mmaccs

@t_mmaccs

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

سولانا در برابر سوی: چرا پادشاه دیفای باقی میماند و جهشهای قیمتی بزرگ در راه است؟

In my personal view Solana is the best project on the DEFI Tokenazation of Real assets Gaming NFT. Solana best leverage against Sui first is that Sui is not faster or more saclable and the SUI zkLogin is a hge wealness for any web 3 projects. You dont want the possibility to open your safe box i n a Bank with your facebook password!!! Solana aproach on DEFI is the aproach that undestand that web 3 is all about your keys your assets and makes evything around that. Meaning there is not a Solana Killler as nver was an ETH killer. You cant be slow, its not secure to be slow as wel the other security issue is Your assets your Keys mainly along with the number of transactions as well of the volume that make more liquidity and decentralize the network. Regarding TA If a Bear Mkt will be Best $75 cousld be a fair Traget. $50 also has odds. If the Bull Continuation theres a Big Cup and Handle so yu can figure the traget of that. But why shouldnt Solana make 20,000% to 50,000% from the $8 price if now Solana poupuse is more clear an sread know, to Institutions that are on the game as well of US Gov (Crypto ZAr on wWhite House)?

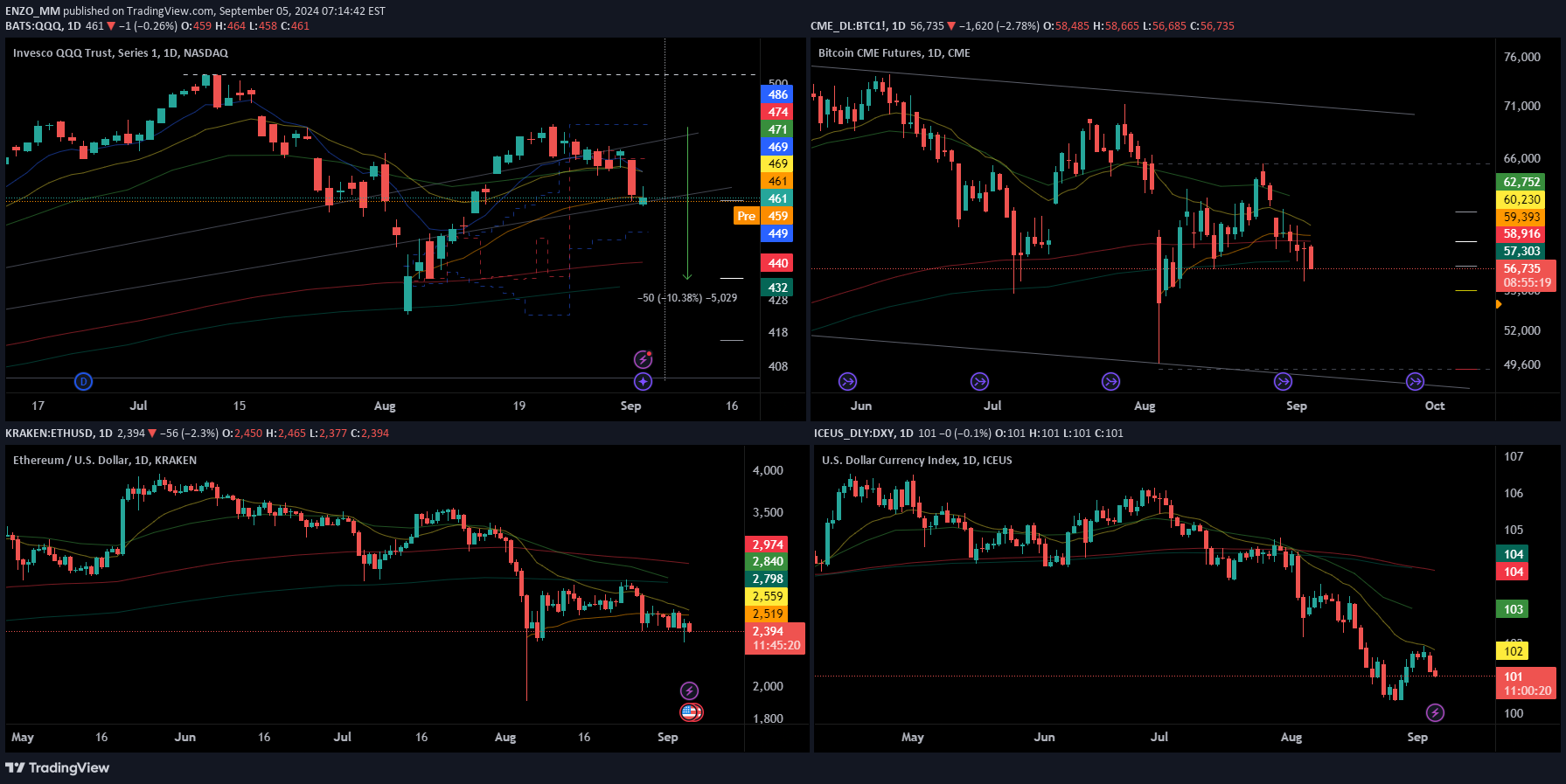

بیتکوین در آستانه نقطهی حساس: آیا بسته شدن هفته بالای میانگین متحرک 50 روزه پایان ریزش است؟

Testing 9SMA and 23.6 Fib ( from ATH till the last low 98K) Key Week close over 50 Weekly SMA If Week close Up 50 Weekly SMA is Bulish on BTC, because it will also closing Up 38.2 Fib from Apri Low till ATH. (Tomorrow Premarket and Daily DXY staying down 100 is at least not Bearish.)BTC 50 Weekly SMA and 38.2 Fib since april 20252 low till ATH. DXY bellow 100 , Nyse premaket Up. Bullish Day is expected and odds for Bullish Continuation

الگوی W بیت کوین: آیا اکنون زمان جهش از میانگین متحرک 50 هفتهای است؟

W Pattern 21 Jun could be aplly Now and bounce Up. BTC 50WSMA !! 1st step of Bonk Bounce Up is tight to BTC 50Weekly SMA holding as 1st step. BTC could drop even to 92K and The Bonk W turn into a Box with $0,000001 Support similar as what happened sibce march to april 2025 but ltaking less days. Is surprised how Bonk hold price since BTC even Break the shadow of 100K till 98K.BTC 50 W SMA hold along with 38.2 Fib from apr 2025 till ATH. Bonks Hold very good whhen BTC close the shadow and close the week bouncig back from 50 W SMA ( also up 38.2 Fib) Expecting Bulish day and odds to Bullish Continuation as the Rally that started in apil 2025 with a similar pattern

هدف بیت کوین در بازار خرسی کجاست؟ پیشبینی دقیق قیمت بر اساس چرخههای گذشته

If similar 2017 Top Cycle: 56 K at 200 Weekly SMA and 50 Monthly SMA 57K also 38.2 Fib (of this Cycle) from 15k to ATH If similar 2021 Top Cycle: could drop till 45K the 50 Fib of actual Cycle and below the 200 Weeky SMA. If is important to state because the actual Week and the next week the price must be below the 200 Daily SMA and 50 Weekly SMA both at 102K. Also November must end at 99K at the most, meaning the 100K level has been breked. If the price end up or at this SMA mention is a Bullis signal (up or at 103K).50 Weekky SMA Holds and 38.2 Reatrce from april Low till ATH So I expect a bulish Day ( DXY down NYSE premkt Up) and odds for Bullish Continution

سقوط بیت کوین به کجا؟ پیشبینی خطرناک از محدوده 70K تا 58K!

92K is the Top Pattren Revresal Target that is at the Golden of last Rally. 70K was las cycle High. 58K is the 38.2 Fibonacci from the starting point of this Cycle 15K till ATH. Also around 58K the 200WeeklySMA(55K) and 50MonthlySMA(58K) Never use Leverage on Crypto SHort or Long Not Financial Advise just AnalisisFrom 92K 85K ould be a wigh owm. If Bear Mkt then 68K and could even get to 55K that is the 200 ewwkly SDMA and also the 50 Monthly SMABTC Hold 50 W SMA and 38.2 Fib from April 2025 to ATH Expecting Bulish Day and odds for Bulish continuation in play

پیشبینی سقوط دوجکوین: آیا قیمت به ۰.۰۷ یا ۰.۰۵ دلار بازمیگردد؟

Doge if Bear Mkt is IN then Proce Drops back to $0.07 $0.05 The Big Red line is the 23.6 at 0.1789 Big Support idf Breaks down then The other Big Red line is 38.2 at 0.07 (The Big Red Lines are Fibonacci fron The last Cycle till ATH) Lower low of this Cycle at 0.05Lets see how this week and the next BTC close For the Retrace on Doge still in Place ths Week and the next BTChas t close below the 50 Week SMA 102K. Also 103K is the 38.2 Fib from the low of apr 25 to this ATH. meaning its has to close below this level also. Also the month of November must close at the most at 99K berakin 100K level. If BTC closes November at 100K that is not a bearish signal if it closes at 103K is a Buslish signal What Has to do with Doge? A Bear scenario could be an explanation of the poor performance of Doge in thus cycle for now compared with Solana foe ex..but if Doge decouple from BTC and start a Rally still has to reach at least $3 to $5 ( in a Bear scenario of BTC) till december If BTC is bouncing back and still gets bullish then Doge has to reach at least $5 to $7 till december. I mean Has t reach not as a forcast but a necesity to still think Doge as a Player....a not as other alt that already has its moment. The target of 0.07 and 0.05 or even lower 0.35 50Fib from the last cucle till 2021 ATH. if reached and Doge dont start ist srally now ( as its happening) i think Doge will start lowering its market cap relative to other coins and go to the mid 50 on rank of market cap to 2026BTC Hold 50 W SMA and 38.2 Fib since april 2025 to ATH . NYSE premakt Up DXY below 100. Doge 23.6 Fib from last cule low till ATH $0.1788 Hold So expecting ullish day and odd for Bullish continuation

تحلیل شوکهکننده اتریوم: ریزش هدفگذاری شده از ۳۰ هزار دلار تا ۲۵۰۰ دلار!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.