limitlessroh

@t_limitlessroh

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

limitlessroh

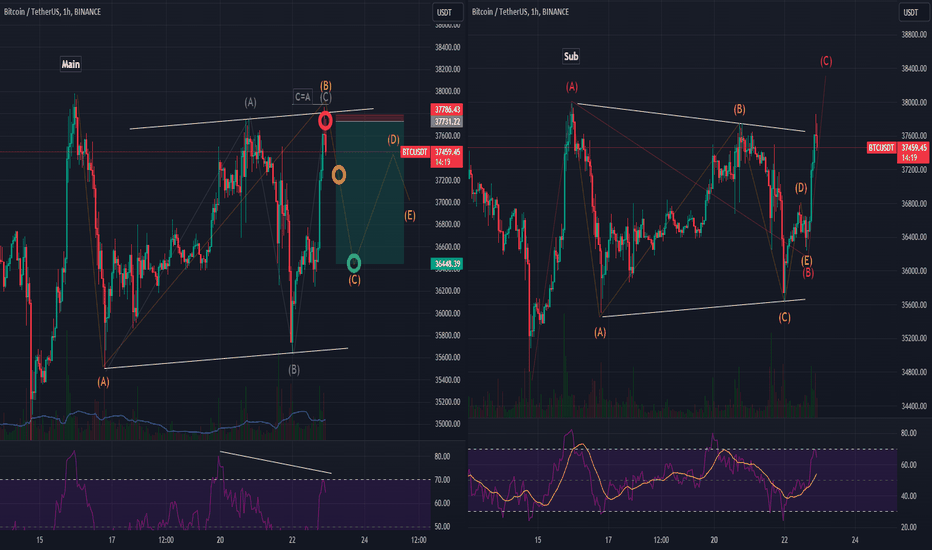

$BTC Short-term bearish (update: 01/06/2024)

Main Scenario - Double three-ing -Let's suppose 49-39k was an impulse. -After a retracement(Blue B), a falling wedge was observed as the first wave(green), meaning there will be more. -Despite a sharp drop(grey B), there was a strong bounce from 42k. The bounce had impulse characteristics. (Dark grey; Grey C) -This opens up a possibility of a flat wave. (Grey ABC; purple w) -Then, BTC failed to shape an impulse and formed a channel.(Purple x, left) -Then, it broke above Grey C. (Purple y) -So far, BTC is following the characteristics of Triple Three. -If it advances above purple y without falling below purple x(left one) but fails to break above (blue B), it finishes Triple Three, which is also wave 2. -What's left is a downward wave 3, the quickest and longest wave within an impulse. Sub Scenario - Trianle-ing -It is also possible that BTC is triangle-ing as a wave 4. -If it exceeds 43.8k, then current upward wave from 39k can be an impulse.(Yellow, left) -If it becomes an impulse, the next compelling scenario is a 5-3-5 advance, meaning it will have one more advance followed by a drop. (Orange) -Next, don't forget, we had an impulse wave from 49k to 39k. (Red A) -Soon the orange wave C finishes(Red B), a drop to 37k awaits. (Red C) TLTR: -Should BTC fail to exceed 43.8k, it opens up a possibility of a drop to at least 37k. -If BTC breaks above 43.8k(Orange A), I expect a retracement to at least 42k, then a break above Orange A, and then a drop to at least 37k.

limitlessroh

$BTC Short-term bearish

Main scenario -Anticipate a drop to 37k, making a 535 zig-zag pattern. -Previous wave from 49K-38.5K can be an impulse. -Suppose BTC is wave 4-ing, if the first wave within wave 4 is an impulse, it substantially raises the possibility of breaking the previous bottom. (aka. 5-3-5 zigzag). Sub scenario -If BTC penetrates below 37K, it raises the possibility of dropping to a minimum of 26K.

limitlessroh

$BTC Short-term Bullish(update 01/23/2024)

Main Anticipate one more drop below 39.5K, making a wedge pattern before BTC retraces to minimum 43K. Today 4h RSI dropped to a new low, raising potential movement to go down further. Looking through a wave lense, I see a potential impulse downward movement presenting suppose 41.7K level was truncated(pink) When a rapid movement such as wave 3, checking a line chart can be helpful to extract possible scenarios. In a line chart, 41.4K is not the bottom - 41.7K is. With that scenario, the current wave from the 49k top to now can be an impulse. Suppose 49K top to current downward movement is an impulse wave, and suppose BTC is in wave 4, it substantially raises the possibility of one scenario, the 5-3-5 WXY movement, meaning there will be more drop after a bounce up from now. Depending on wave B(blue), C bottom will be either 39K or 37K. Then, BTC will break above 49K to finish green wave 5. Sub Suppose BTC ends its current downward movement without the truncation scenario above, 39K will be the bottom of green wave 4, and BTC will break above 49K, but not too far from it.

limitlessroh

limitlessroh

$BTC current wave analysis (update 1/4/2024)

BTC current wave analysis (update 1/4/2024) -To complete an impulse from 15K, there must be at least three more ups and downs between 40K-48K to finish wave 1. -Because the wave from 32.5K cannot be counted as an impulse, I expect an ending diagonal. -32.5K is the starting point of the current ending diagonal because of the correction size between 35K-32.5K, which happened Oct 23rd. -To be an impulse wave, there should've been an impulse or a wedge between 35K-32.5K correction and the next bigger correction. -The next bigger correction was 38K-35K from Nov 9 to Nov 14. -The wave between 38K-35K correction and 35K-32.5K correction cannot be counted as an impulse. -This leads to the conclusion that the wave is wedge-ing. -Wedge B is always the biggest & fastest wave within the wedge. -My initial expectation was the pink wedge on the left chart. -The current -12% drop on Jan 3rd is the biggest correction so far since the 35K-32.5K correction, being eligible for Wedge B. -This correction(purple B) also bounced off at the Fib 0.618 level of 32.5K-45.9K(purple A) run. -I will trade based on this scenario as long as BTC doesn't break below 32.5K.

limitlessroh

$BTC Current wave breakdown

BTC Current wave breakdown -Speculating 48K to be a resist level, and 40K to be a support level. --Looking at the fib of the 65-15K correction, --Neither the 0.382 nor 0.5 range worked as a resistance level, making 0.618(48K) compelling to be the top of this wave. --48K is also the end of the thickest value area within 64-15K correction --Historically, BTC topped at Fib 0.618 level of a total bear market move twice out of three, in 2016 and 2019, before it had a substantial pullback. Only in 2013, it topped at 0.5. -The wave from $FWB:25K -current 45K is impulse-able if it makes 3-4 more tops with corrections in between. -If it finishes an impulse, there will be a big correction, minimum to 27K, then BTC is set to explode, entering a bull market for a new ATH. Sub scenario: ABC-ing or ended -It could drop from any now, or top at 50K without a correction. -At least drops to 26.7k. -Likely to triangle, double three, or triple three. (80%) -Potentially breaks 15k level. (20%) TLTR: BTC will be going sideways between 40k-48k for months. Suppose it makes 3-4 more tops from now, the future is bright. Less than three tops, not so much.

limitlessroh

$BTC Short-term Bearish

Main -Finishes a wedge with classic five higher highs. -Risk/Reward ratio: 3.5~20 Plan -If it breaks the upper trendline, take a loss, and watch till it makes sense. -50% profit at 37.9k. -If it keeps making higher highs, short with lower leverages, and hold until the trendline breaks. -Next 25% profit at 37k. -After 75% profit, there could be a flat wave, making a new high without touching 34.8k. If that's the case, close the position, then short at flat B. -Full profit at the 34.8k & switch. Sub 1. There could be a few more tops maintaining the wedge trendline. 2. Breaks current wedge trendline, and makes a new one.

limitlessroh

$BTC Short-term bearish

$BTC Short-term bearish This could be the last point of resistance. Fantastic Risk/Reward ratio. More wave analysis & breakdowns on my X: twitter.com/Hyunwoo_Roh

limitlessroh

$BTC Short-term bearish

BTC Short switching Reasons: - C=A, possible triangle B is finished. - Channel resist. - 1h, 5, divergence confirmed. - Risk/reward ratio: 23. Risks: - 15m oversold - possible to break 37.9k (Sub scenario) Plan: 1. Half profit at 37.3k. 2. Take a loss if it shoots up. 3. Switch 36.5k ish

limitlessroh

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.