jdgpro64

@t_jdgpro64

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

jdgpro64

jdgpro64

آیا بیتکوین به ۱۱۰۰ دلار میرسد؟ تحلیل حرکت قیمت و پیشبینی ۲۰۲۶

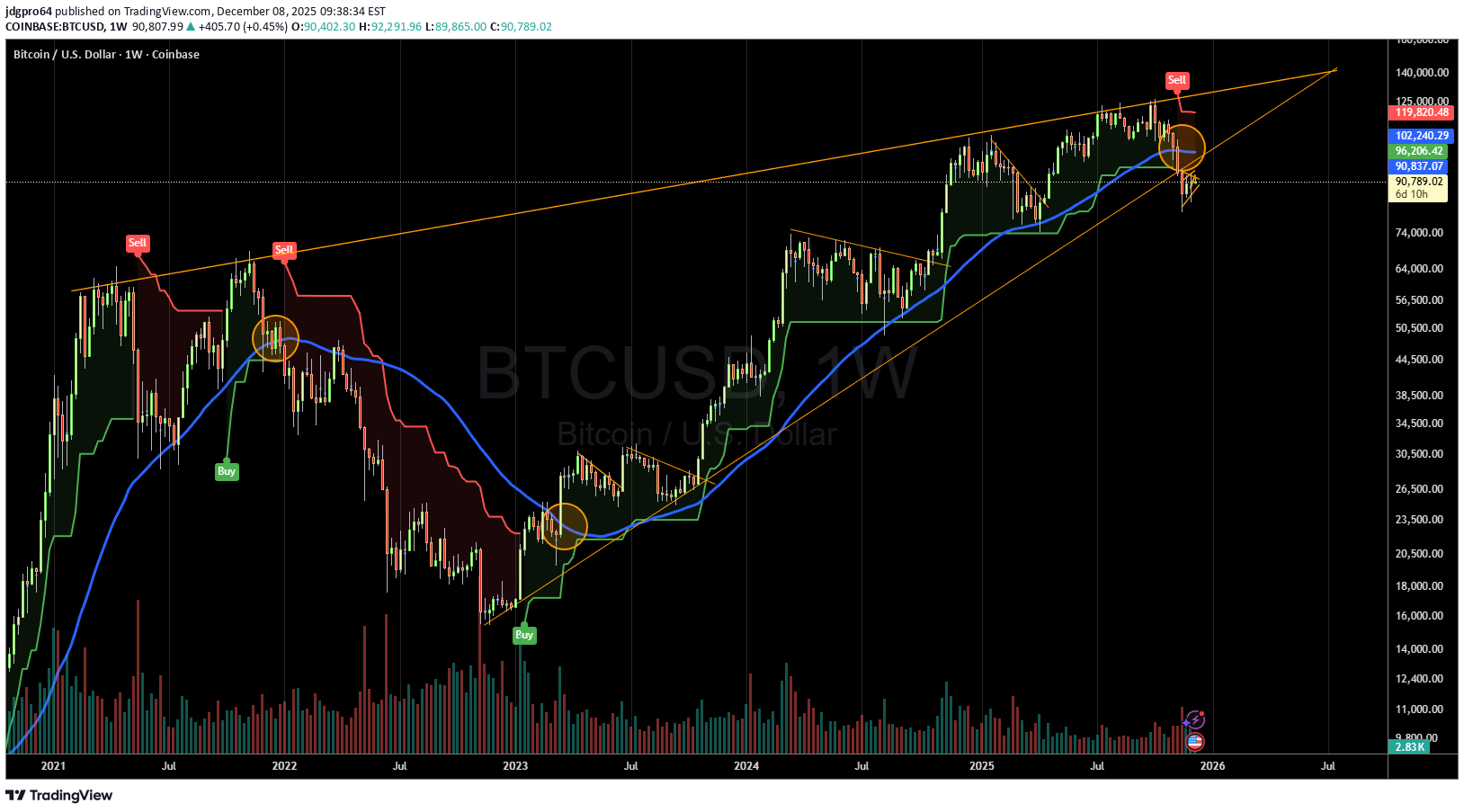

The price had broken the channel twice in almost three years. November 2024 say a break up and out and the price has currently broken down and out, but still within the bullish wedge. If the price were to break down and out of the wedge after breaking below the channel, that would likely trigger a a further decline in price. If the price climbs back into the channel and tracks a bitcoin breakout, the measured move is above $1,000 sometime in Q1/Q2 2026.

jdgpro64

سقوط بیتکوین به زیر ۱۰۲ هزار دلار: پایان بازار صعودی یا فرصت خرید؟

Measured move down and two weekly closes below the 50 SMA weekly at $102,300 would likely end the bull market, which seems more likely evry day.

jdgpro64

MSTR Near Breakout

The markets are red, but not MSTR. Bullish wedge could breakout within a week pointing to $450+. MACD and Bressert crossing up. Little bit of RSI bullish divergence showing up on the daily.

jdgpro64

Time for a Bounce?

This descending wedge seems to point to number go up soonSo BTC has broken out of the wedge. PT is $123K

jdgpro64

Two Measured Moves

Giant invert head and shoulders sending BTC to $300k with a short stop at $185K.

jdgpro64

The Path is Clear

The textbook head and shoulders broke out and back tested the neck line. Almost time for number go up

jdgpro64

Two For One Special

Two patterns have appeared1. Bull flag pointing to $160,0002. Head and Shoulders pattern with the $364,000 PTI would place probabilities of the bull flag PT at 85% and the H&S PT at 60%. NFA and GLTA

jdgpro64

Buckle Up Butter Cup

MSTR contrast with MS Global Liquidity advanced 55 days shows possible upside in May-June. Daily RSI bullish divergence seems to support.

jdgpro64

Could Be Bottoming!

Some bullish divergence is showing up on the 1 hour chart. If the bottom is in, then the divergence should start showing up on longer time frames. We shall see.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.