leongaban

@t_leongaban

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

leongaban

Following Colin Talks Crypto's BTC & Global M2 money supply. I'm using his script to generate global M2, in his version there is a 108 day - 86 day offset. Here with SPX I adjusted to between that range at 96 days. This sets up a strong outlook for SPX6900 going into the new few months.Note sure why the yellow M2 line didn't line up when first published

leongaban

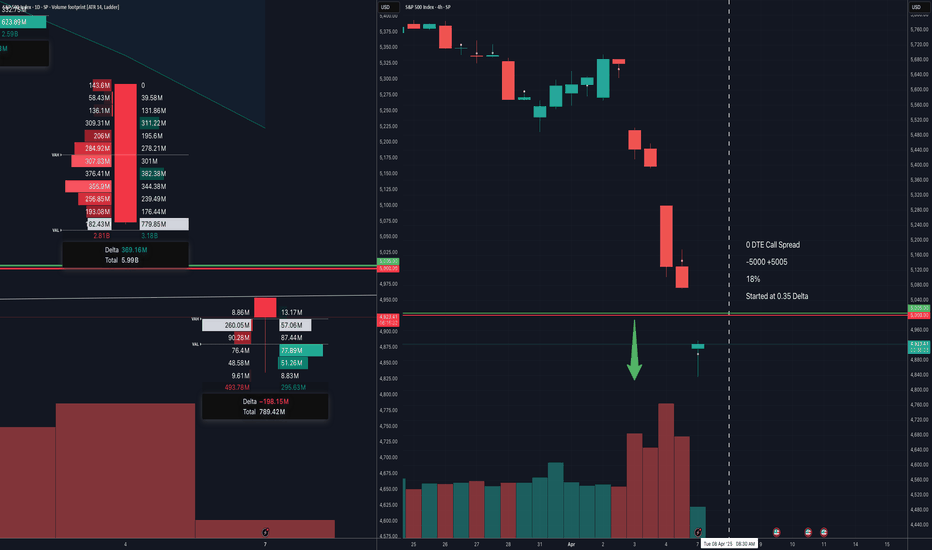

This may be my last super aggressive Call Spread on SPX, then will watch how the market plays out rest of this week. -5000 +5005 expires today, 18% Everything is off atm. Only options play this week, otherwise I'm a huge buyer of Crypto.Closed early! Insane jump, closed quick, lost 10%

leongaban

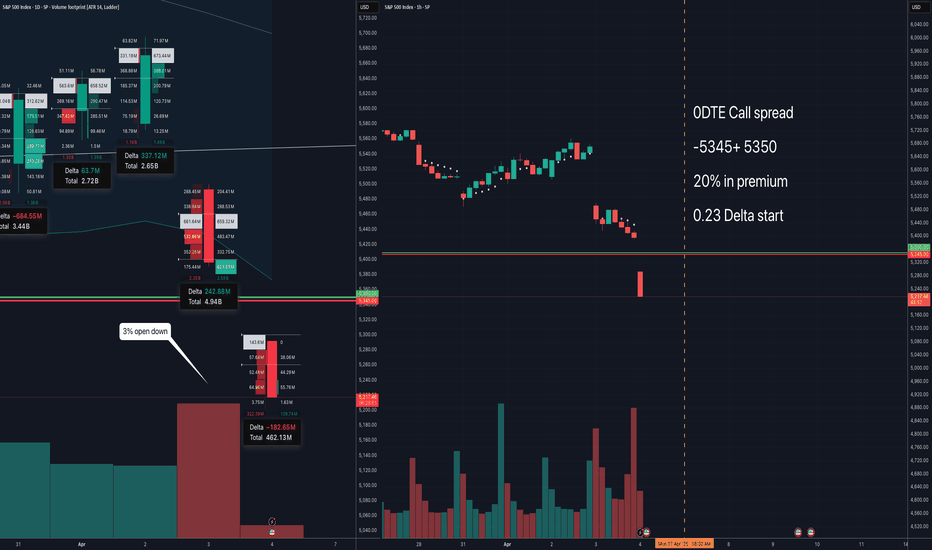

20% gain in premium on this one, pretty aggressive.... started at 0.23 -5345 +5350 0 DTE SPXClosed full profit, and GODDAMN SPX died :o I could have sold this Call Spread ITM and made hella more $ lol

leongaban

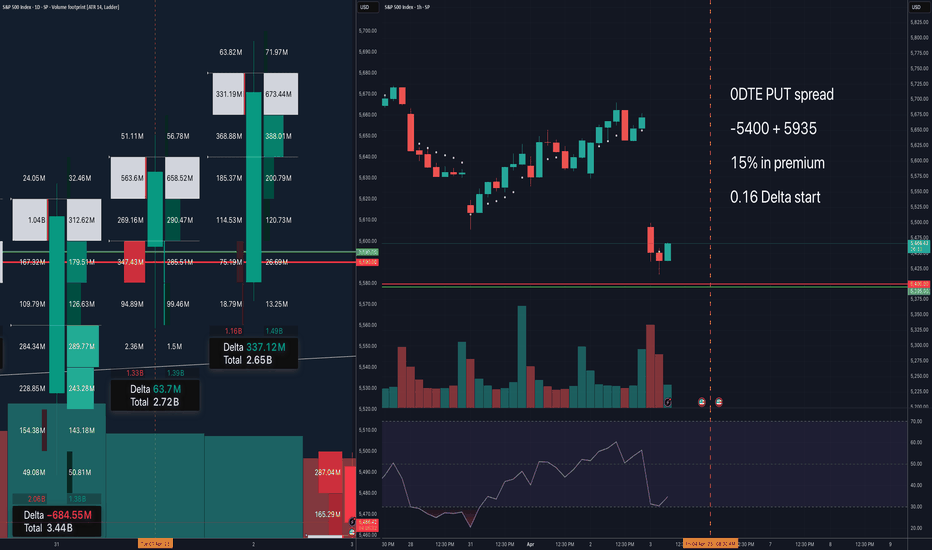

Playing the bounce / recovery on a big drop for SPX today, short term 0 DTE. -5400 +5395 15% gain in premium

leongaban

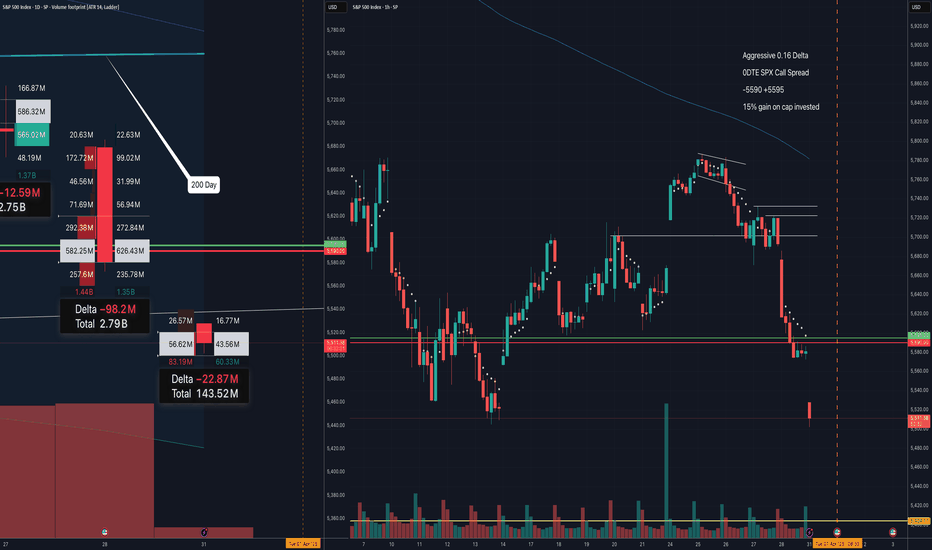

-5590 +5595 Normally I don't do Sell Side at such a high Delta, but SPX is crashing hard, technicals are hard to deny atm, taking advantage. Short term 0 DTE trade. 15% gain in premium.Closed early to lock in 4.5% gain :) Quick win, fast day trade - within 1 hour.Glad I closed this aggressive play out early today, as price has surprisingly bounced back hard.

leongaban

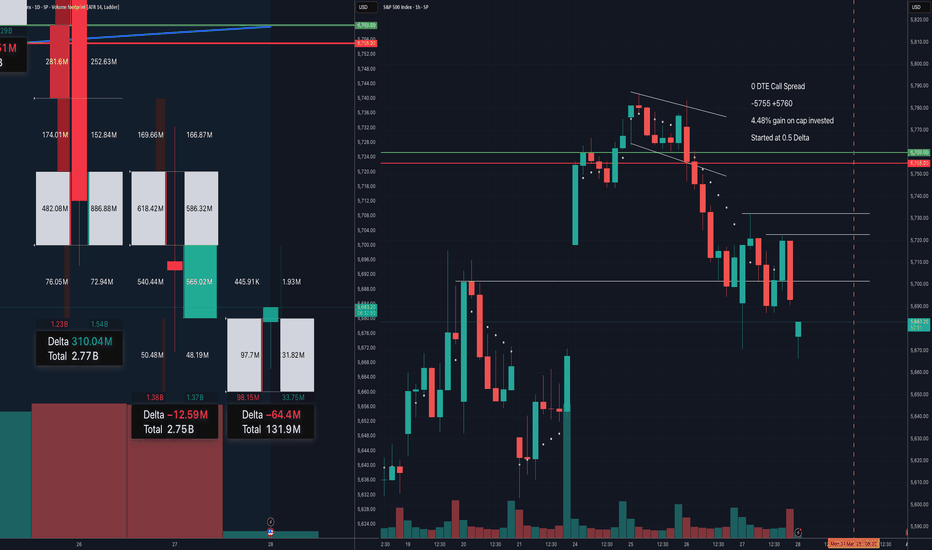

0 DTE Call Spread -5755 +5760 4.48% gain on cap invested Started at 0.5 DeltaTrade is wining hard, Delta is now 0

leongaban

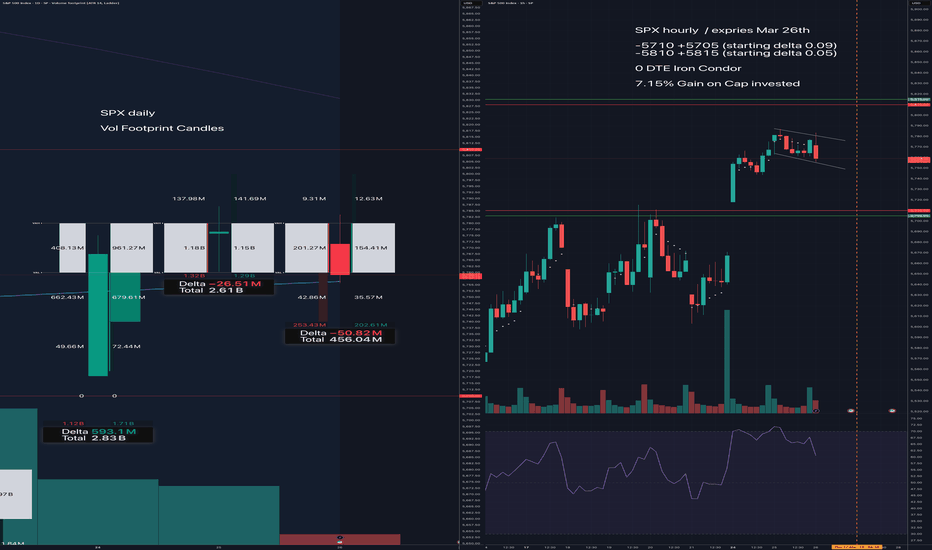

-5710 +5810 Wide 0 DTE, Dorian Trader style Iron Condor. 7.15% gain in premium on capital invested. I made sure that the short leg is below the gap up candle on the 24thPosition stopped out, alert triggered

leongaban

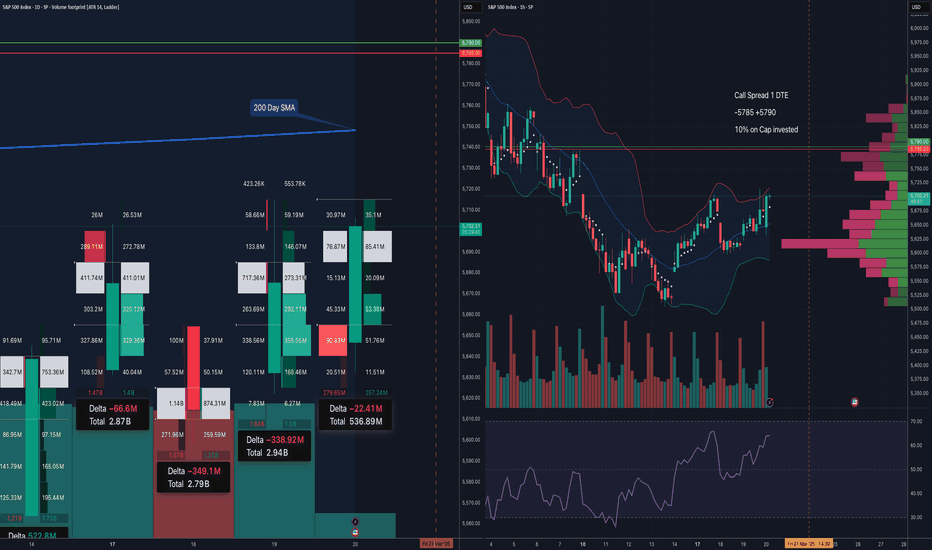

Another 1 DTE on SPX -5785 +5790 Started position on 0.12 delta, and making 10% on Premium (post fees) on cap invested. High confidence in target.Another winner, weekly profits on the Sell Side

leongaban

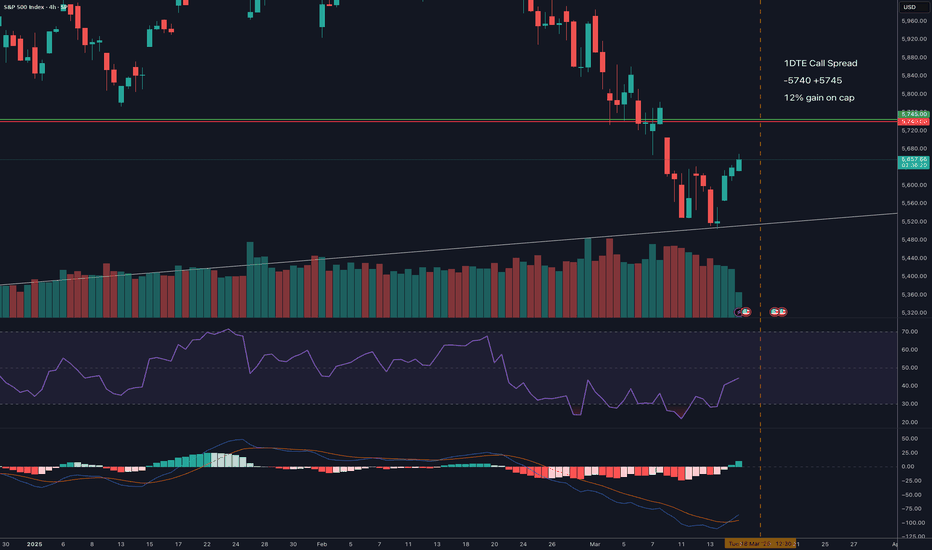

-5740 +5745 12.72% gain in premium on cap invested, expecting a bearish week, also first 1 DTE of 2025.Position was being threatened yesterday, but will end in full profit by EOD.Full win on this one, all 12.72% gain in premium Will wait till after the next JPowell talk before putting on a new trade

leongaban

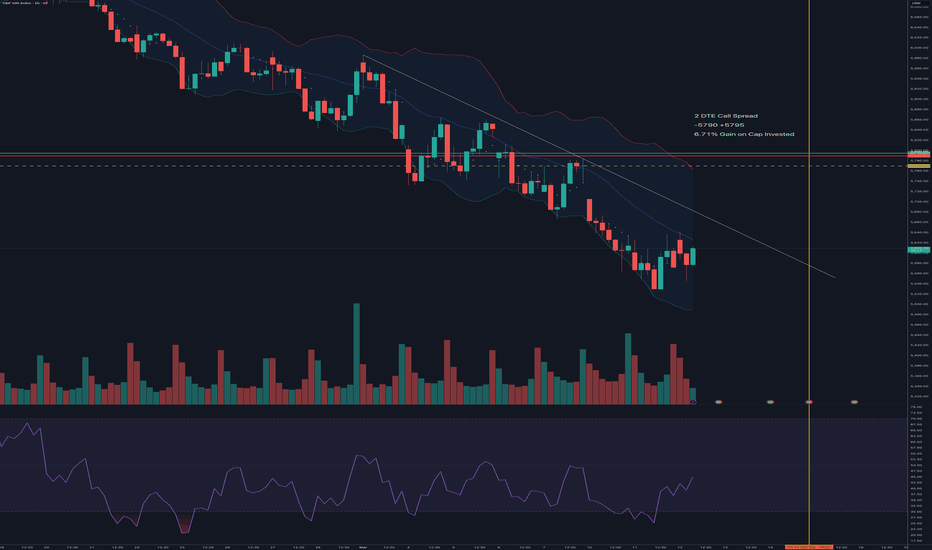

Won on the last 4 trades, 3 out of the 4 where bearish directional, with 1 Iron Condor. I think the markets are recovering, but the SPX is still weak... 2 DTE to finish out the week. -5790 +5795 for 6.71% post feesMy Trade will close today with full profit Note there is a bounce atm, but I expect more weakness, waiting for this bounce to start to form a lower high... then come back in for another bearish Sell Side trade. At least that is my posture atm, may change next week with more info.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.