mohammadshamoradi

@t_mohammadshamoradi

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

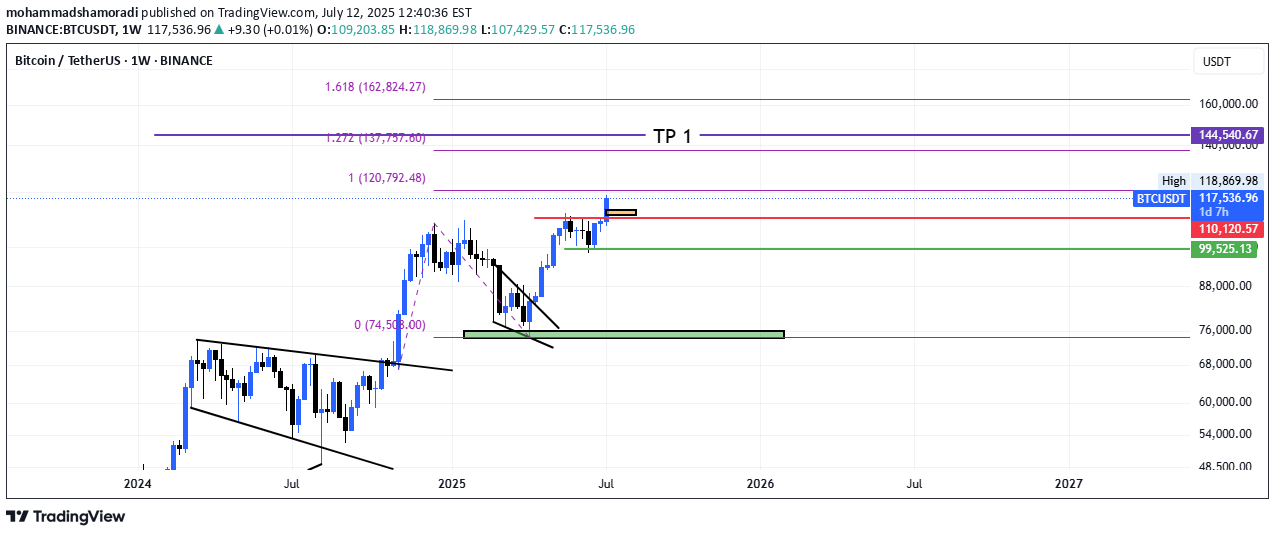

If Bitcoin's weekly timeframe is modeled according to the previous step, it can go up to $120,000 for the first target, according to the previous analysis, but the second target could be in the range of $137,757 to $144,000.

Bitcoin came and made its move according to the FVG, which was in the $98,000 to $99,000 range, but considering the war that took place between Iran, the United States, and Israel and that affected the markets, I expected it to reach the $91,000 or even $85,000 area and then make a move, but considering the previous analysis and consolidation in the $109,000 area and the breakout of $110,000, it started its move and is expected to go up to $120,000 in the short term and up to $144,000 in the medium term.

Bitcoin has two paths: if it stabilizes above 111,800, it can go to the target of 144,540, but if this move is a fake break, it can go to the targets of 91,410 and even 85,662, but it is expected to fall and then move.

"Gold may have another upward move toward the red zone, and from there, considering the RD_ divergence, it could reach the green lines which indicate potential support. This analysis was conducted on the weekly timeframe. Please share your thoughts in the comments. Thank you

"Gold may have another upward move toward the red zone, and from there, considering the RD_ divergence, it could reach the green lines which indicate potential support. This analysis was conducted on the weekly timeframe. Please share your thoughts in the comments. Thank you.

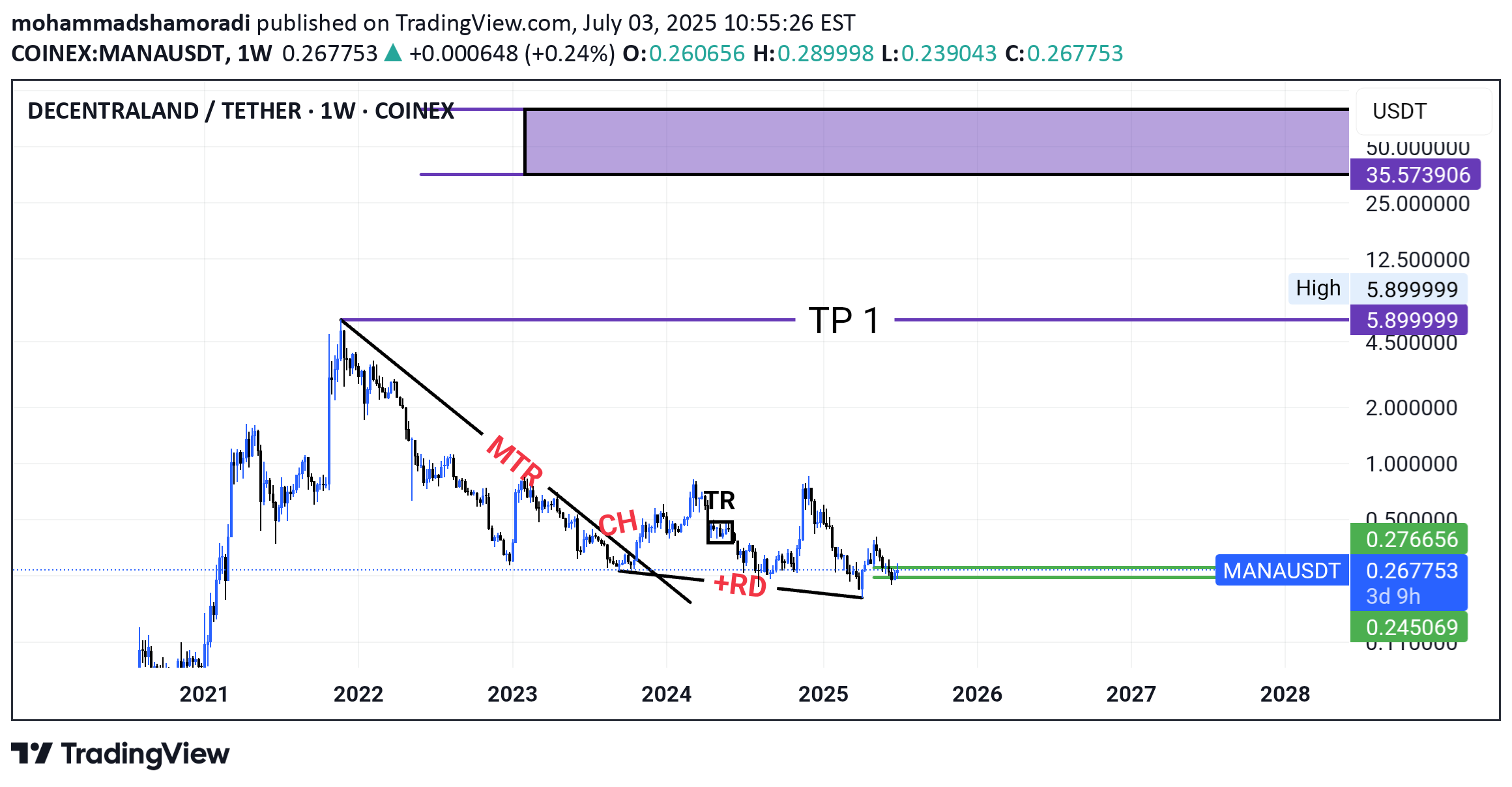

"Given the weekly timeframe and the trend change from bearish to ranging, it is expected that the MANA token will move from this green zone toward its first target, namely TP1."

"Given the weekly timeframe and the trend change from bearish to ranging, it is expected that the MANA token will move from this green zone toward its first target, namely TP1."

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.