mralkhateeb

@t_mralkhateeb

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

mralkhateeb

After a year of dedicated effort towards building a successful AI-powered prediction system, countless trials, and overcoming numerous setbacks, we're proud to introduce our forecasting model. This model operates solely on technical and fundamental indicators, eliminating human bias from its predictions.While no system can perfectly forecast the complexities of market movements with 100% accuracy, ours aims to shed light on potential trading opportunities.Trade with caution.Follow us on [Platform X] for more trading signals.x.com : @HKtrading81

mralkhateeb

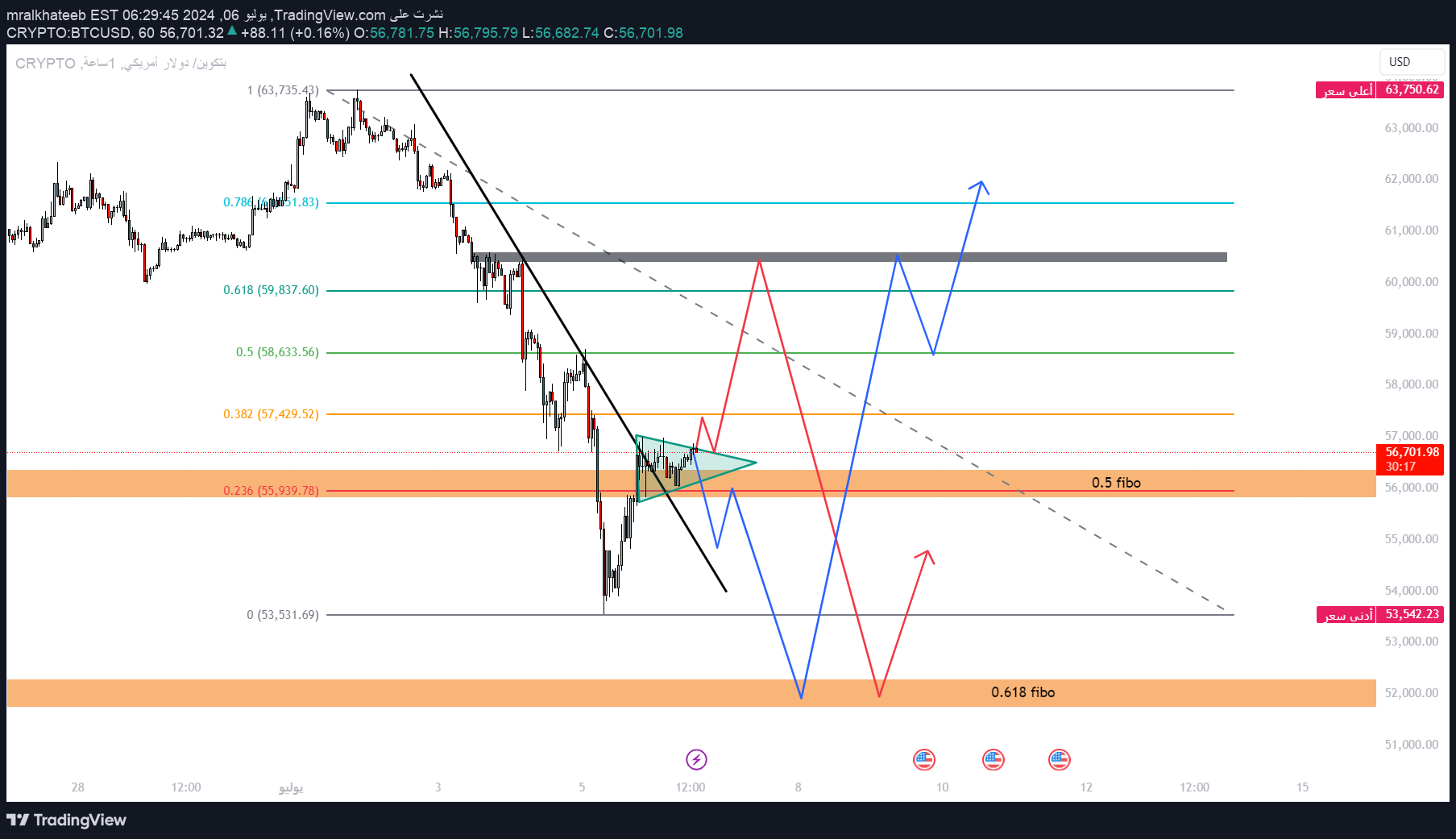

This is my idea about Bitcoin The first case is to retest the triangle side and rush towards the 59-61 level الف then drop again to the 0.618 Fibo daily level The second case is to drop below the 0.5 Fibo daily level and retest it and drop to the 0.618 Fibo daily level then rush towards the 59-61 level الف This is not a recommendation but an idea about the Bitcoin movementComment: We had published an analysis about Bitcoin on May 11 and expected to reach these levels

mralkhateeb

According to the chart --- We believe that Bitcoin has ended the wave of violent decline and is suitable for purchase from its current levels with targets close to its previous historical peak

mralkhateeb

Praise be to God, we referred in our previous analysis to the decline of gold Now, the potential areas for a rebound and a return to the rise are shown on the chart The first zone is 2367 - 2370, and it is possible to buy from it with a stop loss of 2365 for those with medium and weak portfolios. As for those with portfolios that are likely to fall more than that, buying can be increased from the areas 2360 - 2355. If the price falls, it has a stop for all at 2349 The target for the internal liquidity zone is 2436

mralkhateeb

Last week, we expected a new peak for gold and we succeeded in that, but we expected the decline to continue to more levels before rising to this peak, but we did not succeed in that. Gold is now at a new peak, so a corrective decline is expected Therefore, we prefer cautious selling over buying from its current levels until 2393 is a reasonable plot while maintaining strict capital management. The movement of gold will not become clear with certainty whether it will continue upward or continue to correct now, and it is better to wait for what the chart will turn out to be at the 2393 levels. The deal was closed: the goal was reached: Congratulations to whoever entered into the deal - I will update you soon with a second deal, God willing

mralkhateeb

It is possible that we will see a new peak for gold this week between 2450 - 2460, but it is now clear that it is going through a corrective period on the medium frames, where it is expected to fall to levels 2344 - 2340 as the first level 2312 - 2308 Second level 2300 - 2290 Third level Therefore, buying from the second level is possible, but stopping the loss below the 2290 level will be a bit far and contains a lot of risk, so the best areas to buy are from the 2300 - 2290 level with targets of 2430.

mralkhateeb

Bitcoin is still in a correction path under strong selling pressure so the correction is likely to continue To target levels of 57,000 - 55,000 - and perhaps it may reach liquidity levels below 52,000 before starting an upward wave targeting levels of 72,000, rising to a target that may reach higher than that.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.