milikgroupy_tv

@t_milikgroupy_tv

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

milikgroupy_tv

Certainly! Below is a detailed analysis regarding the potential of assets like the S&P 500, Bitcoin (BTC/USD), and Gold (XAU/USD) reaching an all-time high in preparation for the expected interest rate cut in September

milikgroupy_tv

Long Setup: ABC Correction Completion & Bullish Order Block Reaction Analysis Overview: Price has completed a corrective ABC structure, with point B forming after a liquidity sweep below prior lows. This aligns with a strong bullish Order Block (OB) zone, suggesting potential for a reversal. Key Points: BOS (Break of Structure) confirms bullish intent after the sweep. Point B sits inside the demand zone / OB, providing confluence for a buy setup. Projected target (Point C) aligns with a major supply zone and previous structural highs. Entry & Targets: Entry: Near point B after bullish confirmation in the OB zone. Target: 26.982 (upper supply zone & projected C wave completion). Stop Loss: 4.266 (below liquidity sweep low). Risk-to-Reward: Favorable R:R with strong technical confluences. Notes: This setup relies on bullish continuation from the demand zone. A clear break and close below 4.266 would invalidate the idea.

milikgroupy_tv

ICP/USDT setting up a classic fair value gap play. After a BOS and strong bullish reaction from the swing low, we're now approaching a critical imbalance zone ($5.87). A reaction here could confirm either continuation or retracement to fill inefficiencies below. Watching closely for a reaction at FVG+. Will bulls break higher or revisit demand?

milikgroupy_tv

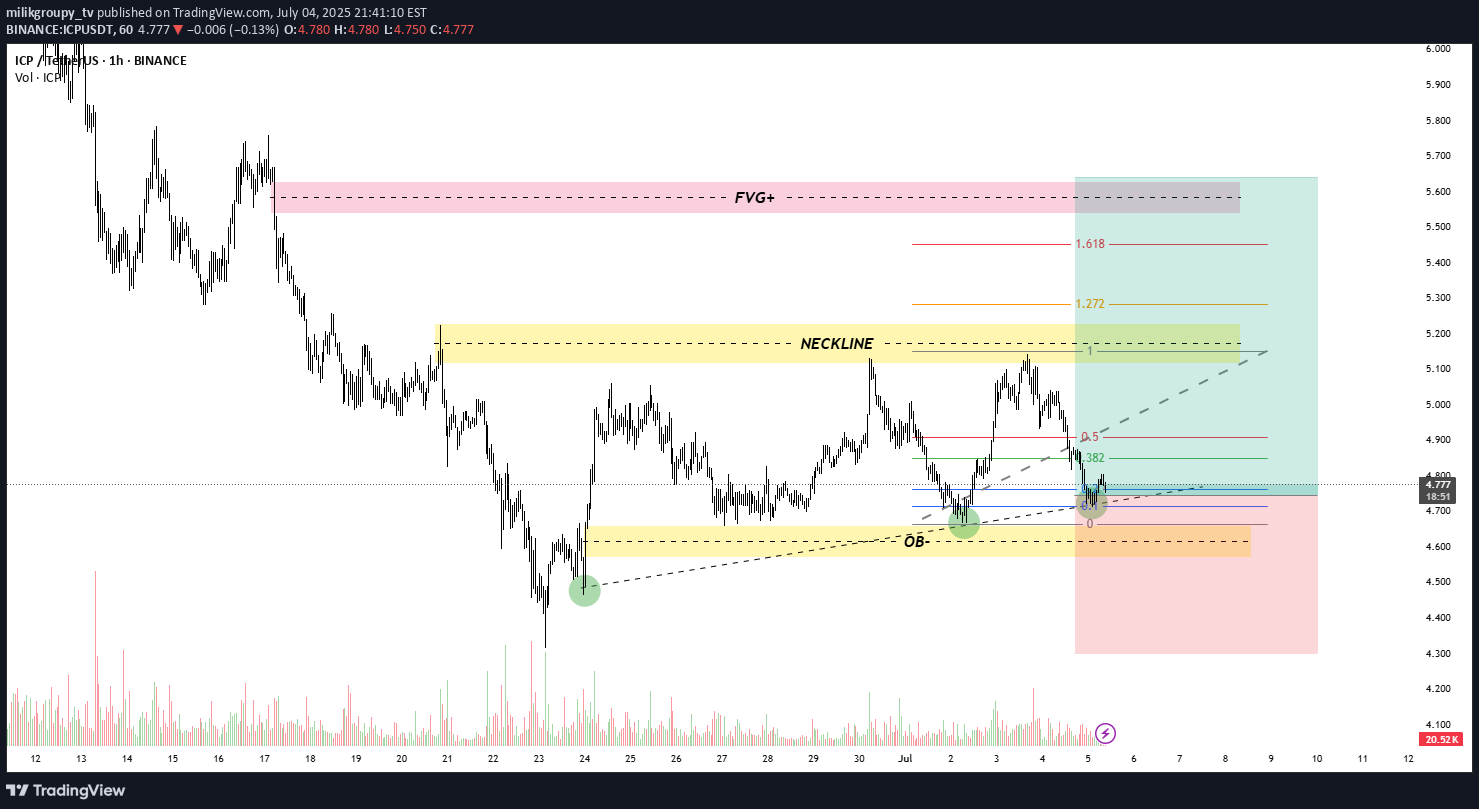

Current Price Action: The price is currently in a corrective phase, with price interacting with significant support and demand levels, marked as OB (Order Block) and NECKLINE. These levels are crucial for potential reversals.Key Levels to Watch:FV+ Zone (Fair Value Gap): The upper resistance is marked by the FV+ zone, indicating a potential area of rejection or a strong bearish bias.OB (Order Block): The price is testing a significant Order Block at the lower end, which could provide a bullish reversal if price respects this demand zone.NECKLINE: A possible neckline of a reversal pattern, it could confirm a bullish breakout if the price sustains above it.Fibonacci Retracements: Price is currently retracing, and key Fibonacci levels (0.382, 0.5, 0.618) are in play. A bounce off the 0.5 Fibonacci level could signal a potential upside move towards the 1.272 and 1.618 extensions, providing a target for future price action.Trendline Support: A potential trendline (represented by the dashed line) could provide additional support for a reversal in price if it holds.Key Price Targets:First Target: Reaching the 0.618 Fibonacci level aligns with potential resistance at higher levels.Further Targets: Targeting the 1.272 and 1.618 Fibonacci extensions for further upside potential.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.