larsnicog

@t_larsnicog

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

larsnicog

تحلیل جامع سولانا: آیا خرید در قیمت ۱۸۰ دلار منطقی است؟

As we can see, Solana is currently sitting at a resistance level and has managed to hold up well there. In addition, the uptrend has not been broken, since the candle closed back above the potential trend break. The long wicks we’ve seen across several cryptocurrencies occurred because many trading algorithms on crypto exchanges were not designed to handle such situations properly. These algorithms often compare prices, demand, and supply across different exchanges to determine fair pricing. For example, if $1 billion were to flow into Solana in a single day, it would have a much larger price impact than $100 million per day over ten days. That’s why traders should always wait for candle closures before making decisions. The recent crash was triggered by an announcement from Donald Trump, which wasn’t directly related to cryptocurrencies themselves. The broader uptrend remains intact and continues. Given the current uncertainty, prices are moving sideways. I would consider buying Solana around the $180 level or below, as that still represents a good entry price for this asset. If we soon see rate cuts and the U.S. dollar weakens further under Trump, more investors are likely to move into alternative assets such as cryptocurrencies and Solana remains one of the leading projects in that space.

larsnicog

آیا هنوز برای خرید اپل (AAPL) دیر نیست؟ تحلیل قیمت و زمان ورود بهینه

If we take a closer look, we can see that we could still enter around the $240–245 range and take profits at around $260. From a fundamental perspective, the numbers also look solid for the coming quarters. Although the fair value is estimated to be around $230 per share, we have to keep in mind that we’re talking about Apple — a company with high liquidity and strong cash flow. Therefore, a difference of around +$15 (at $245) is not a major concern. The recent drop was mainly caused by the announcement of new tariffs, which pushed the price down artificially. We expect the stock to reach around $260 within the next two weeks. There is also strong support in the lower box area.

larsnicog

We see greater potential in Algorand

We see greater potential in Algorand, but we can't say with certainty that it will rise during this bull run. I believe the projects behind Algorand have a strong impact and could trigger significant hype. We're approaching a breakout point that could lead to another move upward. If we break through the $0.47 level, we would turn bullish and could expect the beginning of a hype cycle.

larsnicog

Sign of a bullish trend

As we can see here, this could be a sign of a bullish trend. If the price rises to $1690, we will have broken through the resistance level, indicating a clear upward movement. We would initially set the take profit level at $1815. The news is also positive — Bitcoin has recently experienced a breakout as well.

larsnicog

Is gold currently in a bullish or bearish trend?

We’ve seen gold surge significantly during times of uncertainty. The problem is, when we look back at the 2008 financial crisis, we notice a similarly exponential rise, which was followed by a 45% correction after reaching its peak. Based on a current price of $3,400, a correction down to $1,800 is possible. This means it’s very realistic that gold could spike again sharply—especially if Powell ends up being fired—and then, once things start to calm down again, we could see a major correction of at least 45%.

larsnicog

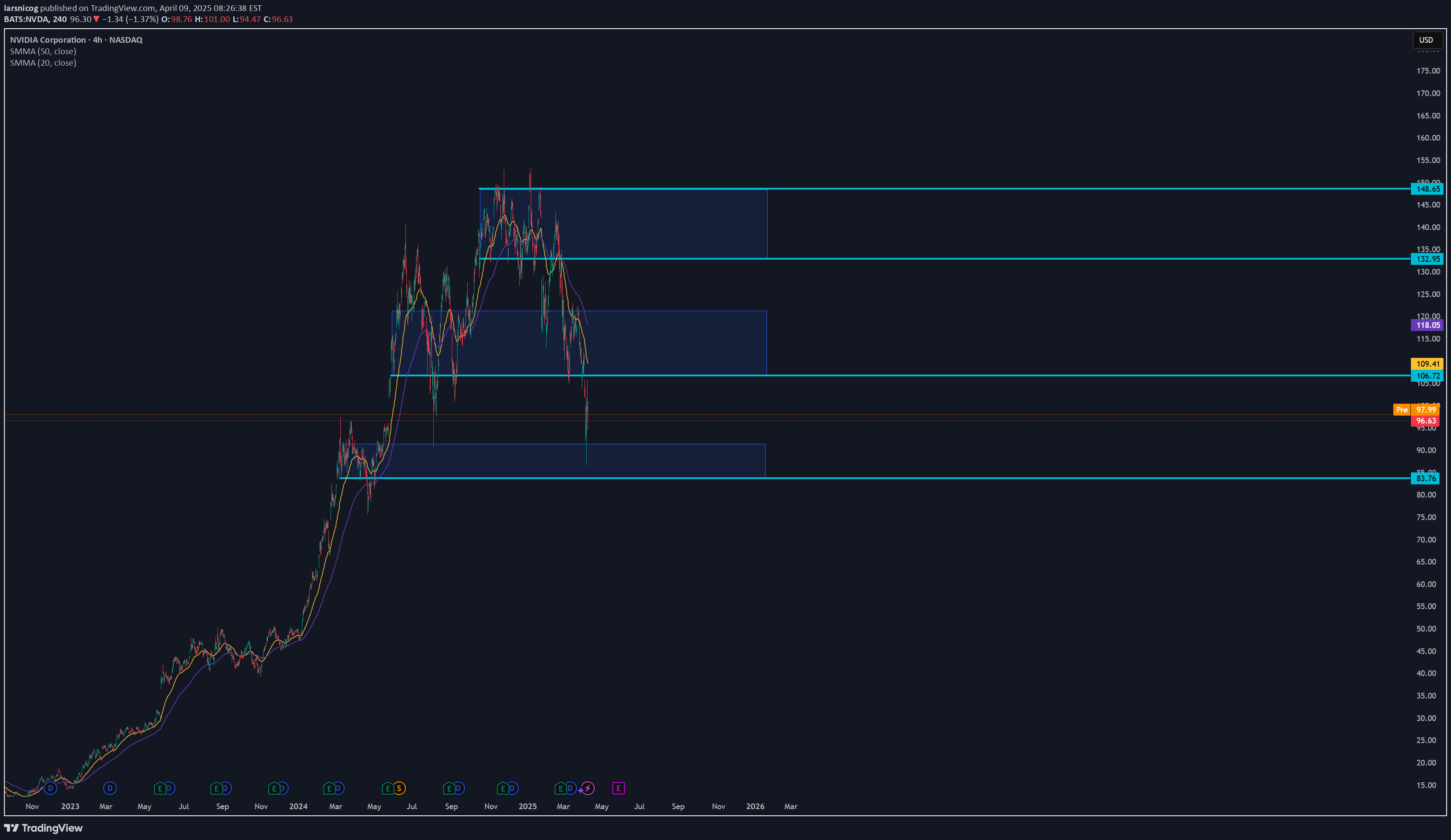

We're seeing a nice box breakout NVDA | Bullish?

We're seeing a nice box breakout here, which could indicate a good opportunity for a deeper correction. Therefore, we're setting the target at $91.5 and would continue moving lower until we see another box breakout in the opposite direction. Additionally, there is a major resistance level around the $91.5 zone, which will give us insight into how far NVDA's downtrend might go—or whether this could mark the turning point.

larsnicog

Solana has just made an upward move

Solana has just made an upward move due to liquidation levels. At the $140 level, we will most likely see a brief downtrend again, after which we will set the price target at $174. Based on historical data, this timing would also make sense, and it aligns with the liquidation levels from futures positions.

larsnicog

Ethereum has been highly volatile and is rapidly losing value.

Ethereum has been highly volatile and is rapidly losing value. This is not only due to actions taken by Trump but also because of the looming recession that many analysts are predicting. But will this recession truly materialize, and if so, will it also impact the crypto market?The recession is most likely to continue affecting traditional markets, especially financial firms. Tech companies have already suffered significantly and may face an additional decline of up to 20%. Ethereum will also be affected, as it is not classified as a digital currency but rather as an asset—primarily due to U.S. regulatory policies.This means Ethereum is tied to recessionary trends. Since the crypto market hasn't yet entered its own growth cycle, which is still expected to come, we may still see a short-term drop in price down to around $831. After that, our mid-term price targets are up to $2,460.

larsnicog

We’ve seen a solid correction in NVDA - Bullish?

We’ve seen a solid correction in NVDA following its rally since early 2024. The stock has broken through key levels and managed to hold within the resistance zone between $80 and $90. We will most likely enter a sideways movement until the situation regarding tariffs becomes clearer. This could extend into June, after which we might expect an upward move toward the $132.95 zone. By early 2026, we are likely to see a new all-time high, especially if the trade tensions and tariffs between China and the US are resolved and overall uncertainty decreases.

larsnicog

We see a very strong bullish signal for ETH. A limit order before the $2800 mark for a long position up to $3300 is a possible scenario. We had a breakout and were also able to confirm the sideways movements from previous price actions.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.