jalapablo

@t_jalapablo

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

jalapablo

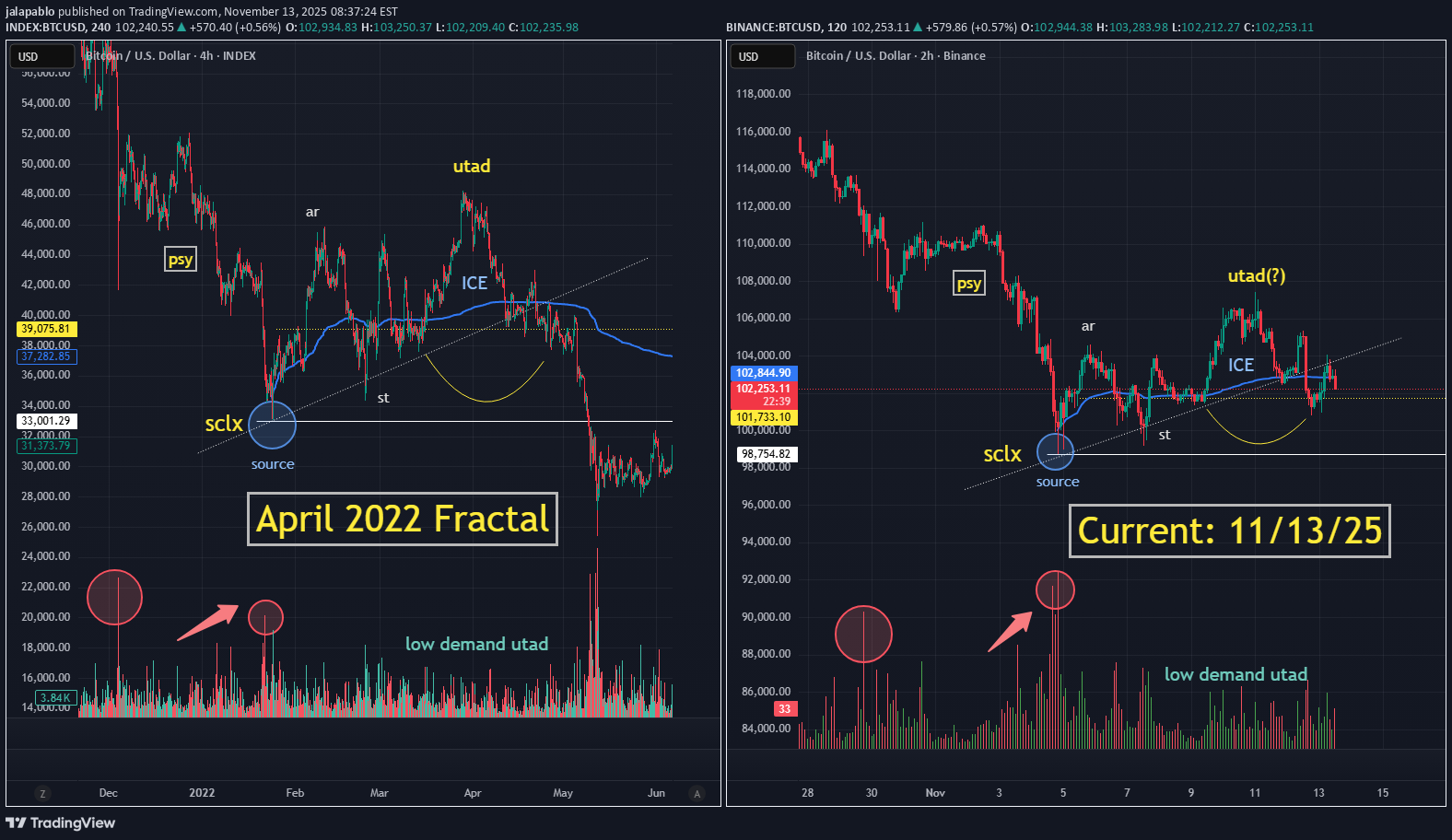

Bitcoin 4-Year Cycle Fractals

Play the 4/22 continuation bars to see what may be on the menu for us this year (2026). Both underneath the 200/400 SMAs and above the 200 weekly SMA.

jalapablo

تحلیل ساختاری بیت کوین: آیا قیمت سقوط میکند یا در این محدوده تثبیت میشود؟ (تحلیل 13 نوامبر)

Fractal Range Analysis for BTC (11/13/25): At ICE (AVWAP) & under microtrend support. Look for short consolidation in this area as buyers attempt to hold the ICE (102.8). If not, we are falling back to 99K for SCLX mitigation. See video for details.

jalapablo

قیمت ارز دیجیتال روز (ROSE): هدف بعدی کجاست؟ ورود احتمالی در این نقطه!

Throwing this one out there as a freebie because I'm in a generous mood today. Rose looks like it's reaccumulating along the 1.272 extension and due for another potential leg to the golden ratio. I took a preliminary entry at the purple line. It's nice to see some green fire amidst the sea of red engulfing the markets these past few days. Not financial advice.

jalapablo

BTC: Three Levels of Possible Distribution

The preliminary supply level has already been hit. Next in line is the 75K zone, an old minor re-accumulation area from last year's markup drive. Third takes us to a level we may at last find some reliable support: 65-70K. That's the area I'll most likely be stepping in. Not financial advice.Good luck, stay safe in the markets, Jala.Don't forget to subscribe!

jalapablo

This chart looks at the potential -- potential meaning I DO NOT have a crystal ball -- selloff of BTC due to the levied Trump tariffs taking effect today 2/1/25 upon Canada, Mexico & China. The timing of this event falls conspicuously in line with the wave playout from sub-cycle B 2021 before break of structure and the series of LPSYs and could necessitate the markdown needed to maintain the congruency between these two charts; thus far, they have been step-in-step. Not financial advice.

jalapablo

BTC's current distribution playing out in almost replicate fashion to 2021 sub-cycle B top. I expect the same general wave trajectory to keep play out, taking into account minor degrees of deviation. The deviation is in the scope of rallies and selloffs, but not in direction. I've been tracking the waves since mid-December and so far, everything has been forecastable. It's helped keep members from my group from FOMOing at key junctures where they would've been trapped going long. Subscribe and stay safe in the crypto markets!

jalapablo

APE Swing After FW Breakout

Ape Coin is looking to break north from the falling wedge after a failed supply volume test on narrowing spread. I'm riding it up the Fib extension ladder after a .596 preliminary entry point at 1K. This was too juicy to walk away from.

jalapablo

BTC's ETF Rollout: Comparing the PA with Gold's ETF in 2004

Comparing the aftermath of price action when Gold's ETF was first introduced in November of 2004 with today's Bitcoin -- otherwise known as Digital Gold -- and where we presently sit as we await the SEC's ruling. Will we go up or down? The million-dollar question -- literally. #btc #gold #cryptoNot financial advice (but you already knew that, right?)

jalapablo

Bitcoin: Horns of the Devil Beneath 48K. Wolfe Wave Bear Signal

Horns of the Devil emerged at the top of the rising wedge, at the 5-point in a Wolfe Wave pattern. This sign typically appears at the top of macro countertrends and signifies a potential liquidity grab as Market Makers sell the peak to rebuy at lower levels to double-bottom out and establish deep positions in preparation for macro bull reversals. In this case, according to WW theory, the target line from wave 1 to 4 is where the price is projected to fall from the 5-point -- to about 25K. Volume Analysis also shows a steady decrease in demand overall throughout the ascending wedge. This is a further bearish signal. Of course, this is BTC and anything is possible. I wouldn't buy at this point, however, as the current range on the 30 minute shows a typical Wyckoff distribution structure, with the current pullback from 45K resembling a classic UTAD after a series of meager upthrusts. Proceed with caution. * Not financial advice. #bitcoin #btc

jalapablo

BTC: RW Failures to Rally & Supply Predomination

BTC is not doing too well beneath the RW. Demand is low, supply predominates, and the PA seems to be seeking to mitigate the prior low of the secondary test in phase b. And this is all happening as the DXY continues to rally. I'm expecting at some point a retest of the low, at least to TR support. A deep shakeout can take us even lower before we see any macro reversals. Let's see how it all plays out. Be sure to LIKE and SUBSCRIBE if charts like these are beneficial to you.Stop getting smashed and start winning in crypto. My charts will teach you how! If you like big wins and big money, be sure to SUBSCRIBE to this channel. Here's why: I track all USD-paired cryptocurrencies on all the major CEXs and seek out the most lucrative swing trades. All my charts are clean and easy-to-follow with exceptional win rates ranging consistently between 80-85%. Check out my chart history and see for yourself.I've been a full-time cryptocurrency swing trader and investor since 2017. My technical analysis is based on a combination of Wyckoff, VSA, EWT & Fibonacci ratios. I never shill and only chart crypto assets I invest my own money in. My success over the years has allowed me to do this full-time. You are welcome to piggy-back my strategies at your own risk.**Not a financial advisor. Always DYOR and trade at your own risk.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.