mrjones2020

@t_mrjones2020

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

mrjones2020

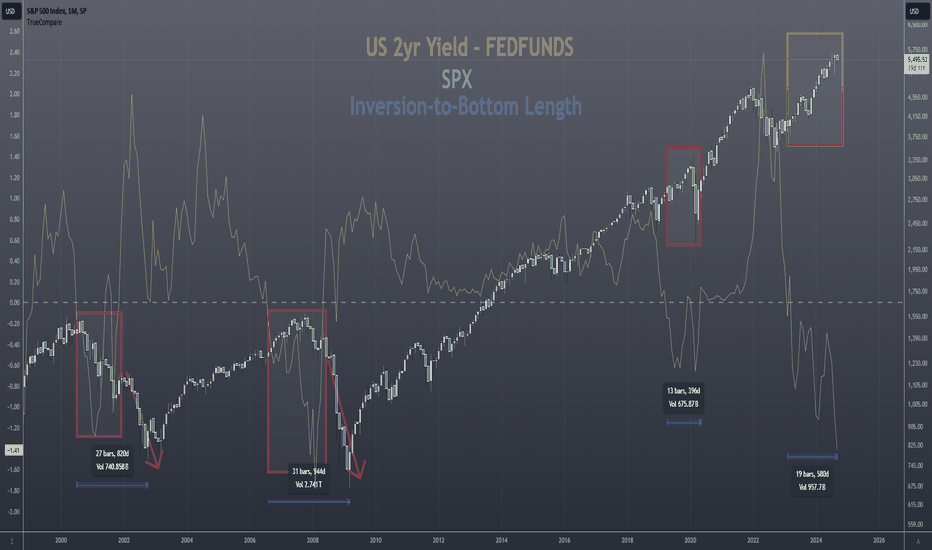

2yr Yield - FEDFUNDS "Inversion"

Over the past ~25yr, we've seen 3 instances of 2yr Yield dropping below the FEDFUNDS rate set by the Federal Reserve. All 3 instances coincide with Recessions. On this chart, you see the Yield Differential (Yellow), the SPX (Candles), along with the time of said "Rate Cycle Inversions" (Blue Bar Counts Below Price). As you can see, all 3 previous instances lead to significant corrections and/or volatility with notable downside. Not since the 2008 "GFC" have we seen an "inversion" of this magnitude. While correlation is NOT causation...It can be a "warning light" signaling 'Danger Ahead'. It is certainly forewarning us that the probabilities of a recession/down-turn are gaining momentum. Yes, people have been calling for Doom n Gloom, "Top is In", Recession imminent... for a couple years now. And I am not recommending you sell everything and hide under a rock. What I am recommending however, is that you reduce leverage if you have any, perhaps lock in some profits while you're "on top", and head into the coming days/weeks/months with eyes wide open, alert to potential quick corrections when this wild ride inevitably 'ends'. Each instance resulted in the "recent lows" being violated. If history rhymes this time, that could mean low 3k's incoming for SPX. COULD. Can your portfolio/strategy/mindset handle that kind of volatility/drawdown? Just some food for thought. As always, good luck, have fun, and practice solid risk management. Thank you for your time and consideration.

mrjones2020

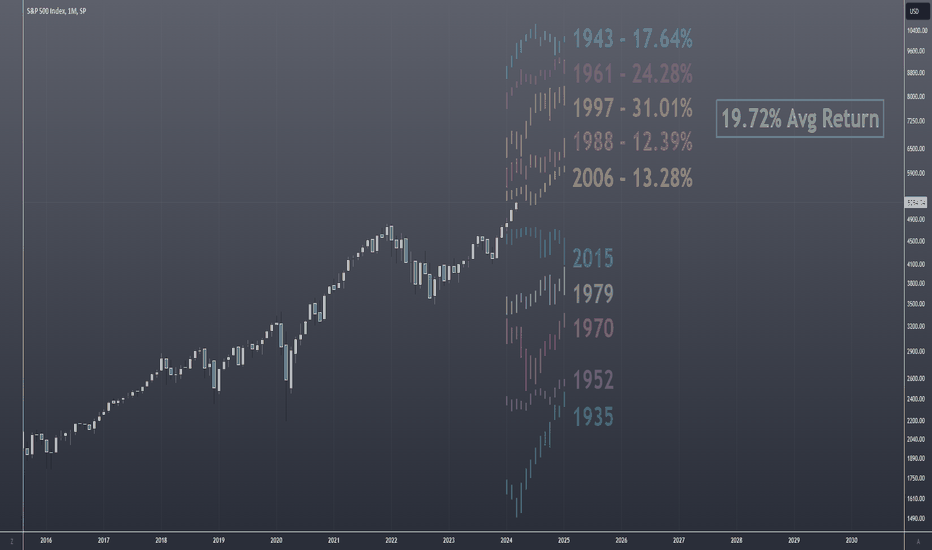

Macro Gift for Easter..

Happy Easter All.... So here's a chart I haven't shared yet that may interest some of you. For those who know/have heard of Numerology, this year is an "8"; (you add each individual digit of the year - 2+0+2+4), then look at prior "8" years. I won't get into the reason for this, it's a deep, long discussion...but let's check these 8's out. Over the past ~90yr, here are the Bar Patterns for the year. The Top Patterns are those most closely fitting our current PA. The Bottom Patterns are those least matching. Of notable interest is that, IMO, we most closely match 1943&1961 at the moment. Two periods of (pre)Inflation. Particularly 1943, when we had large govt deficits (as we do now) do to war spending. Might be something you find useful to follow in the coming months. As always, good luck, have fun, and practice solid risk management.

mrjones2020

BTC Ichi Wave Targets

Based on BTC's recent Daily PA/Structure, here are some potential downside targets; until BTC manages to take out that "C" Wave High (44.x). N Wave - 39.8k V Wave - 35.9k E Wave - 35.6k As always, good luck, have fun, and practice solid risk management.

mrjones2020

mrjones2020

BTC Bears Feeling the Horns

BTC Bears Feeling the Horns Job well done Bulls. You blasted thru the overhead resistance I mentioned in yesterday's video, and have hit the first target (NT Wave). In this video I discuss further upside targets, should be manage to stay above the cloud on the Daily. As always, good luck, have fun and practice solid risk management.

mrjones2020

A quick update on Bitcoin

A quick update on Bitcoin This is a quick video discussing BTC's recent price developments, and what I'm looking for. Cautiously Bullish sums up my current stance. As always, good luck, have fun, and practice solid risk management.

mrjones2020

BTC Macro Outlook

BTC Macro Outlook BTC has done well this year so far. I've long said, Bitcoin is the markets most sensitive liquidity gauge. We're likely to see some 'hiccups' in Global Liquidity Q3/Q4 this year (12mo Money Supply RoC tanking, TGA about to 'refill', Rates Rising, China 'ReOpening' flop, etc etc)... So that begs the question; What to expect for BTC over the next 6 months? A) BTC Closes on Weekly over the Kijun, after putting in a Bullish Div on Oscis. This is also a Close over a Monthly Bearish Open ("Bull" Line, an Al Brooks theory / trapped traders). B) BTC re-tests the "Bull" Line, as well as the ATH Weekly Forecast Line, along with the Kijun; some very nice confluence. It then proceeds to rocket higher. Since then, we've chopped along sideways. Now where to from here? Much of that depends on Global Liquidity, as mentioned above. If markets continue to climb this "wall of worry", and we see BTC Close above the new Forecast Line just above price, the top of the Cloud is the next likely stop. D) Is the next target if we see a Weekly Close above the Cloud. It's where the Monthly Kijun sits, as well as the Forecast Line from March '22 High, Monthly ATH Forecast Line (Red), a Flat in the Weekly SSB; Just LOTS of confluence in this zone - Call it 40-48k. If on the other hand, we wick up into the Forecast Line just above price, and reject, the cluster at C becomes a very likely target. C) Cluster has our Weekly and Monthly Forecast Lines off the Post ATH Low (~~15k), the above mentioned "Bull" Line, and our March '23 Low Forecast Line, again, LOTS of confluence. Should the cluster at C fail to hold, we've likely found ourselves in a Global Liquidity Crisis / Global Recession / Global Depression type environment, and sub 15k is incoming, perhaps even sub 12k, and the world has bigger concerns than the price of BTC. As always, good luck, have fun, practice solid risk management.

mrjones2020

BTC - Where we've been, and where we're likely headed.

What an exciting ride it's been in Macro Markets lately! If you're into S&M that is. I've long said, thanks to Luke Gromen, BTC is our best Liquidity Gauge in markets. And BTC hasn't failed us this time either. It sniffed out a change in tides, well before any other asset in markets.Where we've been....1) BTC on the Weekly chart puts in a beautiful, textbook "Bullish Divergence".2) BTC closes on the Weekly, above the Kijun, and with High Volume (Green candle, not color, the 'g' below it; indicating high volume and high price movement : Bill Williams theory)3)BTC breaks above the Descending Forecast Line (Orange Dotted) from our 69k ATH! This is HUGE. I took profits on Longs here, as generally speaking, the first touch of a Forecast Line rejects. We proceeded to grind down the Forecast Line (on the upside of it), and this week have broken back out to the Upside, consequently also breaking through the new Forecast Line made by our original piercing/pullback of the 69k Line.This is all beautifully Bullish, and as I said...was indicative of BTC sniffing out a Pause/Pivot/Trouble in the FED's "tightening" scheme. It will definitely be interesting to see what Powell does re: Rate Hikes in a few days.So here we are, breaking through many "resistance" areas, and now sitting just below this very thick Cloud. A pullback to the Ascending Forecast Line (from the 15,xxx Lows) would not surprise me, and would likely represent a perfect Buying Opportunity (currently 19,2xx and rising).Where we're likely headed....4) The 32-33k region has a very flat Kijun and SSB, a likely candidate for a Target on running Liquidity/Pausing/Resistance.5) The current Monthly Kijun as well as ~~Weekly SSB around 42,2xx would be the next higher target.6) Followed by the 69k ATH Monthly Forecast Line (Red Dotted Descending) currently > 50k and descending.Unless Global Macro forces change suddenly, and the FED decides to ramp rates much higher ( I don't see this happening ), I see Medium to Long Term upside for BTC, and Dips are for buying. As always, good luck, have fun, and practice solid risk management.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.