kush23456

@t_kush23456

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

kush23456

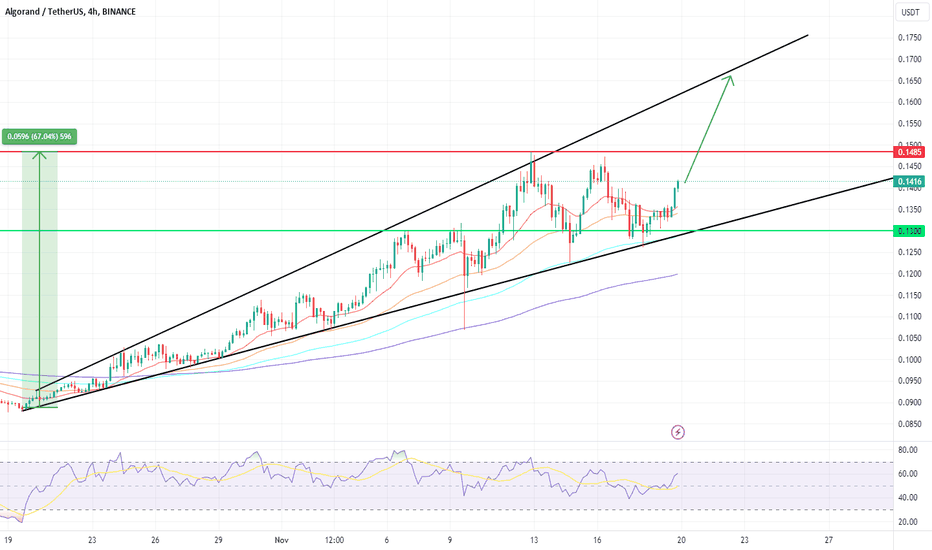

I'll Go To The Moon (ALGOUSDT)

ALGO has been trading in an ascending broadening wedge pattern since 19th October. In that time it has risen by ~67% and is once again trading above all EMA's. The market is shaky at the moment and any drops in BTC are causing bigger drops in alts, but any increase in BTC is not necessarily increasing alts much. In any case, despite the very recent downward pressure ALGO found support around $0.13 and is looking to push up to the top of the channel for a short-term 20% increase. In the mid-term, if a breakout of the channel occurs we can target the $0.20 range. If there is any major downward pressure, ALGO could fall considerably to $0.10, but that seems unlikely for now. It has been a while since ALGO has shown some strength, now that it has the explosion should be big. Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only. Please feel free to leave your comments and thoughts below!

kush23456

NEO - RELOADED

Since August 2023, NEO has had a strong run, as have many altcoins, growing ~141%. It is now trading above all EMA's and recently rebounded from the 20-day EMA as support. NEO was one of the first 'larger' altcoins to break out of the bearish to bullish phase a few weeks ago. Since then, it has attempted to break the resistance at ~$15 - $15.60, 3-5 times resulting in long wicks. Each time, the resistance won and short-term support was found with the strongest at ~$11.19. Provided BTC continues consolidating or growing, we can see NEO push even further, targeting the $20 area (67% gain). If this doesn't happen, we could see NEO continue consolidating in the value area between $11 - $14 or finding longer-term support around $9 before proceeding to try again. If it consolidates, NEO could move to the top of the value area in the short-term for a modest 16% gain. Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only. Please feel free to leave your comments and thoughts below!

kush23456

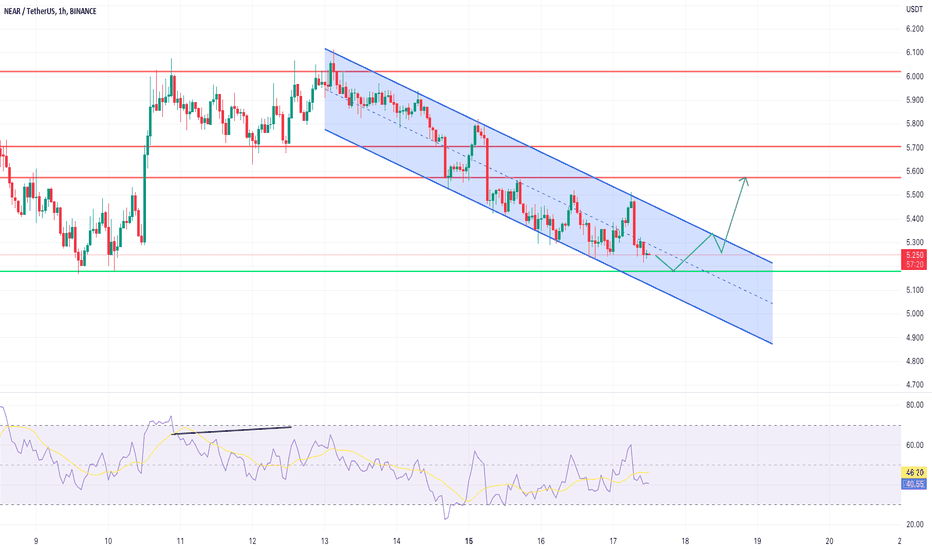

NEARing the bottom

Recently, I made an analysis on NEAR where it was trading within an ascending channel. It traded inside it for a short amount of time but eventually broke out of that channel and has been trading within the descending channel shown above. I expect that NEAR will continue to trade inside this channel for the short-term but is approaching a short-term support zone at ~5.17. If it holds, NEAR can push toward the upper bound of the descending channel. If the support does not hold, NEAR can continue trading downward in the channel until its next major support zone at ~4.57. As always, this is not financial advice and all information is for educational purposes only. Please feel free to leave any thoughts and comments below.

kush23456

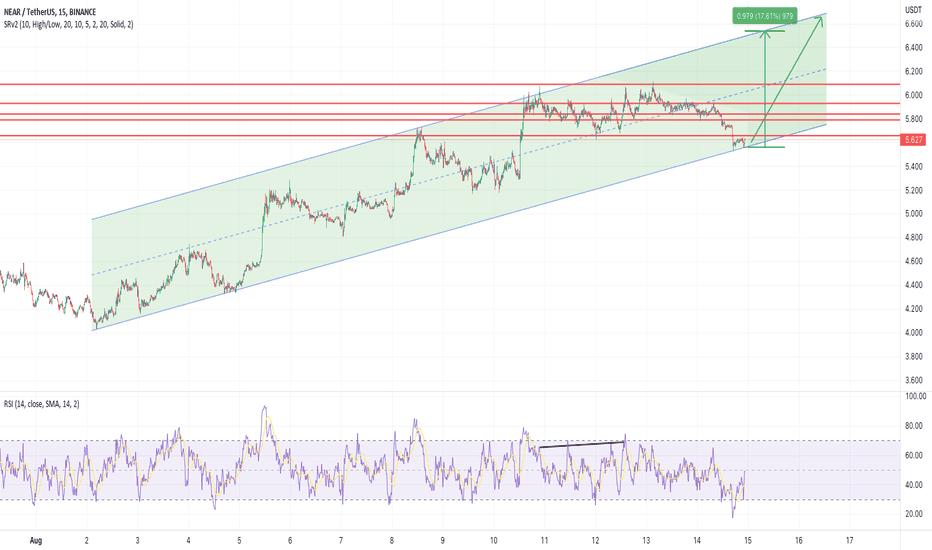

We're NEAR the edge

NEAR has been trading in this ascending channel since the beginning of August, pretty much like every other altcoin. However, NEAR sometimes detaches from BTC's usual movements so it is one that can make us profit and hold its support when others don't. From a TA perspective this ascending channel has held many times before and held once more today. As long as BTC keeps some stability and continues to stay within its short-term ascending channel without large moves downwards, NEAR can move toward the top of this channel for a ~15-17% profit. Of course, it is very important to remember in every altcoin analysis, that BTC is still in an overall downward channel on the weekly timeframe. A move downward can cause major volatility in the alts. https://www.tradingview.com/x/D7ePpPxn/ As usual, this is not financial advice and all ideas are for education purposes only. Always happy to hear more and learn about different perspectives so please feel free to leave any comments and thoughts below!We broke out of the channel Support levels are at: - Short term: ~5.2 and 4.88 - Long term: ~4.53 and 3.9 and 3.6

kush23456

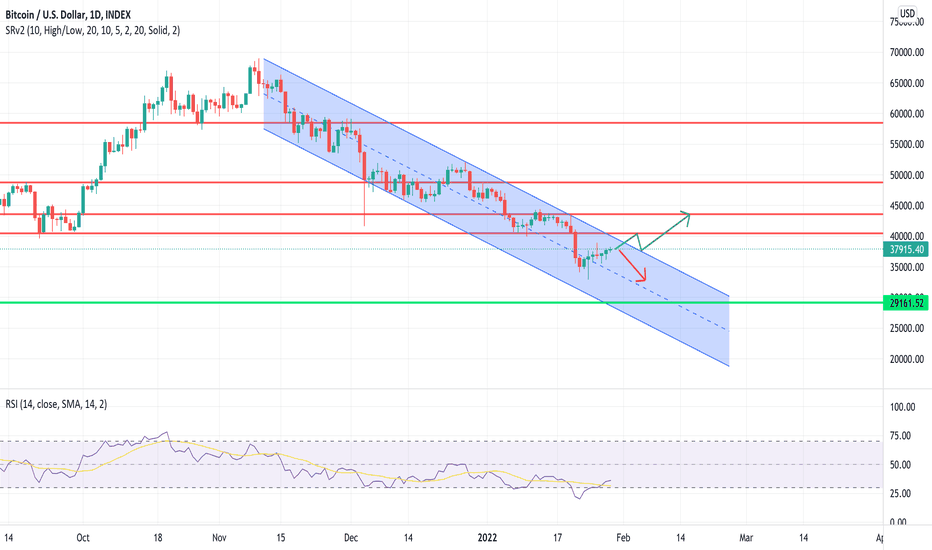

BTC - A simple idea

Hi all, it has been a short while since I have made a post. I haven't posted much altcoin analysis as sometimes it is better to be silent than to force an analysis where you don't truly believe it is useful or educational. To me, most channel ideas I could see were weak and drops in BTC meant they would be broken easily and indeed, this happened. Instead, I thought I would post a simple BTC analysis. There is a tonne of BTC analysis out there which is why I never thought there was a real need for me to post one. Some ideas use lots of indicators, some find similarities to historic movements in BTC (or even the stock market from years ago...hmm), some are pure HOPIUM but a few are useful and educational. Here, I have nothing fancy. A simple descending channel that BTC has been trading in since the top. We can look for a breakout as it reaches the top of the channel but it is likely we will be met with strong resistance and trade downward in the channel for a little longer. Macro factors affecting the stock market and cryptocurrency are in play so we must be cautious. Always happy to hear your thoughts! Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

kush23456

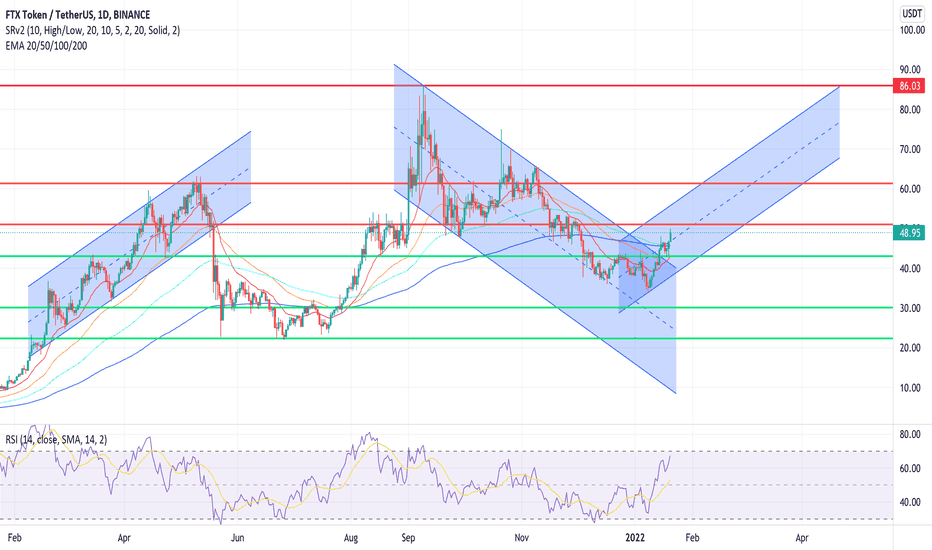

FTX, does history really repeat? (FTTUSDT)

FTT was trading in a descending channel since its ATH (~86) which it reached in September 2021. Recently, it has broken out of this channel and here we hypothesise an ascending channel. From analysing FTT’s previous pattern where it formed an ascending channel it seems that this could occur once again. This idea is that FTT will continue to trade in this channel for the near term. The initial resistances within the channel are at ~51 and ~61. If BTC continues to move up, FTT can flip these resistances into support. Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

kush23456

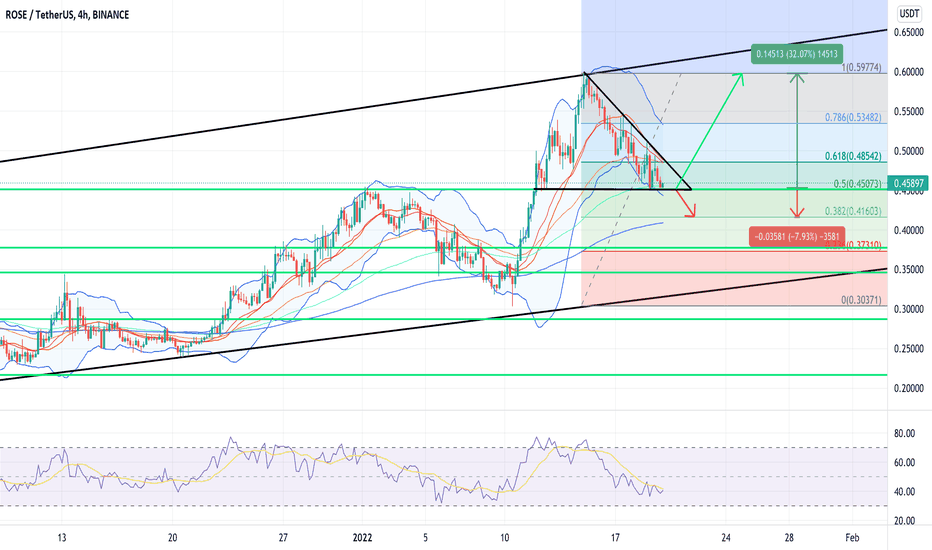

ROSEs are red...

ROSE is currently testing its 100-day EMA and ~0.455 level. It has also been trading within an ascending channel since December 2021 where it gained ~192%. Naturally, since its ATH it has faced a pullback to its 50% fib level. ROSE must now decide whether to fall further toward the 38.2 level, which is a common occurrence when BTC is weak, or it can gain momentum and re-test its higher fibs and ultimately its ATH. ROSE has a good risk: reward ratio. If BTC avoids a further fall below the 40k level, ROSE can move up. It is important to wait for confirmation of the trend before entering a trade. Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

kush23456

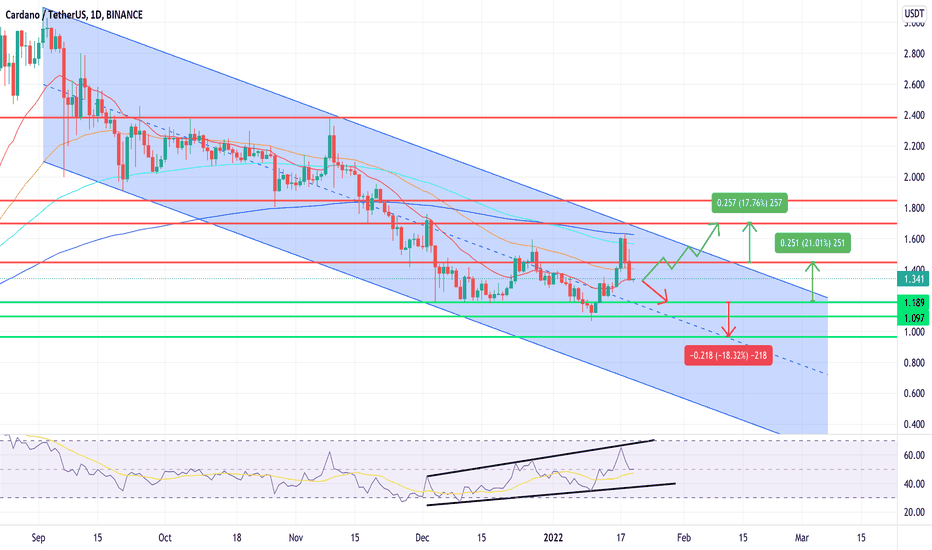

Dude, where's my CARDANO?

ADA has been making lower highs since September 2021 which has resulted in a descending channel. The fall was catalysed by the regulatory concerns which resulted in eToro delisting the former top 3 coin. Of course, news and fear strongly affect this infant market, thus the coin fell from its ATH by ~65% (to its recent low). To initiate a trade the supports and resistances are marked on the chart. At one point we wondered whether we would see ADA at $1 and we did. Will we see it again? There is very strong support just above the $1 level which would be a fantastic place to catch a bounce. Alternatively, we can catch a bounce at either of the other support levels. Trade carefully and with a good strategy! Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

kush23456

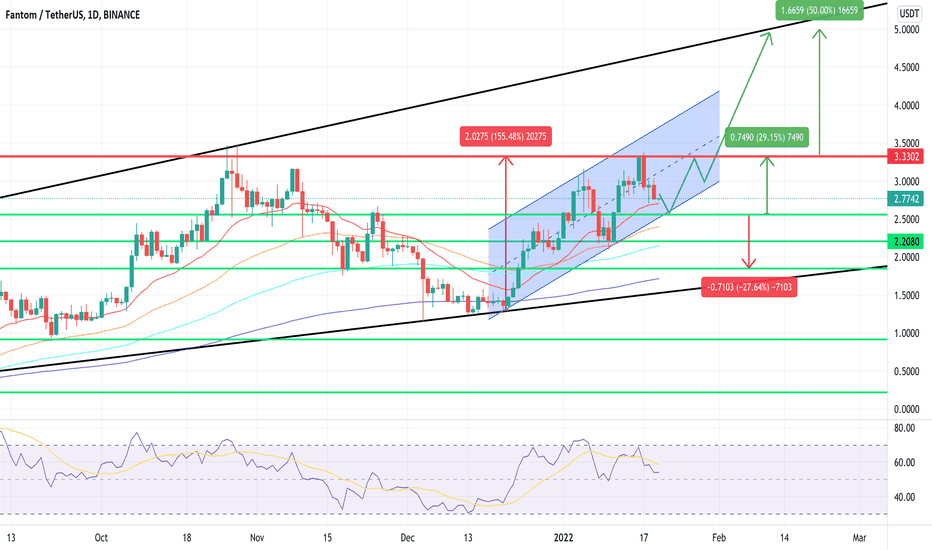

FANTOM of the Opera

FTM has performed very well since 21st Dec, gaining 155% to date. It is eye-opening when you realise how large the width of these channels are and the benefits of holding a coin for the long-term; especially those with good fundamentals. We can see FTM has long-term support (bottom black line), it is trading above all EMA’s and is currently using the 20-day EMA as support. FTM has attempted to breakout from its daily resistance at ~3.33 and faced pullback which may partly be due to the weakness in BTC. It is currently holding short-term support where it has previously seen long candle wicks. If it hits the short-term support at ~2.56 this could be a good area to look for buy setups for a re-test of ~3.33 resistance (29.15% gain). Alternatively, FTM could push toward the resistance from this point without further pullback and if that happens, there is a good chance that it flips the ~3.33 level to support. Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

kush23456

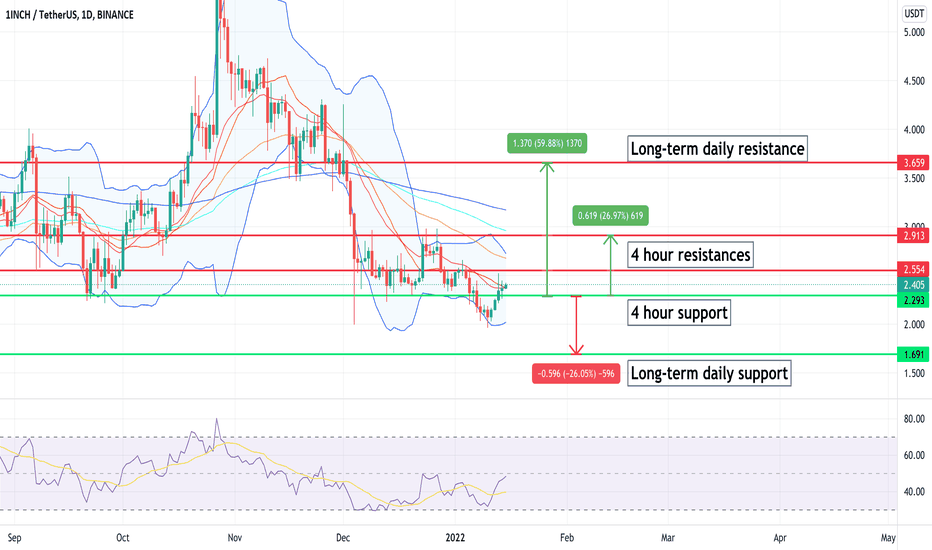

*Insert pun* - 1INCHUSDT (Long-term analysis)

1INCH has been trading near its support since December 2021 and looks ready to move up further. Over the past 4 days, it has had a change of trend and began to push toward short-term resistances. For ease, I have marked the daily (long-term) and 4-hour (shorter-term) supports and resistances with % changes. I hope you find this useful whether you are a holder who likes the project and is looking to accumulate or a trader. With it currently testing its 20-day EMA and looking good on other indicators, I think 1INCH can break its 4-hour resistances soon. Coupled with a more bullish recovery in BTC (i.e. push above ~45.6k) it can reach its daily resistance quickly. What are your thoughts? Please note I am not a financial advisor and this is not financial advice. All ideas are for educational purposes only :) Please feel free to leave your comments and thoughts below!

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.