lifestylemaniacsrt

@t_lifestylemaniacsrt

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

lifestylemaniacsrt

Bitcoin will have a local top in March, at ~17 weeks after the previous cycle top was broken by a weekly candle close (2.618 Fibonacci, ~150k), and the final top will be in September at ~47 weekly candles (halfway between 2.618 and 3.618 Fibonacci, ~180k). This is what happened in 2021, and similar to 2017.

lifestylemaniacsrt

Arbitrum price action based on crypto cycle theory and Fibonacci retracement

lifestylemaniacsrt

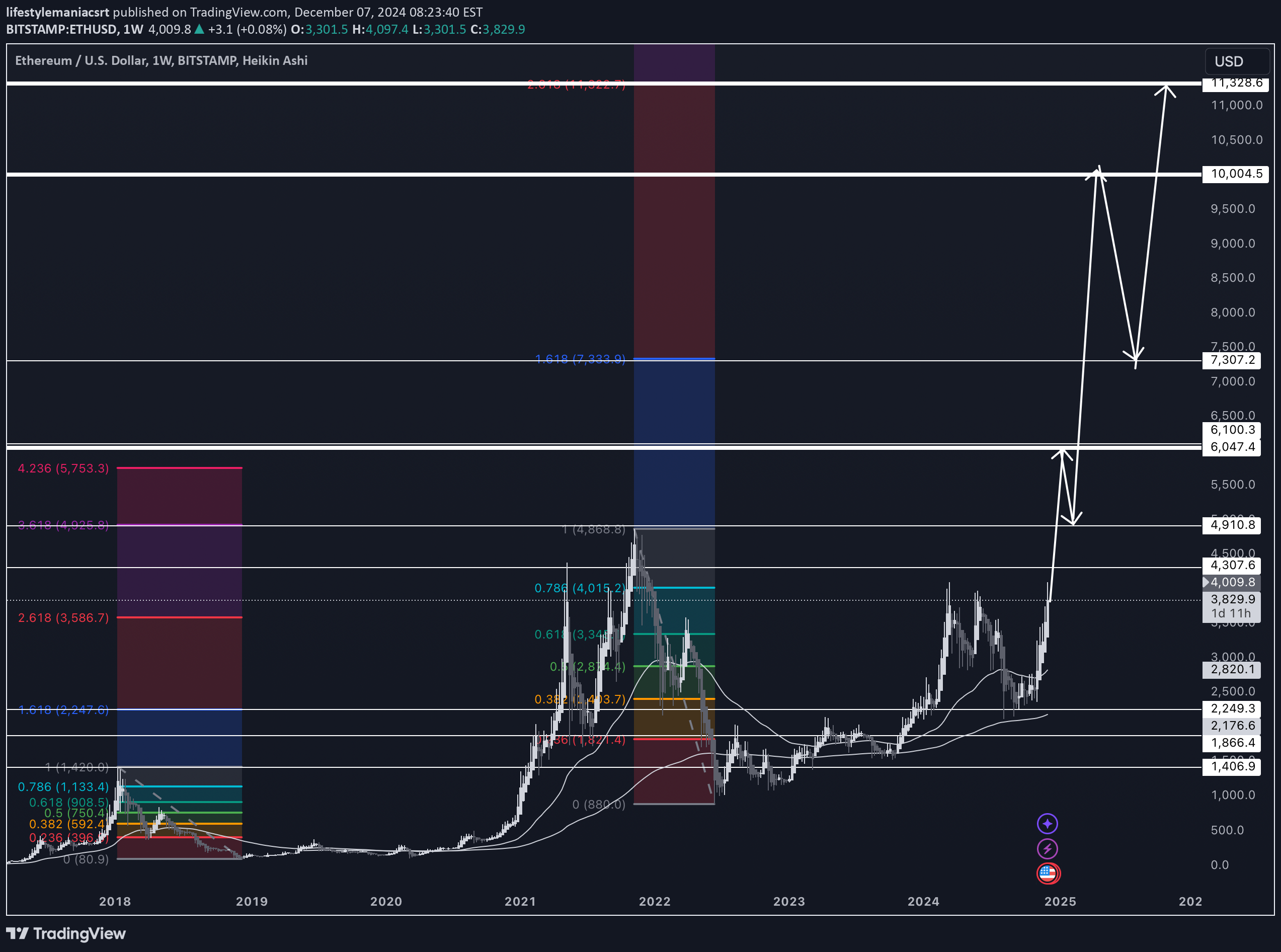

Ethereum is repeating the same price action it did in 2021, but fast with 1 month. It will go to the middle between Fibonacci 1 and 1.618 (~$6000), correct to Fibonacci 1 (~$4900) in the end of January or beginning of February. After this, it will go to, approximatively, the middle between 1.618 and 2.618 Fibonacci, which is $10.000, a big psychological level. This will happen in April. After this it will correct to the 1.618 Fibonacci level during summer and go to the final cycle high in October at 2.618 Fibonacci level (~$11.000-$12.000). The only difference is the previous cycle high was 3.618 and now it is at 2.618. This is because of the law of diminishing returns.

lifestylemaniacsrt

In 2021, Bitcoin had a correction in January when it hit the 2x (~$40.000) of the previous ATH (~$20.000), which was at around middle between 1.618 and 2.618 Fibonacci. After that it hit the final cycle top at $64.000 2.618 Fibonacci in April 2021. In 2024, the price action is faster with 1 month. It will reach ~$125.000 (middle of 1.618 and 2.618 Fibonacci) in the end of December or beginning of January and then drop to $100.000 again. After that, it will continue to 2.618 Fibonacci at ~$150.000 in March.The only difference is the previous cycle high was 3.618 and now it is at 2.618. This is because of the law of diminishing returns.

lifestylemaniacsrt

Results on XAUUSD using the Pineconnector Pepperstone Forex Strategy

lifestylemaniacsrt

Results on BTCUSD using the Pineconnector Pepperstone Forex Strategy

lifestylemaniacsrt

2019 - 2024 results on XAUSUSD using the Pineconnector Pepperstone Forex Strategy

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.