to balance itself in this area $70-$65K. But that doesn't mean it cannot continue to bomb dive to a psychological price level $50K which makes total sense after hitting $100K.Understand that all other coins have lost nearly or more of their value. If you were on the sidelines and cashed out at the highs consider yourself smart or lucky or both-- that was a good move. But are you considering buying at what some consider this to be a 'discount selloff' to buy the dip and HODL once more for a return to ATH?Crypto tends to do its run during Fall/Winder. Is it smart to buy now or wait more mid-summer to start loading up the boat?What are your thoughts!

The Reality of Bitcoin HODL. The odds of 100k AGAIN

Let's break down this BTCUSD BTCUSD chart and discuss the potential scenarios for 2025, considering current world economic conditions.**Chart Analysis:*** **Timeframe:** Daily (1D) chart, showing price action from early 2024 to March 2025.* **Key Levels:** * **Resistance:** $109,590 (recent high), $100,000 (psychological level). * **Support:** $80,000 (recent low), $72,000 (previous consolidation), $68,000 (strong support zone).* **Price Action:** * **2024:** A period of consolidation and accumulation, with a clear upward trendline from May to November. This suggests growing bullish momentum. * **Late 2024/Early 2025:** A significant rally, pushing BTC above $100,000 and reaching the $109,590 high. * **Recent Correction:** A sharp pullback from the highs, indicating profit-taking and potential trend reversal. The price is currently hovering around $86,000. * **Grey Box:** A highlighted area around $80,000 - $88,000, which represents a key support zone.**Most Likely Scenario for 2025 (Given Current World Economic Conditions):****Current World Economic Conditions (Considerations):*** **Inflation:** Persistently high inflation in many countries is a major concern. Bitcoin is often seen as a hedge against inflation.* **Interest Rates:** Central banks are raising interest rates to combat inflation, which can negatively impact risk assets like Bitcoin.* **Geopolitical Uncertainty:** Ongoing conflicts and tensions create market volatility and uncertainty.* **Regulatory Landscape:** The regulatory environment for cryptocurrencies is still evolving, with potential for both positive and negative developments.* **Economic Slowdown/Recession:** Growing concerns about a global economic slowdown or recession.**Scenario:** **Range-Bound Trading with Potential for Further Correction**Given the current economic climate, the most likely scenario for 2025 is a period of range-bound trading for Bitcoin, with potential for further downside correction. Here's why:* **Uncertainty and Risk Aversion:** Economic uncertainty and rising interest rates make investors more risk-averse, reducing demand for volatile assets like Bitcoin.* **Technical Indicators:** The recent sharp pullback suggests a potential trend reversal. The $80,000 support level is crucial. A break below this level could trigger further selling pressure.* **Inflation Hedge Narrative:** While Bitcoin is seen as an inflation hedge, its correlation with traditional markets has increased in recent times, making it susceptible to broader market sentiment.**Buy/Sell Recommendations (General Guidance):*** **Long-Term Investors:** If you're a long-term investor with a high-risk tolerance, consider dollar-cost averaging (DCA) into Bitcoin during periods of weakness. The $72,000 and $68,000 levels could provide attractive entry points.* **Short-Term Traders:** Short-term traders should exercise caution and wait for clear signs of a trend reversal before entering long positions. Look for confirmation signals like a break above key resistance levels with strong volume.* **Risk Management:** Always use stop-loss orders to limit potential losses. Never invest more than you can afford to lose.**Important Notes:*** **This analysis is based on the provided chart and general economic conditions. The cryptocurrency market is highly volatile and unpredictable.*** **Do your own research and consult with a financial advisor before making any investment decisions.*** **Keep an eye on key economic indicators, regulatory developments, and market sentiment.****In conclusion, while Bitcoin has shown strong bullish momentum in the past, the current economic climate suggests a more cautious approach. Expect range-bound trading with potential for further correction in 2025.**

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.