humorousHunter37388

@t_humorousHunter37388

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

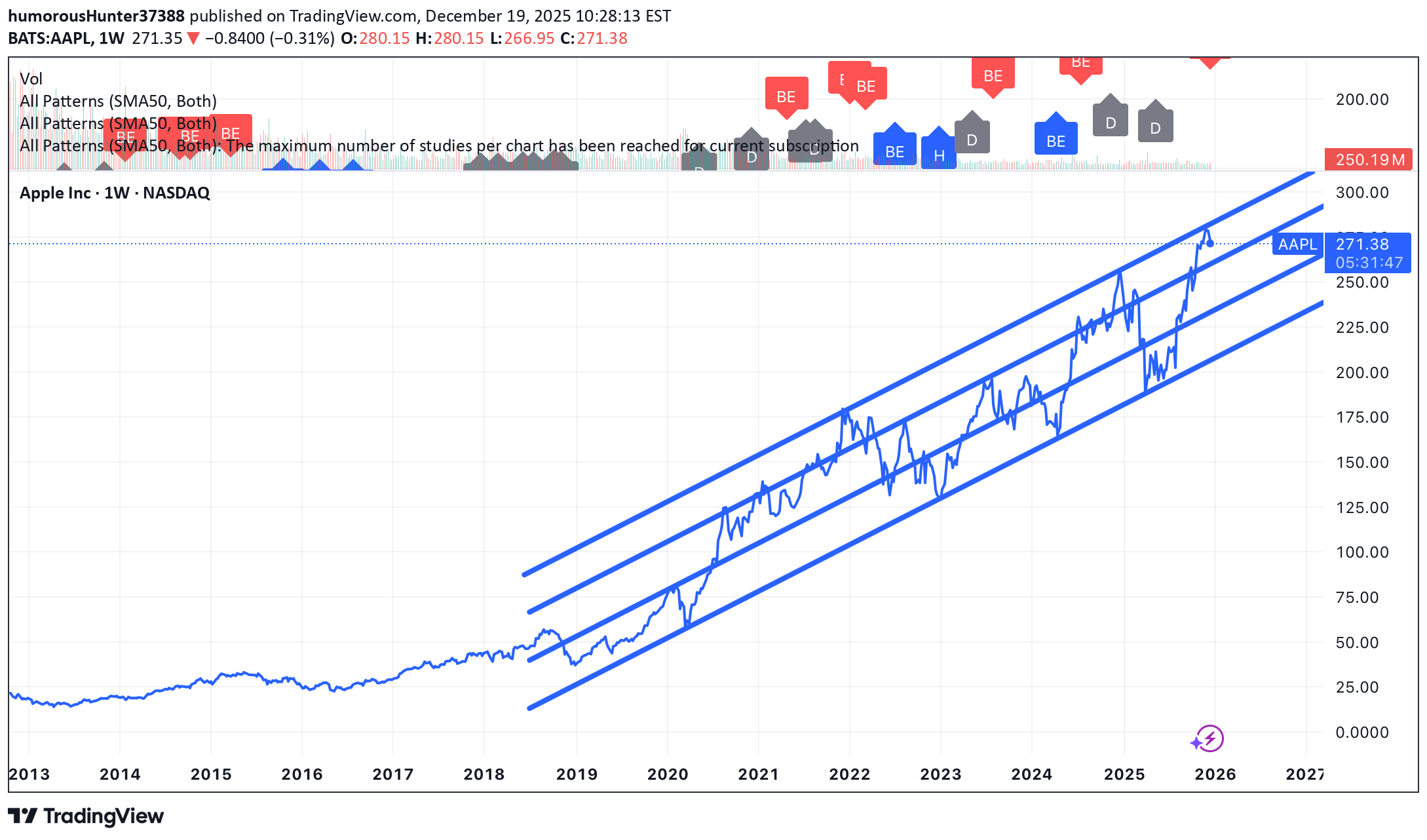

پیشبینی صعودی قیمت: آیا کانال صعودی حفظ میشود و هدف بعدی کجاست؟

Price remains inside a well-defined rising channel, respecting diagonal support and resistance. The Elliott structure suggests a bullish sequence with Wave 3 completed and price currently developing a Wave 4 consolidation within the channel. From a Fibonacci perspective, the last pullback held the 38.2%–50% retracement zone (~205–215), confirming trend strength. As long as price stays above this area, the primary bullish structure remains intact. Key Levels •Support / Entry zone: 215–210 (fib + diagonal support) •Secondary support: 200 (invalidates bullish structure below) •Resistance / Partial exits: 235–240 •Upper channel target: 255–265 Strategy •Buy pullbacks near diagonal support (210–215) •Trim or exit partially near 235–240 •Trend continuation expected while holding above 200 Overall structure remains bullish, with higher targets toward the upper channel if support continues to hold.

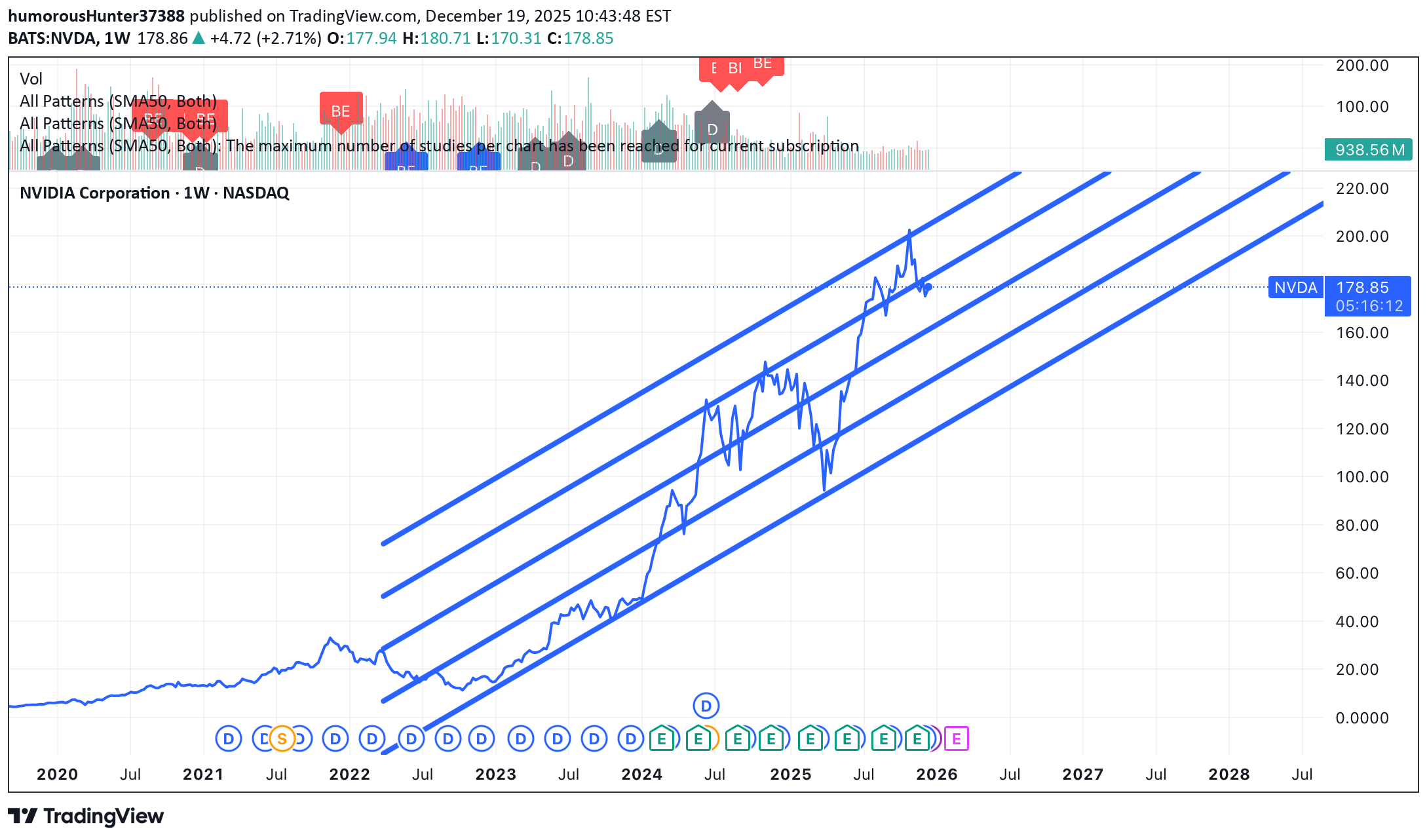

Price continues to respect a strong long-term…

Price continues to respect a strong long-term rising channel, with multiple diagonal supports acting as dynamic demand zones. The broader Elliott structure suggests NVDA is in an extended Wave 5, following a powerful Wave 3 and a shallow Wave 4 correction. From a Fibonacci perspective, the last pullback held above the 38.2%–50% retracement zone (~150–160), confirming strength and trend continuation. Price is now consolidating above the channel midline, a typical behavior before continuation in late-cycle trends. Elliott Outlook •Primary trend remains bullish (Wave 5 in progress) •Current consolidation looks corrective, not impulsive •No major bearish divergence on higher timeframes Key Levels (Fibonacci & Diagonals) •Support: 165–160 (38.2% fib + diagonal support) •Major support: 150 (50% fib, trend invalidation below) •Resistance: 185–190 •Upper channel targets: 210–230 Entry Strategies •Conservative: Buy pullbacks into 165–160 with confirmation •Aggressive: Partial entries above 180 on continuation •Invalidation: Weekly close below 150 As long as price remains inside the rising channel and above key Fibonacci supports, NVDA’s bullish structure stays intact, with higher targets toward the upper diagonal over the coming months.

AAPL – Weekly Elliott & Fibonacci Price trades inside…

AAPL – Weekly Elliott & Fibonacci Price trades inside a long-term rising channel. The structure points to a late Wave 5, with momentum fading near 290–300. The current pullback fits a Wave 4, holding above key Fibonacci supports at 260 (38.2%) and 245 (50%). As long as price stays above 245, the primary uptrend remains intact, with scope for a final push toward 300+.

Meta is a fundamentally strong stock, supported by robust cash f

Meta is a fundamentally strong stock, supported by robust cash flows and long-term growth drivers. Mid-to-long-term bullish trend remains intact. Price is consolidating within an ascending channel, holding the lower diagonal support. Accumulation phase in progress around current levels.

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.