icenevermelts

@t_icenevermelts

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

icenevermelts

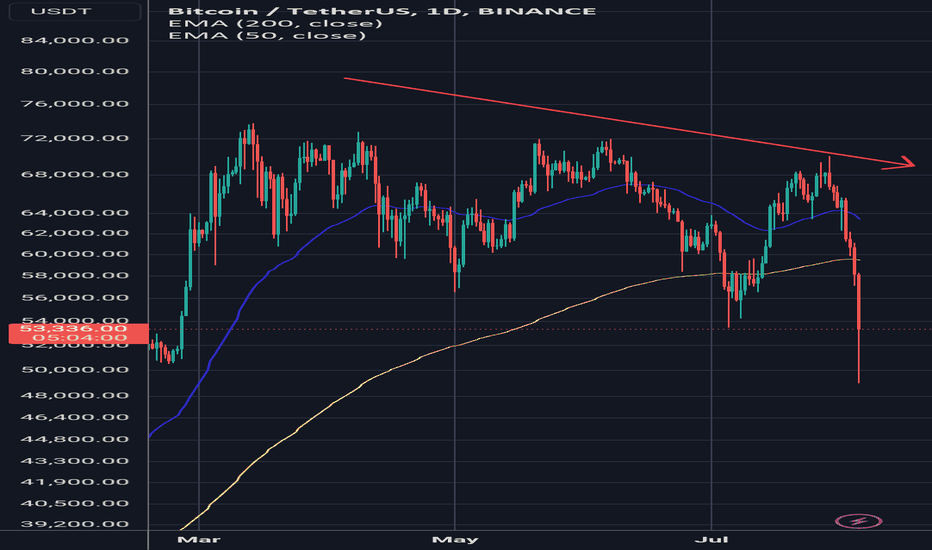

Technical Analysis: The Bitcoin (BTC/USDT) chart on the Binance exchange (H1 timeframe) exhibits a clear bearish trend. This is evident from the following: * Lower highs and lower lows: The price has been consistently making lower peaks and troughs, forming a descending channel. * Breakdown below EMAs: The price has broken below both the 50-day EMA (red line) and the 200-day EMA (blue line), which are now acting as resistance. * Bearish engulfing candle: The formation of a bearish engulfing candlestick pattern further confirms the downward momentum. * High volume: The increased volume during the recent downward move suggests strong selling pressure. Fundamental Analysis: Several fundamental factors contribute to the current bearish sentiment surrounding Bitcoin: * Regulatory concerns: Increased regulatory scrutiny and potential restrictions on cryptocurrencies in various countries create uncertainty and fear among investors. * Macroeconomic factors: Rising interest rates and a stronger US dollar are making riskier assets like Bitcoin less attractive. * Market sentiment: The recent decline in Bitcoin's price has triggered a wave of negative sentiment, leading to further selling pressure. Trading Signal: Based on the technical and fundamental analysis, the short-term outlook for Bitcoin is bearish. Sell: Enter a short position at the current market price (54,652.3 USDT) or wait for a retest of the broken support level (around 56,177.2 USDT) for a better entry. Stop Loss: Place a stop-loss order above the recent swing high (around 59,569.2 USDT). Take Profit 1: Target the next support level (around 53,408.7 USDT). Take Profit 2: Consider a further target at 51,639.2 USDT if the downtrend continues.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.