logindaten

@t_logindaten

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

logindaten

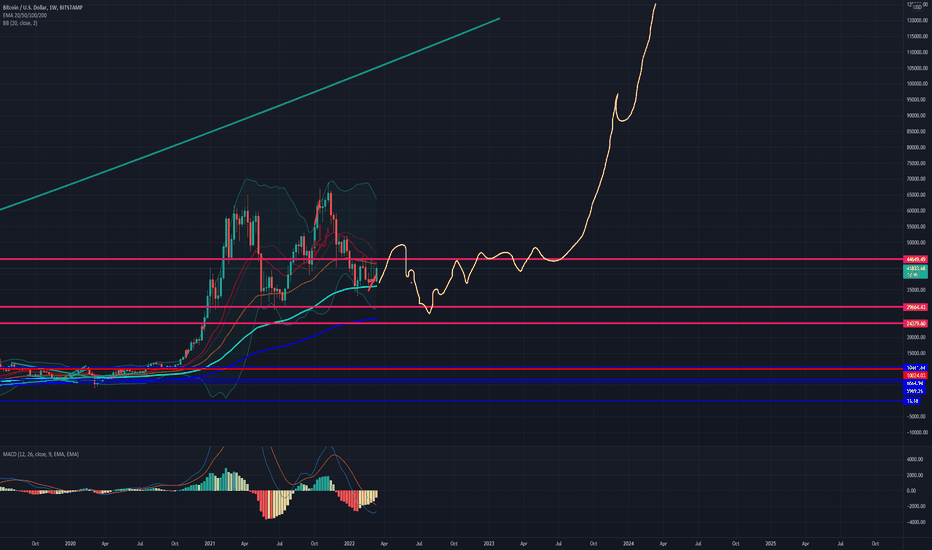

BTC/USD buy area

Many indicators show that we are in the final stretch of this bull market. I expect one last push before the sell-off begins. This roadmap is intended to show you the path to the perfect entry point. Yes, we can go even lower. In Bitcoin's history, we have certainly experienced more severe corrections. However, we have considerably more capital, and the hype phases were not as pronounced as in previous bull markets. At this level, the market will encounter considerable resistance. Chears

logindaten

BTCUSD Forcast

I'd love to show you where we'll be going over the next few days and weeks. Bitcoin shows no signs of weakness despite this massive rise. As long as we don't see any weakness, we will remain bullish. However, bear in mind that despite a bull market, no market only rises. Corrections are part of it and are healthy. In the Bitcoin universe, the 61 Fib is very strongly valued, which is why I see the start of a correction there at the LATEST. In the worst case scenario, we will see the low 30s zone at the 38 fib, which should not be a cause for concern. Bitcoin is exactly where it belongs cyclically. Be careful now when accumulating and take advantage of the setback. Before we crack the ATH. CheersBTC hit exactly the target and start with the correctionprediction seems valid Expect 35k - 37k

logindaten

Bitcoin forcast

Bitcoin forcast it looks like bitcoin is taking a breather before embarking on the next bullish wave. now we are in the crypto spring and the next 1-2 years will bring us a lot of joy :) For me, BTC < 25000 USD is considered a suitable accumulation zone. in fact, i think we'll be going back to that level very soon. enjoy the trip

logindaten

BTCUSD first bullish strength

the next move after the consolidation could actually be a bullish first impulse which could attack the 200 EMA in blue for the first time. Since we haven't touched these since April, there could be additional selling pressure here.It takes a long time to develop an actual floor.The next half year we could stay in this range + - 10000 which brings great opportunities for the future

logindaten

BTC near to bottom

looks like we're near the ground. we cannot rule out that we have seen the bottom or will sell even marginally lower. However, we see increased volume on Coinbase and negative divergence, which also predicted the end of the bull market. we will see a recovery rally in Q1 which will be followed by another sell off but will not make a new low. The market will love ramping up the 61 Fib which will trigger the new wave. i accumulate at this level Save this post :)Bitcoin hit the first Long target

logindaten

BTC last sell off

Bitcoin shows weakness in the current important supportWhat we need for the next uptrend is a last to shake out the weak hands.The diences are not doing well and the markets in general are under pressure. Panick is on the market and the emotional phases can be irendaer than those actually.Next Target 10000-15000 to build massive positions

logindaten

Bitcoin forecast for the next few years

My forecast for the Bitcoinwe are currently at strong supportsI think we're going to move a little in this space before we start a relief rally.it cannot be ruled out that we are currently going even deeper.in fact i expect short ones between 20000-25000 before we approach new highs.cannot be ruled out that we can go deeperThe fact is that in the current situation we will not see a new all-time high for a long timeThe time to re-accumulate has begun

logindaten

BTC consolidate the last wave

Bitcoin takes a while to consolidate the upward movement.we are currently on very important and strong supports.I personally expect that we will see prices below 30000. This is the time for me to accumulate heavily for the next wave.

logindaten

BTC fakeout?

The BTC could next head for a fakeout before starting a recovery rally.

logindaten

bitcoin shows strength

It seems we have hit a short and medium term bottom.The market is slowly showing strength again in combination with a very important support line (Week EMA)The next hurdle will be between the 61 and 78 Fib. From there, the market will decide whether the sell-off will continue or, if necessary, new highs can be started.Personally, I think we will run sideways for a while before the market has made up its mind.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.