muhammadsufyan4000

@t_muhammadsufyan4000

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

muhammadsufyan4000

AVAXUSDT exhibits strong bullish momentum, supported by robust buying pressure and positive technical indicators, suggesting potential upward movement ahead. Traders are encouraged to monitor for continuation patterns and favorable entry points in the current market environment.

muhammadsufyan4000

TONUSDT in Demand Zone. Entry Zone is Already Marked. We will Target it to the Supply Zone.

muhammadsufyan4000

XRP is Going Bullish ? According to the latest data gathered, the current price of XRP is $0.53, and XRP is presently ranked No. 7 in the entire crypto ecosystem. The circulation supply of XRP is $29,546,323,688.35, with a market cap of 55,288,951,055 XRP. In the past 24 hours, the crypto has increased by $0.0026 in its current value. For the last 7 days, XRP has been in a good upward trend, thus increasing by 6.7%. XRP has shown very strong potential lately, and this could be a good opportunity to dig right in and invest. During the last month, the price of XRP has increased by 0.56%, adding a colossal average amount of $0.0030 to its current value. This sudden growth means that the coin can become a solid asset now if it continues to grow. XRP Price Prediction 2025 After the analysis of the prices of XRP in previous years, it is assumed that in 2025, the minimum price of XRP will be around $0.8603. The maximum expected XRP price may be around $1.05. On average, the trading price might be $0.8922 in 2025.

muhammadsufyan4000

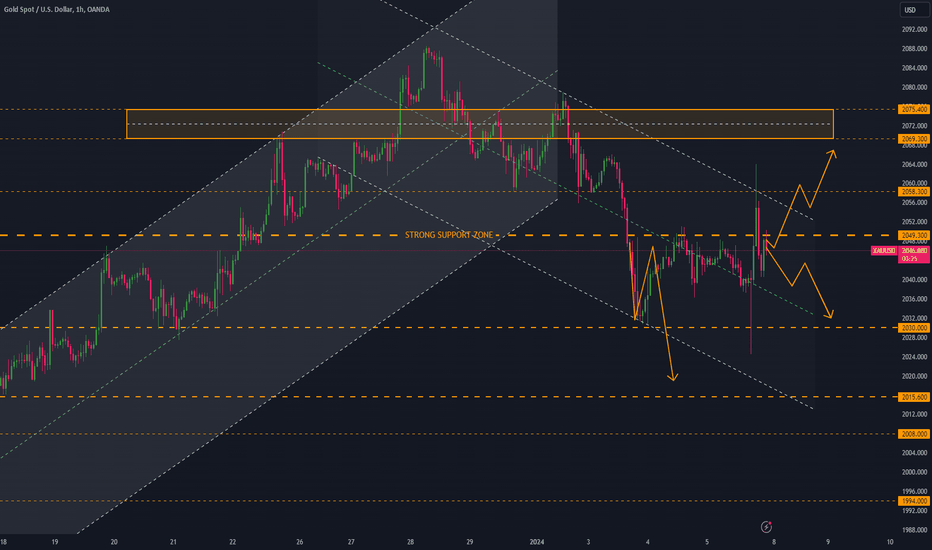

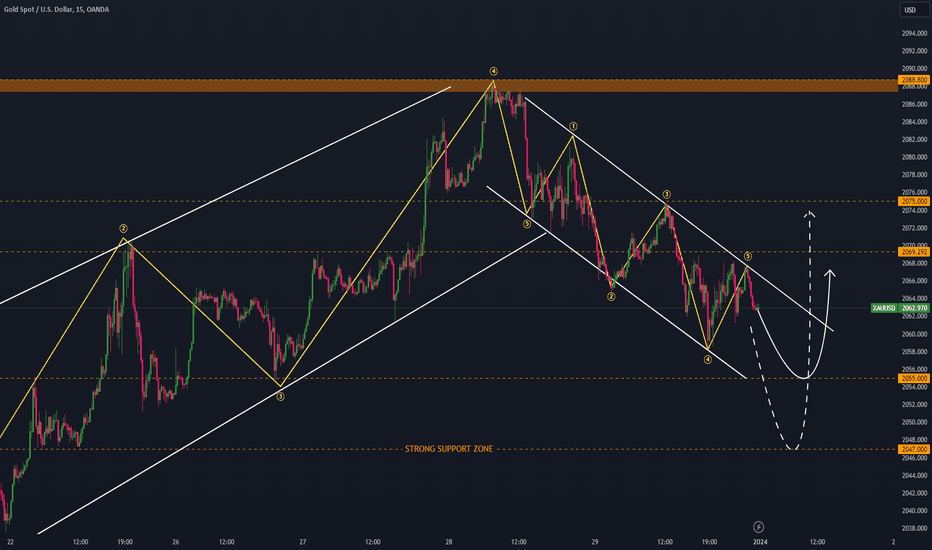

Gold is declining. Gold is taking more Effects on the comments of Fed Representative rather then conflict in the Red Sea. Support Level 2013, 1994, 1976 Resistance Level 2039, 2049

muhammadsufyan4000

If it closes above 2049.300 then it plans to go up but If it closes below 2049.300 then then it's next target will be 2038 & 2030.

muhammadsufyan4000

Overall the Bias of Gold is Long. According to Commitments of Traders (COT) Reports the institutions are adding long positions. If you see correlation of US 2Y AND 10Y BOND against Gold, You can see Gold is Long Plus Everyone knows that Gold is a Safe Heaven, And there is War going between Russia & Ukraine + Israel & Palestine, So it can correct itself up to 2047 which is it's Strong Support Zone + 2047 is also a 0.382 Fib Retracement Level.

muhammadsufyan4000

Overall the Bias of Gold is Long. According to Commitments of Traders (COT) Reports the institutions are adding long positions. If you see correlation of US 2Y AND 10Y BOND against Gold, You can see Gold is Long Plus Everyone knows that Gold is a Safe Heaven, And there is War going between Russia & Ukraine + Israel & Palestine, So it can correct itself up to 2047 which is it's Strong Support Zone + 2047 is also a 0.382 Fib Retracement Level.

muhammadsufyan4000

Overall the Bias of Gold is Long. According to Commitments of Traders (COT) Reports the institutions are adding long positions. If you see correlation of US 2Y AND 10Y BOND against Gold, You can see Gold is Long Plus Everyone knows that Gold is a Safe Heaven, And there is War going between Russia & Ukraine + Israel & Palestine, So it can correct itself up to 2047 which is it's Strong Support Zone + 2047 is also a 0.382 Fib Retracement Level.

muhammadsufyan4000

FOMC will decide the direction of gold. I'm expecting a pump in Gold and dollar getting weaker let's see!!!

muhammadsufyan4000

There is no Divergence Formed. There is a Bearish Flag Which gives a signal to the continuation of Trend. Important Support Levels are marked on the Chart.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.