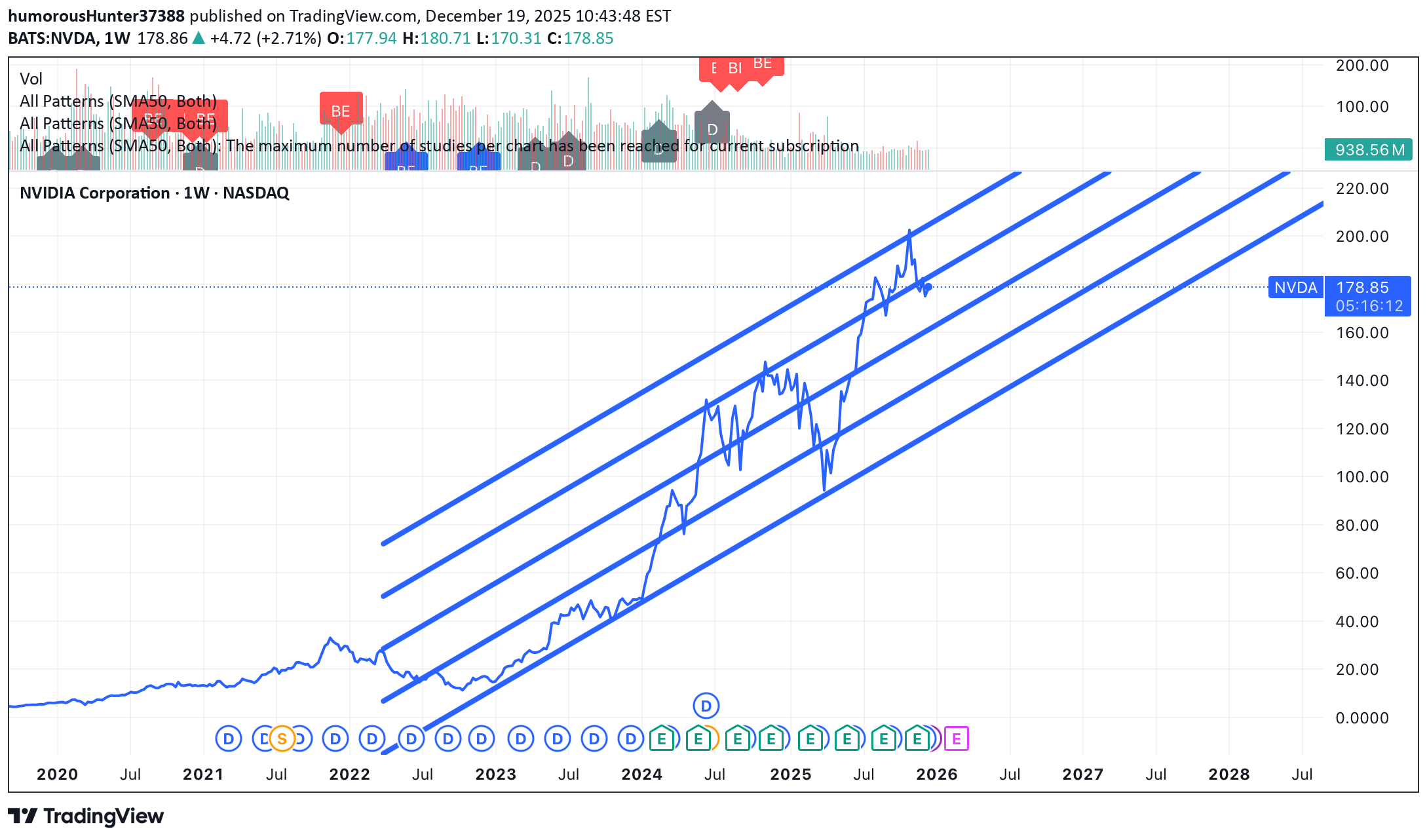

Technical analysis by humorousHunter37388 about Symbol NVDAX on 12/19/2025

Price continues to respect a strong long-term…

Price continues to respect a strong long-term rising channel, with multiple diagonal supports acting as dynamic demand zones. The broader Elliott structure suggests NVDA is in an extended Wave 5, following a powerful Wave 3 and a shallow Wave 4 correction. From a Fibonacci perspective, the last pullback held above the 38.2%–50% retracement zone (~150–160), confirming strength and trend continuation. Price is now consolidating above the channel midline, a typical behavior before continuation in late-cycle trends. Elliott Outlook •Primary trend remains bullish (Wave 5 in progress) •Current consolidation looks corrective, not impulsive •No major bearish divergence on higher timeframes Key Levels (Fibonacci & Diagonals) •Support: 165–160 (38.2% fib + diagonal support) •Major support: 150 (50% fib, trend invalidation below) •Resistance: 185–190 •Upper channel targets: 210–230 Entry Strategies •Conservative: Buy pullbacks into 165–160 with confirmation •Aggressive: Partial entries above 180 on continuation •Invalidation: Weekly close below 150 As long as price remains inside the rising channel and above key Fibonacci supports, NVDA’s bullish structure stays intact, with higher targets toward the upper diagonal over the coming months.