maayan_tiran

@t_maayan_tiran

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

maayan_tiran

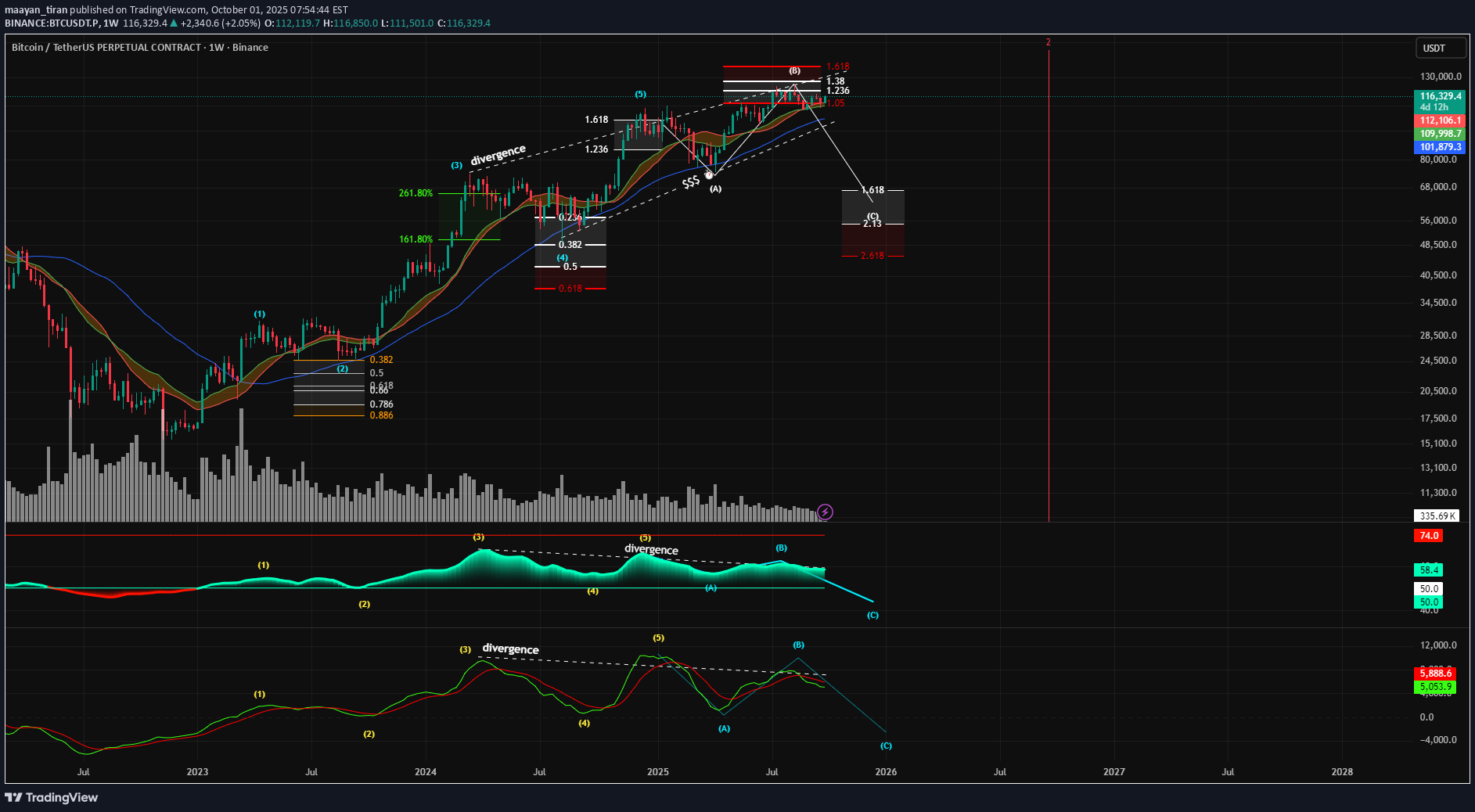

اوج بیت کوین در راه است؟ پیشبینی سقوط بزرگ با موج الیوت و واگرایی خطرناک

Bitcoin may be approaching a significant macro top, with multiple technical indicators aligning to signal a potential reversal and a subsequent major corrective wave. Key Projections: Potential Top Formation: The current price action is forming what appears to be the peak of a corrective Wave (B), with a potential top range between $109,000 and $150,000. Projected Corrective Target: Following the completion of Wave (B), a significant downward move, labeled as Wave (C), is anticipated. This corrective wave targets the $45,000 - $67,000 price zone. Timeline: The entire corrective structure, from the formation of the top to the potential bottom of Wave (C), is projected to unfold by approximately September 2026. Elliott Wave Structure: The primary thesis is based on an Elliott Wave count. The chart indicates the completion of a five-wave impulse cycle, and the market is now in a larger A-B-C corrective pattern. The current price is likely forming the peak of the B-wave. Fibonacci Confluence: There is a strong confluence of Fibonacci extension levels at the potential top. The peak of the current Wave (B) is precisely testing the 1.618 Fibonacci extension level, a critical ratio often associated with the termination of corrective waves. Significant Bearish Divergence (Crucial Point): This is one of the most compelling signals on the chart.While the price is making higher highs (from the peak of wave (5) to the peak of wave (B)).Both the RSI and the MACD indicators are showing lower highs. This is a classic, multi-indicator bearish divergence on a high timeframe (weekly), indicating that the upward momentum is weakening significantly and a trend reversal is becoming more likely.

maayan_tiran

Pancake swing trade

Pancake is getting ready to release all the pressure that was build up inside of it. we have vast amount of liquidity above us that we need to take.Get ready! 🚀🌕(You have the full responsibility for each action that u take because I'm not your financial advisor)

maayan_tiran

ETH long signal

ETH looks great for short term trade. *Depends on how the market will behave during this week*

maayan_tiran

BTC bull cycle comes to an end.

We can see it clearly on the chart. BTC has ended the 5 waves pattern in Elliot wave count. you can see it on the chart, you can see it on the MACD & RSI.What we are seeing now is that because of Greed & Hype no one is selling bitcoin. the up-trend we are seeing now is the result of no sellers and Hype Buyers. This is a bull trap. We can see the divergence clear as day. Stay alert and dont let them catch you this time.

maayan_tiran

PNUT trade

157% gain on Chart Time 5 — all thanks to leverage. What a trade PNUTUSDT.P

maayan_tiran

BTC short term Wave count

Analyzing a Bitcoin (BTC) form Wyckoff schema in a 4H chart.We can’t determine if it’s an accumulation or distribution yet. Based on MACD and Elliott Wave Theory, I believe the chart will follow a similar pattern. However, time will determine the outcome. If BTC declines and accumulates within a shorter time frame of Elliot support levels, it could be a long trade opportunity.(This analysis is not financial advice. Your actions are solely your responsibility.)

maayan_tiran

BTC reach his top

Elliot wave count + Fibonacci time line shows btc gonna enter to a bear market soonupdated chart

maayan_tiran

BTC/GOLD

It looks like btc got blocked by the last ATH comparing to gold. but we still holding on above the support line. also we just closed the FVG and we are close to OB under the FVG if we break it. Lets see how it develops

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.