hnizdos

@t_hnizdos

What symbols does the trader recommend buying?

Purchase History

پیام های تریدر

Filter

Signal Type

hnizdos

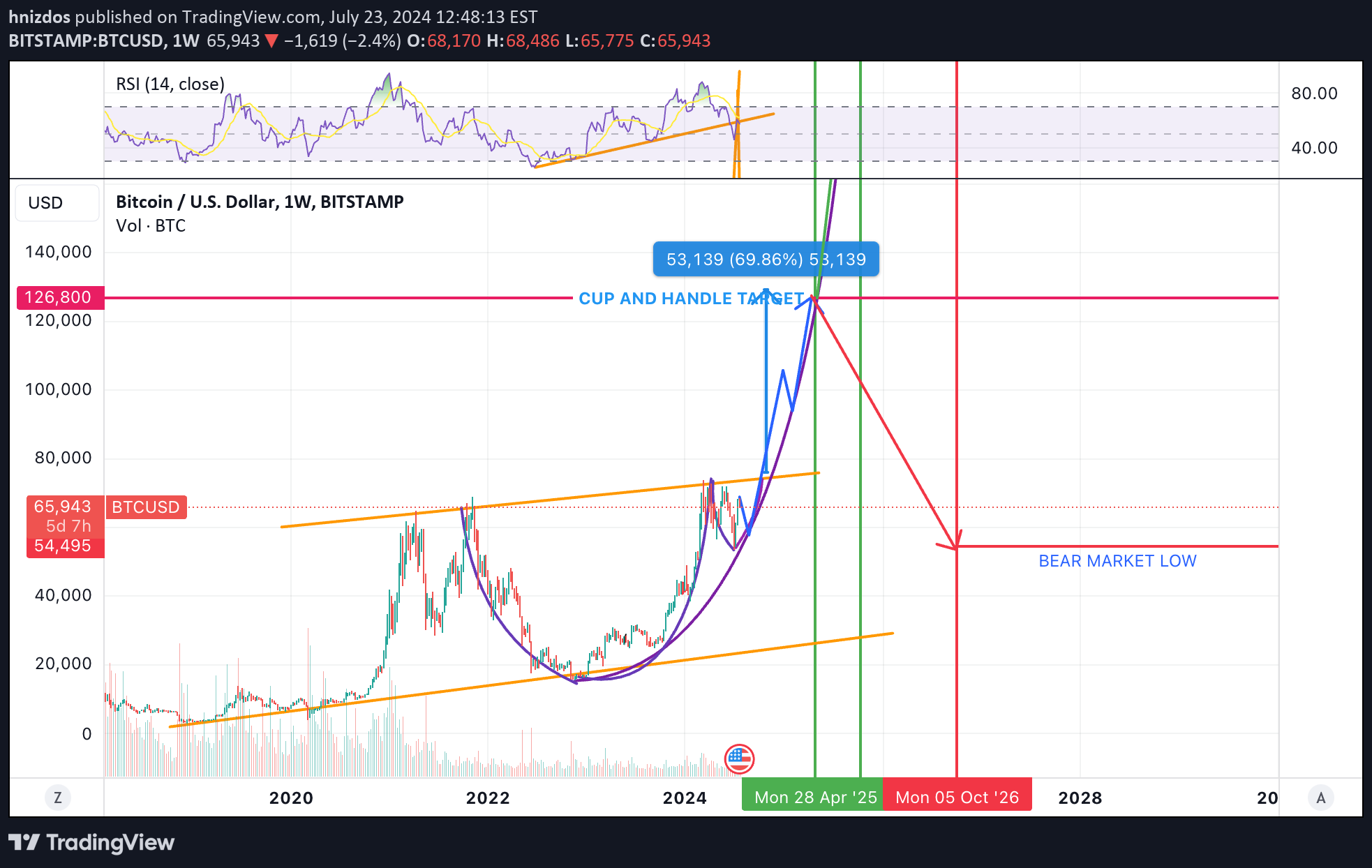

A little reflection on the development of the price of BTC. Currently almost 0 interest from small retail investors. If we look at the price development since the top of the last cycle as a cup and handle (purple curve) or a growing orange channel, from the point of view of technical analysis, the target is between 115-130,000 USD. Around 100t, retail investors will gradually start entering. Everyone expects a peak around Q4/2025 at 180-250t. But what if it doesn't? What if the big players, to be specific, for example Blackrock, who completely control all the media and can freely manipulate the opinion of the majority, are interested in dumping BTC on small retail players again? And when better than when every analyst who knows how to connect two points with a straight line will shout that the peak is in 6 months at 250-500t USD? Going even further, I venture to predict that by then the Nasdaq will be between $24,000-27,000. And the US economy is likely to be overtaken by significantly rising unemployment and potential deflation. Not to predict - Nasdaq respects its blue logarithmic channel from Figure 2 rather nicely. Q1-Q2/2025 we will probably reach the top of the channel - the last bottom was Q4/2022, from which we bounced up hard. We still have around 35% growth to go. And yes, maybe this time everything will really be different and AI will change everything and we will fly with valuations to the sky. But let's be honest, is that really the point of the game? What better opportunity to send the markets down than in this combination? Q1-Q2/2025 will be interesting. And when everyone is shouting that BTC is going to 500t USD, American mortgages are being taken for leveraged positions and the taxi driver is recommending which altcoins to buy, remember the end of 2021 when everyone was shouting that we are going to 100k.

hnizdos

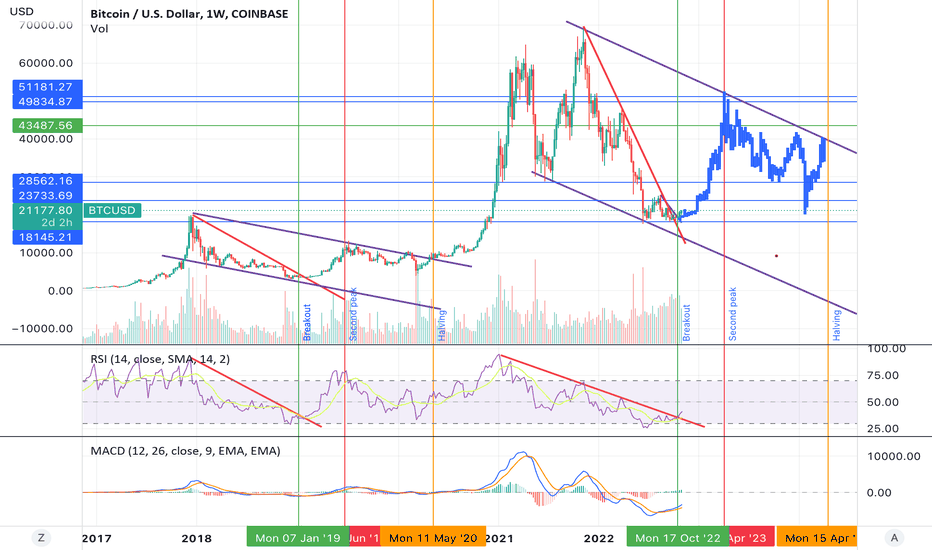

If we look in the previous bull run, there are few main points: After the breakout of the falling price and weekly RSI resistance, it took BTC approximately 160 days to make a second peak at 0.618 fibo level Such a movement would take us to about 50k at around April 2023 There are actually many similarities - mainly the big channel that the btc stays in the whole time, breaking out only around halving Also, in the previous run, breakout of the falling price and RSI weekly resistance accured at the same time, same as now

hnizdos

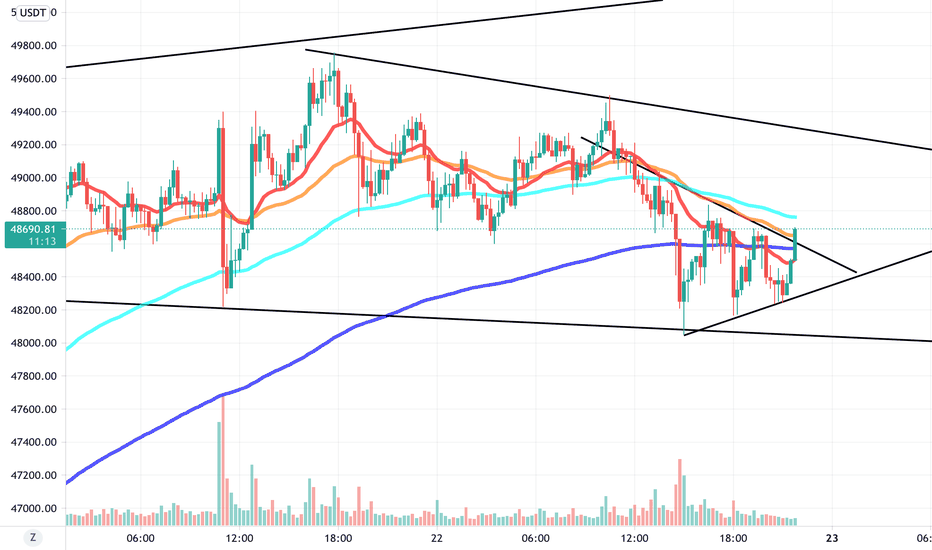

My take on what is gonna happen: BTC is currently forming a bull flag, which should break up, within few days, taking us above 51k. There, after hitting a major resistance (golden pocket, measured from ATH to 29k) we should finally make a significant correction. Depending on the sell pressure, that would take us back to either 47k or even 42k, probably ending in late September. From there on, BTC would be primed for further rally, possibly taking us to around 100k

Disclaimer

Any content and materials included in Sahmeto's website and official communication channels are a compilation of personal opinions and analyses and are not binding. They do not constitute any recommendation for buying, selling, entering or exiting the stock market and cryptocurrency market. Also, all news and analyses included in the website and channels are merely republished information from official and unofficial domestic and foreign sources, and it is obvious that users of the said content are responsible for following up and ensuring the authenticity and accuracy of the materials. Therefore, while disclaiming responsibility, it is declared that the responsibility for any decision-making, action, and potential profit and loss in the capital market and cryptocurrency market lies with the trader.