moneymagnateash

@t_moneymagnateash

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

moneymagnateash

In this episode of Profit And Learn, we sit down with seasoned gold and derivatives trader Casey Olsen to break down the forces driving gold’s rally. He provides an insider’s perspective on the gold mining industry, explaining the process of extracting gold and the challenges miners face. Finally, Casey shares his approach to trading gold derivatives, offering valuable insights into how professionals navigate the market using futures and options. Whether you’re an investor, trader, or just curious about the gold market, this episode is packed with expert knowledge you won’t want to miss!

moneymagnateash

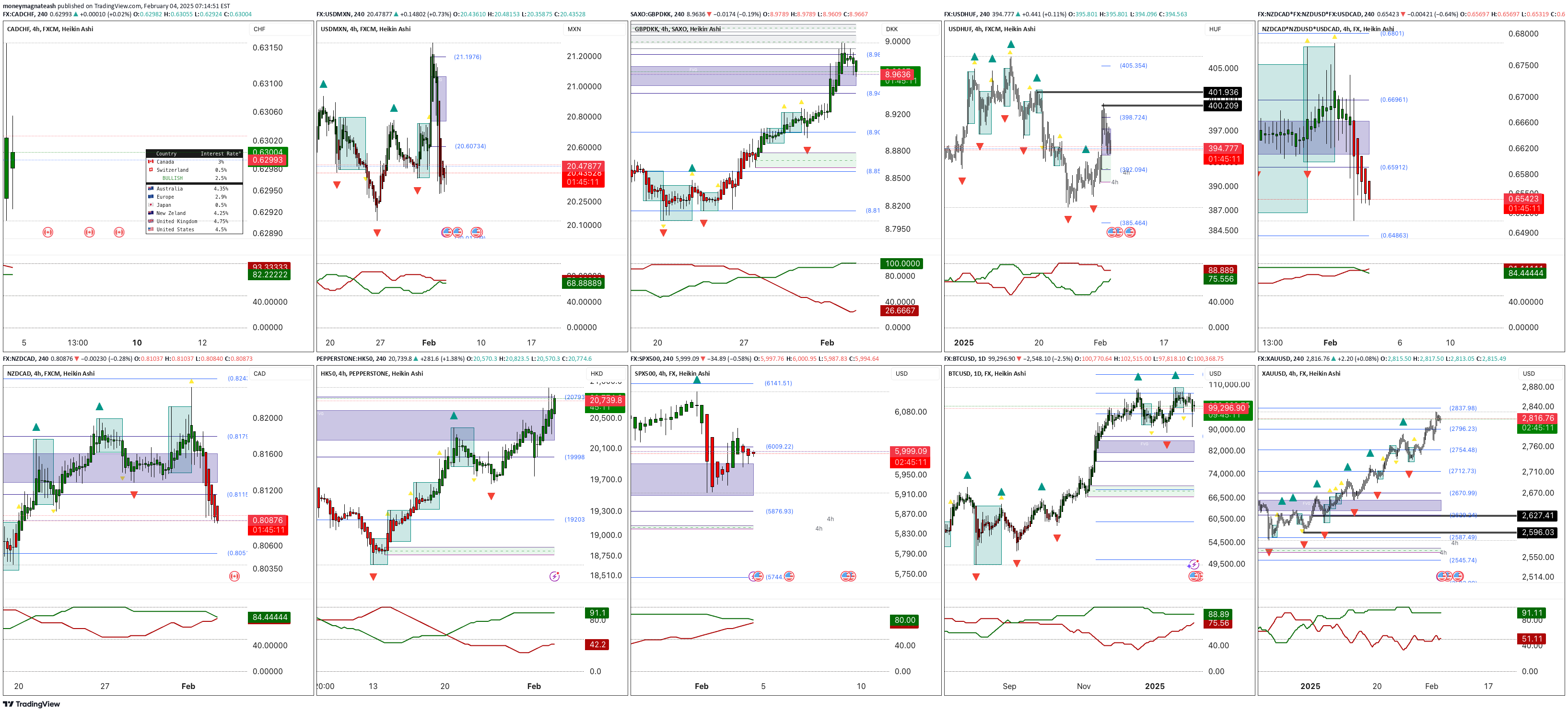

Key Market Observations 1. Currency Pairs •CAD/CHF (Top Left) – Bearish Volatility •Heavy rejection at resistance, sharp sell-off. •Strong reaction from previous supply zone, price rebounding slightly. •RSI shows slight recovery, but momentum remains weak. •USD/MXN (Top Center) – Rangebound Movement •Failed breakout at 20.4 level, retracing lower. •Potential re-test of support near 20.0 before next directional move. •GBP/DKK & USD/HUF (Top Right) – Bullish Moves •GBP/DKK: Strong rally, pushing into Fibonacci retracement levels. •USD/HUF: Holding 8.90 level, looking extended after breakout. 2. Indices & Equities •SPX500 (Bottom Center) – Significant Drop & Recovery •S&P 500 dropped into a demand zone, aggressive buy reaction. •20,400 remains key resistance to reclaim bullish trend. •Market still undecided, watching for breakout or deeper pullback. •HK50 (Bottom Left) – Bullish Breakout •Hong Kong index surged through resistance near 0.82, •Testing upper Fibonacci range, likely continuation if risk sentiment holds. 3. Crypto & Dollar Index •BTC/USD (Bottom Right) – Retracement Phase •Bitcoin rejected near 6,100, pulling back into key liquidity zone. •If 5,900 fails, further downside to 5,850 before reversal. •DXY (Dollar Index) – Strength Holding •The dollar remains strong, trading near 108.2, maintaining bullish structure. •Key factor in FX volatility, impacting USD pairs. CADCHF USDMXN NZDCAD HK50 SPX500 BTCUSD XAUUSD$15 for ANY TradingView.com Subscription | tradingview.com/pricing/?share_your_love=moneymagnateash

moneymagnateash

BCHUSD / BCHTHB Flowing to the upside with bulls stepping up the pressure all day. On the daily, BCHUSD & BCHTHB trades at a discount to Fair Value. However, on the lower time frames it's trading at Fair Values or above. Give this trade some time to pull back and catch a sizable deal off the near term support level. [BCHUSD 435 | BCHTHB 15,000]. Loving the fact that this deal can bring us between 9.48% ^ 12.42%.

moneymagnateash

Podcasting the truth about direct dealing, retail treading, and why you should take your work seriously. You are a real trader. Your order flow matters and impacts the markets more than you think. Check out this podcast when you have time to chill. Peace.In the direct dealing example; The buyer of 5 million DOGE then sells above the market, is a example of how direct dealing works.* Not a precise reflection of the DOGE market, as I'm sure it may be hard to fit this much doge in at the market or above it. I did not do a Volatility/Liquidity/Volume study. Just shooting around the idea that deals are made on chat lines etc. Hope this helps.Direct Dealing; Buyer takes .3100 for 5 Million from Brody who sells it to him. Now Brody, has 45.45K USD from the deal. They have to decide to buy or sell those US Dollars. Meanwhile, the buyer decides to make a quick flip on the DOGE by selling to a buddy who he knows that's buying DOGE and holding long term. Since, he's willing to buy above Market, Buyer, works a deal to sell 2.5 Million Doge (Half) to his buddy and work the other 2.5 Million coins, at the market (Which causes the price to fall). Hope this helps. lol$15 for ANY TradingView.com Subscription | tradingview.com/pricing/?share_your_love=moneymagnateash

moneymagnateash

Sticking with the trade here and buying up some more DOGE.

moneymagnateash

Dogecoin (DOGEUSD) is building upward momentum, trading near $0.45 after successfully defending support around $0.43. The 4-hour Heikin Ashi chart shows steady bullish progress, with price action contained within the green upward trend zone. Key resistance levels to watch are at $0.49 and $0.54, while immediate support lies at $0.44 and $0.42. A sustained breakout above $0.49 could pave the way for a rally toward $0.54 and higher levels. Conversely, a pullback below $0.43 may indicate a temporary correction before a renewed push upward. Traders should monitor volume and sentiment closely for confirmation of trend continuation or potential reversals.Still holding this position.Down 5 Pennies.

moneymagnateash

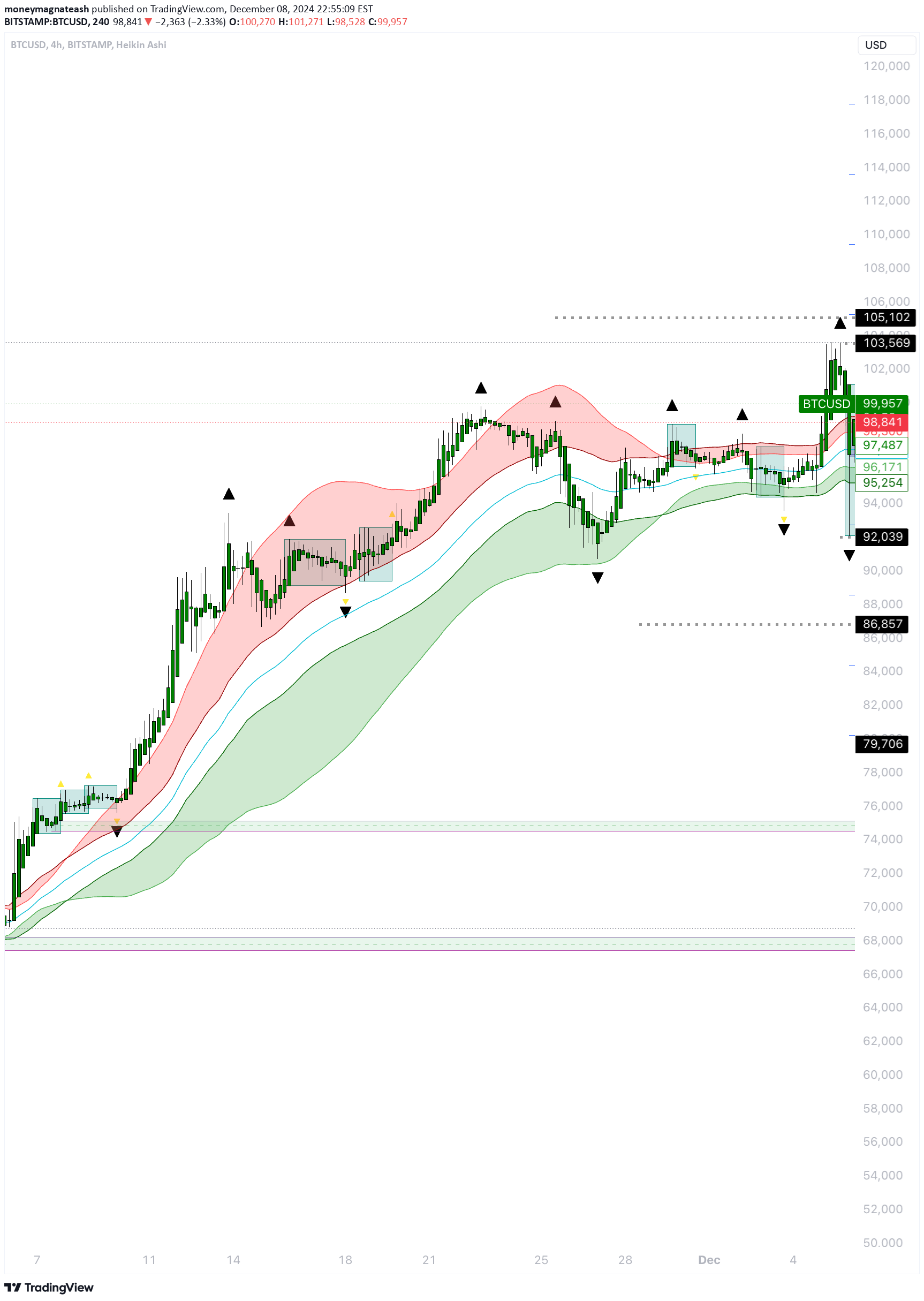

Bitcoin (BTCUSD) is holding steady above the psychological $100,000 level after testing strong support near $97,000. The 4-hour Heikin Ashi chart shows a bullish continuation pattern, with price action remaining within the green trend channel, suggesting sustained upward momentum. Key resistance levels are at $101,200 and $105,000, while support is anchored at $98,000 and $96,900. The price’s ability to maintain strength above $100,000 indicates solid demand, potentially paving the way for further gains if momentum holds. Traders should watch for consolidation or a breakout above $101,200 for confirmation of the next bullish leg. Conversely, a pullback below $98,000 could signal a near-term correction.

moneymagnateash

See the GBPJPY video to learn more.•Trend: GBP/JPY continues its bearish trajectory, respecting the EMA resistance and forming lower highs and lows on the 4-hour charThis should be listed under NZDCAD....Ton strikes back!AUDNZD*...I should get some rest.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.