jonah1111

@t_jonah1111

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

jonah1111

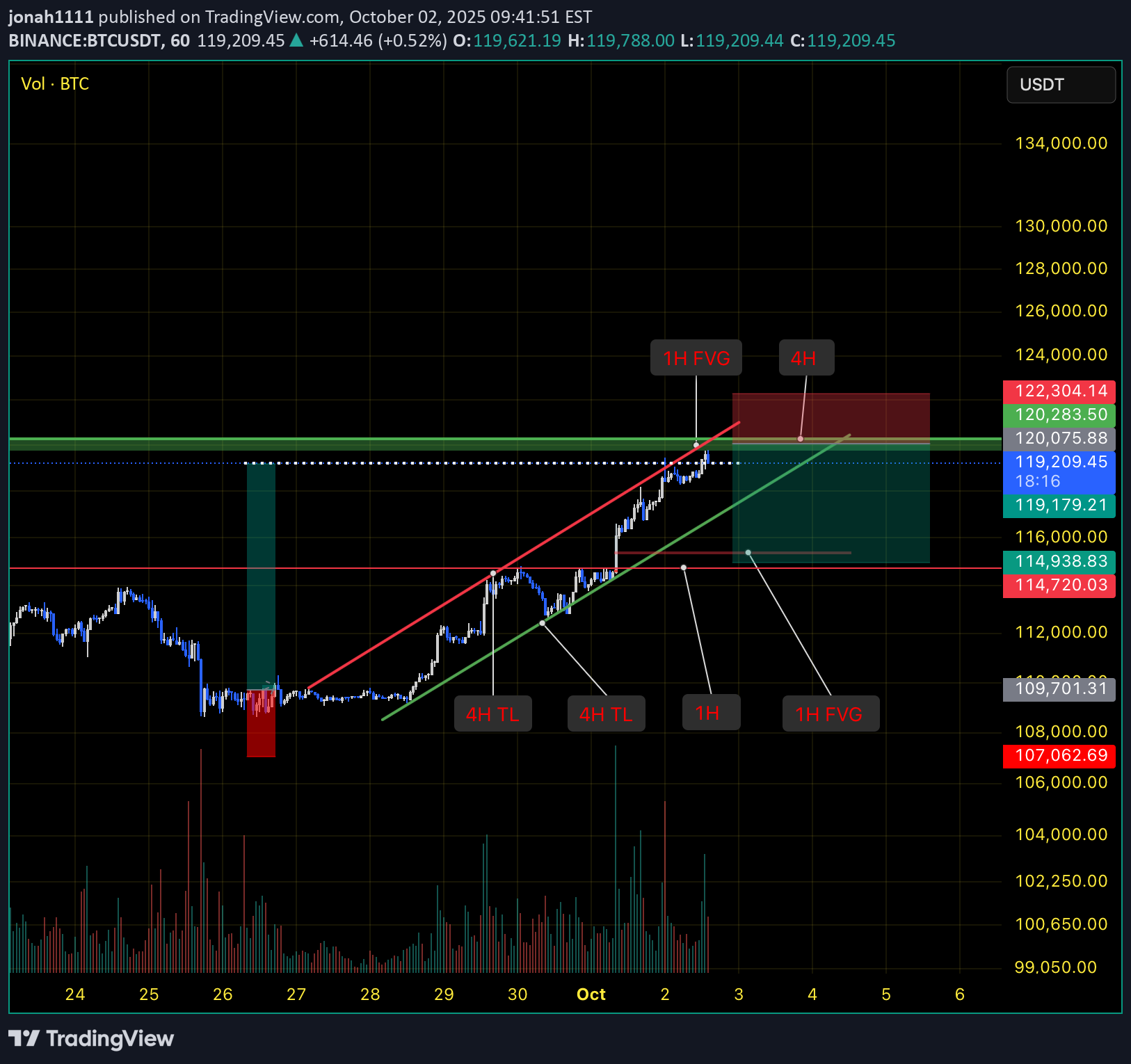

پیشبینی کوتاهمدت بیت کوین: آیا وقت فروش (Short) فرا رسیده است؟

First confluence is the 1H FVG, but the candle that created it had no real volume, which makes me see it as weak continuation and a potential rejection area. The 4H trendline has been respected multiple times but also broken enough that it’s losing strength, even though it hasn’t fully given way yet. There’s also an unfilled 1H bearish FVG that lines up as a clear downside target if structure starts breaking down. Both 1H trendlines are still trending upward, but if they give way, momentum flips quickly. Support on the 1H is the main level I’m watching once that fails, it opens up a deeper sweep into lower liquidity zones. Confluences •1H bearish FVG (unfilled) → downside target •1H support → break level •1H bullish FVG → rejection zone •4H TL → weakening •Deeper liquidity zone → lower target Bias: I’m short here. Watching for rejection off the 1H imbalance and targeting the unfilled bearish FVG and lower liquidity. A clean hold above structure would invalidate.

jonah1111

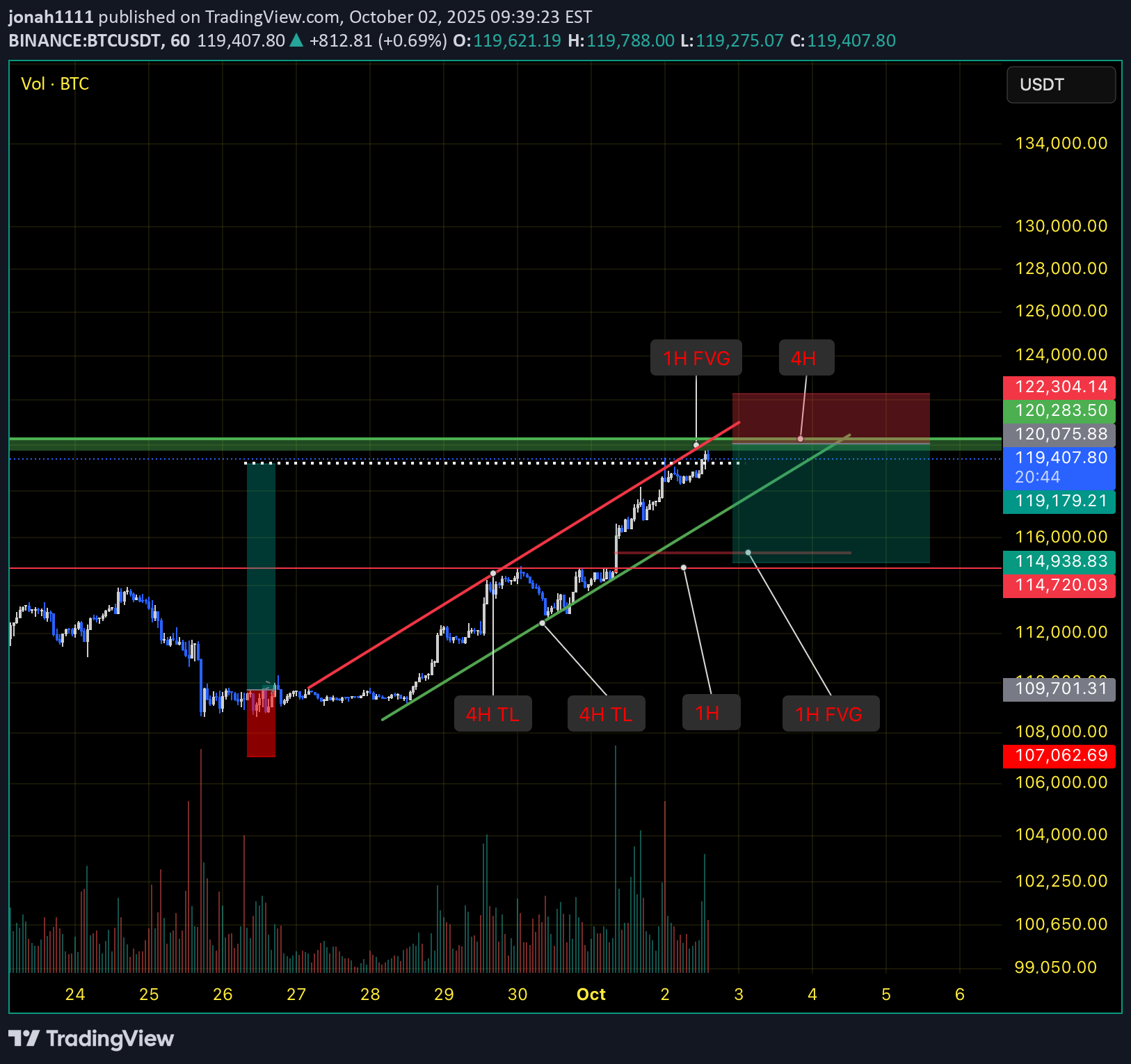

تحلیل کوتاه بیت کوین (BTC): فرصت شورت با هدفهای مشخص!

First confluence is the 1H FVG, but the candle that created it had no real volume, which makes me see it as weak continuation and a potential rejection area. The 4H trendline has been respected multiple times but also broken enough that it’s losing strength, even though it hasn’t fully given way yet. There’s also an unfilled 1H bearish FVG that lines up as a clear downside target if structure starts breaking down. Both 1H trendlines are still trending upward, but if they give way, momentum flips quickly. Support on the 1H is the main level I’m watching once that fails, it opens up a deeper sweep into lower liquidity zones. Confluences •1H bearish FVG unfilled → downside target •1H support → break level •1H bullish FVG → rejection zone •4H TL → weakening •Deeper liquidity zone → lower target Bias: I’m short here. Watching for rejection off the 1H imbalance and targeting the unfilled bearish FVG and lower liquidity. A clean hold above structure would invalidate.

jonah1111

BTC

Price is compressing between a 4H trendline and ascending support. We’ve tapped into the 1H FVG and holding structure above it, showing bullish intent.I’m watching for a break and retest of the 4H trendline, expecting a move into the 30M OB and 1H FVG above. Wave count suggests we’re in a local (2)-(3) leg, targeting continuation toward 111k area.

jonah1111

BTC

Price swept the highs and dumped straight into the FVG. Looks like a clean move for accumulation. I’m expecting a bounce back up to the sell zone where the move started.

jonah1111

Bitcoin is in a really interesting spot in the next few days

It will be fascinating to see how the market responds over the next few days, especially given the intense volatility Bitcoin has displayed recently. With the price correcting sharply from $103,679 to below $94,000 due to over-leveraged positions and cascading liquidations, traders and analysts are divided on whether this is a momentary pullback or a prelude to a deeper crash. A significant drop could present opportunities for long-term investors hoping to capitalize on lower prices and fuel the continuation of the broader rally.The anticipation is heightened as external factors like central bank policies and advancements in technology, such as quantum computing, add layers of complexity to Bitcoin’s trajectory. These macroeconomic and technical developments are creating mixed sentiment in the market, where every short-term dip could either signify a buying opportunity or herald further bearish trends. A major crash could recalibrate the market structure, providing a more solid foundation for a potential resurgence in the months ahead

jonah1111

Please criticise

Potential trade :)???????????? ???????????? ???????????? ????????????

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.