im0mostafa

@t_im0mostafa

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

im0mostafa

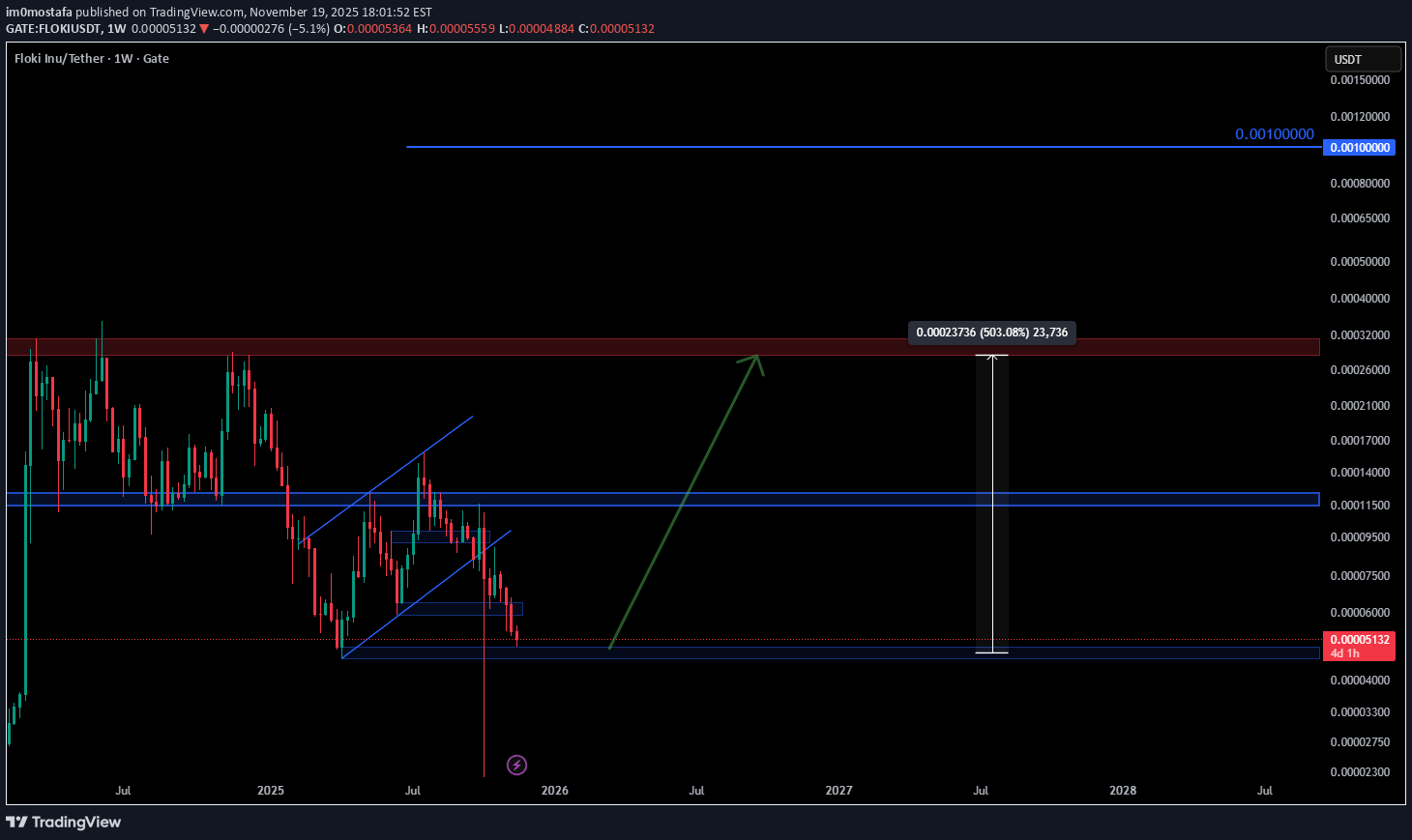

خرید فوری فلوکی: آیا اکنون بهترین زمان برای سرمایهگذاری است؟

I will buy FLOKI now, it is the best price now to buy

im0mostafa

خرید بیت کوین همین حالا: فرصت طلایی در حمایت هفتگی و هدفهای نجومی تا ۱ میلیون دلار!

Bitcoin is currently testing a major weekly support zone which forms the first strong buy area (Buy 1). If this support is broken, a second strong buy zone (Buy 2). A lower-probability scenario is a deeper correction toward (Buy 3), which is a major long-term support. Summary: Bitcoin is currently in a strong buying zone on weekly support, with medium-term upside targets extending toward 150,000$ and possibly 200,000$ and more to 1M (Why not)

im0mostafa

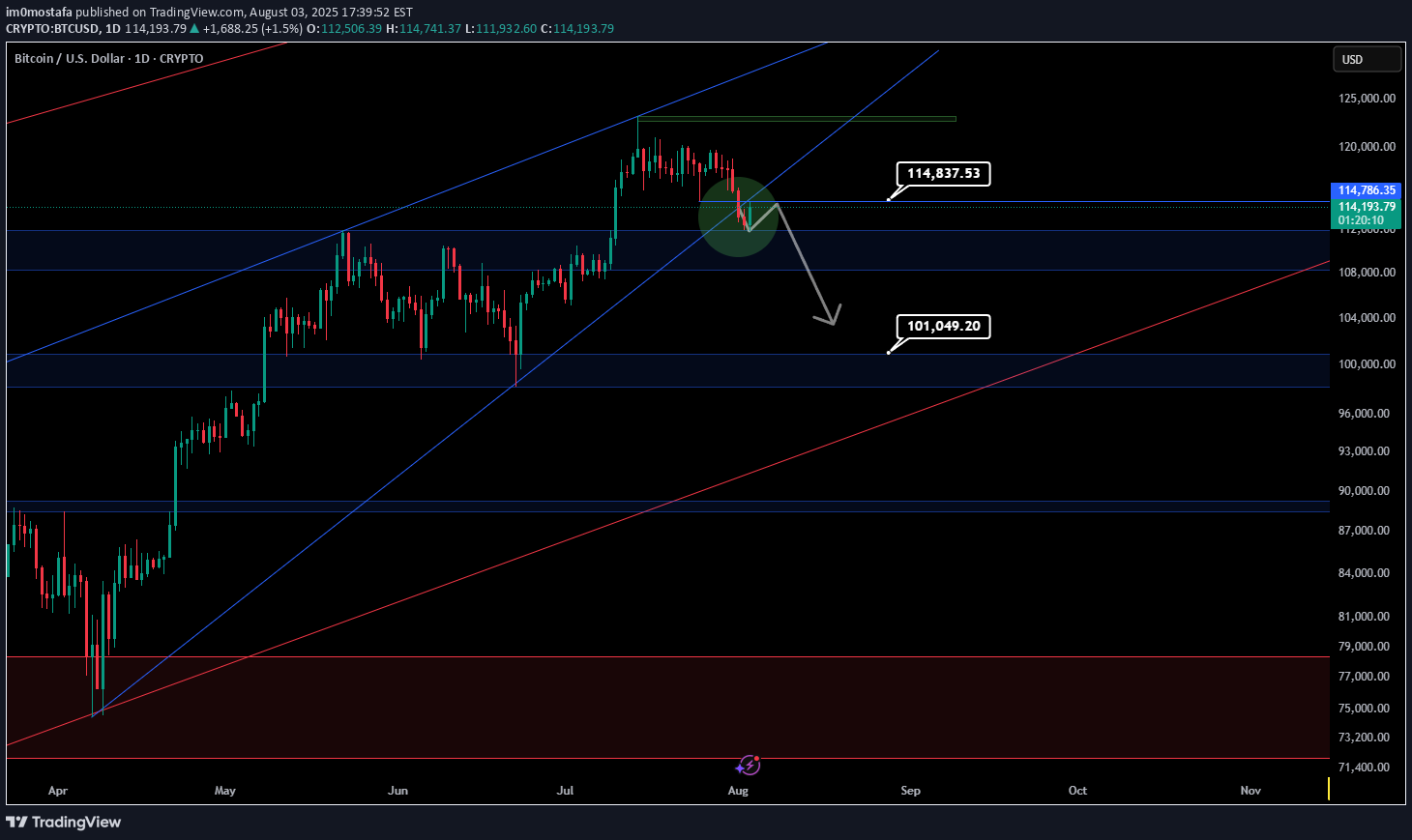

BTC TO 100k

Break daily Trend and retest it, so the next step going to 100k

im0mostafa

Bitcoin to 130k

BTC is still moving inside the falling wedge. A bounce from the lower boundary could trigger a breakout and push price toward $130,000 in the coming weeks.

im0mostafa

Bitcoin to 126k

BTC trying to broke out of the falling channel, the next target is $126000

im0mostafa

Ethereum to 15K ? or fall to 500$ !!

📊 Ethereum – Long range outlook If the price manages to break the red resistance zone above and hold above it, the path will be poised to reach the main target at $15,000, as shown by the rising arrows. If it fails, it has another opportunity to regroup buyers from the resistance at $2,228, with a very important trend that will support the upward move. If the price fails to break the rebound from $2,227, closes this area ($2,227), and then breaks the weekly trend, we expect a sharp drop to $1,408 and even $500 in the long term. Main Target : 15,000$

im0mostafa

BITCOIN FALL TO 78K ! OR GOING TO 170K ?

📊 Bitcoin Possible Scenarios (BTC/USDT Analysis) 🟢 Green Scenario (Immediate Bullish Breakout): If the price breaks above the $120,000 resistance without any significant pullback, this would signal strong bullish continuation. It suggests buyer dominance and could lead to a fast move toward higher levels. 🟡 Yellow Scenario (Bullish Correction): If BTC fails to break $120,000, we may see a drop toward $112,000. If this level breaks, price could head down to $100,000 to collect liquidity and attract buyers. From there, a strong rebound is likely, restoring bullish momentum (with weekly trendline support) 🔴 Red Scenario (Bearish Reversal): If price breaks clearly below $100,000, especially with a violation of the weekly trendline, this could trigger a deeper correction toward the $78,000 – $74,000 zone. This scenario would mark a potential shift in long-term market structure. Main Target : 170,000

im0mostafa

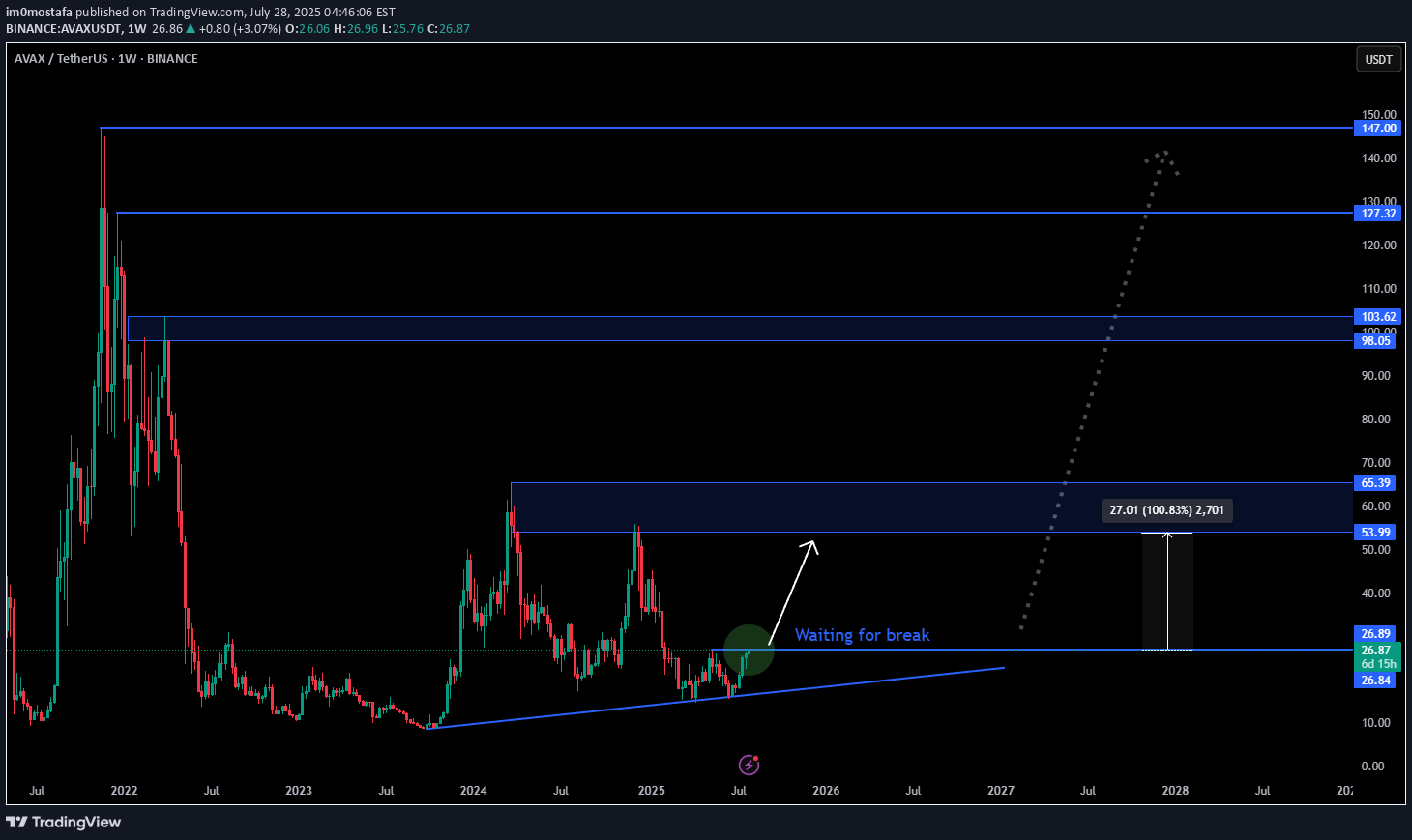

AVAX Massive Move Coming!

Price is at a strong bottom — one of the best buying zones. Just need a break above $27 to confirm the move.

im0mostafa

BNB easy to 1000$

BNB has clearly broken above a key resistance zone between $793 and $820. The weekly close above this level is a strong bullish signal. ✅ If price holds above this area, the path toward $1000 becomes technically easy and highly likely, supported by a steady long-term uptrend. 📌 Summary: Holding above $820 could lead BNB directly to $1000, with a possible retest acting as confirmation.

im0mostafa

Big Move soon for Arbitrum (ARB) !, EASY 100%

On the weekly chart, ARB is facing a clear long-term downtrend line. Currently, price is approaching a very important weekly resistance zone around $0.5, which has been tested multiple times. ✅ A confirmed breakout and retest above $0.5 could open the way for higher targets like 1.2$ and more ... 📌 Summary: Bullish scenario only valid after a clean breakout and successful retest

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.